could someone explain me how they got 2 years and four month at the end? dont know where they got it from. thanks

Homework Answers

| Project A: | ||||||||||

| Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||||

| Cumulative cash flow | -50000 | -25000 | -5000 | 10000 | 20000 | 20000 | ||||

| Payback period=Years before full recovery of cost+(Unrecovered cash flow at the start of the year/Cashflow during the year)=2+(5000/15000)=2+0.33=2.33 years | ||||||||||

| Multiply 0.33 by 12 to convert it into month | ||||||||||

| 0.33*12=4 months | ||||||||||

| Hence, Answer is 2 years and 4 months | ||||||||||

Add Answer to:

could someone explain me how they got 2 years and four

month at the end? dont...

4. CAPITAL INVESTMENT DECISIONS The following information relates to three possible capital expenditure projects. Because of...

4. CAPITAL INVESTMENT DECISIONS The following information relates to three possible capital expenditure projects. Because of capital rationing only one project can be accepted. Project A Project B Project C Initial Cost $230,000 $250,000 $190,000 Expected life 5years 5 years 4 years Scrap value expected $10,000 $15,000 $10,000 Expected Cash Inflows: $ $ $ End Year 1 85,000 95,000 45,000 End Year 2 70,000 70,000 65,000 End Year 3 65,000 55,000 95,000 End Year 4 60,000 50,000 100,000 End Year...

Please, I need the answer and the approaches step by step( all the information about how...

Please, I need the answer and the approaches step by step( all

the information about how to get the data) in an easy way for my

understanding Thanks!

Question.3 As the accountant for Gamble Limited you have the responsibility for eveluating capi proposals. For th of both proposals are as follows al. Details e coming year the following two proposals have been presented for your approv Proposal X This project will require an initial investment of є500 000 n plant...

Please, I need the answer and the approaches step by step( all

the information about how to get the data) in an easy way for my

understanding Thanks!

Question.3 As the accountant for Gamble Limited you have the responsibility for eveluating capi proposals. For th of both proposals are as follows al. Details e coming year the following two proposals have been presented for your approv Proposal X This project will require an initial investment of є500 000 n plant...

Finance

The Business School is examining the viability of setting up a new one year postgraduate degree in International Finance, starting one year from now. The degree will run in conjunction with the existing programmes, as well as offering two new courses aimed at this specific new program. Theuniversity will only run the new programme if it turns out to be a positive net present value. Following a period of consultation, the Business School produces a report on the viability of...

5. Tommy is going to receive a cash flow of 5100 monthly for 15 years. Timmy...

5. Tommy is going to receive a cash flow of 5100 monthly for 15 years. Timmy w poing to receive a cash flow of $100 monthly forever. If the discount is 125. how cho Jimmy's cash flow worth as of today? A) $1.294.36 B) $1.323.57 C) $1,545.4) D) $1,667.83 D 57.493 83 6. You have just obtained the loan in the mount of $10.000 You make monthly payment of 53226719 for 3 years. What is the quoted interest rate on...

5. Tommy is going to receive a cash flow of 5100 monthly for 15 years. Timmy w poing to receive a cash flow of $100 monthly forever. If the discount is 125. how cho Jimmy's cash flow worth as of today? A) $1.294.36 B) $1.323.57 C) $1,545.4) D) $1,667.83 D 57.493 83 6. You have just obtained the loan in the mount of $10.000 You make monthly payment of 53226719 for 3 years. What is the quoted interest rate on...

Because of its inability to control film and personnel costs in its radiology department, Sanger General...

Because of its inability to control film and personnel

costs in its radiology department, Sanger General Hospital wants to

replace its existing picture archive and communication (PAC) system

with a newer version. The existing system, which has a current book

value of $2,250,000, was purchased three years ago for $3,600,000

and is being depreciated on a straight-line basis over an

eight-year life to a salvage value of $0. This system could be sold

for $800,000 today. The new PAC system...

Because of its inability to control film and personnel

costs in its radiology department, Sanger General Hospital wants to

replace its existing picture archive and communication (PAC) system

with a newer version. The existing system, which has a current book

value of $2,250,000, was purchased three years ago for $3,600,000

and is being depreciated on a straight-line basis over an

eight-year life to a salvage value of $0. This system could be sold

for $800,000 today. The new PAC system...

