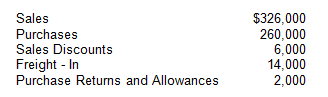

The accounting records of Seattle Outlet include the following

for January:

A physical count determined the cost of inventory on hand at

January 31 to be $42,000. If gross profit amounts

to 25% of net sales, compute the beginning inventory at January

1.

Select one:

a. $10,000

b. $26,000

c. $8,000

d. $24,000

e. $6,000

Homework Answers

Solution:

Net sales = sales - sale discounts = $326000 - $6000 = $320,000

Cost of goods sold = Net Sales - Gross profit = $320000 - ($320000*25%) = $240,000

Cost of net purchases = Purchase + freight in - purchase return and allowances = $260000 + $14000 - $2000 = $272,000

Beginning Inventory = Cost of goods sold + Ending inventory - Cost of net purchases

= $240000 + $42000 - $272000 = $10,000

Hence option "a" is correct.

Add Answer to:

The accounting records of Seattle Outlet include the following

for January:

A physical count determined the...

1.The accounting records of Seattle Outlet include the following for January: A physical count determined the...

1.The accounting records of Seattle Outlet include the following for January: A physical count determined the cost of inventory on hand at January 31 to be $42,000. If gross profit amounts to 25% of net sales, compute the beginning inventory at January 1. Select one: a. $10,000 b. $26,000 c. $8,000 d. $24,000 e. $6,000 2. On 12/31/12, as part of the year-end adjusting journal entries, the Strickland Company accrues three day's wages of $600 ($200 per day). The proper...

The following information was taken from the accounting records of Northern Lights for the month of...

The following information was taken from the accounting records of Northern Lights for the month of October, 20--: Sales $344,000 Sales Returns and Allowances 3,410 Sales Discounts 370 Purchases 194,500 Purchases Returns and Allowances 9,740 Purchases Discounts 5,560 Freight-In 1,580 Merchandise Inventory, October 1 42,000 Merchandise Inventory, October 31 33,000 Complete a partial income statement for the month of October, showing gross profit. Northern Lights Income Statement (partial) For the month ended October 31, 20- Sales Sales returns and allowances...

The following information was taken from the accounting records of Northern Lights for the month of October, 20--: Sales $344,000 Sales Returns and Allowances 3,410 Sales Discounts 370 Purchases 194,500 Purchases Returns and Allowances 9,740 Purchases Discounts 5,560 Freight-In 1,580 Merchandise Inventory, October 1 42,000 Merchandise Inventory, October 31 33,000 Complete a partial income statement for the month of October, showing gross profit. Northern Lights Income Statement (partial) For the month ended October 31, 20- Sales Sales returns and allowances...

The following information was taken from the accounting records of Bryan’s Auto Part for the month...

The following information was taken from the accounting records of Bryan’s Auto Part for the month of March, 20--: Sales $450,000 Sales Returns and Allowances 2,410 Sales Discounts 960 Purchases 185,000 Purchases Returns and Allowances 8,540 Purchases Discounts 6,560 Freight-In 2,225 Merchandise Inventory, March 1 48,000 Merchandise Inventory, March 31 28,000 Complete a partial income statement for the month of March, showing gross profit. Sales Sales returns and allowances Sales discounts Net sales Cost of goods sold:...

The following selected information is for Sunland Company for the year ended January 31, 2021: Freight...

The following selected information is for Sunland Company for the year ended January 31, 2021: Freight in $6,500 Purchase discounts $12,000 Freight out 7,300 Purchase returns and allowances 16,100 Insurance expense 12,000 Rent expense 20,100 Interest expense 6,000 Salaries expense 60,500 Merchandise inventory, beginning 61,500 Salaries payable 2,500 Merchandise inventory, ending 42,000 Sales 325,000 O. G. Pogo, capital 105,000 Sales discounts 14,000 O. G. Pogo, drawings 42,200 Sales returns and allowances 20,100 Purchases 213,000 Unearned sales revenue 4,500 (a) Prepare...

Assume that we are auditing the records of Forde Corporation. A physical inventory has been taken...

Assume that we are auditing the records of Forde Corporation. A physical inventory has been taken by the company under our observation. However, the valuation extensions have not been completed. The records of the company show the following account data. The gross margin last period was 35% of net sales; we anticipate that it will be 25% for the year under audit. Sales, gross $1,512,000 Beginning inventory $480,000 Sales returns (returned to inventory) 24,000 Freight-in 33,600 Purchases, gross 744,000 Purchase...

You have been provided with the following selected accounts for Monty Ltd. for the year ended...

