1.Indicate the proper journal entry to record payment of a cash dividend previously declared:

Select one:

a. Debit Cash, credit Dividend Payable

b. Debit Dividends, credit Cash

2.A bookkeeper erroneously recorded a $7 accrual of wages payable using this journal entry:

|

Sales Discount |

$7 |

||

|

Inventory |

$7 |

||

Indicate the effect of the error on Expenses, Assets, and Liabilities, respectively:

Select one:

a. No Error, Understated, No Error

b. Overstated, No Error, Understated

c. Understated, Understated, Understated

d. No Error, No Error, Understated

e. Understated, No Error, Understated

c. Debit Dividends, credit Dividend Payable

d. Debit Dividend Payable, credit Cash

e. Debit Cash, credit Dividends

3.

The Vlasik Company paid a cash dividend previously declared and

recorded this journal entry.

Determine the effect of the error on Net Income, Liabilities and

Owners' Equity, respectively:

Select one:

a. Overstated, Overstated, Overstated

b. Understated, No Error, No Error

c. Understated, Overstated, Understated

d. Overstated, Overstated, No Error

e. Overstated, No Error, No Error

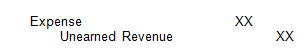

4.

The Pieper Corp. recorded the accrual of an expense by debiting Unearned Revenue and crediting Accounts Receivable.

Indicate the effect of the error on Assets, Liabilities, and Net Income, respectively:

Select one:

a. Understated, Understated, Overstated

b. Overstated, Understated, Overstated

c. Understated, No Error, Overstated

d. No Error, No Error, No Error

e. Understated, No Error, Understated

Homework Answers

Solution 1:

Proper journal entry to record payment of a cash dividend previously declared is "Debit Dividend Payable, credit Cash"

Hence option d is correct.

Solution 2:

Effect of the error on Expenses, Assets, and Liabilities, respectively are "Understated, Understated, Understated"

Hence option c is correct.

Solution 3:

effect of the error on Net Income, Liabilities and Owners' Equity, respectively are "Understated, Overstated, Understated"

Hence option c is correct.

Solution 4:

effect of the error on Assets, Liabilities, and Net Income respectively are "Understated, Understated, Overstated"

Hence option a is correct.

Add Answer to:

1.Indicate the proper journal entry to record payment of a cash

dividend previously declared:

Select one:...

1. On 12/31/12, as part of the year-end adjusting journal entries, the Strickland Company accrues three...

1. On 12/31/12, as part of the year-end adjusting journal entries, the Strickland Company accrues three day's wages of $600 ($200 per day). The proper 12/31/12 closing entries are made. No reversing entry is made on 1/1/13. Strickland pays the weekly payroll of $1,000 on 1/2/13. The balance in the Wage Expense account after the 1/2/13 journal entry will be: Select one: a. $0 b. $400 c. $600 d. $1,000 e. $1,200 2. Which principle is most representative of the...

A bookkeeper erroneously recorded the accrual of revenue using this journa Sales Discount Depreciation Expense The...

A bookkeeper erroneously recorded the accrual of revenue using this journa Sales Discount Depreciation Expense The effect of this error on Total Expenses and Total Assets (respectively Select one: a. No Error, Understated Ob. Overstated, Understated c. No Error, No Error Od. Understated, No Error e. Understated, Understated The Vlasik Company declared an $8 cash dividend and recorded this journal entry (assume the amount is accurate, but not necessarily the accounts): Unearned Revenue Prepaid Insurance 58 Indicate the effect of...

A bookkeeper erroneously recorded the accrual of revenue using this journa Sales Discount Depreciation Expense The effect of this error on Total Expenses and Total Assets (respectively Select one: a. No Error, Understated Ob. Overstated, Understated c. No Error, No Error Od. Understated, No Error e. Understated, Understated The Vlasik Company declared an $8 cash dividend and recorded this journal entry (assume the amount is accurate, but not necessarily the accounts): Unearned Revenue Prepaid Insurance 58 Indicate the effect of...

write down the journal entry that the company ACTUALLY MADE (shown on the right side of...

write down the journal entry that the company ACTUALLY MADE

(shown on the right side of the attached sheet) for each

error.

