Homework Answers

Add Answer to:

Score: U UI 5 PLS 33 Of 33 (28 complete) S6-5 (similar to) It is December...

Score: 0 of 5 pts 33 of 33 (28 complete) HW Score: 72 S6-5 (similar to)...

Score: 0 of 5 pts 33 of 33 (28 complete) HW Score: 72 S6-5 (similar to) Questi It is December 31, the end of the year, and the controller of Ruiz Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Beproty year-end adjustments, Rulz reports the following data: $ 445,000 Cost of goods sold.. . Historical cost of ending inventory as determined by a physical count 66.000 Rue determines that the current replacement cost of ending inventory is $47.000. Show...

Score: 0 of 5 pts 33 of 33 (28 complete) HW Score: 72 S6-5 (similar to) Questi It is December 31, the end of the year, and the controller of Ruiz Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Beproty year-end adjustments, Rulz reports the following data: $ 445,000 Cost of goods sold.. . Historical cost of ending inventory as determined by a physical count 66.000 Rue determines that the current replacement cost of ending inventory is $47.000. Show...

It is December 31, the end of the year, and the controller of Ramirez Corporation is...

It is December 31, the end of the year, and the controller of Ramirez Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Before any year-end adjustments, Ramirez reports the following data: Cost of goods sold Historical cost of ending inventory S 375,000 as determined by a physical count Ramirez determines that the current replacement cost of ending inventory is $45,000. Show what Ramirez should report for ending inventory and for cost of goods sold. Identify the financial statement where...

It is December 31, the end of the year, and the controller of Ramirez Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Before any year-end adjustments, Ramirez reports the following data: Cost of goods sold Historical cost of ending inventory S 375,000 as determined by a physical count Ramirez determines that the current replacement cost of ending inventory is $45,000. Show what Ramirez should report for ending inventory and for cost of goods sold. Identify the financial statement where...

1, and the controller of Martin Corporation is applying the lower-of-cost-or-market (LCM) e following data: Data...

1, and the controller of Martin Corporation is applying the lower-of-cost-or-market (LCM) e following data: Data Table $ 380,000 Cost of goods sold Historical cost of ending inventory, as determined by a physical count 58,000 Print Done y number in the input fields and then click Check Answer. Clear All Assignments S6-10 (similar to) Question Help It is December 31, the end of the year, and the controller of Martin Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Before...

1, and the controller of Martin Corporation is applying the lower-of-cost-or-market (LCM) e following data: Data Table $ 380,000 Cost of goods sold Historical cost of ending inventory, as determined by a physical count 58,000 Print Done y number in the input fields and then click Check Answer. Clear All Assignments S6-10 (similar to) Question Help It is December 31, the end of the year, and the controller of Martin Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Before...

It is December 31, 2017, end f year, and the controller f Santana Corporation is applying...

It is December 31, 2017, end f year, and the controller f Santana Corporation is applying the lower-of-cost-or-net-realizable-value (LCNRV) rule to inventories. Before any year-end adjustments, Santana has these data: Cost of goods sold.. 375.000 Historical cost of ending inventory, as determined by a physical count.... 67,000 .. Santana determines that the net realizable value of ending inventory item appears. $44,000. Show what Santana should report for ending inventory and for cost of goods sold. Identify the financial statement where...

It is December 31, 2017, end f year, and the controller f Santana Corporation is applying the lower-of-cost-or-net-realizable-value (LCNRV) rule to inventories. Before any year-end adjustments, Santana has these data: Cost of goods sold.. 375.000 Historical cost of ending inventory, as determined by a physical count.... 67,000 .. Santana determines that the net realizable value of ending inventory item appears. $44,000. Show what Santana should report for ending inventory and for cost of goods sold. Identify the financial statement where...

pls help me complete Required information [The following information applies to the questions displayed below.] Daniel...

pls help me complete

Required information [The following information applies to the questions displayed below.] Daniel Company uses a periodic inventory system. Data for the current year: beginning merchandise inventory (ending inventory December 31, prior year), 2,000 units at $38; purchases, 8,000 units at $40; expenses (excluding income taxes), $184,500; ending inventory per physical count at December 31, current year, 1,800 units; sales, 8,200 units; sales price per unit, $75; and average income tax rate, 30 percent. Required: 1-a. Compute...

pls help me complete

Required information [The following information applies to the questions displayed below.] Daniel Company uses a periodic inventory system. Data for the current year: beginning merchandise inventory (ending inventory December 31, prior year), 2,000 units at $38; purchases, 8,000 units at $40; expenses (excluding income taxes), $184,500; ending inventory per physical count at December 31, current year, 1,800 units; sales, 8,200 units; sales price per unit, $75; and average income tax rate, 30 percent. Required: 1-a. Compute...

