Grouper Corporation’s retail store and warehouse closed for an entire weekend while the year-end inventory was...

Grouper Corporation’s retail store and warehouse closed for an

entire weekend while the year-end inventory was counted. When the

count was finished, the controller gathered all the count books and

information from the clerical staff, completed the ending inventory

calculations, and prepared the following partial income statement

for the general manager for Monday morning:

| Sales | $ | 2,752,000 | |||||

| Beginning inventory | $ | 646,000 | |||||

| Purchases | 1,550,000 | ||||||

| Total goods available for sale | 2,196,000 | ||||||

| Less ending inventory | 646,000 | ||||||

| Cost of goods sold | 1,550,000 | ||||||

| Gross profit | $ | 1,202,000 |

The general manager called the controller into her office after

quickly reviewing the preliminary statements. “You’ve made an error

in the inventory,” she stated. “My pricing all year has been

carefully controlled to provide a gross profit of 36%, and I know

the sales are correct.”

(a)

How much should the ending inventory have been?

| Expected ending inventory | $enter the Expected ending inventory in dollars

|

Homework Answers

Answer

- Gross Profit as per General Manager = $ 2752000 sales x 36% = $ 990,720

- Cost of Goods Sold = $ 2752000 sales - $ 990720 gross

profit

= $ 1,761,280 - Expected ending inventory = Total Goods available for sale –

Cost of Goods Sold

= $ 2196000 – 1761280

= $ 434,720 Answer

Add Answer to:

Grouper Corporation’s retail store and warehouse closed for an

entire weekend while the year-end inventory was...

Concord Corporation’s retail store and warehouse closed for an entire weekend while the year-end inventory was...

Concord Corporation’s retail store and warehouse closed for an

entire weekend while the year-end inventory was counted. When the

count was finished, the controller gathered all the count books and

information from the clerical staff, completed the ending inventory

calculations, and prepared the following partial income statement

for the general manager for Monday morning:

Sales

$

2,741,000

Beginning inventory

$

642,000

Purchases

1,550,000

Total goods available for sale

2,192,000

Less ending inventory

642,000

Cost of goods sold

1,550,000

Gross profit...

Concord Corporation’s retail store and warehouse closed for an

entire weekend while the year-end inventory was counted. When the

count was finished, the controller gathered all the count books and

information from the clerical staff, completed the ending inventory

calculations, and prepared the following partial income statement

for the general manager for Monday morning:

Sales

$

2,741,000

Beginning inventory

$

642,000

Purchases

1,550,000

Total goods available for sale

2,192,000

Less ending inventory

642,000

Cost of goods sold

1,550,000

Gross profit...

Travis Company has just completed a physical Inventory count at year-end, December 31 of the current...

Travis Company has just completed a physical Inventory count at year-end, December 31 of the current year. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to $65,700. During the audit, the independent CPA developed the following additional Information a Goods costing $870 were being used by a customer on a trial basis and were excluded from the inventory count at December 31 of the...

Travis Company has just completed a physical Inventory count at year-end, December 31 of the current year. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to $65,700. During the audit, the independent CPA developed the following additional Information a Goods costing $870 were being used by a customer on a trial basis and were excluded from the inventory count at December 31 of the...

Travis Company has just completed a physical Inventory count at year-end, December 31 or the current...

Travis Company has just completed a physical Inventory count at year-end, December 31 or the current year. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to 565,700. During the audit, the independent CPA developed the following additional Information: a. Goods costing $870 were being used by a customer on a trial basis and were excluded from the inventory count at December 31 of the...

Travis Company has just completed a physical Inventory count at year-end, December 31 or the current year. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to 565,700. During the audit, the independent CPA developed the following additional Information: a. Goods costing $870 were being used by a customer on a trial basis and were excluded from the inventory count at December 31 of the...

Travis Company has just completed a physical inventory count at year-end, December 31 of the current...

Travis Company has just completed a physical inventory count at year-end, December 31 of the current year. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to $67,000. During the audit, the independent CPA developed the following additional information: a. Goods costing $950 were being used by a customer on a trial basis and were excluded from the inventory count at December 31 of the...

Travis Company has just completed a physical inventory count at year-end, December 31 of the current year. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to $67,000. During the audit, the independent CPA developed the following additional information: a. Goods costing $950 were being used by a customer on a trial basis and were excluded from the inventory count at December 31 of the...

