Homework Answers

| Question 1) | Question 2) | |||||

| Income | Income | |||||

| Bob | 160 | Bob | 260 | |||

| Saily | 6245 | Saily | 6245 | |||

| Total Income | 6405 | Total Income | 6505 | |||

| Expenses | Expenses | |||||

| Mortgage | 1580 | Mortgage | 1580 | |||

| Transportation | 288 | Transportation | 288 | |||

| Clothing | 146 | Clothing | 146 | |||

| Personal care | 62 | Personal care | 62 | |||

| Student loans | 544 | Student loans | 0 | |||

| Leisure | 160 | Leisure | 160 | |||

| property taxea | 271.67 | property taxea | 271.67 | |||

| Misc | 188 | Misc | 188 | |||

| Gifts & donations | 95 | Gifts & donations | 95 | |||

| Car insurance | 357 | Car insurance | 357 | |||

| Groceries | 584 | Groceries | 584 | |||

| Car Payment | 262 | Car payment | 262 | |||

| Health care | 63 | Health care | 63 | |||

| Household | 169 | Household | 169 | |||

| utilities | 269 | utilities | 269 | |||

| Vacations | 290 | Vacations | 290 | |||

| House insurance | 426 | House insurance | 426 | |||

| Telecomunications | 163.5 | Telecomunications | 163.5 | |||

| Gym | 94.5 | Gym | 94.5 | |||

| Total Expenses | 6012.67 | Total Expenses | 5468.67 | |||

| Net Income | 392.33 | Net Income | 1036.33 | |||

| Less savings 10% | 6405*10% | 640.5 | Less savings 10% | 6405*10% | 640.5 | |

| Deficit | -248.17 | Surplus | 395.83 | |||

| Question 3) | Question 4) | |||||

| Income | Income | |||||

| Bob | 260 | Bob | 520 | |||

| Saily | 6245 | Saily | 6245 | |||

| Total Income | 6505 | Total Income | 6765 | |||

| Expenses | Expenses | |||||

| Mortgage | 1632 | Mortgage | 1632 | |||

| Transportation | 288 | Transportation | 288 | |||

| Clothing | 146 | Clothing | 146 | |||

| Personal care | 62 | Personal care | 62 | |||

| Roof expense | 500 | Roof expense | 0 | |||

| Leisure | 160 | Leisure | 160 | |||

| property taxea | 271.67 | property taxea | 271.67 | |||

| Misc | 188 | Misc | 188 | |||

| Gifts & donations | 95 | Gifts & donations | 95 | |||

| Car insurance | 357 | Car insurance | 357 | |||

| Groceries | 584 | Groceries | 584 | |||

| Car payment | 262 | Car payment | 0 | |||

| Health care | 63 | Health care | 63 | |||

| Household | 169 | Household | 169 | |||

| utilities | 269 | utilities | 269 | |||

| Vacations | 290 | Vacations | 290 | |||

| House insurance | 426 | House insurance | 426 | |||

| Telecomunications | 163.5 | Telecomunications | 163.5 | |||

| Gym | 94.5 | Gym | 94.5 | |||

| Total Expenses | 6020.67 | Total Expenses | 5258.67 | |||

| Net Income | 484.33 | Net Income | 1506.33 | |||

| Less savings 10% | 6405*10% | 640.5 | Less savings 10% | 6405*10% | 640.5 | |

| Deficit | -156.17 | Surplus | 865.83 | |||

| If No Savings Surplus | 484.33 | |||||

| Stop saving is not ata all a good decisiion, however ther can reduce vacation expenses or Other miscelaneous till they settledown | ||||||

Add Answer to:

Excel Budget Assignment THE BOB STORY.. Using the Excel Budget Spreadsheet as a guide, fill in...

7. Preparing a cash budget Brock and Sam started to create a budget (based on last...

7. Preparing a cash budget Brock and Sam started to create a budget (based on last year’s income and expense statement) but got stuck. They know that you have learned how to create budgets and are asking for your help. They would like you to input the correct values for the first three months of next year. Income and Expense Statement Name(s): Brock and Sam Wilson For the year ending: As of December 31 Dollars Income Wages and salaries Name:...