I need help with answering number 17 11) Rylan Industries is expected to pay a B-2...

I need help with answering number 17

11) Rylan Industries is expected to pay a B-2 nes is expected to pay a dividend of $5.40 year for the next four years. If the current price yan stock is $32.16, and Rylan's equity cost of capital is 14%, what price would you expect Rylan's stock to sell for at the end of the four years? A) $22.19 11) B) 577.67 C) $27.74 D) $49.93 Gremlin industries will pay a dividend of...

I need help with answering number 17

11) Rylan Industries is expected to pay a B-2 nes is expected to pay a dividend of $5.40 year for the next four years. If the current price yan stock is $32.16, and Rylan's equity cost of capital is 14%, what price would you expect Rylan's stock to sell for at the end of the four years? A) $22.19 11) B) 577.67 C) $27.74 D) $49.93 Gremlin industries will pay a dividend of...

SECTION A (40 marks): Answer ALL Questions in this section. QUESTION ONE a) Aseda Ltd incurred...

SECTION A (40 marks): Answer ALL Questions in this section. QUESTION ONE a) Aseda Ltd incurred the following cost in its manufacturing operations GH¢ Cost of material purchase 20,000 Import duties 400 Trade discount @10% of purchase cost Cash discount 500 Irrecoverable taxes 1,000 Salary of factory plant operator 2,500 Direct labour 5,000 Salary of factory supervisor 4,000 Cost of expected production losses 800 Administrative overhead (Note) 16,000 Cost of storage of raw material for further processing 2,000 Marketing cost...

SECTION A (40 marks): Answer ALL Questions in this section. QUESTION ONE a) Aseda Ltd incurred the following cost in its manufacturing operations GH¢ Cost of material purchase 20,000 Import duties 400 Trade discount @10% of purchase cost Cash discount 500 Irrecoverable taxes 1,000 Salary of factory plant operator 2,500 Direct labour 5,000 Salary of factory supervisor 4,000 Cost of expected production losses 800 Administrative overhead (Note) 16,000 Cost of storage of raw material for further processing 2,000 Marketing cost...

I need Summary of this Paper i dont need long summary i need What methodology they used , what is the purpose of this p...

I need Summary of this Paper i dont need long summary i need

What methodology they used , what is the purpose of this paper and

some conclusions and contributes of this paper. I need this for my

Finishing Project so i need this ASAP please ( IN 1-2-3 HOURS

PLEASE !!!)

Budgetary Policy and Economic Growth Errol D'Souza The share of capital expenditures in government expenditures has been slipping and the tax reforms have not yet improved the income...

I need Summary of this Paper i dont need long summary i need

What methodology they used , what is the purpose of this paper and

some conclusions and contributes of this paper. I need this for my

Finishing Project so i need this ASAP please ( IN 1-2-3 HOURS

PLEASE !!!)

Budgetary Policy and Economic Growth Errol D'Souza The share of capital expenditures in government expenditures has been slipping and the tax reforms have not yet improved the income...

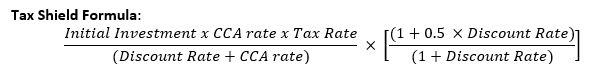

Case: Investment Proposals for Ontario Coffee Home It is January 1, 2019. You are a Senior...

Case: Investment Proposals for Ontario Coffee

Home

It is January 1, 2019. You are a Senior Analyst at Ontario

Coffee Home (OCH), one of the leading coffee chains and wholesaler

of coffee/bakery products in Ontario. The CEO of Ontario Coffee

Home, Jerry Donovan, has reached out to you to draft a report to

evaluate two investment proposals.

Requirements

1. Identify which revenues

and costs are relevant to your analysis, and which costs are

irrelevant. Summarize all the information that will be...

Case: Investment Proposals for Ontario Coffee

Home

It is January 1, 2019. You are a Senior Analyst at Ontario

Coffee Home (OCH), one of the leading coffee chains and wholesaler

of coffee/bakery products in Ontario. The CEO of Ontario Coffee

Home, Jerry Donovan, has reached out to you to draft a report to

evaluate two investment proposals.

