Homework Answers

Suppose, initially Christine purchased the new BMW car by taking a loan of $ L . The load was to be paid off by her in 20 equal quarterly payments along with an interest rate of 12% per year with quarterly compounding . Thus in each quarter, the interest charged could be calculated by dividing the annual rate of interest(12%) by the number of quarters in a year (i.e., 4). So the total amount of loan inclusive of interests charged that was to be paid by Christine to the Bank is given by :

$ L [1 + (12/4)

Now since Christine planned to pay this entire amount in 20 equal quarterly payments, she must have decided to pay

$ (1.806) L / 20 = $ (36.12) L .

But she made her quarterly payments only for 16 times before selling the car to her friend Jane. So Jane needed to pay the remaining loan amount to the bank that is the payment due for the next 2 installments , which equals to :

$ (36.12) L

Now , Jane decides to pay the unpaid balance by making 16 quarterly payments at the same interest rate 12% compounded quarterly. The only difference is that now her interest would be calculated solely on the amount that she needs to pay (unpaid by Christine)

. In total 16 installments, she needs to pay an amount inclusive of interests equal to :

$(144.48) L

Now since Jane pays this amount in 16 equal installments, she pays in each installment an amount equal to :

$ (260.93)L /16 = $ (16.308) L

But she only pays up to her 13th installment. Remaining 3

payments left unpaid when she sold the car to Ally. So to repay the

entire loan balance, Ally needs to pay : $ (16.308) L

We know that Ally ultimately pays $ 3000 . Then we can deduce that,

$ (48.924) L $ 3000

or. L = 3000 / 48.924 = 146772

Thus ,the amount of Christine's loan to purchase was $ 146772 when it was new.

Add Answer to:

(6) Christine Sohn bought a BMW when she came to LA as a purchased by taking a loan that was to be paid off in 20 e...

14. Loan amortization and capital recovery After Shipra got a job, the first thing she bought...

14. Loan amortization and capital recovery After Shipra got a job, the first thing she bought was a new car. She took out an amortized loan for $20,000—with no ($0) down payment. She agreed to pay off the loan by making annual payments for the next four years at the end of each year. Her bank is charging her an interest rate of 6% per year. Yesterday, she called to ask that you help her compute the annual payments necessary...

14. Loan amortization and capital recovery After Shipra got a job, the first thing she bought was a new car. She took out an amortized loan for $20,000—with no ($0) down payment. She agreed to pay off the loan by making annual payments for the next four years at the end of each year. Her bank is charging her an interest rate of 6% per year. Yesterday, she called to ask that you help her compute the annual payments necessary...

Please read the questions carefully. Please draw the cash flow diagrams and explain the steps that...

Please read the questions carefully. Please draw the cash flow diagrams and explain the steps that you are going to approach to solve the problems then solve the problem. Show the details in solving the problems. Please write legible hand writing, otherwise there is a deduction from your grade 10 points Missing Cash Flow Diagram is deductible points equal to 10% of the total points for each question. Question - 1 A series of equal semiannual cash flows starts with...

Please read the questions carefully. Please draw the cash flow diagrams and explain the steps that you are going to approach to solve the problems then solve the problem. Show the details in solving the problems. Please write legible hand writing, otherwise there is a deduction from your grade 10 points Missing Cash Flow Diagram is deductible points equal to 10% of the total points for each question. Question - 1 A series of equal semiannual cash flows starts with...

answer those 4 please Fatima just borrowed 83,364 dollars. She plans to repay this loan by...

answer those 4 please Fatima just borrowed 83,364 dollars. She plans to repay this loan by making a special payment of 29,387 dollars in 7 years and by making regular annual payments of 13,147 dollars per year until the loan is paid off. If the interest rate on the loan is 17.93 percent per year and she makes her first regular annual payment of 13,147 dollars immediately, then how many regular annual payments of 13,147 dollars must Fatima make? Round...

Suppose your friend April is considering to refinance her mortgage. She bought her house 60 months...

Suppose your friend April is considering to refinance her mortgage. She bought her house 60 months ago. The amount of loan equals 154,00. She paid cash to cover the 5% down payment plus all required closing costs (closing costs include application fee, appraisal fee, loan origination fees and other costs, usually about 3%-5% of the loan amount). Since she had a decent credit history and relatively stable income, her mortgage rate was 5.25% for 30 years at the time of...

