Homework Answers

| Answer -1 |

| Option A is Correct |

|

company should record the land amounting fair value proportion of the total cash consideration, |

| Land value = $ 1600,000*200,000/2,000,000 = $ 160,000. |

| Answer is A |

| Correct answer--------$923,972 | |||

| Option B is correct | |||

| Working | |||

| Year | Amount paid | PV factor @7% | Present value of payment |

| 0 | $195,000.00 | 1 | $ 195,000 |

| 1 | $780,000.00 | 0.93458 | $ 728,972 |

| Present value of payment and cost of land to be recorded | $ 923,972 | ||

Add Answer to:

A company purchased land, a building, and equipment for one price of $1,600,000. The estimated fair...

- / 10 View Policies Current Attempt in Progress Sunland Company purchased land, a building, and...

- / 10 View Policies Current Attempt in Progress Sunland Company purchased land, a building, and equipment on January 2, 2021, for $895,000. The company paid $160,000 cash and signed a mortgage note payable for the remainder. Management's best estimate of the value of the land was $370,000; of the building, $416,250; and of the equipment. $138,750. Record the purchase. (Use Mortgage Payable for account.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually....

- / 10 View Policies Current Attempt in Progress Sunland Company purchased land, a building, and equipment on January 2, 2021, for $895,000. The company paid $160,000 cash and signed a mortgage note payable for the remainder. Management's best estimate of the value of the land was $370,000; of the building, $416,250; and of the equipment. $138,750. Record the purchase. (Use Mortgage Payable for account.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually....

5 points Save Ans A company purchased land, a building, and equipment for one price of...

5 points Save Ans A company purchased land, a building, and equipment for one price of $1,750,000. The estimated fair values of the land building and equipment are 5218.750.51531250 and $437 500 respectively. At what amount would the company record the land? $218.750 $1,750,000 $175,000 $185.000

5 points Save Ans A company purchased land, a building, and equipment for one price of $1,750,000. The estimated fair values of the land building and equipment are 5218.750.51531250 and $437 500 respectively. At what amount would the company record the land? $218.750 $1,750,000 $175,000 $185.000

On January 3, 2019, HDR Company acquired a tract of land just outside the city limits....