You have been provided with the following selected accounts for

Monty Ltd. for the year ended April 30, 2018:

Inventory, May 1, 2017

$578,000

Interest expense

$28,000

Purchases

5,853,000

Interest income

20,000

Accounts receivable

757,000

Accounts payable

589,000

Sales

9,378,000

Administrative expenses

800,000

Purchase discounts

36,000

Selling expenses

141,000

Freight in

117,000

Cash

166,000

Land

919,000

Common shares

195,000

Sales returns and allowances

236,000

Monty conducted a physical inventory count on April 30, 2018.

Inventory on hand at that date...

You have been provided with the following selected accounts for

Monty Ltd. for the year ended April 30, 2018:

Inventory, May 1, 2017

$578,000

Interest expense

$28,000

Purchases

5,853,000

Interest income

20,000

Accounts receivable

757,000

Accounts payable

589,000

Sales

9,378,000

Administrative expenses

800,000

Purchase discounts

36,000

Selling expenses

141,000

Freight in

117,000

Cash

166,000

Land

919,000

Common shares

195,000

Sales returns and allowances

236,000

Monty conducted a physical inventory count on April 30, 2018.

Inventory on hand at that date...

Tippah Antiques uses the periodic inventory system to account for its inventory transactions. The following account...

Tippah Antiques uses the periodic inventory system to account for its inventory transactions. The following account titles and balances were drawn from Tippah’s records for Year 2: beginning balance in inventory, $42,000; purchases, $128,000; purchase returns and allowances, $12,000; sales, $520,000; sales returns and allowances, $3,900; freight-in, $1,000; and operating expenses, $130,000. A physical count indicated that $26,000 of merchandise was on hand at the end of the accounting period. Required a. Prepare a schedule of cost of goods sold....

Tippah Antiques uses the periodic inventory system to account for its inventory transactions. The following account titles and balances were drawn from Tippah’s records for Year 2: beginning balance in inventory, $42,000; purchases, $128,000; purchase returns and allowances, $12,000; sales, $520,000; sales returns and allowances, $3,900; freight-in, $1,000; and operating expenses, $130,000. A physical count indicated that $26,000 of merchandise was on hand at the end of the accounting period. Required a. Prepare a schedule of cost of goods sold....

PRACTICE PROBLEM - PERIODIC Adjustment Data: For the Year Ended December 31, 2014 1) A physical merchandise inventory t...

PRACTICE PROBLEM - PERIODIC Adjustment Data: For the Year Ended December 31, 2014 1) A physical merchandise inventory taken on December 31 amounted to $8,000 2) Accrued Salesman Salary, $7,000 3) The store machinery purchased has an estimated useful life of 5 years 4) Unusued office supplies at year end $3,000. Required a) Prepare Worksheet as of December 31, 2014 - Place accounts in Financial Statement Order d) Prepare All Financial Statements (Income Statement, Capital Statement, Balance Sheet) e) Prepare...

PRACTICE PROBLEM - PERIODIC Adjustment Data: For the Year Ended December 31, 2014 1) A physical merchandise inventory taken on December 31 amounted to $8,000 2) Accrued Salesman Salary, $7,000 3) The store machinery purchased has an estimated useful life of 5 years 4) Unusued office supplies at year end $3,000. Required a) Prepare Worksheet as of December 31, 2014 - Place accounts in Financial Statement Order d) Prepare All Financial Statements (Income Statement, Capital Statement, Balance Sheet) e) Prepare...

Flounder Corp. uses a periodic inventory system and reports the following information: sales $1,840,000; sales returns...

Flounder Corp. uses a periodic inventory system and reports the following information: sales $1,840,000; sales returns and allowances $125,000; sales discounts $29,000; purchases $879,000; purchase returns and allowances $12,000; purchase discounts $15,000; freight in $14,000; freight out $41,000; beginning inventory $99,000; and ending inventory $78,000. Assuming Flounder uses a multiple-step income statement Calculate net sales Net sales $ Calculate net purchases. Net purchases $ Calculate cost of goods purchased. Cost of goods purchased 5 Calculate cost of goods sold. Cost...

Flounder Corp. uses a periodic inventory system and reports the following information: sales $1,840,000; sales returns and allowances $125,000; sales discounts $29,000; purchases $879,000; purchase returns and allowances $12,000; purchase discounts $15,000; freight in $14,000; freight out $41,000; beginning inventory $99,000; and ending inventory $78,000. Assuming Flounder uses a multiple-step income statement Calculate net sales Net sales $ Calculate net purchases. Net purchases $ Calculate cost of goods purchased. Cost of goods purchased 5 Calculate cost of goods sold. Cost...