7. Preparing a cash budget Dan and June started to create a budget (based on last...

7. Preparing a cash budget Dan and June started to create a budget (based on last year’s income and expense statement) but got stuck. They know that you have learned how to create budgets and are asking for your help. They would like you to input the correct values for the first three months of next year. Income and Expense Statement Name(s): Dan and June Kuryaki For the year ending: As of December 31 Dollars Income Wages and salaries Name:...

Assignment 1 Create a monthly budget using Excel. Each of the rows should represent days in...

Assignment 1 Create a monthly budget using Excel. Each of the rows should represent days in the month: 1st, 2nd, 3rd, etc. with the last row titled “Total.” Each of the columns should represent areas in which you spend money: groceries, restaurants, utilities, entertainment, school/work, car, shopping, misc., etc. At the bottom of each column on the Total row, use a SUM formula to add all of the rows for the whole month so that you can track your spending...

drop down for B. choices are income/expense,income/expense, surplus/deficit Income statement preparation Adam and Arin Adams have...

drop down for B. choices are income/expense,income/expense,

surplus/deficit

Income statement preparation Adam and Arin Adams have collected their personal income and expense information and have asked you to put together an income and expense statement for the year ended December 31, 2019. The following information is received from the Adams family a. Create a personal income and expensestament for the period ended December 31, 2019 should be similar to a corporate income statement b. Did the Adams family have a...

drop down for B. choices are income/expense,income/expense,

surplus/deficit

Income statement preparation Adam and Arin Adams have collected their personal income and expense information and have asked you to put together an income and expense statement for the year ended December 31, 2019. The following information is received from the Adams family a. Create a personal income and expensestament for the period ended December 31, 2019 should be similar to a corporate income statement b. Did the Adams family have a...

Due: November 4.2019 1. EXCEL Spreadsheet: a. You must use the FINANCIAL FUNCTIONS in EXCEL to...

Due: November 4.2019 1. EXCEL Spreadsheet: a. You must use the FINANCIAL FUNCTIONS in EXCEL to calculate your answers b. All calculations must be done in Excel Do not calculate anything on your calculator and just enter the number into Excel (if you do this, you will not receive credit for this assignment). Do the calculation within the cell c. You must reference cells from your base case (Only input variables that change for each requirement.) d. Your spreadsheet should...

Due: November 4.2019 1. EXCEL Spreadsheet: a. You must use the FINANCIAL FUNCTIONS in EXCEL to calculate your answers b. All calculations must be done in Excel Do not calculate anything on your calculator and just enter the number into Excel (if you do this, you will not receive credit for this assignment). Do the calculation within the cell c. You must reference cells from your base case (Only input variables that change for each requirement.) d. Your spreadsheet should...

Jamie Lee Jackson, age 24, now a busy full-time college student and part-time bakery clerk, has...

Jamie Lee Jackson, age 24, now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her Income towards savings, which includes accumulating enough money towards the $13,000 down payment she needs to begin her dream of opening a cupcake cafe. Jamie Lee has been making regular deposits to both her regular, as well as her emergency savings account....

Jamie Lee Jackson, age 24, now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her Income towards savings, which includes accumulating enough money towards the $13,000 down payment she needs to begin her dream of opening a cupcake cafe. Jamie Lee has been making regular deposits to both her regular, as well as her emergency savings account....

Jamie Lee Jackson, age 24. now a busy full-time college student and part-time bakery clerk, has...

Jamie Lee Jackson, age 24. now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her income towards savings, which includes accumulating enough money towards the $10,000 down payment she needs to begin her dream of opening a cupcake cafe. Jamie Lee has been making regular deposits to both her regular, as well as her emergency savings account....

Jamie Lee Jackson, age 24. now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her income towards savings, which includes accumulating enough money towards the $10,000 down payment she needs to begin her dream of opening a cupcake cafe. Jamie Lee has been making regular deposits to both her regular, as well as her emergency savings account....