Requirements

1. Identify which revenues

and costs are relevant to your analysis, and which costs are

irrelevant. Summarize all the information that will be...

Case: Investment Proposals for Ontario Coffee Home

Case: Investment Proposals for Ontario Coffee HomeIt is January 1, 2019. You are a Senior Analyst at Ontario Coffee Home (OCH), one of the leading coffee chains and wholesaler of coffee/bakery products in Ontario. The CEO of Ontario Coffee Home, Jerry Donovan, has reached out to you to draft a report to evaluate two investment proposals.Requirements1. Identify which revenues and costs are relevant to your analysis, and which costs are irrelevant. Summarize all the information that will be required for each...

Case: Investment Proposals for Ontario Coffee HomeIt is January 1, 2019. You are a Senior Analyst at Ontario Coffee Home (OCH), one of the leading coffee chains and wholesaler of coffee/bakery products in Ontario. The CEO of Ontario Coffee Home, Jerry Donovan, has reached out to you to draft a report to evaluate two investment proposals.Requirements1. Identify which revenues and costs are relevant to your analysis, and which costs are irrelevant. Summarize all the information that will be required for each...

Most questions answered within 3 hours.

-

Random characters You decide to create a program characters.py

that fills a two-dimensional list with random...

asked 6 minutes ago -

What are the major sources of error in your determination of the

molar mass? Select all...

asked 10 minutes ago -

A. Suppose your manager indicates that for a normally

distributed data set you are analyzing, your...

asked 31 minutes ago -

During the month of August, the average temperature of a lake

next to a local college...

asked 13 minutes ago -

Which of these four researchers is most likely to have made Type

1 error

Kim who...

asked 26 minutes ago -

In a performance test, each of two cars takes 8.9 s to

accelerate from rest to...

asked 27 minutes ago -

Sapphire Aerospace operates 52 weeks per year, and its cost of

goods sold last year was...

asked 31 minutes ago -

Create ER Model

Assets are resources that are used in CMS to display content.

Each asset...

asked 26 minutes ago -

For each the following molecules draw the best possible

structure based on formal charges for each...

asked 32 minutes ago -

A proton moves in the plane of this paper toward the top of the

page. A...

asked 41 minutes ago -

different divisions differing lines of business use

different costs of capital because their cost of equity...

asked 37 minutes ago -

Give an algorithm to determine whether or not the elements

of

an array of integers are...

asked 44 minutes ago

Please, I need the answer and the approaches step by step( all

the information about how to get the data) in an easy way for my

understanding Thanks!

Question.3 As the accountant for Gamble Limited you have the responsibility for eveluating capi proposals. For th of both proposals are as follows al. Details e coming year the following two proposals have been presented for your approv Proposal X This project will require an initial investment of є500 000 n plant...

Please, I need the answer and the approaches step by step( all

the information about how to get the data) in an easy way for my

understanding Thanks!

Question.3 As the accountant for Gamble Limited you have the responsibility for eveluating capi proposals. For th of both proposals are as follows al. Details e coming year the following two proposals have been presented for your approv Proposal X This project will require an initial investment of є500 000 n plant...

5. Tommy is going to receive a cash flow of 5100 monthly for 15 years. Timmy w poing to receive a cash flow of $100 monthly forever. If the discount is 125. how cho Jimmy's cash flow worth as of today? A) $1.294.36 B) $1.323.57 C) $1,545.4) D) $1,667.83 D 57.493 83 6. You have just obtained the loan in the mount of $10.000 You make monthly payment of 53226719 for 3 years. What is the quoted interest rate on...

5. Tommy is going to receive a cash flow of 5100 monthly for 15 years. Timmy w poing to receive a cash flow of $100 monthly forever. If the discount is 125. how cho Jimmy's cash flow worth as of today? A) $1.294.36 B) $1.323.57 C) $1,545.4) D) $1,667.83 D 57.493 83 6. You have just obtained the loan in the mount of $10.000 You make monthly payment of 53226719 for 3 years. What is the quoted interest rate on...

Because of its inability to control film and personnel

costs in its radiology department, Sanger General Hospital wants to

replace its existing picture archive and communication (PAC) system

with a newer version. The existing system, which has a current book

value of $2,250,000, was purchased three years ago for $3,600,000

and is being depreciated on a straight-line basis over an

eight-year life to a salvage value of $0. This system could be sold

for $800,000 today. The new PAC system...