Write down the journal enrtry that the company SHOULD HAVE

made.

thank you!!

in the column headings in the table. Use the following symbols:0 = overstated, U = understated and NE no effect Total Revenue Total Expenses Net Income Total Assets Total Liabilities Error Owners' Equity a. Recorded a declared but unpaid dividend by debiting dividends and crediting...

write down the journal entry that the company ACTUALLY MADE

(shown on the right side of the attached sheet) for each

error.

Write down the journal enrtry that the company SHOULD HAVE

made.

thank you!!

in the column headings in the table. Use the following symbols:0 = overstated, U = understated and NE no effect Total Revenue Total Expenses Net Income Total Assets Total Liabilities Error Owners' Equity a. Recorded a declared but unpaid dividend by debiting dividends and crediting...

8) Daisy Co. previously received & recorded $5,000 cash from a client for future consulting services....

8) Daisy Co. previously received & recorded $5,000 cash from a client for future consulting services. Now Daisy Co. has provided $3,000 of the services and earned that revenue. What is the necessary adjusting entry? Debit Credit If this adjustment is not made, the following are overstated, understated, or not impacted: (completed for you on this question) Assets: not impacted Revenue: understated Liabilities: overstated Expense:_not impacted Stockholders' Equity: understated 9) Interest of $450 has accrued on a note payable. What...

8) Daisy Co. previously received & recorded $5,000 cash from a client for future consulting services. Now Daisy Co. has provided $3,000 of the services and earned that revenue. What is the necessary adjusting entry? Debit Credit If this adjustment is not made, the following are overstated, understated, or not impacted: (completed for you on this question) Assets: not impacted Revenue: understated Liabilities: overstated Expense:_not impacted Stockholders' Equity: understated 9) Interest of $450 has accrued on a note payable. What...

On the date of payment for a cash dividend, what journal entry is required? O A....

On the date of payment for a cash dividend, what journal entry is required? O A. Debit Retained Earnings and credit Dividends Payable O B. Debit Dividends and credit Retained Earnings OC. Debit Dividends Payable and credit Cash OD. Debit Cash and credit Dividends Payable

On the date of payment for a cash dividend, what journal entry is required? O A. Debit Retained Earnings and credit Dividends Payable O B. Debit Dividends and credit Retained Earnings OC. Debit Dividends Payable and credit Cash OD. Debit Cash and credit Dividends Payable

The entry to record expired insurance is omitted. This error causes Select one: a. assets to...

The entry to record expired insurance is omitted. This error causes Select one: a. assets to be overstated. b. expenses to be overstated. c. liabilities to be overstated. d. liabilities to be understated. e. an increase in liabilities on the balance sheet.

(6 of 10) A company pays a $2,000 cash dividend that was declared and initially recorded...

(6 of 10) A company pays a $2,000 cash dividend that was declared and initially recorded last month. Prepare the general journal entry DEBIT: Cash for $2,000; CREDIT: Dividends for $2,000 DEBIT: Dividends for $2,000; CREDIT: Cash for $2,000 DEBIT: Dividends for $2,000; CREDIT: Dividends Payable for $2,000 DEBIT: Dividends Payable for $2,000; CREDIT: Cash for $2,000

(6 of 10) A company pays a $2,000 cash dividend that was declared and initially recorded last month. Prepare the general journal entry DEBIT: Cash for $2,000; CREDIT: Dividends for $2,000 DEBIT: Dividends for $2,000; CREDIT: Cash for $2,000 DEBIT: Dividends for $2,000; CREDIT: Dividends Payable for $2,000 DEBIT: Dividends Payable for $2,000; CREDIT: Cash for $2,000

Question 9 6 The journal entry to record the declaration of a cash dividend would include...

Question 9 6 The journal entry to record the declaration of a cash dividend would include a: debit to Retained Earnings debit to Dividend Expense debit to Dividends Payable credit to Cash Ne

Question 9 6 The journal entry to record the declaration of a cash dividend would include a: debit to Retained Earnings debit to Dividend Expense debit to Dividends Payable credit to Cash Ne

1. The Charleston Company pre-pays annual rent. If the adjusting entry to record the current period’s...

1. The Charleston Company pre-pays annual rent. If the adjusting entry to record the current period’s prepaid rent expired is not recorded: Select one: a. Current assets will be understated b. Net income will be overstated c. Current liabilities will be overstated d. Current liabilities will be understated e. Gross Profit will be overstated 2. Which organization is attempting to establish one set of accounting standards to be used in every country in the world? Select one: a. PCAOB b....