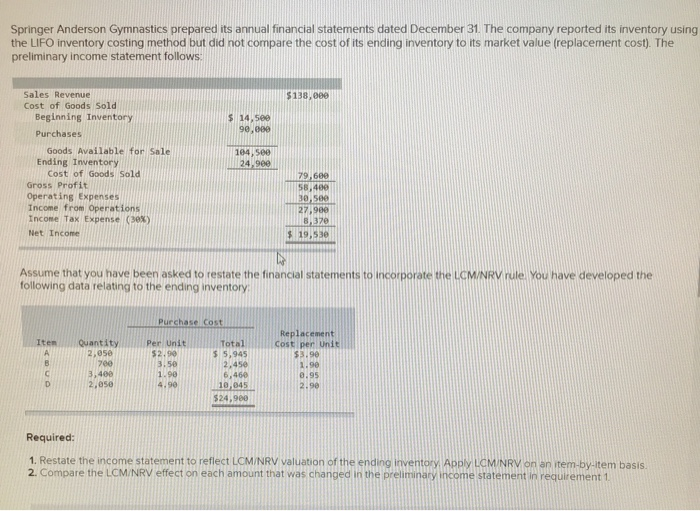

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $ 138,000 $14.500 90.000 Sales Revenue Cost of Goods Sold Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (30%) Net Income 24.900...

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $ 138,000 $14.500 90.000 Sales Revenue Cost of Goods Sold Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (30%) Net Income 24.900...

$200 000 of other loans are repayable within 1 year. The remaining amount is payable in full at the end of 2022. The provision for employee benefits includes $22 000 payable within 1 year. The warra...

$200 000 of other loans are repayable within 1 year. The

remaining amount is payable in full at the end of 2022.

The provision for employee benefits includes $22 000 payable

within 1 year.

The warranty provision is in respect of a 12-month warranty

given on certain goods sold.

NewCat Ltd transferred $10 000 out of retained earnings into

general reserve.

The bank loan is for 5 years and repayable in full at the end

of the term. The interest...

$200 000 of other loans are repayable within 1 year. The

remaining amount is payable in full at the end of 2022.

The provision for employee benefits includes $22 000 payable

within 1 year.

The warranty provision is in respect of a 12-month warranty

given on certain goods sold.

NewCat Ltd transferred $10 000 out of retained earnings into

general reserve.

The bank loan is for 5 years and repayable in full at the end

of the term. The interest...

Read below and answer, Why does a business that has profit of $30,000 per year need...

Read below and answer, Why does a business that has profit of

$30,000 per year need a bank loan?

Jones Electrical Distribution After several years of rapid growth, in the spring of 2007 Jones Electrical Distribution anticipated a further substantial increase in sales. Despite good profits, the company had experienced a shortage of cash and had found it necessary to increase its borrowing from Metropolitan Bank-a local one- branch bank-to $250,000 in 2006. The maximum loan that Metropolitan would make...

Read below and answer, Why does a business that has profit of

$30,000 per year need a bank loan?

Jones Electrical Distribution After several years of rapid growth, in the spring of 2007 Jones Electrical Distribution anticipated a further substantial increase in sales. Despite good profits, the company had experienced a shortage of cash and had found it necessary to increase its borrowing from Metropolitan Bank-a local one- branch bank-to $250,000 in 2006. The maximum loan that Metropolitan would make...

Most questions answered within 3 hours.

-

A z-score

communicates a raw score’s "relative standing"

under the normal curve in relation to:

asked 54 seconds ago -

An object is vibrating on a spring with the following equation

of motion:

?=(30 ??)cos((2?)/(160)?)

a)...

asked 8 seconds ago -

Vulcan Flyovers offers scenic overflights of Mount St. Helens,

the volcano in Washington State that explosively...

asked 2 minutes ago -

If organizations do not adapt fast enough and move incrementally

from the twentieth-century model to the...

asked 3 minutes ago -

A helium balloon with 2.5L of gas has a gauge pressure of 10,000

Pa. The balloon...

asked 7 minutes ago -

What is responsible for Jupiter's enormous magnetic field?

asked 23 minutes ago -

At the end of the year, a company offered to buy 5,000 units of

a product...

asked 24 minutes ago -

Implement C++ program for each of the following.