TH VOIR. IVICUUIU TI Score: 0 of 1 pt 6 of 6 (5 complete) P6-28A (similar...

TH VOIR. IVICUUIU TI Score: 0 of 1 pt 6 of 6 (5 complete) P6-28A (similar to) Fit World began May with merchandise Inventory of 70 crates of vitamins that cost a total of $4,560. During the month, Fit World purchased and sold merchandise on account as follows: E! (Click the icon to view the transactions.) Read the requirements Requirement 1. Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold,...

TH VOIR. IVICUUIU TI Score: 0 of 1 pt 6 of 6 (5 complete) P6-28A (similar to) Fit World began May with merchandise Inventory of 70 crates of vitamins that cost a total of $4,560. During the month, Fit World purchased and sold merchandise on account as follows: E! (Click the icon to view the transactions.) Read the requirements Requirement 1. Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold,...

1. Harlequin Co. has used the LIFO retail method since it began op...

1. Harlequin Co. has used the LIFO retail method since it began operations in early 2015 (its base year). Its beginning inventory for 2016 was $36,000 at cost and $72,000 at retail prices. At the end of 2016, it computed its estimated ending inventory at retail to be $120,000. Assuming its cost-to-retail percentage for 2016 transactions was 60%, what is the inventory balance that Harlequin Co. would report in its 12/31/16 balance sheet? Hint: $64,800 2. Using the data from...

Problem 8.4A Year-End Adjustments; Shrinkage Losses and LCM (LO8-1,LO8-2,LO8-3) Mary’s Nursery uses a perpetual inventory system....

Problem 8.4A Year-End Adjustments; Shrinkage Losses and LCM (LO8-1,LO8-2,LO8-3) Mary’s Nursery uses a perpetual inventory system. At December 31, the perpetual inventory records indicate the following quantities of a particular blue spruce tree. Quantity Unit Cost Total Cost First purchase (oldest) 130 $ 25.00 $ 3,250 Second purchase 120 28.50 3,420 Third purchase 100 39.00 3,900 Total 350 $ 10,570 A year-end physical inventory, however, shows only 310 of these trees on hand. In its financial statements, Mary’s Nursery values...

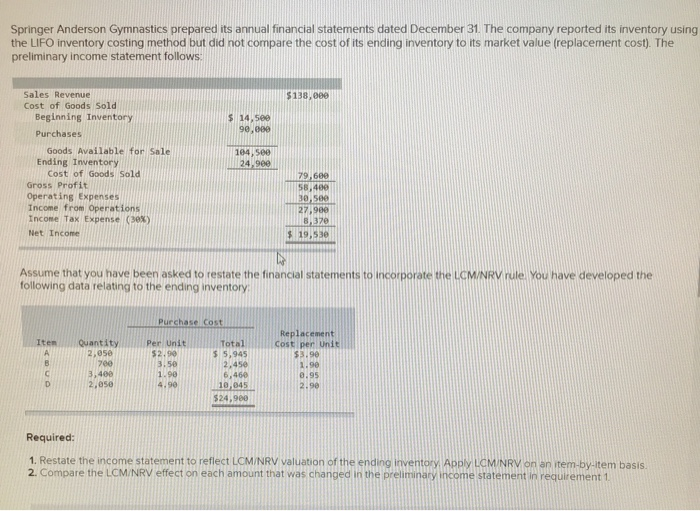

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $ 138,000 $14.500 90.000 Sales Revenue Cost of Goods Sold Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (30%) Net Income 24.900...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $ 138,000 $14.500 90.000 Sales Revenue Cost of Goods Sold Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (30%) Net Income 24.900...

A physical Inventory of Liverpool Company taken at December 31 reveals the following. Per Unit Cost...

