The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The...

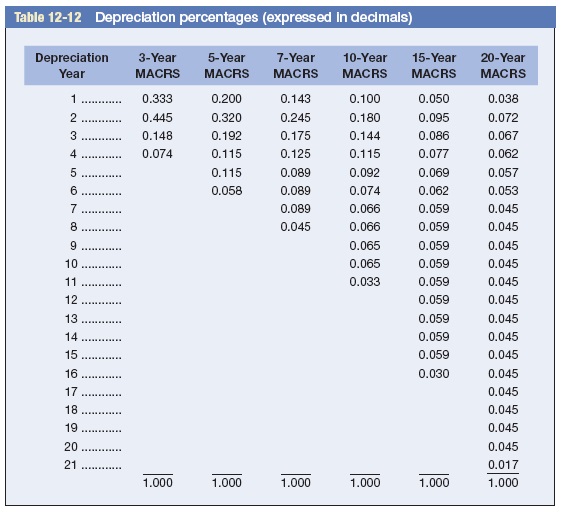

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $210,000. Of this amount, $170,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $40,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods.

The contract will require an additional investment of $53,000 in

working capital at the beginning of the first year and, of this

amount, $33,000 will be returned to the Spartan Technology Company

after six years.

The investment will produce $72,000 in income before depreciation

and taxes for each of the six years. The corporation is in a 25

percent tax bracket and has a 14 percent cost of capital.

a. Calculate the net present value. (Do

not round intermediate calculations and round your answer to 2

decimal places.)

b. Should the investment be undertaken?

-

Yes

-

No

Homework Answers

| Tax rate | 25% | |||||||

| Calculation of annual depreciation | ||||||||

| 100 | ||||||||

| Depreciation | Year-1 | Year-2 | Year-3 | Year-4 | Year-5 | Year-6 | Total | |

| Opening WDV | $ 170,000 | $ 170,000 | $ 170,000 | $ 170,000 | $ 170,000 | $ 170,000 | ||

| Dep Rate | 20.00% | 32.00% | 19.20% | 11.52% | 11.52% | 5.76% | ||

| Depreciation | $ 34,000 | $ 54,400 | $ 32,640 | $ 19,584 | $ 19,584 | $ 9,792 | $ 170,000 | |

| Calculation of annual operating cash flow | ||||||||

| Year-1 | Year-2 | Year-3 | Year-4 | Year-5 | Year-6 | |||

| Pretax operating cost saving | $ 72,000 | $ 72,000 | $ 72,000 | $ 72,000 | $ 72,000 | $ 72,000 | ||

| Less: Depreciation | $ 34,000 | $ 54,400 | $ 32,640 | $ 19,584 | $ 19,584 | $ 9,792 | ||

| Profit before tax | $ 38,000 | $ 17,600 | $ 39,360 | $ 52,416 | $ 52,416 | $ 62,208 | ||

| Tax@25% | $ 9,500 | $ 4,400 | $ 9,840 | $ 13,104 | $ 13,104 | $ 15,552 | ||

| Profit After Tax | $ 28,500 | $ 13,200 | $ 29,520 | $ 39,312 | $ 39,312 | $ 46,656 | ||

| Add Depreciation | $ 34,000 | $ 54,400 | $ 32,640 | $ 19,584 | $ 19,584 | $ 9,792 | ||

| Cash Profit after-tax | $ 62,500 | $ 67,600 | $ 62,160 | $ 58,896 | $ 58,896 | $ 56,448 | ||

| Calculation of NPV | ||||||||

| 14.00% | ||||||||

| Year | Capital | Working capital | Operating cash | Annual Cash flow | PV factor | Present values | ||

| 0 | $ (210,000) | $ (53,000) | $ (263,000) | 1.0000 | $ (263,000) | |||

| 1 | $ 62,500 | $ 62,500 | 0.8772 | $ 54,825 | ||||

| 2 | $ 67,600 | $ 67,600 | 0.7695 | $ 52,016 | ||||

| 3 | $ 62,160 | $ 62,160 | 0.6750 | $ 41,956 | ||||

| 4 | $ 58,896 | $ 58,896 | 0.5921 | $ 34,871 | ||||

| 5 | $ 58,896 | $ 58,896 | 0.5194 | $ 30,589 | ||||

| 6 | $ 40,000 | $ 33,000 | $ 56,448 | $ 129,448 | 0.4556 | $ 58,975 | ||

| Net Present Value | $ 10,231 | |||||||

| As we can see that NPV is positive, hence project should be undertaken | ||||||||

Add Answer to:

The Spartan Technology Company has a proposed contract with the

Digital Systems Company of Michigan. The...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $230,000. Of this amount, $160,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $70,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $230,000. Of this amount, $160,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $70,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $225,000. Of this amount, $180,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $45,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $225,000. Of this amount, $180,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $45,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $160.000. Of this amount. $135,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $25.000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $160.000. Of this amount. $135,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $25.000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investm...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $175,000. Of this amount, $155,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $20,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $160,000. Of this amount, $145,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $15,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $160,000. Of this amount, $145,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $15,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $140,000. Of this amount, $100,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $40,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $370,000. Of this amount, $250,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $120,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

Problem 12-30 Working capital requirements in capital budgeting (LO12-4] The Spartan Technology Company has a proposed...

