Homework Answers

Answer 16:

Fewer projects are accepted because NPV of fewer projects will be

positive when we discount future values of projects using higher

cost of capital

Answer 17:

Perpetuity

Answer 18:

Less risky the firm's financial position

Answer 19:

Relate balance sheet assets to income statement sales

Answer 20:

Have long term effects on a firm

Add Answer to:

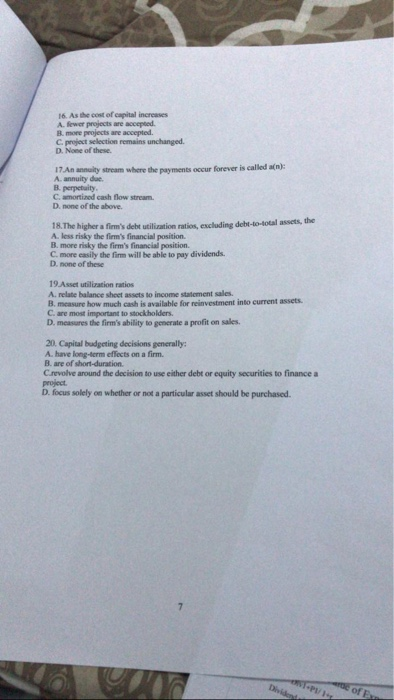

16. As the cost of capital increases A fewer projects are accepted B. more projects are...

29. If a firm applies its overall cost of capital to all its proposed projects, then...

29. If a firm applies its overall cost of capital to all its proposed projects, then the divisions within the firm will tend to A) receive more B) avoid risky projects so that they will receive more funding. C) become less risky over time based on the projects that are accepted. D) have equal probabilities of receiving funding for their projects. . E) propose less risky projects than if separate discount rates were applied funding if they represent the riskiest...

29. If a firm applies its overall cost of capital to all its proposed projects, then the divisions within the firm will tend to A) receive more B) avoid risky projects so that they will receive more funding. C) become less risky over time based on the projects that are accepted. D) have equal probabilities of receiving funding for their projects. . E) propose less risky projects than if separate discount rates were applied funding if they represent the riskiest...

If the projects were independent, which project(s) would be accepted? a) Neither b) Project A c)...

If the projects were independent, which project(s) would be

accepted?

a) Neither

b) Project A

c) Project B

d) Project A and B

If the projects were mutually exclusive, which project(s) would

be accepted?

a)Neither

b) Project A

c) Project B

d) Project A and B

Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line...

If the projects were independent, which project(s) would be

accepted?

a) Neither

b) Project A

c) Project B

d) Project A and B

If the projects were mutually exclusive, which project(s) would

be accepted?

a)Neither

b) Project A

c) Project B

d) Project A and B

Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line...

Апаlysis OPTIMAL CAPITAL BUDGET Marble Construction estimates that its WACC is 10 % if equity comes...

Апаlysis OPTIMAL CAPITAL BUDGET Marble Construction estimates that its WACC is 10 % if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 10.8%. The company believes that it will exhaust its retained earnings at $2,500,000 of capital due to the number of highly profitable projects available to the firm and its limited earmings. The company is considering the following seven investment projects: Project Size...

Апаlysis OPTIMAL CAPITAL BUDGET Marble Construction estimates that its WACC is 10 % if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 10.8%. The company believes that it will exhaust its retained earnings at $2,500,000 of capital due to the number of highly profitable projects available to the firm and its limited earmings. The company is considering the following seven investment projects: Project Size...

Ch 12: End-of-Chapter Problems - Cash Flow Estimation and Risk Analysis OPTIMAL CAPITAL BUDGET Marble Construction...

Ch 12: End-of-Chapter Problems - Cash Flow Estimation and Risk Analysis OPTIMAL CAPITAL BUDGET Marble Construction estimates that its WACC is 10% if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 10.8%. The company believes that it will exhaust its retained earnings at $2,500,000 of capital due to the number of highly profitable projects available to the firm and its limited earnings. The company...