1.Given the following: 2013 Net Loss is: Select one: a. $38 b. $6 c. $12 d....

1.Given the following:

2013 Net Loss is:

Select one:

a. $38

b. $6

c. $12

d. $13

e. $8

2.The Walton Company accrued a revenue and recorded this journal

entry.

Determine the effect of the error on the following:

Select one:

a. Assets Understated, Net Income No Error

b. Assets No Error, Net Income No Error

c. Assets Understated, Net Income Understated

d. Assets Overstated, Net Income No Error

e. Assets No Error, Net Income Understated

3.

In preparing its...

1.Given the following:

2013 Net Loss is:

Select one:

a. $38

b. $6

c. $12

d. $13

e. $8

2.The Walton Company accrued a revenue and recorded this journal

entry.

Determine the effect of the error on the following:

Select one:

a. Assets Understated, Net Income No Error

b. Assets No Error, Net Income No Error

c. Assets Understated, Net Income Understated

d. Assets Overstated, Net Income No Error

e. Assets No Error, Net Income Understated

3.

In preparing its...

Most questions answered within 3 hours.

-

After watching the lectures I am still having a hard time

understanding these equations.

1. The...

asked 42 minutes ago -

Testing:

H0:μ=56.9

H1:μ<56.9

Your sample consists of 23 subjects, with a mean of 56.3 and

standard...

asked 46 minutes ago -

straight wire, labeled as Wire A, lies horizontally on a

tabletop and is oriented to run...

asked 47 minutes ago -

For a Chi-Squared Goodness of Fit Test about a uniform

distribution, complete the table.

Round to...

asked 1 hour ago -

Milk of magnesia is only slightly soluble in water. Kc for the

reaction Mg(OHs)(s)>Mg2+(a) + 2OH-1(aq)...

asked 1 hour ago -

Excel's HYPGEOM.DIST function can be used to compute _____.

a. both hypergeometric probabilities and cumulative

hypergeometric...

asked 1 hour ago -

The rocket used for the human lunar missions was the Saturn V

rocket. At liftoff the...

asked 1 hour ago -

1. The East Street Bagel Shop has a weekly demand for 3,500

bagels, which they make...

asked 1 hour ago -

paraphrasing each paragraph

“Where two or more persons knowingly act together unlawfully,

the act of each...

asked 1 hour ago -

The lateral line system in fish is contained which of the

following?

chemoreceptors

photoreceptors

mechanoreceptors

odor...

asked 1 hour ago -

Find the y-intercept of y =-5 x. The y-intercept of y equals

negative 5 x is______...

asked 1 hour ago -

Customers arrive randomly at a gas station at the average rate

of 30 per hour, while...

asked 1 hour ago

A bookkeeper erroneously recorded the accrual of revenue using this journa Sales Discount Depreciation Expense The effect of this error on Total Expenses and Total Assets (respectively Select one: a. No Error, Understated Ob. Overstated, Understated c. No Error, No Error Od. Understated, No Error e. Understated, Understated The Vlasik Company declared an $8 cash dividend and recorded this journal entry (assume the amount is accurate, but not necessarily the accounts): Unearned Revenue Prepaid Insurance 58 Indicate the effect of...

A bookkeeper erroneously recorded the accrual of revenue using this journa Sales Discount Depreciation Expense The effect of this error on Total Expenses and Total Assets (respectively Select one: a. No Error, Understated Ob. Overstated, Understated c. No Error, No Error Od. Understated, No Error e. Understated, Understated The Vlasik Company declared an $8 cash dividend and recorded this journal entry (assume the amount is accurate, but not necessarily the accounts): Unearned Revenue Prepaid Insurance 58 Indicate the effect of...

write down the journal entry that the company ACTUALLY MADE

(shown on the right side of the attached sheet) for each

error.