Suppose your friend April is considering to refinance her mortgage. She bought her house 60 months ago. The amount of loan equals 154,00. She paid cash to cover the 5% down payment plus all required closing costs (closing costs include application fee, appraisal fee, loan origination fees and other costs, usually about 3%-5% of the loan amount). Since she had a decent credit history and relatively stable income, her mortgage rate was 5.25% for 30 years at the time of...

Part II-Mortgage Refinance Suppose your friend April is considering to refinance her mortgage. She bought her...

Part II-Mortgage Refinance Suppose your friend April is considering to refinance her mortgage. She bought her bonge 60 months ago. The amount of loan equals 154,000. She paid cash to cover the 5% down payment plus all required closing costs closing costs include application fee, appraisal fee. loan origination fees and other costs, usually about 3%-5% of the loan amount). Since she had a decent credit history and relatively stable income, her mortgage rate was 5.25% for 30 years at...

Part II-Mortgage Refinance Suppose your friend April is considering to refinance her mortgage. She bought her bonge 60 months ago. The amount of loan equals 154,000. She paid cash to cover the 5% down payment plus all required closing costs closing costs include application fee, appraisal fee. loan origination fees and other costs, usually about 3%-5% of the loan amount). Since she had a decent credit history and relatively stable income, her mortgage rate was 5.25% for 30 years at...

1. Diana bought a RM5,888 karaoke set on an instalment basis in which she made a...

1. Diana bought a RM5,888 karaoke set on an instalment basis in which she made a RM888 down payment. To settle the balance, she has to pay RM1,000 every month for the principal payment plus interest of 1% per month on any unpaid balance. Construct a repayment schedule to show her monthly payments. 2.A man purchased a car selling for RM12,750 by making instalment payments. If he was charged 4% based on the reducing balance and the total interest paid...

13-19 odd please 13. A $10,000 loan is to be amortized for 10 years with quarterly...

13-19 odd please

13. A $10,000 loan is to be amortized for 10 years with quarterly payments of $334.27. If the interest rate is 6% compounded quarterly, what is the unpaid balance immediately after the sixth payment? 14. A debt of $8000 is to be amortized with 8 equal semi- annual payments of $1288.29. If the interest rate is 12% compounded semiannually, find the unpaid balance immediately after the fifth payment. 15. When Maria Acosta bought a car 2 years...

13-19 odd please

13. A $10,000 loan is to be amortized for 10 years with quarterly payments of $334.27. If the interest rate is 6% compounded quarterly, what is the unpaid balance immediately after the sixth payment? 14. A debt of $8000 is to be amortized with 8 equal semi- annual payments of $1288.29. If the interest rate is 12% compounded semiannually, find the unpaid balance immediately after the fifth payment. 15. When Maria Acosta bought a car 2 years...

TRUE OF FALSE QUESTIONS. 1 - When a loan is paid off over a shorter period...

TRUE OF FALSE QUESTIONS. 1 - When a loan is paid off over a shorter period of time, the total interest costs are reduced. 2- The term cooperative describes a method of ownership for housing rather than a type of building. 3- The process in which the lender sues the borrower to prove default and asks the court to order the sale of the property to pay the debt is called foreclosure. 4- The damage deposit is an amount paid...

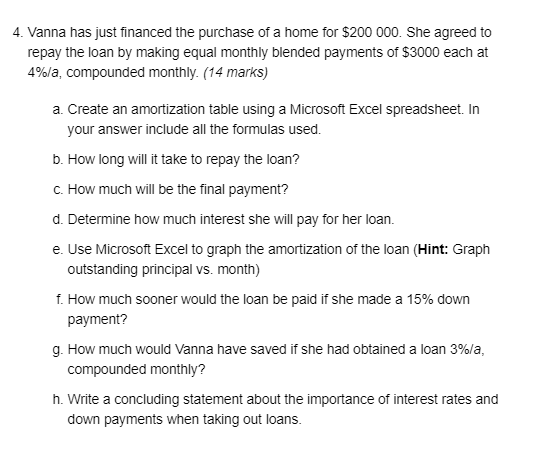

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. (14 marks) Create an amortization table using a Microsoft Excel spreadsheet. In y

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. a. Create an amortization table using a Microsoft Excel spreadsheet. In your answer include all the formulas used.b.How long will it take to repay the loan?c. How much will be the final payment?d. Determine how much interest she will pay for her loan.e. Use Microsoft Excel to graph the amortization...

