Homework Answers

Add Answer to:

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO Inventory costing method but did not compare the cost of its ending inventory to its market value replacement Con The preliminary income statement follows: 83,ece Sales Revenue Cost of Goods sold Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of goods sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (355) Net Income 94,000 20. zee 7.30...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO Inventory costing method but did not compare the cost of its ending inventory to its market value replacement Con The preliminary income statement follows: 83,ece Sales Revenue Cost of Goods sold Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of goods sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (355) Net Income 94,000 20. zee 7.30...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The comp...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows $124,000 Sales Revenue Cost of Goods Sold Beginning Inventory $11,000 83,000 Purchases 94,000 20,700 Goods Available for Sale Ending Inventory 73,300 50,700 27,000 23,700 8,295 15,405 Cost of Goods Sold Gross Profit Operating Expenses Income from Operations...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows $124,000 Sales Revenue Cost of Goods Sold Beginning Inventory $11,000 83,000 Purchases 94,000 20,700 Goods Available for Sale Ending Inventory 73,300 50,700 27,000 23,700 8,295 15,405 Cost of Goods Sold Gross Profit Operating Expenses Income from Operations...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: Sales Revenue $ 122,000 Cost of Goods Sold Beginning Inventory $ 10,500 Purchases 82,000 Goods Available for Sale 92,500 Ending Inventory 20,500 Cost of Goods Sold 72,000 Gross Profit 50,000 Operating Expenses 26,500 Income from Operations 23,500...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31 The company reported Inventory using...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31 The company reported Inventory using the Lifo Inventory coating method but old not compare the cost of its ending inventory to its market value replacement cost. The preliminary income statement follows: Coat of Good Said Sede d a Cor Sale ENNE LIVE Best of Gooda Sol The Cron Postina The E Lens Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31 The company reported Inventory using the Lifo Inventory coating method but old not compare the cost of its ending inventory to its market value replacement cost. The preliminary income statement follows: Coat of Good Said Sede d a Cor Sale ENNE LIVE Best of Gooda Sol The Cron Postina The E Lens Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $144,000 $ 16,000 93,800 Sales Revenue Cost of Goods Sold Beginnine Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (30%) Net Income 109,000...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $144,000 $ 16,000 93,800 Sales Revenue Cost of Goods Sold Beginnine Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (30%) Net Income 109,000...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory...

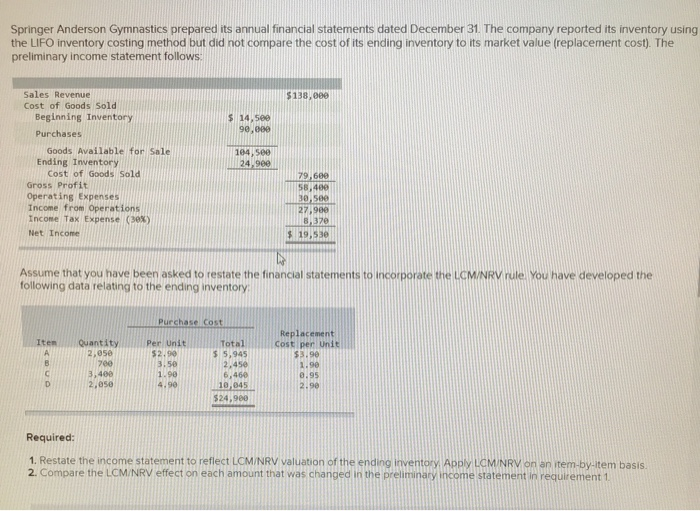

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $ 138,000 $14.500 90.000 Sales Revenue Cost of Goods Sold Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (30%) Net Income 24.900...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $ 138,000 $14.500 90.000 Sales Revenue Cost of Goods Sold Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (30%) Net Income 24.900...

Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule....

Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You have developed the following data relating to the ending inventory: Purchase Cost Replacement Cost per Unit $4.20 2.20 1.10 Per Unit $3.20 4.00 2.20 Quantity 1,600 750 3,700 1,600 Total $ 5,120 3,000 8,140 8,320 Item A B 5.20 3.20 $24,580 Required: 1. Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. 2. Compare...

Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You have developed the following data relating to the ending inventory: Purchase Cost Replacement Cost per Unit $4.20 2.20 1.10 Per Unit $3.20 4.00 2.20 Quantity 1,600 750 3,700 1,600 Total $ 5,120 3,000 8,140 8,320 Item A B 5.20 3.20 $24,580 Required: 1. Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. 2. Compare...

Smart Company prepared its annual financial statements dated December 31. The company reported its inventory using...

Smart Company prepared its annual financial statements dated December 31. The company reported its inventory using the FIFO inventory costing method and failed to evaluate its net realizable value at December 31. The preliminary income statement follows: Sales Revenue $ 302,000 Cost of Goods Sold Beginning Inventory $ 41,000 Purchases 204,000 Goods Available for Sale 245,000 Ending Inventory 95,400 Cost of Goods Sold 149,600 Gross Profit 152,400 Operating Expenses 72,000 Income from Operations 80,400 Income Tax Expense (30%) 24,120 Net...

Smart Company prepared its annual financial statements dated December 31. The company reported its inventory using...

Smart Company prepared its annual financial statements dated

December 31. The company reported its inventory using the FIFO

inventory costing method and failed to evaluate its net realizable

value at December 31. The preliminary income statement

follows:

Smart Company prepared its annual financial statements dated December 31. The company reported its inventory using the FIFO inventory costing method and failed to evaluate its net realizable value at December 31. The preliminary Income statement follows Sales Revenue Cost of Goods Sold...

Smart Company prepared its annual financial statements dated

December 31. The company reported its inventory using the FIFO

inventory costing method and failed to evaluate its net realizable

value at December 31. The preliminary income statement

follows:

Smart Company prepared its annual financial statements dated December 31. The company reported its inventory using the FIFO inventory costing method and failed to evaluate its net realizable value at December 31. The preliminary Income statement follows Sales Revenue Cost of Goods Sold...

PLEASE HELP!!! (the incone tax and net income are wrong because im unsure how to get...

PLEASE HELP!!! (the incone tax and net income are wrong

because im unsure how to get the correct income tax!)

hp. 7, 8 and 9) Saved Help Save & Exit Subm Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $120,000 $10,000 81,000 203 Sales Revenue...

PLEASE HELP!!! (the incone tax and net income are wrong

because im unsure how to get the correct income tax!)

hp. 7, 8 and 9) Saved Help Save & Exit Subm Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $120,000 $10,000 81,000 203 Sales Revenue...

Most questions answered within 3 hours.

-

Write a program to solve the Josephus problem, with the following

modification:

Sample Input:

./a.out n...

asked 2 hours ago -

At the start of a CD it is spinning at a rate of 525 rpm

(revolutions...

asked 2 hours ago -

4. Without doing any calculations, predict whether the observed

∆T would increase, decrease or remain the...

asked 3 hours ago -

Based on the range, which of the following sets of scores has

the greatest variability? 3,...

asked 5 hours ago -

Ripples in a pond travel at a velocity of 3 m/s with one peak

passing a...

asked 4 hours ago -

A man stands on the roof of a building of height 13.0 mm and

throws a...

asked 4 hours ago -

The extent to which assets are financed by borrowed funds and

other liabilities is indicated by:...

asked 5 hours ago -

Explain in detail

Germany is the fifth largest economy

explain what goods and services Germany specializes...

asked 6 hours ago -

The density of platinum is 21.45 g/mL. If a cube of platinum

with a mass of...

asked 6 hours ago -

Accounts Receivable

Sales

A/R Posting

Extended Sales Invoice

Packing Slip

Compare invoice to packing slip 2...

asked 6 hours ago -

Michaella, age 23, is a full-time law student and is claimed by

her parents as a...

asked 6 hours ago -

Why are polymers not typically casted into products?