Write down the journal enrtry that the company SHOULD HAVE

made.

thank you!!

in the column headings in the table. Use the following symbols:0 = overstated, U = understated and NE no effect Total Revenue Total Expenses Net Income Total Assets Total Liabilities Error Owners' Equity a. Recorded a declared but unpaid dividend by debiting dividends and crediting...

write down the journal entry that the company ACTUALLY MADE

(shown on the right side of the attached sheet) for each

error.

Write down the journal enrtry that the company SHOULD HAVE

made.

thank you!!

in the column headings in the table. Use the following symbols:0 = overstated, U = understated and NE no effect Total Revenue Total Expenses Net Income Total Assets Total Liabilities Error Owners' Equity a. Recorded a declared but unpaid dividend by debiting dividends and crediting...

8) Daisy Co. previously received & recorded $5,000 cash from a client for future consulting services. Now Daisy Co. has provided $3,000 of the services and earned that revenue. What is the necessary adjusting entry? Debit Credit If this adjustment is not made, the following are overstated, understated, or not impacted: (completed for you on this question) Assets: not impacted Revenue: understated Liabilities: overstated Expense:_not impacted Stockholders' Equity: understated 9) Interest of $450 has accrued on a note payable. What...

8) Daisy Co. previously received & recorded $5,000 cash from a client for future consulting services. Now Daisy Co. has provided $3,000 of the services and earned that revenue. What is the necessary adjusting entry? Debit Credit If this adjustment is not made, the following are overstated, understated, or not impacted: (completed for you on this question) Assets: not impacted Revenue: understated Liabilities: overstated Expense:_not impacted Stockholders' Equity: understated 9) Interest of $450 has accrued on a note payable. What...

On the date of payment for a cash dividend, what journal entry is required? O A. Debit Retained Earnings and credit Dividends Payable O B. Debit Dividends and credit Retained Earnings OC. Debit Dividends Payable and credit Cash OD. Debit Cash and credit Dividends Payable

On the date of payment for a cash dividend, what journal entry is required? O A. Debit Retained Earnings and credit Dividends Payable O B. Debit Dividends and credit Retained Earnings OC. Debit Dividends Payable and credit Cash OD. Debit Cash and credit Dividends Payable

(6 of 10) A company pays a $2,000 cash dividend that was declared and initially recorded last month. Prepare the general journal entry DEBIT: Cash for $2,000; CREDIT: Dividends for $2,000 DEBIT: Dividends for $2,000; CREDIT: Cash for $2,000 DEBIT: Dividends for $2,000; CREDIT: Dividends Payable for $2,000 DEBIT: Dividends Payable for $2,000; CREDIT: Cash for $2,000

(6 of 10) A company pays a $2,000 cash dividend that was declared and initially recorded last month. Prepare the general journal entry DEBIT: Cash for $2,000; CREDIT: Dividends for $2,000 DEBIT: Dividends for $2,000; CREDIT: Cash for $2,000 DEBIT: Dividends for $2,000; CREDIT: Dividends Payable for $2,000 DEBIT: Dividends Payable for $2,000; CREDIT: Cash for $2,000

Question 9 6 The journal entry to record the declaration of a cash dividend would include a: debit to Retained Earnings debit to Dividend Expense debit to Dividends Payable credit to Cash Ne

Question 9 6 The journal entry to record the declaration of a cash dividend would include a: debit to Retained Earnings debit to Dividend Expense debit to Dividends Payable credit to Cash Ne

1.Given the following:

2013 Net Loss is:

Select one:

a. $38

b. $6

c. $12

d. $13

e. $8

2.The Walton Company accrued a revenue and recorded this journal

entry.

Determine the effect of the error on the following:

Select one:

a. Assets Understated, Net Income No Error

b. Assets No Error, Net Income No Error

c. Assets Understated, Net Income Understated

d. Assets Overstated, Net Income No Error

e. Assets No Error, Net Income Understated

3.

In preparing its...

1.Given the following:

2013 Net Loss is:

Select one:

a. $38

b. $6

c. $12

d. $13

e. $8

2.The Walton Company accrued a revenue and recorded this journal

entry.

Determine the effect of the error on the following:

Select one:

a. Assets Understated, Net Income No Error

b. Assets No Error, Net Income No Error

c. Assets Understated, Net Income Understated

d. Assets Overstated, Net Income No Error

e. Assets No Error, Net Income Understated

3.

In preparing its...