Homework Answers

In case of any doubt or issue please comment below

Add Answer to:

quant analysis help

What is the operating cash flow for 2016? Total Revenues Cost of Sales...

1. Which of the following regarding financial statement analysis is false? a) According to the DuPont...

1. Which of the following regarding financial statement analysis is false? a) According to the DuPont identity, Return on Equity is affected by operating efficiency (or profitability), asset use efficiency, and financial leverage. b) We can calculate the market value based measures of firm performance using only financial statements prepared according to GAAP. c) Asset management ratios measure the intensity and efficiency of asset use. d) For common size statements, we divide balance sheet items by total assets and income...

OCF=operating cash flow NCS-net capital spending NWC= net working capital CFS=cash flow to shareholders CFC=cash flow...

OCF=operating cash flow

NCS-net capital spending

NWC= net working capital

CFS=cash flow to shareholders

CFC=cash flow to creditors

FCF=free cash flow

1. A firm has the financial information shown below. The average tax rate is 30%. The plowback ratio is 50%. Calculate OCF, NCS, change in NWC, CFS, CFC, and FCF. Income Statement 2019 Revenues $20,000 Cost of Goods Sold $10.000 Other operating expenses $1,000 Depreciation expense $3.000 EBIT $6,000 Interest Expense $3,200 Taxable income $2.800 Taxes $840 Net income...

OCF=operating cash flow

NCS-net capital spending

NWC= net working capital

CFS=cash flow to shareholders

CFC=cash flow to creditors

FCF=free cash flow

1. A firm has the financial information shown below. The average tax rate is 30%. The plowback ratio is 50%. Calculate OCF, NCS, change in NWC, CFS, CFC, and FCF. Income Statement 2019 Revenues $20,000 Cost of Goods Sold $10.000 Other operating expenses $1,000 Depreciation expense $3.000 EBIT $6,000 Interest Expense $3,200 Taxable income $2.800 Taxes $840 Net income...

Income Statement Sales/Revenue Total revenue 76,480,000,000 Cost of Revenue 25,110,000,000 Gross Profit 51,370,000,000 Operating Exp 31,810,000,000...

Income Statement Sales/Revenue Total revenue 76,480,000,000 Cost of Revenue 25,110,000,000 Gross Profit 51,370,000,000 Operating Exp 31,810,000,000 Selling General & Admin - Other Operating Expense 3,390,000,000 Unusual Expense 16,180,000,000 EBIT after Unusual Expense 2,130,000,000 Non Operating Income/Expense 385,000,000 Equity in Affiliates (Pretax) 1,020,000,000 Interest Expense 17,670,000,000 Pretax Income 16,370,000,000 Other After Tax Income (Expense) 1,300,000,000 Consolidated Net Income - Minority Interest Expense 1,300,000,000 Net Income - Discontinued Operations 1,300,000,000 Net Income After Extraordinaries - Preferred Dividends 1,300,000,000 Net Income Available to...

Please list the formula and definition of each term Times interest earned = Free cash flow...

Please list the formula and definition of each term Times interest earned = Free cash flow = Profitability ratios = Earnings per share = Price-earnings ratio = Gross profit rate = Profit margin = Return on assets = Asset turnover = Payout ratio = Return on common stockholders’ equity= Liquidity ratios measure Working capital = Current ratio = Current cash debt coverage = Inventory turnover = Days in inventory = Accounts receivable turnover = Average collection period = Solvency ratios=...

NORTHEAST ART SUPPLY, INC. STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31,2017 CASH FLOW...

NORTHEAST ART SUPPLY, INC. STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31,2017 CASH FLOW FROM OPERATING ACTIVITIES: $30,175 Net Income Adjustments to reconcile net income to net cash flows S 8,500 Decrease in accounts receivable Increase in inventory Increase in accounts payable Increase in income taxes payable 1,000 (5,000) 6,000 3.000 13.500 $43,675 Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of Equipment Purchase of Investments Sale of Investments $ (2,000) (10,000) 20,000 Net...

