On 12-31-15, Acme purchased a machine. Acme signed a $800,000 zero-interest bearing note. The note is...

On 12-31-15, Acme purchased a machine. Acme signed a $800,000 zero-interest bearing note. The note is payable in full on 12-31-17. Assume an acceptable interest rate on similar notes was 4%. On 12-31-15, Acme incurred and paid $12,000 to have the machine installed in its sales office. In this problem, you can ignore depreciation – we’ll get to that in chapter 11. Prepare the entries Acme should make related to this note on:

- 12-31-15.

- 12-31-16.

- 12-31-17.

Homework Answers

Zero interest notes are issued at a lower price than their face value / future value. Here face value / future value is $ 800,000

Acme has purchased machine against the zero interest note whose face value is $ 800,000. To find out the cost of machine we need to find out present value of zero interest bond.

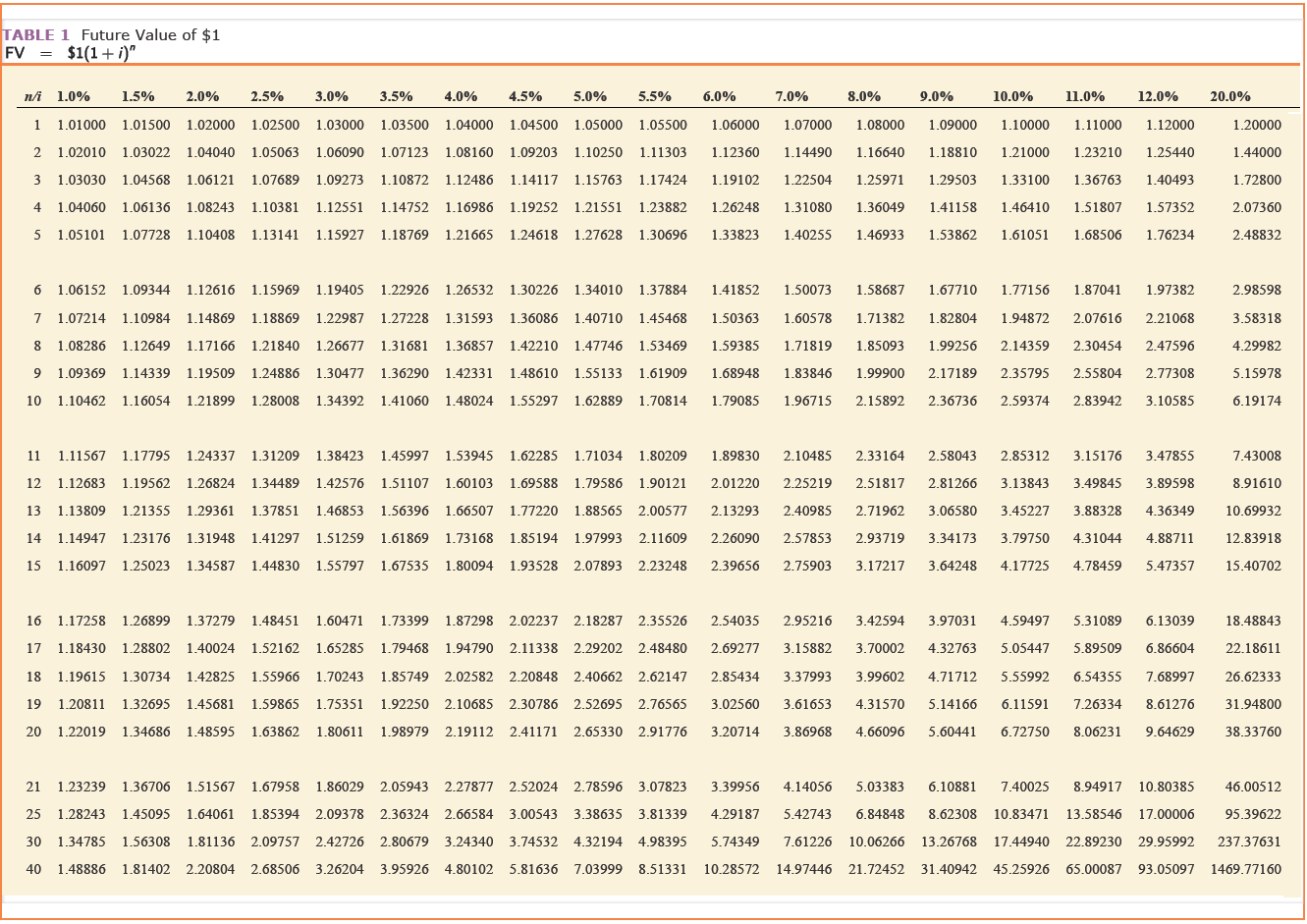

Present Value (PV) = FV / (1 + i%)n

where FV = future value, i% = the interest rate and n= the term in years

Here in current scenario:

FV = $ 800,000

i% = 4% ( as interest on similar bond is 4%)

n= 2 years

PV= $ 800,000 /(1 + 4%)2 = $ 739,645

Cost of machine will be recorded at $ 739,645 plus installation charges of $ 12,000

Difference between PV and FV is the interest / discount on bonds and will be amortized over 2 years.

Discount / Interest on bond = FV - PV = $ 800,000 - 739,645 = $ 60,355

Amortization of interest expense per year = (FV - PV) / No. of years for bond payment

Amortization of Interest expense per year = ($ 800,000 - 739,645) / 2 = $ 30,177.5

Accounting entries that Acme should make are as under:

| Date | General Journal | Debit | Credit |

| 31-Dec-15 | Machine A/c | $ 751,645 | |

| Discount on notes payable A/c | $ 60,355 | ||

| To Notes Payable A/c | $ 800,000 | ||

| To Cash A/c | $ 12,000 | ||

| (being machine purchased against zero interest note payable on 12-31-17 FV $ 800,000, installation charges paid in cash $ 12,000) | |||

| 31-Dec-16 | Interest Expense A/c | $ 30,177.50 | |

| To Discount on notes payable A/c | $ 30,177.50 | ||

| (being interest amount for the year on bond charged to expense) | |||

| 31-Dec-17 | Interest Expense A/c | $ 30,177.50 | |

| To Discount on notes payable A/c | $ 30,177.50 | ||