Ch 12: End-of-Chapter Problems - Cash Flow Estimation and Risk Analysis OPTIMAL CAPITAL BUDGET Marble Construction estimates that its WACC is 10% if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 10.8%. The company believes that it will exhaust its retained earnings at $2,500,000 of capital due to the number of highly profitable projects available to the firm and its limited earnings. The company...

Hampton Manufacturing estimates that its WACC is 12%. The company is considering the following seven investment...

Hampton Manufacturing estimates that its WACC is 12%. The company is considering the following seven investment projects: Project Size IRR $650,000 13.6% 13.1 В 1,050,000 12,5 1,050,000 C D. 1,200,000 12.3 600,000 E 12.2 F 600,000 11.6 650,000 11.5 a. Assume that each of these projects is independent and that each is just as risky as the firm's existing assets. Which set of projects should be accepted? -Select Project A -Select Project B -Select Project C Project D -Select Project...

Hampton Manufacturing estimates that its WACC is 12%. The company is considering the following seven investment projects: Project Size IRR $650,000 13.6% 13.1 В 1,050,000 12,5 1,050,000 C D. 1,200,000 12.3 600,000 E 12.2 F 600,000 11.6 650,000 11.5 a. Assume that each of these projects is independent and that each is just as risky as the firm's existing assets. Which set of projects should be accepted? -Select Project A -Select Project B -Select Project C Project D -Select Project...

10-7: Composite, or Weighted Average, Cost of Capital, WACC WACC Midwest Electric Company (MEC) uses only...

10-7: Composite, or Weighted Average, Cost of Capital, WACC WACC Midwest Electric Company (MEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of rd-11% as long as it financ at its target capital structure, which calls for 35% debt and 65% common equity. Its last dividend (Do) was $2.20, its expected constant growth rate is 396, and its common stock sells for $21. MEC's tax rate is 40%. Two projects are available: Project...

10-7: Composite, or Weighted Average, Cost of Capital, WACC WACC Midwest Electric Company (MEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of rd-11% as long as it financ at its target capital structure, which calls for 35% debt and 65% common equity. Its last dividend (Do) was $2.20, its expected constant growth rate is 396, and its common stock sells for $21. MEC's tax rate is 40%. Two projects are available: Project...

______ 16. Each of the following is a typical source of long-term capital for a firm EXCEPT &n

______ 16. Each of the following is a typical source of long-term capital for a firm EXCEPT A. Accounts Receivable. B. long-term debt. C. preferred stock. D. common stock. ______ 17. ____________________________ is the process of evaluating and selecting long-term investments that are consistent with the firm’s goal of maximizing owners’ wealth. A. Compounding B. Capital budgeting C. Normalizing D. Underwriting ______ 18. ________________________ are projects whose cash flows in a capital budgeting analysis are unrelated to one another. I.e., accepting one project does not prevent the firm from doing...

Suppose Acme Industries correctly estimates its WACC at a given point in time and then uses that same cost of capital to...

Suppose Acme Industries correctly estimates its WACC at a given point in time and then uses that same cost of capital to evaluate all projects of various risks for the next 10 years. ACME will most likely a)become less risky over time, because it will tend to accept more low risk projects that high risk projects. b)become more risky over time, because it will tend to accept more high risk projects that low risk projects. c)continue at the same risk,...

5. Risk analysis in capital budgeting Projects differ in risk, and risk analysis is a critical...

5. Risk analysis in capital budgeting Projects differ in risk, and risk analysis is a critical component of the capital budgeting process. Consider the case of United Recycling Inc.: United Recycling Inc. is one of the largest recyclers of glass and paper products in the United States. The company is looking into expanding into the cardboard recycling business. The company's CFO has performed a detailed analysis of the proposed expansion. The company's CFO used sophisticated software to analyze a large...