NORTHEAST ART SUPPLY, INC. STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31,2017 CASH FLOW FROM OPERATING ACTIVITIES: $30,175 Net Income Adjustments to reconcile net income to net cash flows S 8,500 Decrease in accounts receivable Increase in inventory Increase in accounts payable Increase in income taxes payable 1,000 (5,000) 6,000 3.000 13.500 $43,675 Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of Equipment Purchase of Investments Sale of Investments $ (2,000) (10,000) 20,000 Net...

Ch 03: End-of-Chapter Problems - Financial Statements, Cash Flow, and Taxes

Ch 03: End-of-Chapter Problems - Financial Statements, Cash Flow, and Taxes The assets of Dallas & Associates consist entirely of current assets and net plant and equipment, and the firm has no excess cash. The firm has total assets of $2.6 million and net plant and equipment equals $2.3 million. It has notes payable of $160,000, long-term debt of $757,000, and total common equity of $1.45 million. The firm does have accounts payable and accruals on its balance sheet. The firm...

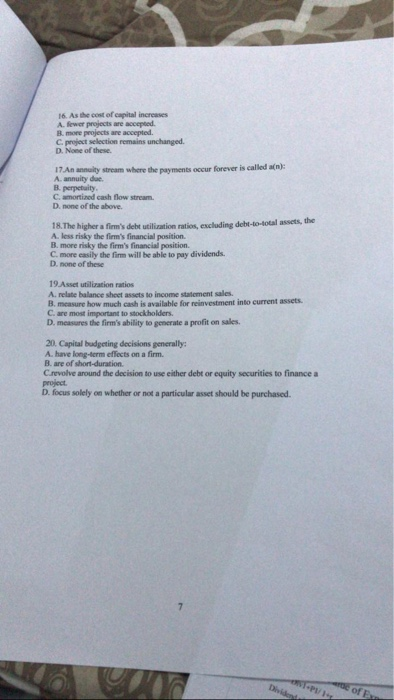

16. As the cost of capital increases A fewer projects are accepted B. more projects are...

16. As the cost of capital increases A fewer projects are accepted B. more projects are accepted. C. project selection remains unchanged. D. None of these 17.An annulty stream where the payments occur forever is called an): A. annuity due B. perpetuity. C. amortized cash flow stream D. none of the above. 18. The higher a firm's debt utilization ratios, excluding debt-to-total assets A less risky the firm's financial position. B. more risky the firm's financial position C. more easily...

16. As the cost of capital increases A fewer projects are accepted B. more projects are accepted. C. project selection remains unchanged. D. None of these 17.An annulty stream where the payments occur forever is called an): A. annuity due B. perpetuity. C. amortized cash flow stream D. none of the above. 18. The higher a firm's debt utilization ratios, excluding debt-to-total assets A less risky the firm's financial position. B. more risky the firm's financial position C. more easily...

The 2021 Income statement of Adrian Express reports sales of $20,310.000, cost of goods sold of...

The 2021 Income statement of Adrian Express reports sales of $20,310.000, cost of goods sold of $12.500,000. and net Income of $1,900,000. Balance sheet Information is provided in the following table. ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 2021 2e20 Assets Current assets: Cash Accounts receivable Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Connon stock Retained earnings Total liabilities and stockholders' equity $ 900.00 $ 910,000 1,725, eee1 .175.000 2,175,08 1,625,000 5.ee8,688...

The 2021 Income statement of Adrian Express reports sales of $20,310.000, cost of goods sold of $12.500,000. and net Income of $1,900,000. Balance sheet Information is provided in the following table. ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 2021 2e20 Assets Current assets: Cash Accounts receivable Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Connon stock Retained earnings Total liabilities and stockholders' equity $ 900.00 $ 910,000 1,725, eee1 .175.000 2,175,08 1,625,000 5.ee8,688...

b. What ao yuu nvestor, why miaghit yul lio 7What is free cash flow? If you...

b. What ao yuu nvestor, why miaghit yul lio 7What is free cash flow? If you were an i cash fRow than net income? and still be valued by investors that is, could a negative free cash flow ever be v and i by investors? Explain your answer How are management's actions incorporat interconnected? 8 Would it be possible for a company to report negative free cash flow ed in EVA and MVA? How What does double taxation of corporate...

b. What ao yuu nvestor, why miaghit yul lio 7What is free cash flow? If you were an i cash fRow than net income? and still be valued by investors that is, could a negative free cash flow ever be v and i by investors? Explain your answer How are management's actions incorporat interconnected? 8 Would it be possible for a company to report negative free cash flow ed in EVA and MVA? How What does double taxation of corporate...