| (being interest amount for the year on bond charged to expense) | |||

| 31-Dec-17 | Notes Payable A/c | $ 800,000 | |

| To Cash A/c | $ 800,000 | ||

| (being cash paid against bond on due date) |

Explanation:

Installation charges will be debited to cost of machinery as all the expenses paid to put the machine to use should form part of cost of machine

Discount on notes payable account is a balance sheet contra liability account, it will be netted off against the notes payable account to display the net liability.

Add Answer to:

On 12-31-15, Acme purchased a machine. Acme signed a $800,000

zero-interest bearing note. The note is...

Brown Corp. borrowed 100,000 on Oct. 1, 2018 and signed a 12 month note bearing interest...

Brown Corp. borrowed 100,000 on Oct. 1, 2018 and signed a 12 month note bearing interest at 6 %. Interest is payable in full at maturity on Sep. 30, 2019. Brown Corp should report interest payable at Dec. 31,2018 in the amount of journal entry to record the accrued liability:

Jane's Donut Co. borrowed $200,000 on January 1, 2016, and signed a one-year note bearing interest...

Jane's Donut Co. borrowed $200,000 on January 1, 2016, and signed a one-year note bearing interest at 12% in payable in full at maturity on october 31, 2017. write journal entry for the following dates: Nov 1, 2016 (borrowed), December 31, 2016 (accured interest), and october 21. 2017 ( due date)?

On March 1, Year1, Fine Co borrowed $10,000 and signed a two year note bearing interest...

On March 1, Year1, Fine Co borrowed $10,000 and signed a two year note bearing interest at 12% per annum compounded annually. Interest is payable in full at maturity on February 28, Year 3. What amount should Fine report as a liability for accrued interest at December 31, Year 2? a) 800 b) 0 c) 1,824 d. 1,024

1. On December 31, year 0, ABC purchased a machine in exchange for an interest-bearing note...

1. On December 31, year 0, ABC purchased a machine in exchange for an interest-bearing note requiring 7 payments of $287457 at the end of each year. The first payment was made on December 31, year 1. At the date of the transaction, the prevailing rate of interest for this type of note was 5.2%. The initial value of the machine is: Answer: ____________ 2. ABC purchased a machine that has an estimated useful life of 6 years for $4834...