A physical Inventory of Liverpool Company taken at December 31 reveals the following. Per Unit Cost Market Units $ 98 335 250 316 194 $ 90 111 86 52 100 95 Item Car audio equipment Speakers Stereos Amplifiers Subwoofers Security equipment Alarms Locks Cameras Binocular equipment Tripods Stabilizers 470 281 2e2 150 93 310 125 84 322 175 160 78 97 84 185 Required: 1. Calculate the lower of cost or market for the Inventory applied separately to each item....

A physical Inventory of Liverpool Company taken at December 31 reveals the following. Per Unit Cost Market Units $ 98 335 250 316 194 $ 90 111 86 52 100 95 Item Car audio equipment Speakers Stereos Amplifiers Subwoofers Security equipment Alarms Locks Cameras Binocular equipment Tripods Stabilizers 470 281 2e2 150 93 310 125 84 322 175 160 78 97 84 185 Required: 1. Calculate the lower of cost or market for the Inventory applied separately to each item....

Most questions answered within 3 hours.

-

4) In a polypeptide, which bond cannot rotate because of its

partial double bond character?

The...

asked 1 minute ago -

Sodium reacts with Hydrochloric acid to form sodium chloride and

hydrogen gas. 2Na(s)+ 2 HCl(aq)-> 2...

asked 1 minute ago -

The following circuits (1 & 2) are combined to form a

series-parallel circuit and resulting circuit...

asked 9 minutes ago -

Feynman's use of path integrals can make some of the transition

from quantum scale to real...

asked 8 minutes ago -

Pb(NO3)2 (aq) + 2 KCl (aq) PbCl2 (s) + 2 KNO3 (aq)

If 54.5mL of 3.82M...

asked 9 minutes ago -

Razeghi (2008) states "In order to succeed at innovation, do not

focus on being creative; rather...

asked 15 minutes ago -

How much heat is required at constant pressure to melt 1 mole of

ice at -25...

asked 18 minutes ago -

Suppose N is a discrete random variable defined by probability

distribution:

n

Pr(N = n)

10...

asked 19 minutes ago -

why are special-interest travelers becoming more important to

tourism service suppliers?

asked 23 minutes ago -

A 50.0-kg child takes a ride on a Ferris wheel that rotates four

times each minute...

asked 45 minutes ago -

What happens to the distribution of gene alleles when a

reproductive isolation arises between different population...

asked 44 minutes ago -

1 – Balance the following

Bi(OH)3 + SnO22- →

SnO32- +

Bi

asked 56 minutes ago

Score: 0 of 5 pts 33 of 33 (28 complete) HW Score: 72 S6-5 (similar to) Questi It is December 31, the end of the year, and the controller of Ruiz Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Beproty year-end adjustments, Rulz reports the following data: $ 445,000 Cost of goods sold.. . Historical cost of ending inventory as determined by a physical count 66.000 Rue determines that the current replacement cost of ending inventory is $47.000. Show...

Score: 0 of 5 pts 33 of 33 (28 complete) HW Score: 72 S6-5 (similar to) Questi It is December 31, the end of the year, and the controller of Ruiz Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Beproty year-end adjustments, Rulz reports the following data: $ 445,000 Cost of goods sold.. . Historical cost of ending inventory as determined by a physical count 66.000 Rue determines that the current replacement cost of ending inventory is $47.000. Show...

It is December 31, the end of the year, and the controller of Ramirez Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Before any year-end adjustments, Ramirez reports the following data: Cost of goods sold Historical cost of ending inventory S 375,000 as determined by a physical count Ramirez determines that the current replacement cost of ending inventory is $45,000. Show what Ramirez should report for ending inventory and for cost of goods sold. Identify the financial statement where...

It is December 31, the end of the year, and the controller of Ramirez Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Before any year-end adjustments, Ramirez reports the following data: Cost of goods sold Historical cost of ending inventory S 375,000 as determined by a physical count Ramirez determines that the current replacement cost of ending inventory is $45,000. Show what Ramirez should report for ending inventory and for cost of goods sold. Identify the financial statement where...