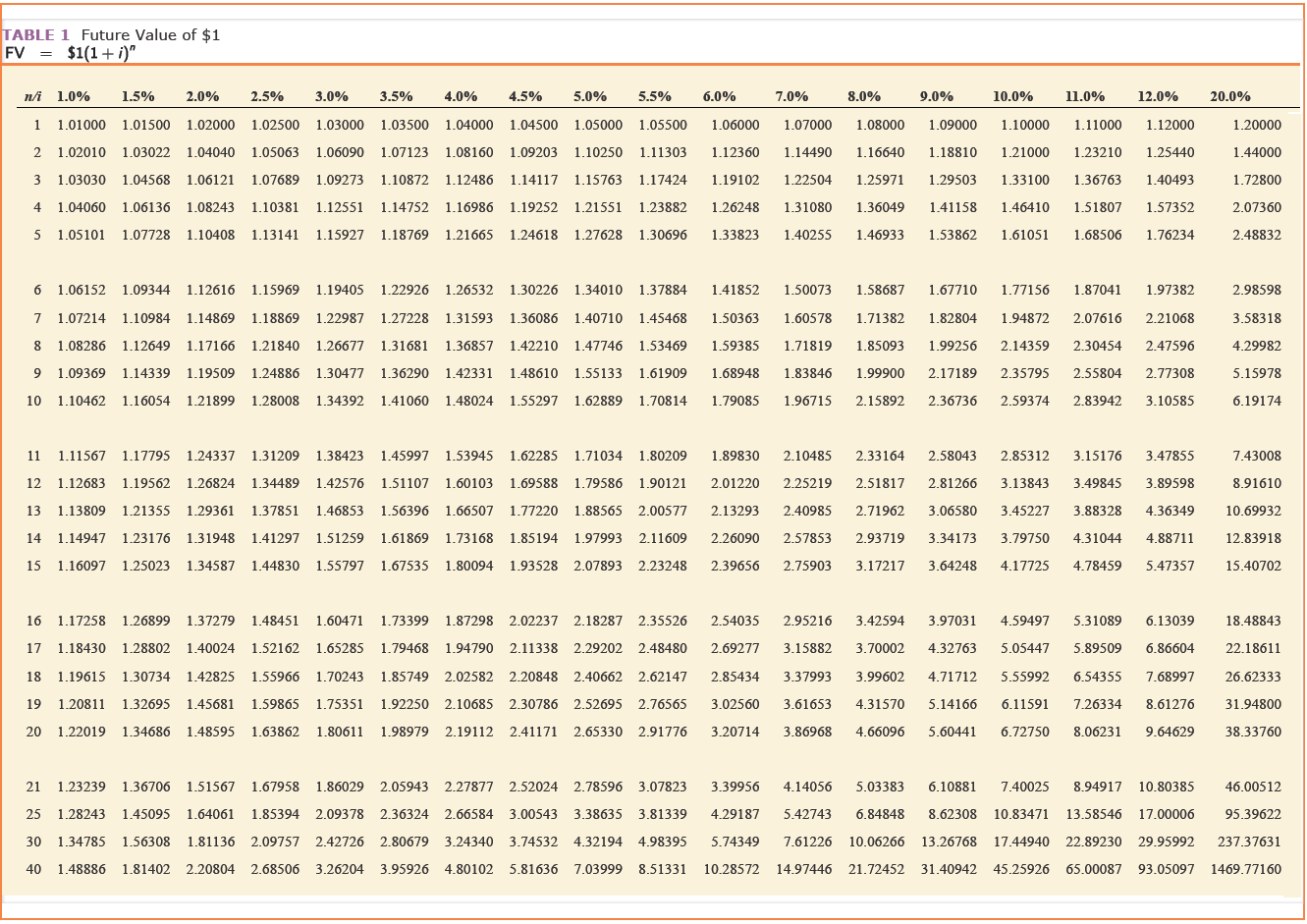

On January 3, 2019, HDR Company acquired a tract of land just outside the city limits. The land and existing building were purchased for $4.8 million. HDR Company paid $800,000 and signed a noninterest-bearing note requiring the company to pay the remaining $4,000,000 on December 31, 2020. An interest rate of 7% properly reflects the time value of money for this type of loan agreement. Transfer taxes, title insurance, and other costs totaling $48,000 were paid at closing. During...

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

Cullumber purchased land and a building on April for 398,400. The company paid 123,600 in cash...

Cullumber purchased land and a building on April for 398,400.

The company paid 123,600 in cash and signed a 5% note payable

Problem 9-6A Cullumber Company purchased land and a building on April 1, 2019, for $398,400. The company paid $123,600 in cash and signed a 5 % note payable for the balance. At that time, it was estimated that the land was worth $159,000 and the building, $239,400. The building was estimated to have a 25-year useful life with...

Cullumber purchased land and a building on April for 398,400.

The company paid 123,600 in cash and signed a 5% note payable

Problem 9-6A Cullumber Company purchased land and a building on April 1, 2019, for $398,400. The company paid $123,600 in cash and signed a 5 % note payable for the balance. At that time, it was estimated that the land was worth $159,000 and the building, $239,400. The building was estimated to have a 25-year useful life with...

Teradene Corporation purchased land as a factory site and contracted with Maxtor Construction to construct a...

Teradene Corporation purchased land as a factory site and contracted with Maxtor Construction to construct a factory. Teradene made the following expenditures related to the acquisition of the land, building, and equipment for the factory: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.): Purchase price of the land $ 1,330,000 Demolition and removal of old building 93,000 Clearing and grading the land...

Teradene Corporation purchased land as a factory site and contracted with Maxtor Construction to construct a...

Teradene Corporation purchased land as a factory site and contracted with Maxtor Construction to construct a factory. Teradene made the following expenditures related to the acquisition of the land, building, and equipment for the factory: (FV of $1, P of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.): Purchase price of the land Demolition and removal of old building Clearing and grading the land before construction Various...