The Pita Pit borrowed $198,000 on November 1, 2021, and signed a six-month note bearing interest...

The Pita Pit borrowed $198,000 on November 1, 2021, and signed a six-month note bearing interest at 12%. Principal and interest are payable in full at maturity on May 1, 2022. In connection with this note, The Pita Pit should report interest expense at December 31, 2021, in the amount of: (Do not round your intermediate calculations.) Multiple Choice $0. $3,960. $11,880. $23,760. This is the last question in the assignment. To submit, use Alt + Shift + S. To...

WILL RATE FAST: P14.8B (LO 3) (Entries for Zero-Interest-Bearing Note) On December 31, 2020, Payson Company...

WILL RATE FAST:

P14.8B (LO 3) (Entries for Zero-Interest-Bearing Note) On December 31, 2020, Payson Company acquired a press from Sugar Corporation by issuing a $400,000 zero-interest-bearing note, payable in full on December 31, 2023. Payson's credit rating permits it to borrow funds from its several lines of credit at 8%. The press is expected to have a 6-year life and a $40,000 salvage value. Round amounts to the nearest dollar. Instructions (a) Prepare the journal entry for the purchase...

WILL RATE FAST:

P14.8B (LO 3) (Entries for Zero-Interest-Bearing Note) On December 31, 2020, Payson Company acquired a press from Sugar Corporation by issuing a $400,000 zero-interest-bearing note, payable in full on December 31, 2023. Payson's credit rating permits it to borrow funds from its several lines of credit at 8%. The press is expected to have a 6-year life and a $40,000 salvage value. Round amounts to the nearest dollar. Instructions (a) Prepare the journal entry for the purchase...

22) Universal Travel Inc. borrowed $500,000 on November 1, 2021, and signed a 12- hole bearing...

22) Universal Travel Inc. borrowed $500,000 on November 1, 2021, and signed a 12- hole bearing interest at 6%. Interest is payable is full y on October 31, 2022. Prepare the journal entries for 1. the issuance of the mote and the interest December 31, 2021 that Universal Travel Inc. (Round your final answer to the nearest woke dollar.) | v 1 2021 Debit Credit Dec. 31, 2021 23) Branch Corporation issued $15 million of commercial paper on March 1...

22) Universal Travel Inc. borrowed $500,000 on November 1, 2021, and signed a 12- hole bearing interest at 6%. Interest is payable is full y on October 31, 2022. Prepare the journal entries for 1. the issuance of the mote and the interest December 31, 2021 that Universal Travel Inc. (Round your final answer to the nearest woke dollar.) | v 1 2021 Debit Credit Dec. 31, 2021 23) Branch Corporation issued $15 million of commercial paper on March 1...

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

On 01-01-15, G purchased a machine for $10,000,000. Installation costs incurred and paid for on 01-01-15...

On 01-01-15, G purchased a machine for $10,000,000. Installation costs incurred and paid for on 01-01-15 were $50,000. G started using the machine on 01-01-15. G estimates it will use the machine for 3 years. At the end of the 3rd year, G will have to dispose of the machine at an estimated cost of $435,000. Assume as of 01-01-15 the interest rate on US Treasury securities was 1.75% and G’s credit standing required a 2% risk premium. G uses...

On October 30, 2019, Sanchez Company acquired a piece of machinery and signed a 12-month note...

On October 30, 2019, Sanchez Company acquired a piece of machinery and signed a 12-month note for $24,000. The face value of the note includes the price of the machinery and interest. The note is to be paid in four $6,000 quarterly installments. The value of the machinery is the present value of the four quarterly payments discounted at an annual interest rate of 16%. Required: 1. Prepare all the journal entries required to record the preceding information including the...

On October 30, 2019, Sanchez Company acquired a piece of machinery and signed a 12-month note for $24,000. The face value of the note includes the price of the machinery and interest. The note is to be paid in four $6,000 quarterly installments. The value of the machinery is the present value of the four quarterly payments discounted at an annual interest rate of 16%. Required: 1. Prepare all the journal entries required to record the preceding information including the...