2018 2017 Income Statement Information Sales revenue Cost of goods sold Net income $ $ 10,440,000...

2018 2017 Income Statement Information Sales revenue Cost of goods sold Net income $ $ 10,440,000 6,827,760 360,000 8,400,000 5,900,000 248,000 Balance Sheet Information Current assets Long-term assets $ 1,600,000 2,200,000 $ 1,500,000 1,900,000 Total assets $ 3,800,000 $ 3,400,000 $ Current liabilities Long-term liabilities Common stock Retained earnings 1.200,000 1,500,000 800,000 300,000 900.000 1,500,000 800,000 200,000 Total liabilities and stockholders' equity 3,800,000 $ 3,400,000 Required: 1. Calculate the following profitability ratios for 2018 (Round your answers to 1 decimal...

2018 2017 Income Statement Information Sales revenue Cost of goods sold Net income $ $ 10,440,000 6,827,760 360,000 8,400,000 5,900,000 248,000 Balance Sheet Information Current assets Long-term assets $ 1,600,000 2,200,000 $ 1,500,000 1,900,000 Total assets $ 3,800,000 $ 3,400,000 $ Current liabilities Long-term liabilities Common stock Retained earnings 1.200,000 1,500,000 800,000 300,000 900.000 1,500,000 800,000 200,000 Total liabilities and stockholders' equity 3,800,000 $ 3,400,000 Required: 1. Calculate the following profitability ratios for 2018 (Round your answers to 1 decimal...

Most questions answered within 3 hours.

-

suppose there is a normally distributed population with a mean of

250 and a standard deviation...

asked 21 minutes ago -

Question Three

Suppose you as project manager are using the Waterfall

development methodology on a large...

asked 1 hour ago -

Which statement is not true about welfare in Canada?

A.Benefits typically vary based on one's ability...

asked 1 hour ago -

Please help me with FLOWCHART and UML diagram for class,

thank you!

#include <iostream>

#include <fstream>...

asked 2 hours ago -

3. Describe the “logic circuit” of the Lac operon. Which

proteins are bound or not to...

asked 2 hours ago -

Ayesha’s adjusted gross income is $60,000 in 2019. She donated a

piece of artwork with a...

asked 2 hours ago -

For Dijkstra’s shortest path algorithm:

a. Give the Big-O time for Dijkstra’s shortest path algorithm

and...

asked 2 hours ago -

Phosphorus violates the 'octet rule' in biological molecules,

forming more covalent bonds than expected based on...

asked 3 hours ago -

A 1.3 eV electron has a 10-4 probability of tunneling

through a 2.4 eV potential barrier....

asked 3 hours ago -

What is the one ingredient that is common to being successful

with all stakeholders?

profit

trust...

asked 3 hours ago -

Write an assembly language 32 bit program that reads in lines of

text by a .txt...

asked 3 hours ago -

what is the density ( in g/L) of hydrogen gas at 29 degrees C and a...

asked 3 hours ago

OCF=operating cash flow

NCS-net capital spending

NWC= net working capital

CFS=cash flow to shareholders

CFC=cash flow to creditors

FCF=free cash flow

1. A firm has the financial information shown below. The average tax rate is 30%. The plowback ratio is 50%. Calculate OCF, NCS, change in NWC, CFS, CFC, and FCF. Income Statement 2019 Revenues $20,000 Cost of Goods Sold $10.000 Other operating expenses $1,000 Depreciation expense $3.000 EBIT $6,000 Interest Expense $3,200 Taxable income $2.800 Taxes $840 Net income...

OCF=operating cash flow

NCS-net capital spending

NWC= net working capital

CFS=cash flow to shareholders

CFC=cash flow to creditors

FCF=free cash flow

1. A firm has the financial information shown below. The average tax rate is 30%. The plowback ratio is 50%. Calculate OCF, NCS, change in NWC, CFS, CFC, and FCF. Income Statement 2019 Revenues $20,000 Cost of Goods Sold $10.000 Other operating expenses $1,000 Depreciation expense $3.000 EBIT $6,000 Interest Expense $3,200 Taxable income $2.800 Taxes $840 Net income...