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. a. Create an amortization table using a Microsoft Excel spreadsheet. In your answer include all the formulas used.b.How long will it take to repay the loan?c. How much will be the final payment?d. Determine how much interest she will pay for her loan.e. Use Microsoft Excel to graph the amortization...

YO16_XL_CH11_GRADER_PS1_HW - Loan Analysis 1.4 Project Description: Janette Franklin, owner of Frank Solutions, LLC, is considering...

YO16_XL_CH11_GRADER_PS1_HW - Loan Analysis

1.4

Project Description:

Janette Franklin, owner of Frank Solutions, LLC, is

considering borrowing $30,000 to finance the renovation of her

office building. She has been given three different loan options

with various terms and interest rates. She knows that she can only

afford to make payments of $530.00 a month and needs your help to

determine which loan option is best.

Instructions:

Step

Instructions

Points Possible

1

Start Excel. Open the file named

e06ch11_grader_h1_Loans.xlsx. Save the...

YO16_XL_CH11_GRADER_PS1_HW - Loan Analysis

1.4

Project Description:

Janette Franklin, owner of Frank Solutions, LLC, is

considering borrowing $30,000 to finance the renovation of her

office building. She has been given three different loan options

with various terms and interest rates. She knows that she can only

afford to make payments of $530.00 a month and needs your help to

determine which loan option is best.

Instructions:

Step

Instructions

Points Possible

1

Start Excel. Open the file named

e06ch11_grader_h1_Loans.xlsx. Save the...

Most questions answered within 3 hours.

-

The energy required to remove an electron from a surface of a

solid element is called...

asked 2 minutes ago -

How would you train your employees to avoid risks of using

mobile devices?

asked 24 minutes ago -

Assume Kw = 1.01 ✕ 10−14

For pure water, we can calculate [H3O+ ] = [OH...

asked 1 hour ago -

Suppose that on a temperature scale X, water boils at 203.0°X

and freezes at -105.7°X. What...

asked 2 hours ago -

BaS crystallizes in a cubic unit cell with S2- ions on each

corner and each face....

asked 2 hours ago -

A. 0≤P(Oi)≤10≤P(Oi)≤1 for each i

B. P(Oi)≤0P(Oi)≤0

C. P(Oi)=1+P(OCi)P(Oi)=1+P(OiC)

D. P(Oi)≥1P(Oi)≥1

If an experiment consists of...

asked 4 hours ago -

A battery has an emf of 9.20V and an internal resistance of 1.20

ohm. a)What resistance...

asked 4 hours ago -

The area of an elastic circular loop decreases at a constant

rate, dA/dt = −6.60×10−3 m2/s...

asked 5 hours ago -

The denaturation of proteins can be described by the

equilibrium

F⇌U

where F and U represent...

asked 6 hours ago -

Please answer what the maximum and minimum force is, and the

angle on the ion is...

asked 6 hours ago -

implement a program that reads a number of rows and a symbol.

The program will draw...

asked 6 hours ago -

Assume that when adults with smartphones are randomly selected,

45% use them in meetings or classes....

asked 7 hours ago

14. Loan amortization and capital recovery After Shipra got a job, the first thing she bought was a new car. She took out an amortized loan for $20,000—with no ($0) down payment. She agreed to pay off the loan by making annual payments for the next four years at the end of each year. Her bank is charging her an interest rate of 6% per year. Yesterday, she called to ask that you help her compute the annual payments necessary...

14. Loan amortization and capital recovery After Shipra got a job, the first thing she bought was a new car. She took out an amortized loan for $20,000—with no ($0) down payment. She agreed to pay off the loan by making annual payments for the next four years at the end of each year. Her bank is charging her an interest rate of 6% per year. Yesterday, she called to ask that you help her compute the annual payments necessary...