5. Risk analysis in capital budgeting Projects differ in risk, and risk analysis is a critical component of the capital budgeting process. Consider the case of United Recycling Inc.: United Recycling Inc. is one of the largest recyclers of glass and paper products in the United States. The company is looking into expanding into the cardboard recycling business. The company's CFO has performed a detailed analysis of the proposed expansion. The company's CFO used sophisticated software to analyze a large...

Marble Construction estimates that its WACC is 9% if equity comes from retained earnings. However, if...

Marble Construction estimates that its WACC is 9% if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 9.6%. The company believes that it will exhaust its retained earnings at $2,400,000 of capital due to the number of highly profitable projects available to the firm and its limited earnings. The company is considering the following seven investment projects: Project IRR 13.7% 13.3 10.1 Size $...

Marble Construction estimates that its WACC is 9% if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 9.6%. The company believes that it will exhaust its retained earnings at $2,400,000 of capital due to the number of highly profitable projects available to the firm and its limited earnings. The company is considering the following seven investment projects: Project IRR 13.7% 13.3 10.1 Size $...

Most questions answered within 3 hours.

-

The average length of time between arrivals at a turnpike

toll-booth is 26 seconds. What is...

asked 1 hour ago -

(a) A piston at 6.1 atm contains a gas that occupies a volume of

3.5 L....

asked 2 hours ago -

Please answer true or false. Words

cannot be changed or added in to make it true...

asked 2 hours ago -

An empty test tube weighs 15.923 grams. Then,

MgCl2•6H2O is added into the test tube. After...

asked 2 hours ago -

Assume memory access is 10 units of time and disk access is

10000 units of time....

asked 2 hours ago -

1. Are all good samples random?

2. Magazines often report surveys giving statistics such as “63%...

asked 3 hours ago -

Under all the various types of market structures, firms

must eventually earn some economic profits for...

asked 2 hours ago -

Consider the following fitness regime for a single locus trait

with two co-dominant alleles: w11 =...

asked 2 hours ago -

A large cable company reports the following.

80% of its customers subscribe to its cable TV...

asked 3 hours ago -

Please answer the question in brief.

Discuss the role of ERP in organizations. Are ERP tools...

asked 2 hours ago -

Discuss the pros and cons of collaborative software such

as SameTime. Does it increase productivity? What...

asked 3 hours ago -

Buying your in-laws a gift because it’s expected is

due to the ____________ motive of gift-giving....

asked 3 hours ago

29. If a firm applies its overall cost of capital to all its proposed projects, then the divisions within the firm will tend to A) receive more B) avoid risky projects so that they will receive more funding. C) become less risky over time based on the projects that are accepted. D) have equal probabilities of receiving funding for their projects. . E) propose less risky projects than if separate discount rates were applied funding if they represent the riskiest...

29. If a firm applies its overall cost of capital to all its proposed projects, then the divisions within the firm will tend to A) receive more B) avoid risky projects so that they will receive more funding. C) become less risky over time based on the projects that are accepted. D) have equal probabilities of receiving funding for their projects. . E) propose less risky projects than if separate discount rates were applied funding if they represent the riskiest...

If the projects were independent, which project(s) would be

accepted?

a) Neither

b) Project A

c) Project B

d) Project A and B

If the projects were mutually exclusive, which project(s) would

be accepted?

a)Neither

b) Project A

c) Project B

d) Project A and B

Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line...

If the projects were independent, which project(s) would be

accepted?

a) Neither

b) Project A

c) Project B

d) Project A and B

If the projects were mutually exclusive, which project(s) would

be accepted?

a)Neither

b) Project A

c) Project B

d) Project A and B

Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line...

Апаlysis OPTIMAL CAPITAL BUDGET Marble Construction estimates that its WACC is 10 % if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 10.8%. The company believes that it will exhaust its retained earnings at $2,500,000 of capital due to the number of highly profitable projects available to the firm and its limited earmings. The company is considering the following seven investment projects: Project Size...