1, and the controller of Martin Corporation is applying the lower-of-cost-or-market (LCM) e following data: Data Table $ 380,000 Cost of goods sold Historical cost of ending inventory, as determined by a physical count 58,000 Print Done y number in the input fields and then click Check Answer. Clear All Assignments S6-10 (similar to) Question Help It is December 31, the end of the year, and the controller of Martin Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Before...

1, and the controller of Martin Corporation is applying the lower-of-cost-or-market (LCM) e following data: Data Table $ 380,000 Cost of goods sold Historical cost of ending inventory, as determined by a physical count 58,000 Print Done y number in the input fields and then click Check Answer. Clear All Assignments S6-10 (similar to) Question Help It is December 31, the end of the year, and the controller of Martin Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Before...

It is December 31, 2017, end f year, and the controller f Santana Corporation is applying the lower-of-cost-or-net-realizable-value (LCNRV) rule to inventories. Before any year-end adjustments, Santana has these data: Cost of goods sold.. 375.000 Historical cost of ending inventory, as determined by a physical count.... 67,000 .. Santana determines that the net realizable value of ending inventory item appears. $44,000. Show what Santana should report for ending inventory and for cost of goods sold. Identify the financial statement where...

It is December 31, 2017, end f year, and the controller f Santana Corporation is applying the lower-of-cost-or-net-realizable-value (LCNRV) rule to inventories. Before any year-end adjustments, Santana has these data: Cost of goods sold.. 375.000 Historical cost of ending inventory, as determined by a physical count.... 67,000 .. Santana determines that the net realizable value of ending inventory item appears. $44,000. Show what Santana should report for ending inventory and for cost of goods sold. Identify the financial statement where...

pls help me complete

Required information [The following information applies to the questions displayed below.] Daniel Company uses a periodic inventory system. Data for the current year: beginning merchandise inventory (ending inventory December 31, prior year), 2,000 units at $38; purchases, 8,000 units at $40; expenses (excluding income taxes), $184,500; ending inventory per physical count at December 31, current year, 1,800 units; sales, 8,200 units; sales price per unit, $75; and average income tax rate, 30 percent. Required: 1-a. Compute...

pls help me complete

Required information [The following information applies to the questions displayed below.] Daniel Company uses a periodic inventory system. Data for the current year: beginning merchandise inventory (ending inventory December 31, prior year), 2,000 units at $38; purchases, 8,000 units at $40; expenses (excluding income taxes), $184,500; ending inventory per physical count at December 31, current year, 1,800 units; sales, 8,200 units; sales price per unit, $75; and average income tax rate, 30 percent. Required: 1-a. Compute...

TH VOIR. IVICUUIU TI Score: 0 of 1 pt 6 of 6 (5 complete) P6-28A (similar to) Fit World began May with merchandise Inventory of 70 crates of vitamins that cost a total of $4,560. During the month, Fit World purchased and sold merchandise on account as follows: E! (Click the icon to view the transactions.) Read the requirements Requirement 1. Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold,...

TH VOIR. IVICUUIU TI Score: 0 of 1 pt 6 of 6 (5 complete) P6-28A (similar to) Fit World began May with merchandise Inventory of 70 crates of vitamins that cost a total of $4,560. During the month, Fit World purchased and sold merchandise on account as follows: E! (Click the icon to view the transactions.) Read the requirements Requirement 1. Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold,...

A physical Inventory of Liverpool Company taken at December 31 reveals the following. Per Unit Cost Market Units $ 98 335 250 316 194 $ 90 111 86 52 100 95 Item Car audio equipment Speakers Stereos Amplifiers Subwoofers Security equipment Alarms Locks Cameras Binocular equipment Tripods Stabilizers 470 281 2e2 150 93 310 125 84 322 175 160 78 97 84 185 Required: 1. Calculate the lower of cost or market for the Inventory applied separately to each item....

A physical Inventory of Liverpool Company taken at December 31 reveals the following. Per Unit Cost Market Units $ 98 335 250 316 194 $ 90 111 86 52 100 95 Item Car audio equipment Speakers Stereos Amplifiers Subwoofers Security equipment Alarms Locks Cameras Binocular equipment Tripods Stabilizers 470 281 2e2 150 93 310 125 84 322 175 160 78 97 84 185 Required: 1. Calculate the lower of cost or market for the Inventory applied separately to each item....