10. Preparing a cash budget Brock and Sam started to create a budget (based on last year's income and expense...

10. Preparing a cash budget Brock and Sam started to create a budget (based on last year's income and expense statement) but got stuck. They know that you have learned how to create budgets and are asking for your help. They would like you to input the correct values for the first three months of next year. Income and Expense Statement Name(s): Brock and Sam Wilson For the year ending: As of December 31 Dollars Income Wages and salaries Name:...

10. Preparing a cash budget Brock and Sam started to create a budget (based on last year's income and expense statement) but got stuck. They know that you have learned how to create budgets and are asking for your help. They would like you to input the correct values for the first three months of next year. Income and Expense Statement Name(s): Brock and Sam Wilson For the year ending: As of December 31 Dollars Income Wages and salaries Name:...

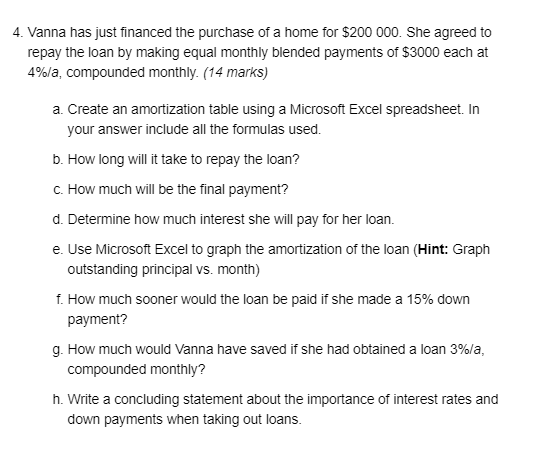

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. (14 marks) Create an amortization table using a Microsoft Excel spreadsheet. In y

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. a. Create an amortization table using a Microsoft Excel spreadsheet. In your answer include all the formulas used.b.How long will it take to repay the loan?c. How much will be the final payment?d. Determine how much interest she will pay for her loan.e. Use Microsoft Excel to graph the amortization...

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. a. Create an amortization table using a Microsoft Excel spreadsheet. In your answer include all the formulas used.b.How long will it take to repay the loan?c. How much will be the final payment?d. Determine how much interest she will pay for her loan.e. Use Microsoft Excel to graph the amortization...

Jamie Lee Jackson, age 24, now a busy full-time college student and part-time bakery clerk, has...

Jamie Lee Jackson, age 24, now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her income towards savings, which includes accumulating enough money towards the $7,500 down payment she needs to begin her dream of opening a cupcake café. Jamie Lee has been making regular deposits to both her regular, as well as her emergency savings account....

Jamie Lee Jackson, age 24, now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her income towards savings, which includes accumulating enough money towards the $7,500 down payment she needs to begin her dream of opening a cupcake café. Jamie Lee has been making regular deposits to both her regular, as well as her emergency savings account....

Most questions answered within 3 hours.

-

Is the purpose of lightning rods to attract lightning?

asked 7 minutes ago -

Let A be an event included in S that is independent of itself.

Then we have:...

asked 6 minutes ago -

The Adverse Childhood Experiences (ACE) Study has had a great

impact on moving psychologists to be...

asked 4 minutes ago -

Write a paper on: Assume that you have been assigned as the

project manager for a...

asked 8 minutes ago -

You plan to save $5,700 per year for the next 10 years. After

the last deposit,...

asked 41 minutes ago -

On January 1, 2019, ABC Corp. borrowed $81,000 by signing an

installment loan. The loan will be...

asked 45 minutes ago -

Enzyme X exhibits maximum activity at pH = 5.25. X shows a sharp

decrease in its...

asked 1 hour ago -

Postulate a reason for why so many aliphatic amino acids are

essential.

asked 59 minutes ago -

Three samples were taken of 4 different dog food bags and their

weights were recorded:

Sample/Observation...

asked 1 hour ago -

The Beatles had 27 number one hits; a radio station asks

listeners to send in a...

asked 1 hour ago -

Help with Java Program Please

Create a simple graph class. The graph class should have the...

asked 1 hour ago -

Which of the following statements is true regarding the nature

of culture?