Апаlysis OPTIMAL CAPITAL BUDGET Marble Construction estimates that its WACC is 10 % if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 10.8%. The company believes that it will exhaust its retained earnings at $2,500,000 of capital due to the number of highly profitable projects available to the firm and its limited earmings. The company is considering the following seven investment projects: Project Size...

Ch 12: End-of-Chapter Problems - Cash Flow Estimation and Risk Analysis OPTIMAL CAPITAL BUDGET Marble Construction estimates that its WACC is 10% if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 10.8%. The company believes that it will exhaust its retained earnings at $2,500,000 of capital due to the number of highly profitable projects available to the firm and its limited earnings. The company...

Ch 12: End-of-Chapter Problems - Cash Flow Estimation and Risk Analysis OPTIMAL CAPITAL BUDGET Marble Construction estimates that its WACC is 10% if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 10.8%. The company believes that it will exhaust its retained earnings at $2,500,000 of capital due to the number of highly profitable projects available to the firm and its limited earnings. The company...

Hampton Manufacturing estimates that its WACC is 12%. The company is considering the following seven investment projects: Project Size IRR $650,000 13.6% 13.1 В 1,050,000 12,5 1,050,000 C D. 1,200,000 12.3 600,000 E 12.2 F 600,000 11.6 650,000 11.5 a. Assume that each of these projects is independent and that each is just as risky as the firm's existing assets. Which set of projects should be accepted? -Select Project A -Select Project B -Select Project C Project D -Select Project...

Hampton Manufacturing estimates that its WACC is 12%. The company is considering the following seven investment projects: Project Size IRR $650,000 13.6% 13.1 В 1,050,000 12,5 1,050,000 C D. 1,200,000 12.3 600,000 E 12.2 F 600,000 11.6 650,000 11.5 a. Assume that each of these projects is independent and that each is just as risky as the firm's existing assets. Which set of projects should be accepted? -Select Project A -Select Project B -Select Project C Project D -Select Project...

10-7: Composite, or Weighted Average, Cost of Capital, WACC WACC Midwest Electric Company (MEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of rd-11% as long as it financ at its target capital structure, which calls for 35% debt and 65% common equity. Its last dividend (Do) was $2.20, its expected constant growth rate is 396, and its common stock sells for $21. MEC's tax rate is 40%. Two projects are available: Project...

10-7: Composite, or Weighted Average, Cost of Capital, WACC WACC Midwest Electric Company (MEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of rd-11% as long as it financ at its target capital structure, which calls for 35% debt and 65% common equity. Its last dividend (Do) was $2.20, its expected constant growth rate is 396, and its common stock sells for $21. MEC's tax rate is 40%. Two projects are available: Project...

5. Risk analysis in capital budgeting Projects differ in risk, and risk analysis is a critical component of the capital budgeting process. Consider the case of United Recycling Inc.: United Recycling Inc. is one of the largest recyclers of glass and paper products in the United States. The company is looking into expanding into the cardboard recycling business. The company's CFO has performed a detailed analysis of the proposed expansion. The company's CFO used sophisticated software to analyze a large...

5. Risk analysis in capital budgeting Projects differ in risk, and risk analysis is a critical component of the capital budgeting process. Consider the case of United Recycling Inc.: United Recycling Inc. is one of the largest recyclers of glass and paper products in the United States. The company is looking into expanding into the cardboard recycling business. The company's CFO has performed a detailed analysis of the proposed expansion. The company's CFO used sophisticated software to analyze a large...

Marble Construction estimates that its WACC is 9% if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 9.6%. The company believes that it will exhaust its retained earnings at $2,400,000 of capital due to the number of highly profitable projects available to the firm and its limited earnings. The company is considering the following seven investment projects: Project IRR 13.7% 13.3 10.1 Size $...

Marble Construction estimates that its WACC is 9% if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 9.6%. The company believes that it will exhaust its retained earnings at $2,400,000 of capital due to the number of highly profitable projects available to the firm and its limited earnings. The company is considering the following seven investment projects: Project IRR 13.7% 13.3 10.1 Size $...