Most questions answered within 3 hours.

-

Smartphones: A poll agency reports that 32% of teenagers aged

12-17 own smartphones. A random sample...

asked 6 minutes ago -

blood glucose level for obese patient population have

a mean of 100 with a standard deviation...

asked 35 minutes ago -

(a) A lightbulb has a resistance of 165 Ω when operating with a

potential difference of...

asked 16 minutes ago -

Questions

Submission Question 2: Stacks

Problem

Write a program that keeps track of where cars are...

asked 15 minutes ago -

Using α = 0.05, test if the mean weight change

is less than 0 if a...

asked 34 minutes ago -

JAVA

Lab -Lottery Calculator

IMPORTANT: This lab is best implemented using a loop structure.

If you...

asked 21 minutes ago -

A diver springs upward with an initial speed of 2.1 m/s from a

3.5-m board.

(a)...

asked 29 minutes ago -

In an isobaric compression process, the volume of steam is

reduced from 1 Mpa and 773...

asked 34 minutes ago -

Which of the following mutations is MOST likely to be

recessive?

A.

Deletion of a haplo-insufficient...

asked 38 minutes ago -

The U.S. Department of Transportation, National Highway Traffic

Safety Administration, reported that 77% of all fatally...

asked 51 minutes ago -

For 1 through 11, create an expression using the relational

operators, the logical operators, and variable...

asked 1 hour ago -

Remove all recursion from the following grammar:

S -> Aa | Bb

A -> Aa |...

asked 57 minutes ago

WILL RATE FAST:

P14.8B (LO 3) (Entries for Zero-Interest-Bearing Note) On December 31, 2020, Payson Company acquired a press from Sugar Corporation by issuing a $400,000 zero-interest-bearing note, payable in full on December 31, 2023. Payson's credit rating permits it to borrow funds from its several lines of credit at 8%. The press is expected to have a 6-year life and a $40,000 salvage value. Round amounts to the nearest dollar. Instructions (a) Prepare the journal entry for the purchase...

WILL RATE FAST:

P14.8B (LO 3) (Entries for Zero-Interest-Bearing Note) On December 31, 2020, Payson Company acquired a press from Sugar Corporation by issuing a $400,000 zero-interest-bearing note, payable in full on December 31, 2023. Payson's credit rating permits it to borrow funds from its several lines of credit at 8%. The press is expected to have a 6-year life and a $40,000 salvage value. Round amounts to the nearest dollar. Instructions (a) Prepare the journal entry for the purchase...

22) Universal Travel Inc. borrowed $500,000 on November 1, 2021, and signed a 12- hole bearing interest at 6%. Interest is payable is full y on October 31, 2022. Prepare the journal entries for 1. the issuance of the mote and the interest December 31, 2021 that Universal Travel Inc. (Round your final answer to the nearest woke dollar.) | v 1 2021 Debit Credit Dec. 31, 2021 23) Branch Corporation issued $15 million of commercial paper on March 1...

22) Universal Travel Inc. borrowed $500,000 on November 1, 2021, and signed a 12- hole bearing interest at 6%. Interest is payable is full y on October 31, 2022. Prepare the journal entries for 1. the issuance of the mote and the interest December 31, 2021 that Universal Travel Inc. (Round your final answer to the nearest woke dollar.) | v 1 2021 Debit Credit Dec. 31, 2021 23) Branch Corporation issued $15 million of commercial paper on March 1...

On October 30, 2019, Sanchez Company acquired a piece of machinery and signed a 12-month note for $24,000. The face value of the note includes the price of the machinery and interest. The note is to be paid in four $6,000 quarterly installments. The value of the machinery is the present value of the four quarterly payments discounted at an annual interest rate of 16%. Required: 1. Prepare all the journal entries required to record the preceding information including the...

On October 30, 2019, Sanchez Company acquired a piece of machinery and signed a 12-month note for $24,000. The face value of the note includes the price of the machinery and interest. The note is to be paid in four $6,000 quarterly installments. The value of the machinery is the present value of the four quarterly payments discounted at an annual interest rate of 16%. Required: 1. Prepare all the journal entries required to record the preceding information including the...