1.

Which account is closed at the end of an accounting period?

Select one:

a. Prepaid Expense

b. Sales Discount

c. Unearned Revenue

d. Retained Earnings

2.

At the end of the current year, the Owners' Equity in LaRose Corporation is $188,000. During the year, the assets of the business had decreased by $90,000, and the liabilities had increased by $36,000. Owners' Equity at the beginning of the year must have been:

Select one:

a. $242,000

b. $314,000

c. $494,000

d. $134,000

e. $126,000

3.

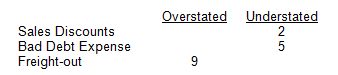

Given the following information:

Gross Profit is:

Select one:

a. Overstated $2

b. Understated $2

c. Overstated $7

d. Understated $7

e. Overstated $3

4.

Which item will not directly adjust Retained Earnings?

Select one:

a. Correction of Error

b. Change in accounting estimate

c. Change in accounting principle

d. Prior Period Adjustment

5.

The disclosure of income tax effects based on the item causing the tax effect is named:

Select one:

a. Cost Principle

b. Matching Principle

c. Intra-period tax allocation

d. Inter-period tax allocation

e. Full Disclosure Principle

Homework Answers

| 1) | Correct Option:b. Sales Discount |

| Explanation: Sales discount account is a nominal account which are belongs to specific accounting period. | |

| Hence it neeed to be closed at each accounting period and amount is tranferred to the income statement. | |

| 2) | Onwers equity = assets - liability |

| Closing Equity | |

| Add: | |

| Reverse of decreased in the assets | |

| Reverse of increase in the liabilities | |

| Beginning Equity | |

| Correct Option:b. $314,000 | |

| 3) | Freight overstated |

| Less: | |

| Sales discount understated | |

| Gross Profit Under stated | |

| Correct Option: d. Understated $7 | |

| 4) | a. Correction of Error |

| 5) | b. Matching Principle |

Add Answer to:

1.

Which account is closed at the end of an accounting period?

Select one:

a. Prepaid...

1. The Charleston Company pre-pays annual rent. If the adjusting entry to record the current period’s...

1. The Charleston Company pre-pays annual rent. If the adjusting entry to record the current period’s prepaid rent expired is not recorded: Select one: a. Current assets will be understated b. Net income will be overstated c. Current liabilities will be overstated d. Current liabilities will be understated e. Gross Profit will be overstated 2. Which organization is attempting to establish one set of accounting standards to be used in every country in the world? Select one: a. PCAOB b....

If the prepaid expenses adjustment was not made, Select one: a. liability will be overstated, equity...

If the prepaid expenses adjustment was not made, Select one: a. liability will be overstated, equity understated and expenses understated. b. assets understated, equity understated and expenses overstated. c. assets overstated, equity overstated, and expenses understated. d. assets understated, equity understated and expenses understated.

1.Indicate the proper journal entry to record payment of a cash dividend previously declared: Select one:...

1.Indicate the proper journal entry to record payment of a cash dividend previously declared: Select one: a. Debit Cash, credit Dividend Payable b. Debit Dividends, credit Cash 2.A bookkeeper erroneously recorded a $7 accrual of wages payable using this journal entry: Sales Discount $7 Inventory $7 Indicate the effect of the error on Expenses, Assets, and Liabilities, respectively: Select one: a. No Error, Understated, No Error b. Overstated, No Error, Understated c. Understated, Understated, Understated d. No Error, No Error,...

1. On 12/31/12, as part of the year-end adjusting journal entries, the Strickland Company accrues three...

1. On 12/31/12, as part of the year-end adjusting journal entries, the Strickland Company accrues three day's wages of $600 ($200 per day). The proper 12/31/12 closing entries are made. No reversing entry is made on 1/1/13. Strickland pays the weekly payroll of $1,000 on 1/2/13. The balance in the Wage Expense account after the 1/2/13 journal entry will be: Select one: a. $0 b. $400 c. $600 d. $1,000 e. $1,200 2. Which principle is most representative of the...

If the beginning inventory is overstated, which one of the following is incorrect? (Assume the error...

If the beginning inventory is overstated, which one of the following is incorrect? (Assume the error in the beginning inventory is a clerical error and previous accounting records are free of errors) Select one: a. working capital at the year end is correctly stated. b. the current ratio at the year end is overstated. c. retained earnings is understated. d. cost of goods sold is overstated

If the beginning inventory is overstated, which one of the following is incorrect? (Assume the error in the beginning inventory is a clerical error and previous accounting records are free of errors) Select one: a. working capital at the year end is correctly stated. b. the current ratio at the year end is overstated. c. retained earnings is understated. d. cost of goods sold is overstated

Born of Frustration, Corp. provides services to its customers on account. Accrued revenue at the end...

Born of Frustration, Corp. provides services to its customers on account. Accrued revenue at the end of the annual accounting period totaled $6,250, but the firm forgot to make an adjusting entry for accrued revenue at the end of the accounting period. Which of the following is true about the period end financial statements? a. None of the answers given are correct. b. Liabilities will be overstated and Stockholders’ Equity will be understated. c. Liabilities will be understated and Stockholders’...

Select the correct answer for each of the following questions.A corporation using the equity method of...

Select the correct answer for each of the following questions.A corporation using the equity method of accounting for its investment in a 40 percent-owned investee, which earned $20,000 and paid $5,000 in dividends, made the following entries: Investment in Investee8,000 Equity in Earnings of Investee 8,000Cash2,000 Dividend Revenue 2,000What effect will these entries have on the investor’s statement of financial position?a. Financial position will be fairly stated.b. Investment in the investee will be overstated, retained earnings understated.c. Investment in the investee will be understated,...