Teradene Corporation purchased land as a factory site and contracted with Maxtor Construction to construct a factory. Teradene made the following expenditures related to the acquisition of the land, building, and equipment for the factory: (FV of $1, P of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.): Purchase price of the land Demolition and removal of old building Clearing and grading the land before construction Various...

explain please! 4. Campos sold equipment for $200,000. The equipment was purchased for $160,000 and had...

explain please!

4. Campos sold equipment for $200,000. The equipment was purchased for $160,000 and had accumulated depreciation of $60,000. What amount is reported as Section 1231 gain? c. $60,000 b. $40,000 e. $200,000 d. $100,000 a. $0 5. On January 1, Year 2, Shah acquired an office building, economic useful life of 40 years, for $780,000 for use in his business. There was no estimated salvage value. Shah depreciated the building under MACRS for 10 years for a total...

explain please!

4. Campos sold equipment for $200,000. The equipment was purchased for $160,000 and had accumulated depreciation of $60,000. What amount is reported as Section 1231 gain? c. $60,000 b. $40,000 e. $200,000 d. $100,000 a. $0 5. On January 1, Year 2, Shah acquired an office building, economic useful life of 40 years, for $780,000 for use in his business. There was no estimated salvage value. Shah depreciated the building under MACRS for 10 years for a total...

Teradene Corporation purchased land as a factory site and contracted with Maxtor Construction to construct a factor...

Teradene Corporation purchased land as a factory site and contracted with Maxtor Construction to construct a factory. Teradene made the following expenditures related to the acquisition of the land, building, and equipment for the factory. (EV of $1. PV of $1. EVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Purchase price of the land Demolition and removal of old building Clearing and grading the land before construction Various...

Teradene Corporation purchased land as a factory site and contracted with Maxtor Construction to construct a factory. Teradene made the following expenditures related to the acquisition of the land, building, and equipment for the factory. (EV of $1. PV of $1. EVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Purchase price of the land Demolition and removal of old building Clearing and grading the land before construction Various...

A company purchased property for $100,000. The property included a building, equipment and land. The building...

A company purchased property for $100,000. The property included a building, equipment and land. The building was appraised at $62,000, the land at $45,000, and the equipment at $18,000 for a total appraised value of $125,000. What is the amount of cost to be allocated to the building in the accounting records? $0 $49,600 $62,000 $100,000 A company purchased office equipment for $24,500 and paid $1,470 in sales tax, $550 for installation, $3,200 for a needed adjustment to the equipment,...

Most questions answered within 3 hours.

-

lease solve all the

questions, don't need to explanations

Q1 - All animal

species have general...

asked 3 hours ago -

Business Phasing

1.Discuss the logical progression for growing a business, which

starts from the initial idea...

asked 3 hours ago -

Modify

When executing on the command line having only

this program name, the program will accept...

asked 4 hours ago -

Kenny Electric Company's noncallable bonds were issued several

years ago and now have 20 years to...

asked 4 hours ago -

find H(e^Jtheta) at theta= 0, pi/10, pi/20, pi/2 for

the following:

a) H(e^Jtheta)= 1+e^Jtheta

b) H(e^Jtheta)=...

asked 5 hours ago -

Home Corporation will open a new store on January 1. Based on

experience from its other...

asked 5 hours ago -

In a neoclassical model, use the IS-LM to analyze the effect of

a permanent money supply...

asked 6 hours ago -

An electron passes through a point 2.67 cm from a long straight

wire as it moves...

asked 6 hours ago -

A grammar is a 4-tuple G, G = (Ν, Σ, Π, Σ, S) where, Ν is...

asked 7 hours ago -

In this part, calculate the present values. Use the Excel PV

function to compute the present...

asked 7 hours ago -

Part 1. Primitive Types, Sorting, Recursion for

Homework.java

a) Implement the static method initializeArray that receives...

asked 8 hours ago -

Using C++, build a sorter that can rank a sequence of numbers in

a descending order....

asked 8 hours ago

- / 10 View Policies Current Attempt in Progress Sunland Company purchased land, a building, and equipment on January 2, 2021, for $895,000. The company paid $160,000 cash and signed a mortgage note payable for the remainder. Management's best estimate of the value of the land was $370,000; of the building, $416,250; and of the equipment. $138,750. Record the purchase. (Use Mortgage Payable for account.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually....