asked 6 hours ago

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO Inventory costing method but did not compare the cost of its ending inventory to its market value replacement Con The preliminary income statement follows: 83,ece Sales Revenue Cost of Goods sold Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of goods sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (355) Net Income 94,000 20. zee 7.30...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO Inventory costing method but did not compare the cost of its ending inventory to its market value replacement Con The preliminary income statement follows: 83,ece Sales Revenue Cost of Goods sold Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of goods sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (355) Net Income 94,000 20. zee 7.30...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows $124,000 Sales Revenue Cost of Goods Sold Beginning Inventory $11,000 83,000 Purchases 94,000 20,700 Goods Available for Sale Ending Inventory 73,300 50,700 27,000 23,700 8,295 15,405 Cost of Goods Sold Gross Profit Operating Expenses Income from Operations...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows $124,000 Sales Revenue Cost of Goods Sold Beginning Inventory $11,000 83,000 Purchases 94,000 20,700 Goods Available for Sale Ending Inventory 73,300 50,700 27,000 23,700 8,295 15,405 Cost of Goods Sold Gross Profit Operating Expenses Income from Operations...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31 The company reported Inventory using the Lifo Inventory coating method but old not compare the cost of its ending inventory to its market value replacement cost. The preliminary income statement follows: Coat of Good Said Sede d a Cor Sale ENNE LIVE Best of Gooda Sol The Cron Postina The E Lens Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31 The company reported Inventory using the Lifo Inventory coating method but old not compare the cost of its ending inventory to its market value replacement cost. The preliminary income statement follows: Coat of Good Said Sede d a Cor Sale ENNE LIVE Best of Gooda Sol The Cron Postina The E Lens Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $144,000 $ 16,000 93,800 Sales Revenue Cost of Goods Sold Beginnine Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (30%) Net Income 109,000...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $144,000 $ 16,000 93,800 Sales Revenue Cost of Goods Sold Beginnine Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (30%) Net Income 109,000...

Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You have developed the following data relating to the ending inventory: Purchase Cost Replacement Cost per Unit $4.20 2.20 1.10 Per Unit $3.20 4.00 2.20 Quantity 1,600 750 3,700 1,600 Total $ 5,120 3,000 8,140 8,320 Item A B 5.20 3.20 $24,580 Required: 1. Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. 2. Compare...

Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You have developed the following data relating to the ending inventory: Purchase Cost Replacement Cost per Unit $4.20 2.20 1.10 Per Unit $3.20 4.00 2.20 Quantity 1,600 750 3,700 1,600 Total $ 5,120 3,000 8,140 8,320 Item A B 5.20 3.20 $24,580 Required: 1. Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. 2. Compare...

Smart Company prepared its annual financial statements dated

December 31. The company reported its inventory using the FIFO

inventory costing method and failed to evaluate its net realizable

value at December 31. The preliminary income statement

follows:

Smart Company prepared its annual financial statements dated December 31. The company reported its inventory using the FIFO inventory costing method and failed to evaluate its net realizable value at December 31. The preliminary Income statement follows Sales Revenue Cost of Goods Sold...

Smart Company prepared its annual financial statements dated

December 31. The company reported its inventory using the FIFO

inventory costing method and failed to evaluate its net realizable

value at December 31. The preliminary income statement

follows:

Smart Company prepared its annual financial statements dated December 31. The company reported its inventory using the FIFO inventory costing method and failed to evaluate its net realizable value at December 31. The preliminary Income statement follows Sales Revenue Cost of Goods Sold...

PLEASE HELP!!! (the incone tax and net income are wrong

because im unsure how to get the correct income tax!)

hp. 7, 8 and 9) Saved Help Save & Exit Subm Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $120,000 $10,000 81,000 203 Sales Revenue...

PLEASE HELP!!! (the incone tax and net income are wrong

because im unsure how to get the correct income tax!)

hp. 7, 8 and 9) Saved Help Save & Exit Subm Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $120,000 $10,000 81,000 203 Sales Revenue...