A.We are born with...

asked 1 hour ago

drop down for B. choices are income/expense,income/expense,

surplus/deficit

Income statement preparation Adam and Arin Adams have collected their personal income and expense information and have asked you to put together an income and expense statement for the year ended December 31, 2019. The following information is received from the Adams family a. Create a personal income and expensestament for the period ended December 31, 2019 should be similar to a corporate income statement b. Did the Adams family have a...

drop down for B. choices are income/expense,income/expense,

surplus/deficit

Income statement preparation Adam and Arin Adams have collected their personal income and expense information and have asked you to put together an income and expense statement for the year ended December 31, 2019. The following information is received from the Adams family a. Create a personal income and expensestament for the period ended December 31, 2019 should be similar to a corporate income statement b. Did the Adams family have a...

Due: November 4.2019 1. EXCEL Spreadsheet: a. You must use the FINANCIAL FUNCTIONS in EXCEL to calculate your answers b. All calculations must be done in Excel Do not calculate anything on your calculator and just enter the number into Excel (if you do this, you will not receive credit for this assignment). Do the calculation within the cell c. You must reference cells from your base case (Only input variables that change for each requirement.) d. Your spreadsheet should...

Due: November 4.2019 1. EXCEL Spreadsheet: a. You must use the FINANCIAL FUNCTIONS in EXCEL to calculate your answers b. All calculations must be done in Excel Do not calculate anything on your calculator and just enter the number into Excel (if you do this, you will not receive credit for this assignment). Do the calculation within the cell c. You must reference cells from your base case (Only input variables that change for each requirement.) d. Your spreadsheet should...

Jamie Lee Jackson, age 24, now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her Income towards savings, which includes accumulating enough money towards the $13,000 down payment she needs to begin her dream of opening a cupcake cafe. Jamie Lee has been making regular deposits to both her regular, as well as her emergency savings account....

Jamie Lee Jackson, age 24, now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her Income towards savings, which includes accumulating enough money towards the $13,000 down payment she needs to begin her dream of opening a cupcake cafe. Jamie Lee has been making regular deposits to both her regular, as well as her emergency savings account....

Jamie Lee Jackson, age 24. now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her income towards savings, which includes accumulating enough money towards the $10,000 down payment she needs to begin her dream of opening a cupcake cafe. Jamie Lee has been making regular deposits to both her regular, as well as her emergency savings account....

Jamie Lee Jackson, age 24. now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her income towards savings, which includes accumulating enough money towards the $10,000 down payment she needs to begin her dream of opening a cupcake cafe. Jamie Lee has been making regular deposits to both her regular, as well as her emergency savings account....

10. Preparing a cash budget Brock and Sam started to create a budget (based on last year's income and expense statement) but got stuck. They know that you have learned how to create budgets and are asking for your help. They would like you to input the correct values for the first three months of next year. Income and Expense Statement Name(s): Brock and Sam Wilson For the year ending: As of December 31 Dollars Income Wages and salaries Name:...

10. Preparing a cash budget Brock and Sam started to create a budget (based on last year's income and expense statement) but got stuck. They know that you have learned how to create budgets and are asking for your help. They would like you to input the correct values for the first three months of next year. Income and Expense Statement Name(s): Brock and Sam Wilson For the year ending: As of December 31 Dollars Income Wages and salaries Name:...

Jamie Lee Jackson, age 24, now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her income towards savings, which includes accumulating enough money towards the $7,500 down payment she needs to begin her dream of opening a cupcake café. Jamie Lee has been making regular deposits to both her regular, as well as her emergency savings account....

Jamie Lee Jackson, age 24, now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her income towards savings, which includes accumulating enough money towards the $7,500 down payment she needs to begin her dream of opening a cupcake café. Jamie Lee has been making regular deposits to both her regular, as well as her emergency savings account....