Exercise 5A-8 Presented below is information related to Swifty Co. for the month of January 2017....

Exercise 5A-8 Presented below is information related to Swifty Co. for the month of January 2017. Beginning inventory Ending inventory Purchases Freight-in Purchase discounts Purchase returns and allowances $28,000 25,000 222,000 6,000 6,000 10,000 Insurance expense Rent expense Salaries and wages expense Sales returns and allowances Sales revenue $13,000 20,000 52,000 14,000 413,000 Prepare the necessary closing entries. (Credit account titles are automatically indented when the amount is not indent manually. If no entry is required, select "No entry for...

Exercise 5A-8 Presented below is information related to Swifty Co. for the month of January 2017. Beginning inventory Ending inventory Purchases Freight-in Purchase discounts Purchase returns and allowances $28,000 25,000 222,000 6,000 6,000 10,000 Insurance expense Rent expense Salaries and wages expense Sales returns and allowances Sales revenue $13,000 20,000 52,000 14,000 413,000 Prepare the necessary closing entries. (Credit account titles are automatically indented when the amount is not indent manually. If no entry is required, select "No entry for...

Most questions answered within 3 hours.

-

Assume Kw = 1.01 ✕ 10−14

For pure water, we can calculate [H3O+ ] = [OH...

asked 18 minutes ago -

Suppose that on a temperature scale X, water boils at 203.0°X

and freezes at -105.7°X. What...

asked 1 hour ago -

BaS crystallizes in a cubic unit cell with S2- ions on each

corner and each face....

asked 1 hour ago -

A. 0≤P(Oi)≤10≤P(Oi)≤1 for each i

B. P(Oi)≤0P(Oi)≤0

C. P(Oi)=1+P(OCi)P(Oi)=1+P(OiC)

D. P(Oi)≥1P(Oi)≥1

If an experiment consists of...

asked 3 hours ago -

A battery has an emf of 9.20V and an internal resistance of 1.20

ohm. a)What resistance...

asked 3 hours ago -

The area of an elastic circular loop decreases at a constant

rate, dA/dt = −6.60×10−3 m2/s...

asked 4 hours ago -

The denaturation of proteins can be described by the

equilibrium

F⇌U

where F and U represent...

asked 5 hours ago -

Please answer what the maximum and minimum force is, and the

angle on the ion is...

asked 5 hours ago -

implement a program that reads a number of rows and a symbol.

The program will draw...

asked 5 hours ago -

Assume that when adults with smartphones are randomly selected,

45% use them in meetings or classes....

asked 5 hours ago -

Determine the number of formula units of

Na2SO4 and moles of oxygen contained in 8.11

moles...

asked 6 hours ago -

Explain in steps on the following code

What would be the output when executed

using System;...

asked 6 hours ago

The following information was taken from the accounting records of Northern Lights for the month of October, 20--: Sales $344,000 Sales Returns and Allowances 3,410 Sales Discounts 370 Purchases 194,500 Purchases Returns and Allowances 9,740 Purchases Discounts 5,560 Freight-In 1,580 Merchandise Inventory, October 1 42,000 Merchandise Inventory, October 31 33,000 Complete a partial income statement for the month of October, showing gross profit. Northern Lights Income Statement (partial) For the month ended October 31, 20- Sales Sales returns and allowances...

The following information was taken from the accounting records of Northern Lights for the month of October, 20--: Sales $344,000 Sales Returns and Allowances 3,410 Sales Discounts 370 Purchases 194,500 Purchases Returns and Allowances 9,740 Purchases Discounts 5,560 Freight-In 1,580 Merchandise Inventory, October 1 42,000 Merchandise Inventory, October 31 33,000 Complete a partial income statement for the month of October, showing gross profit. Northern Lights Income Statement (partial) For the month ended October 31, 20- Sales Sales returns and allowances...

You have been provided with the following selected accounts for

Monty Ltd. for the year ended April 30, 2018:

Inventory, May 1, 2017

$578,000

Interest expense

$28,000

Purchases

5,853,000

Interest income

20,000

Accounts receivable

757,000

Accounts payable

589,000

Sales

9,378,000

Administrative expenses

800,000

Purchase discounts

36,000

Selling expenses

141,000

Freight in

117,000

Cash

166,000

Land

919,000

Common shares

195,000

Sales returns and allowances

236,000

Monty conducted a physical inventory count on April 30, 2018.

Inventory on hand at that date...