Because of its inability to control film and personnel

costs in its radiology department, Sanger General Hospital wants to

replace its existing picture archive and communication (PAC) system

with a newer version. The existing system, which has a current book

value of $2,250,000, was purchased three years ago for $3,600,000

and is being depreciated on a straight-line basis over an

eight-year life to a salvage value of $0. This system could be sold

for $800,000 today. The new PAC system...

I need help with answering number 17

11) Rylan Industries is expected to pay a B-2 nes is expected to pay a dividend of $5.40 year for the next four years. If the current price yan stock is $32.16, and Rylan's equity cost of capital is 14%, what price would you expect Rylan's stock to sell for at the end of the four years? A) $22.19 11) B) 577.67 C) $27.74 D) $49.93 Gremlin industries will pay a dividend of...

I need help with answering number 17

11) Rylan Industries is expected to pay a B-2 nes is expected to pay a dividend of $5.40 year for the next four years. If the current price yan stock is $32.16, and Rylan's equity cost of capital is 14%, what price would you expect Rylan's stock to sell for at the end of the four years? A) $22.19 11) B) 577.67 C) $27.74 D) $49.93 Gremlin industries will pay a dividend of...

SECTION A (40 marks): Answer ALL Questions in this section. QUESTION ONE a) Aseda Ltd incurred the following cost in its manufacturing operations GH¢ Cost of material purchase 20,000 Import duties 400 Trade discount @10% of purchase cost Cash discount 500 Irrecoverable taxes 1,000 Salary of factory plant operator 2,500 Direct labour 5,000 Salary of factory supervisor 4,000 Cost of expected production losses 800 Administrative overhead (Note) 16,000 Cost of storage of raw material for further processing 2,000 Marketing cost...

SECTION A (40 marks): Answer ALL Questions in this section. QUESTION ONE a) Aseda Ltd incurred the following cost in its manufacturing operations GH¢ Cost of material purchase 20,000 Import duties 400 Trade discount @10% of purchase cost Cash discount 500 Irrecoverable taxes 1,000 Salary of factory plant operator 2,500 Direct labour 5,000 Salary of factory supervisor 4,000 Cost of expected production losses 800 Administrative overhead (Note) 16,000 Cost of storage of raw material for further processing 2,000 Marketing cost...

I need Summary of this Paper i dont need long summary i need

What methodology they used , what is the purpose of this paper and

some conclusions and contributes of this paper. I need this for my

Finishing Project so i need this ASAP please ( IN 1-2-3 HOURS

PLEASE !!!)

Budgetary Policy and Economic Growth Errol D'Souza The share of capital expenditures in government expenditures has been slipping and the tax reforms have not yet improved the income...

I need Summary of this Paper i dont need long summary i need

What methodology they used , what is the purpose of this paper and

some conclusions and contributes of this paper. I need this for my

Finishing Project so i need this ASAP please ( IN 1-2-3 HOURS

PLEASE !!!)

Budgetary Policy and Economic Growth Errol D'Souza The share of capital expenditures in government expenditures has been slipping and the tax reforms have not yet improved the income...

Case: Investment Proposals for Ontario Coffee

Home

It is January 1, 2019. You are a Senior Analyst at Ontario

Coffee Home (OCH), one of the leading coffee chains and wholesaler

of coffee/bakery products in Ontario. The CEO of Ontario Coffee

Home, Jerry Donovan, has reached out to you to draft a report to

evaluate two investment proposals.

Requirements

1. Identify which revenues

and costs are relevant to your analysis, and which costs are

irrelevant. Summarize all the information that will be...

Case: Investment Proposals for Ontario Coffee

Home

It is January 1, 2019. You are a Senior Analyst at Ontario

Coffee Home (OCH), one of the leading coffee chains and wholesaler

of coffee/bakery products in Ontario. The CEO of Ontario Coffee

Home, Jerry Donovan, has reached out to you to draft a report to

evaluate two investment proposals.

Requirements

1. Identify which revenues

and costs are relevant to your analysis, and which costs are

irrelevant. Summarize all the information that will be...