- / 10 View Policies Current Attempt in Progress Sunland Company purchased land, a building, and equipment on January 2, 2021, for $895,000. The company paid $160,000 cash and signed a mortgage note payable for the remainder. Management's best estimate of the value of the land was $370,000; of the building, $416,250; and of the equipment. $138,750. Record the purchase. (Use Mortgage Payable for account.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually....

5 points Save Ans A company purchased land, a building, and equipment for one price of $1,750,000. The estimated fair values of the land building and equipment are 5218.750.51531250 and $437 500 respectively. At what amount would the company record the land? $218.750 $1,750,000 $175,000 $185.000

5 points Save Ans A company purchased land, a building, and equipment for one price of $1,750,000. The estimated fair values of the land building and equipment are 5218.750.51531250 and $437 500 respectively. At what amount would the company record the land? $218.750 $1,750,000 $175,000 $185.000

Cullumber purchased land and a building on April for 398,400.

The company paid 123,600 in cash and signed a 5% note payable

Problem 9-6A Cullumber Company purchased land and a building on April 1, 2019, for $398,400. The company paid $123,600 in cash and signed a 5 % note payable for the balance. At that time, it was estimated that the land was worth $159,000 and the building, $239,400. The building was estimated to have a 25-year useful life with...

Cullumber purchased land and a building on April for 398,400.

The company paid 123,600 in cash and signed a 5% note payable

Problem 9-6A Cullumber Company purchased land and a building on April 1, 2019, for $398,400. The company paid $123,600 in cash and signed a 5 % note payable for the balance. At that time, it was estimated that the land was worth $159,000 and the building, $239,400. The building was estimated to have a 25-year useful life with...

Teradene Corporation purchased land as a factory site and contracted with Maxtor Construction to construct a factory. Teradene made the following expenditures related to the acquisition of the land, building, and equipment for the factory: (FV of $1, P of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.): Purchase price of the land Demolition and removal of old building Clearing and grading the land before construction Various...

Teradene Corporation purchased land as a factory site and contracted with Maxtor Construction to construct a factory. Teradene made the following expenditures related to the acquisition of the land, building, and equipment for the factory: (FV of $1, P of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.): Purchase price of the land Demolition and removal of old building Clearing and grading the land before construction Various...

explain please!

4. Campos sold equipment for $200,000. The equipment was purchased for $160,000 and had accumulated depreciation of $60,000. What amount is reported as Section 1231 gain? c. $60,000 b. $40,000 e. $200,000 d. $100,000 a. $0 5. On January 1, Year 2, Shah acquired an office building, economic useful life of 40 years, for $780,000 for use in his business. There was no estimated salvage value. Shah depreciated the building under MACRS for 10 years for a total...

explain please!

4. Campos sold equipment for $200,000. The equipment was purchased for $160,000 and had accumulated depreciation of $60,000. What amount is reported as Section 1231 gain? c. $60,000 b. $40,000 e. $200,000 d. $100,000 a. $0 5. On January 1, Year 2, Shah acquired an office building, economic useful life of 40 years, for $780,000 for use in his business. There was no estimated salvage value. Shah depreciated the building under MACRS for 10 years for a total...

Teradene Corporation purchased land as a factory site and contracted with Maxtor Construction to construct a factory. Teradene made the following expenditures related to the acquisition of the land, building, and equipment for the factory. (EV of $1. PV of $1. EVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Purchase price of the land Demolition and removal of old building Clearing and grading the land before construction Various...

Teradene Corporation purchased land as a factory site and contracted with Maxtor Construction to construct a factory. Teradene made the following expenditures related to the acquisition of the land, building, and equipment for the factory. (EV of $1. PV of $1. EVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Purchase price of the land Demolition and removal of old building Clearing and grading the land before construction Various...