Problem 12-30 Working capital requirements in capital budgeting (LO12-4] The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $102,000. Of this amount, $90,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $12,000. The depreciated assets will have zero resale value. Use Table 12-12....

Problem 12-30 Working capital requirements in capital budgeting (LO12-4] The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $102,000. Of this amount, $90,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $12,000. The depreciated assets will have zero resale value. Use Table 12-12....

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The...

The Spartan Technology Company has a proposed contract with the

Digital Systems Company of Michigan. The initial investment in land

and equipment will be $370,000. Of this amount, $250,000 is subject

to five-year MACRS depreciation. The balance is in nondepreciable

property. The contract covers six years; at the end of six years,

the nondepreciable assets will be sold for $120,000. The

depreciated assets will have zero resale value. Use Table 12-12.

Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the

Digital Systems Company of Michigan. The initial investment in land

and equipment will be $370,000. Of this amount, $250,000 is subject

to five-year MACRS depreciation. The balance is in nondepreciable

property. The contract covers six years; at the end of six years,

the nondepreciable assets will be sold for $120,000. The

depreciated assets will have zero resale value. Use Table 12-12.

Use Appendix B for an approximate answer but calculate...

Corporate Finance

Problem 12-30 Working capital requirements in capital budgeting [LO12-4]The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $300,000. Of this amount, $240,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $60,000. The depreciated assets will have zero resale value. Use Table 12-12. Use ...

Problem 12-30 Working capital requirements in capital budgeting [LO12-4]The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $300,000. Of this amount, $240,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $60,000. The depreciated assets will have zero resale value. Use Table 12-12. Use ...

Most questions answered within 3 hours.

-

How would you train your employees to avoid risks of using

mobile devices?

asked 16 minutes ago -

Assume Kw = 1.01 ✕ 10−14

For pure water, we can calculate [H3O+ ] = [OH...

asked 1 hour ago -

Suppose that on a temperature scale X, water boils at 203.0°X

and freezes at -105.7°X. What...

asked 2 hours ago -

BaS crystallizes in a cubic unit cell with S2- ions on each

corner and each face....

asked 2 hours ago -

A. 0≤P(Oi)≤10≤P(Oi)≤1 for each i

B. P(Oi)≤0P(Oi)≤0

C. P(Oi)=1+P(OCi)P(Oi)=1+P(OiC)

D. P(Oi)≥1P(Oi)≥1

If an experiment consists of...

asked 4 hours ago -

A battery has an emf of 9.20V and an internal resistance of 1.20

ohm. a)What resistance...

asked 4 hours ago -

The area of an elastic circular loop decreases at a constant

rate, dA/dt = −6.60×10−3 m2/s...

asked 5 hours ago -

The denaturation of proteins can be described by the

equilibrium

F⇌U

where F and U represent...

asked 6 hours ago -

Please answer what the maximum and minimum force is, and the

angle on the ion is...

asked 6 hours ago -

implement a program that reads a number of rows and a symbol.

The program will draw...

asked 6 hours ago -

Assume that when adults with smartphones are randomly selected,

45% use them in meetings or classes....

asked 6 hours ago -

Determine the number of formula units of

Na2SO4 and moles of oxygen contained in 8.11

moles...

asked 7 hours ago

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $230,000. Of this amount, $160,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $70,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $230,000. Of this amount, $160,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $70,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $225,000. Of this amount, $180,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $45,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $225,000. Of this amount, $180,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $45,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $160.000. Of this amount. $135,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $25.000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $160.000. Of this amount. $135,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $25.000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $160,000. Of this amount, $145,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $15,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $160,000. Of this amount, $145,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $15,000. The depreciated assets will have zero resale value. Use Table 12-12. Use Appendix B for an approximate answer but calculate...

Problem 12-30 Working capital requirements in capital budgeting (LO12-4] The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $102,000. Of this amount, $90,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $12,000. The depreciated assets will have zero resale value. Use Table 12-12....

Problem 12-30 Working capital requirements in capital budgeting (LO12-4] The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $102,000. Of this amount, $90,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $12,000. The depreciated assets will have zero resale value. Use Table 12-12....

The Spartan Technology Company has a proposed contract with the

Digital Systems Company of Michigan. The initial investment in land

and equipment will be $370,000. Of this amount, $250,000 is subject

to five-year MACRS depreciation. The balance is in nondepreciable

property. The contract covers six years; at the end of six years,

the nondepreciable assets will be sold for $120,000. The

depreciated assets will have zero resale value. Use Table 12-12.

Use Appendix B for an approximate answer but calculate...

The Spartan Technology Company has a proposed contract with the

Digital Systems Company of Michigan. The initial investment in land

and equipment will be $370,000. Of this amount, $250,000 is subject

to five-year MACRS depreciation. The balance is in nondepreciable

property. The contract covers six years; at the end of six years,

the nondepreciable assets will be sold for $120,000. The

depreciated assets will have zero resale value. Use Table 12-12.

Use Appendix B for an approximate answer but calculate...