Please read the questions carefully. Please draw the cash flow diagrams and explain the steps that you are going to approach to solve the problems then solve the problem. Show the details in solving the problems. Please write legible hand writing, otherwise there is a deduction from your grade 10 points Missing Cash Flow Diagram is deductible points equal to 10% of the total points for each question. Question - 1 A series of equal semiannual cash flows starts with...

Please read the questions carefully. Please draw the cash flow diagrams and explain the steps that you are going to approach to solve the problems then solve the problem. Show the details in solving the problems. Please write legible hand writing, otherwise there is a deduction from your grade 10 points Missing Cash Flow Diagram is deductible points equal to 10% of the total points for each question. Question - 1 A series of equal semiannual cash flows starts with...

Suppose your friend April is considering to refinance her mortgage. She bought her house 60 months ago. The amount of loan equals 154,00. She paid cash to cover the 5% down payment plus all required closing costs (closing costs include application fee, appraisal fee, loan origination fees and other costs, usually about 3%-5% of the loan amount). Since she had a decent credit history and relatively stable income, her mortgage rate was 5.25% for 30 years at the time of...

Suppose your friend April is considering to refinance her mortgage. She bought her house 60 months ago. The amount of loan equals 154,00. She paid cash to cover the 5% down payment plus all required closing costs (closing costs include application fee, appraisal fee, loan origination fees and other costs, usually about 3%-5% of the loan amount). Since she had a decent credit history and relatively stable income, her mortgage rate was 5.25% for 30 years at the time of...

Part II-Mortgage Refinance Suppose your friend April is considering to refinance her mortgage. She bought her bonge 60 months ago. The amount of loan equals 154,000. She paid cash to cover the 5% down payment plus all required closing costs closing costs include application fee, appraisal fee. loan origination fees and other costs, usually about 3%-5% of the loan amount). Since she had a decent credit history and relatively stable income, her mortgage rate was 5.25% for 30 years at...

Part II-Mortgage Refinance Suppose your friend April is considering to refinance her mortgage. She bought her bonge 60 months ago. The amount of loan equals 154,000. She paid cash to cover the 5% down payment plus all required closing costs closing costs include application fee, appraisal fee. loan origination fees and other costs, usually about 3%-5% of the loan amount). Since she had a decent credit history and relatively stable income, her mortgage rate was 5.25% for 30 years at...

13-19 odd please

13. A $10,000 loan is to be amortized for 10 years with quarterly payments of $334.27. If the interest rate is 6% compounded quarterly, what is the unpaid balance immediately after the sixth payment? 14. A debt of $8000 is to be amortized with 8 equal semi- annual payments of $1288.29. If the interest rate is 12% compounded semiannually, find the unpaid balance immediately after the fifth payment. 15. When Maria Acosta bought a car 2 years...

13-19 odd please

13. A $10,000 loan is to be amortized for 10 years with quarterly payments of $334.27. If the interest rate is 6% compounded quarterly, what is the unpaid balance immediately after the sixth payment? 14. A debt of $8000 is to be amortized with 8 equal semi- annual payments of $1288.29. If the interest rate is 12% compounded semiannually, find the unpaid balance immediately after the fifth payment. 15. When Maria Acosta bought a car 2 years...

YO16_XL_CH11_GRADER_PS1_HW - Loan Analysis

1.4

Project Description:

Janette Franklin, owner of Frank Solutions, LLC, is

considering borrowing $30,000 to finance the renovation of her

office building. She has been given three different loan options

with various terms and interest rates. She knows that she can only

afford to make payments of $530.00 a month and needs your help to

determine which loan option is best.

Instructions:

Step

Instructions

Points Possible

1

Start Excel. Open the file named

e06ch11_grader_h1_Loans.xlsx. Save the...

YO16_XL_CH11_GRADER_PS1_HW - Loan Analysis

1.4

Project Description:

Janette Franklin, owner of Frank Solutions, LLC, is

considering borrowing $30,000 to finance the renovation of her

office building. She has been given three different loan options

with various terms and interest rates. She knows that she can only

afford to make payments of $530.00 a month and needs your help to

determine which loan option is best.

Instructions:

Step

Instructions

Points Possible

1

Start Excel. Open the file named

e06ch11_grader_h1_Loans.xlsx. Save the...