NORTHEAST ART SUPPLY, INC. STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31,2017 CASH FLOW FROM OPERATING ACTIVITIES: $30,175 Net Income Adjustments to reconcile net income to net cash flows S 8,500 Decrease in accounts receivable Increase in inventory Increase in accounts payable Increase in income taxes payable 1,000 (5,000) 6,000 3.000 13.500 $43,675 Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of Equipment Purchase of Investments Sale of Investments $ (2,000) (10,000) 20,000 Net...

NORTHEAST ART SUPPLY, INC. STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31,2017 CASH FLOW FROM OPERATING ACTIVITIES: $30,175 Net Income Adjustments to reconcile net income to net cash flows S 8,500 Decrease in accounts receivable Increase in inventory Increase in accounts payable Increase in income taxes payable 1,000 (5,000) 6,000 3.000 13.500 $43,675 Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of Equipment Purchase of Investments Sale of Investments $ (2,000) (10,000) 20,000 Net...

The 2021 Income statement of Adrian Express reports sales of $20,310.000, cost of goods sold of $12.500,000. and net Income of $1,900,000. Balance sheet Information is provided in the following table. ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 2021 2e20 Assets Current assets: Cash Accounts receivable Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Connon stock Retained earnings Total liabilities and stockholders' equity $ 900.00 $ 910,000 1,725, eee1 .175.000 2,175,08 1,625,000 5.ee8,688...

The 2021 Income statement of Adrian Express reports sales of $20,310.000, cost of goods sold of $12.500,000. and net Income of $1,900,000. Balance sheet Information is provided in the following table. ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 2021 2e20 Assets Current assets: Cash Accounts receivable Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Connon stock Retained earnings Total liabilities and stockholders' equity $ 900.00 $ 910,000 1,725, eee1 .175.000 2,175,08 1,625,000 5.ee8,688...

b. What ao yuu nvestor, why miaghit yul lio 7What is free cash flow? If you were an i cash fRow than net income? and still be valued by investors that is, could a negative free cash flow ever be v and i by investors? Explain your answer How are management's actions incorporat interconnected? 8 Would it be possible for a company to report negative free cash flow ed in EVA and MVA? How What does double taxation of corporate...

b. What ao yuu nvestor, why miaghit yul lio 7What is free cash flow? If you were an i cash fRow than net income? and still be valued by investors that is, could a negative free cash flow ever be v and i by investors? Explain your answer How are management's actions incorporat interconnected? 8 Would it be possible for a company to report negative free cash flow ed in EVA and MVA? How What does double taxation of corporate...

2018 2017 Income Statement Information Sales revenue Cost of goods sold Net income $ $ 10,440,000 6,827,760 360,000 8,400,000 5,900,000 248,000 Balance Sheet Information Current assets Long-term assets $ 1,600,000 2,200,000 $ 1,500,000 1,900,000 Total assets $ 3,800,000 $ 3,400,000 $ Current liabilities Long-term liabilities Common stock Retained earnings 1.200,000 1,500,000 800,000 300,000 900.000 1,500,000 800,000 200,000 Total liabilities and stockholders' equity 3,800,000 $ 3,400,000 Required: 1. Calculate the following profitability ratios for 2018 (Round your answers to 1 decimal...

2018 2017 Income Statement Information Sales revenue Cost of goods sold Net income $ $ 10,440,000 6,827,760 360,000 8,400,000 5,900,000 248,000 Balance Sheet Information Current assets Long-term assets $ 1,600,000 2,200,000 $ 1,500,000 1,900,000 Total assets $ 3,800,000 $ 3,400,000 $ Current liabilities Long-term liabilities Common stock Retained earnings 1.200,000 1,500,000 800,000 300,000 900.000 1,500,000 800,000 200,000 Total liabilities and stockholders' equity 3,800,000 $ 3,400,000 Required: 1. Calculate the following profitability ratios for 2018 (Round your answers to 1 decimal...