You have been provided with the following selected accounts for

Monty Ltd. for the year ended April 30, 2018:

Inventory, May 1, 2017

$578,000

Interest expense

$28,000

Purchases

5,853,000

Interest income

20,000

Accounts receivable

757,000

Accounts payable

589,000

Sales

9,378,000

Administrative expenses

800,000

Purchase discounts

36,000

Selling expenses

141,000

Freight in

117,000

Cash

166,000

Land

919,000

Common shares

195,000

Sales returns and allowances

236,000

Monty conducted a physical inventory count on April 30, 2018.

Inventory on hand at that date...

Tippah Antiques uses the periodic inventory system to account for its inventory transactions. The following account titles and balances were drawn from Tippah’s records for Year 2: beginning balance in inventory, $42,000; purchases, $128,000; purchase returns and allowances, $12,000; sales, $520,000; sales returns and allowances, $3,900; freight-in, $1,000; and operating expenses, $130,000. A physical count indicated that $26,000 of merchandise was on hand at the end of the accounting period. Required a. Prepare a schedule of cost of goods sold....

Tippah Antiques uses the periodic inventory system to account for its inventory transactions. The following account titles and balances were drawn from Tippah’s records for Year 2: beginning balance in inventory, $42,000; purchases, $128,000; purchase returns and allowances, $12,000; sales, $520,000; sales returns and allowances, $3,900; freight-in, $1,000; and operating expenses, $130,000. A physical count indicated that $26,000 of merchandise was on hand at the end of the accounting period. Required a. Prepare a schedule of cost of goods sold....

PRACTICE PROBLEM - PERIODIC Adjustment Data: For the Year Ended December 31, 2014 1) A physical merchandise inventory taken on December 31 amounted to $8,000 2) Accrued Salesman Salary, $7,000 3) The store machinery purchased has an estimated useful life of 5 years 4) Unusued office supplies at year end $3,000. Required a) Prepare Worksheet as of December 31, 2014 - Place accounts in Financial Statement Order d) Prepare All Financial Statements (Income Statement, Capital Statement, Balance Sheet) e) Prepare...

PRACTICE PROBLEM - PERIODIC Adjustment Data: For the Year Ended December 31, 2014 1) A physical merchandise inventory taken on December 31 amounted to $8,000 2) Accrued Salesman Salary, $7,000 3) The store machinery purchased has an estimated useful life of 5 years 4) Unusued office supplies at year end $3,000. Required a) Prepare Worksheet as of December 31, 2014 - Place accounts in Financial Statement Order d) Prepare All Financial Statements (Income Statement, Capital Statement, Balance Sheet) e) Prepare...

Flounder Corp. uses a periodic inventory system and reports the following information: sales $1,840,000; sales returns and allowances $125,000; sales discounts $29,000; purchases $879,000; purchase returns and allowances $12,000; purchase discounts $15,000; freight in $14,000; freight out $41,000; beginning inventory $99,000; and ending inventory $78,000. Assuming Flounder uses a multiple-step income statement Calculate net sales Net sales $ Calculate net purchases. Net purchases $ Calculate cost of goods purchased. Cost of goods purchased 5 Calculate cost of goods sold. Cost...

Flounder Corp. uses a periodic inventory system and reports the following information: sales $1,840,000; sales returns and allowances $125,000; sales discounts $29,000; purchases $879,000; purchase returns and allowances $12,000; purchase discounts $15,000; freight in $14,000; freight out $41,000; beginning inventory $99,000; and ending inventory $78,000. Assuming Flounder uses a multiple-step income statement Calculate net sales Net sales $ Calculate net purchases. Net purchases $ Calculate cost of goods purchased. Cost of goods purchased 5 Calculate cost of goods sold. Cost...

Exercise 5A-8 Presented below is information related to Swifty Co. for the month of January 2017. Beginning inventory Ending inventory Purchases Freight-in Purchase discounts Purchase returns and allowances $28,000 25,000 222,000 6,000 6,000 10,000 Insurance expense Rent expense Salaries and wages expense Sales returns and allowances Sales revenue $13,000 20,000 52,000 14,000 413,000 Prepare the necessary closing entries. (Credit account titles are automatically indented when the amount is not indent manually. If no entry is required, select "No entry for...

Exercise 5A-8 Presented below is information related to Swifty Co. for the month of January 2017. Beginning inventory Ending inventory Purchases Freight-in Purchase discounts Purchase returns and allowances $28,000 25,000 222,000 6,000 6,000 10,000 Insurance expense Rent expense Salaries and wages expense Sales returns and allowances Sales revenue $13,000 20,000 52,000 14,000 413,000 Prepare the necessary closing entries. (Credit account titles are automatically indented when the amount is not indent manually. If no entry is required, select "No entry for...