If the accrued revenues adjustment was not made, Select one: a. liabilities will be understated, equity...

If the accrued revenues adjustment was not made, Select one: a. liabilities will be understated, equity overstated, and revenues understated. b. assets will be understated, equity understated and revenue understated. c. assets will be overstated, equity overstated, and revenues understated. d. liabilities will be overstated, equity understated and revenues understated.

15. Which of the following accounts is not closed at the end of the accounting period?...

15. Which of the following accounts is not closed at the end of the accounting period? Retained Earnings b. Operating Expenses c. Dividends d. Service Revenue

15. Which of the following accounts is not closed at the end of the accounting period? Retained Earnings b. Operating Expenses c. Dividends d. Service Revenue

1. In preparing its August 31 bank reconciliation, Reinstein Corp. has available the following balance per...

1. In preparing its August 31 bank reconciliation, Reinstein

Corp. has available the following balance per bank

and reconciling items:

The 8/31 correct balance of cash is:

Select one:

a. $17,650

b. $18,050

c. $16,850

d. $19,050

e. $17,450

2.Given the following Ending Inventory errors for the Portland

Company:

Indicate the error in 2017 Net Income and 12/31/17 Retained

Earnings:

Select one:

a. Net Income Overstated $10, Retained Earnings Understated

$30

b. Net Income Understated $70, Retained Earnings Understated

$30...

1. In preparing its August 31 bank reconciliation, Reinstein

Corp. has available the following balance per bank

and reconciling items:

The 8/31 correct balance of cash is:

Select one:

a. $17,650

b. $18,050

c. $16,850

d. $19,050

e. $17,450

2.Given the following Ending Inventory errors for the Portland

Company:

Indicate the error in 2017 Net Income and 12/31/17 Retained

Earnings:

Select one:

a. Net Income Overstated $10, Retained Earnings Understated

$30

b. Net Income Understated $70, Retained Earnings Understated

$30...

Most questions answered within 3 hours.

-

(Expected rate of return and risk) Carter Inc. is evaluating a

security. Calculate the investment’s expected...

asked 1 hour ago -

What specific indicators can point to lack of progress for

African Americans in American society?

asked 2 hours ago -

1-The Electrons in a beam are moving at 2.7×108 m/s in an

electric field of 15000...

asked 3 hours ago -

A gas tank is a vertical cylinder. It has a radius of 1m, a

height of...

asked 3 hours ago -

Accent Software faces the following conditions. All of these

support Accent’s use of a market-penetration pricing...

asked 4 hours ago -

A mathematically inclined friend emails you the following

instructions: "Meet me in the cafeteria the first...

asked 4 hours ago -

A monopoly sells in two countries . The demand curves in the two

countries are p1...

asked 5 hours ago -

A .15kg rubber ball is bounced off a wall. Before hitting the

wall, the ball moves...

asked 6 hours ago -

A manufacturing company preparing to build a new plant is

considering three potential locations for it....

asked 6 hours ago -

B. If compound Y has approximately the same values of solubility

in toluene as compound X,...

asked 6 hours ago -

Oscar Inc. has inventory in Japan valued at 39,051,000 Yen one

year ago. One year ago...

asked 7 hours ago -

If Canada suffered from "fundamental disequilibrium," and its

government choose not to devalue its currency, a...

asked 7 hours ago

If the beginning inventory is overstated, which one of the following is incorrect? (Assume the error in the beginning inventory is a clerical error and previous accounting records are free of errors) Select one: a. working capital at the year end is correctly stated. b. the current ratio at the year end is overstated. c. retained earnings is understated. d. cost of goods sold is overstated

If the beginning inventory is overstated, which one of the following is incorrect? (Assume the error in the beginning inventory is a clerical error and previous accounting records are free of errors) Select one: a. working capital at the year end is correctly stated. b. the current ratio at the year end is overstated. c. retained earnings is understated. d. cost of goods sold is overstated

15. Which of the following accounts is not closed at the end of the accounting period? Retained Earnings b. Operating Expenses c. Dividends d. Service Revenue

15. Which of the following accounts is not closed at the end of the accounting period? Retained Earnings b. Operating Expenses c. Dividends d. Service Revenue

1. In preparing its August 31 bank reconciliation, Reinstein

Corp. has available the following balance per bank

and reconciling items:

The 8/31 correct balance of cash is:

Select one:

a. $17,650

b. $18,050

c. $16,850

d. $19,050

e. $17,450

2.Given the following Ending Inventory errors for the Portland

Company:

Indicate the error in 2017 Net Income and 12/31/17 Retained

Earnings:

Select one:

a. Net Income Overstated $10, Retained Earnings Understated

$30

b. Net Income Understated $70, Retained Earnings Understated

$30...

1. In preparing its August 31 bank reconciliation, Reinstein

Corp. has available the following balance per bank

and reconciling items:

The 8/31 correct balance of cash is:

Select one:

a. $17,650

b. $18,050

c. $16,850

d. $19,050

e. $17,450

2.Given the following Ending Inventory errors for the Portland

Company:

Indicate the error in 2017 Net Income and 12/31/17 Retained

Earnings:

Select one:

a. Net Income Overstated $10, Retained Earnings Understated

$30

b. Net Income Understated $70, Retained Earnings Understated

$30...