Let D = [-48, -14, -8, 0, 1,...

asked 44 minutes ago -

Consider a labor market in which LD = 400 – 4W and LS = 250 +...

asked 58 minutes ago -

Let’s say you are teaching a typically-developing young child

how to eat with a spoon. Describe...

asked 42 minutes ago -

Ask Your Teacher A toy gun uses a spring to project a 5.6-g soft

rubber sphere...

asked 53 minutes ago -

*****DO NOT ANSWER THIS QUESTION IF YOU DON'T

KNOW*******

Question - PERSONAL DEVELOPMENT ESSAY and Detailed...

asked 1 hour ago

Concord Corporation’s retail store and warehouse closed for an

entire weekend while the year-end inventory was counted. When the

count was finished, the controller gathered all the count books and

information from the clerical staff, completed the ending inventory

calculations, and prepared the following partial income statement

for the general manager for Monday morning:

Sales

$

2,741,000

Beginning inventory

$

642,000

Purchases

1,550,000

Total goods available for sale

2,192,000

Less ending inventory

642,000

Cost of goods sold

1,550,000

Gross profit...

Concord Corporation’s retail store and warehouse closed for an

entire weekend while the year-end inventory was counted. When the

count was finished, the controller gathered all the count books and

information from the clerical staff, completed the ending inventory

calculations, and prepared the following partial income statement

for the general manager for Monday morning:

Sales

$

2,741,000

Beginning inventory

$

642,000

Purchases

1,550,000

Total goods available for sale

2,192,000

Less ending inventory

642,000

Cost of goods sold

1,550,000

Gross profit...

Travis Company has just completed a physical Inventory count at year-end, December 31 of the current year. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to $65,700. During the audit, the independent CPA developed the following additional Information a Goods costing $870 were being used by a customer on a trial basis and were excluded from the inventory count at December 31 of the...

Travis Company has just completed a physical Inventory count at year-end, December 31 of the current year. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to $65,700. During the audit, the independent CPA developed the following additional Information a Goods costing $870 were being used by a customer on a trial basis and were excluded from the inventory count at December 31 of the...

Travis Company has just completed a physical Inventory count at year-end, December 31 or the current year. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to 565,700. During the audit, the independent CPA developed the following additional Information: a. Goods costing $870 were being used by a customer on a trial basis and were excluded from the inventory count at December 31 of the...

Travis Company has just completed a physical Inventory count at year-end, December 31 or the current year. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to 565,700. During the audit, the independent CPA developed the following additional Information: a. Goods costing $870 were being used by a customer on a trial basis and were excluded from the inventory count at December 31 of the...

Travis Company has just completed a physical inventory count at year-end, December 31 of the current year. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to $67,000. During the audit, the independent CPA developed the following additional information: a. Goods costing $950 were being used by a customer on a trial basis and were excluded from the inventory count at December 31 of the...

Travis Company has just completed a physical inventory count at year-end, December 31 of the current year. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to $67,000. During the audit, the independent CPA developed the following additional information: a. Goods costing $950 were being used by a customer on a trial basis and were excluded from the inventory count at December 31 of the...

$200 000 of other loans are repayable within 1 year. The

remaining amount is payable in full at the end of 2022.

The provision for employee benefits includes $22 000 payable

within 1 year.

The warranty provision is in respect of a 12-month warranty

given on certain goods sold.

NewCat Ltd transferred $10 000 out of retained earnings into

general reserve.

The bank loan is for 5 years and repayable in full at the end

of the term. The interest...

$200 000 of other loans are repayable within 1 year. The

remaining amount is payable in full at the end of 2022.

The provision for employee benefits includes $22 000 payable

within 1 year.

The warranty provision is in respect of a 12-month warranty

given on certain goods sold.

NewCat Ltd transferred $10 000 out of retained earnings into

general reserve.

The bank loan is for 5 years and repayable in full at the end

of the term. The interest...

Read below and answer, Why does a business that has profit of

$30,000 per year need a bank loan?

Jones Electrical Distribution After several years of rapid growth, in the spring of 2007 Jones Electrical Distribution anticipated a further substantial increase in sales. Despite good profits, the company had experienced a shortage of cash and had found it necessary to increase its borrowing from Metropolitan Bank-a local one- branch bank-to $250,000 in 2006. The maximum loan that Metropolitan would make...

Read below and answer, Why does a business that has profit of

$30,000 per year need a bank loan?

Jones Electrical Distribution After several years of rapid growth, in the spring of 2007 Jones Electrical Distribution anticipated a further substantial increase in sales. Despite good profits, the company had experienced a shortage of cash and had found it necessary to increase its borrowing from Metropolitan Bank-a local one- branch bank-to $250,000 in 2006. The maximum loan that Metropolitan would make...