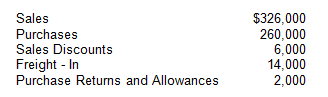

1.The accounting records of Seattle Outlet include the following

for January:

A physical count determined the cost of inventory on hand at

January 31 to be $42,000. If gross profit amounts

to 25% of net sales, compute the beginning inventory at January

1.

Select one:

a. $10,000

b. $26,000

c. $8,000

d. $24,000

e. $6,000

2.

On 12/31/12, as part of the year-end adjusting journal entries, the Strickland Company accrues three day's wages of $600 ($200 per day). The proper 12/31/12 closing entries are made. No reversing entry is made on 1/1/13. Strickland pays the weekly payroll of $1,000 on 1/2/13. The balance in the Wage Expense account after the 1/2/13 journal entry will be:

Select one:

a. $0

b. $400

c. $600

d. $1,000

e. $1,200

3.

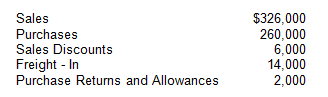

The accounting records of Seattle Outlet include the following

for January:

A physical count determined the cost of inventory on hand at

January 31 to be $42,000. If gross profit amounts

to 25% of net sales, compute the beginning inventory at January

1.

Select one:

a. $10,000

b. $26,000

c. $8,000

d. $24,000

e. $6,000

Homework Answers

1.

Sales = $326,000

Sales discount = $6,000

Net sales = Sales - sales discount

= 326,000-6,000

= $320,000

Gross profit = 25% of net sales

= 320,000 x 25%

= $80,000

Cost of goods sold = Net sales - Gross profit

= 320,000-80,000

= $240,000

Cost of goods sold = Beginning inventory + Purchases - Purchase return + Freight in - Ending inventory

240,000 = Beginning inventory + 260,000-2,000+14,000-42,000

Beginning inventory = $10,000

Correct option is a.

2.

Wages per day = $200

Wages expense for 3 days i.e. $300 was debited on 12/31/12.

Now, on 1/2/13, wages expense will be debited for two days i.e 200 x 2 = $400

The balance in the Wage Expense account after the 1/2/13 journal entry will be: $400

Correct option is (b)

3.

Sales = $326,000

Sales discount = $6,000

Net sales = Sales - sales discount

= 326,000-6,000

= $320,000

Gross profit = 25% of net sales

= 320,000 x 25%

= $80,000

Cost of goods sold = Net sales - Gross profit

= 320,000-80,000

= $240,000

Cost of goods sold = Beginning inventory + Purchases - Purchase return + Freight in - Ending inventory

240,000 = Beginning inventory + 260,000-2,000+14,000-42,000

Beginning inventory = $10,000

Correct option is a.

Kindly comment if you need further assistance.

Thanks‼!

Add Answer to:

1.The accounting records of Seattle Outlet include the following

for January:

A physical count determined the...

The accounting records of Seattle Outlet include the following for January: A physical count determined the...

The accounting records of Seattle Outlet include the following for January: A physical count determined the cost of inventory on hand at January 31 to be $42,000. If gross profit amounts to 25% of net sales, compute the beginning inventory at January 1. Select one: a. $10,000 b. $26,000 c. $8,000 d. $24,000 e. $6,000 Sales Purchases Sales Discounts Freight - In Purchase Returns and Allowances $326,000 260,000 6,000 14,000 2,000

The following selected information is for Sunland Company for the year ended January 31, 2021: Freight...

The following selected information is for Sunland Company for the year ended January 31, 2021: Freight in $6,500 Purchase discounts $12,000 Freight out 7,300 Purchase returns and allowances 16,100 Insurance expense 12,000 Rent expense 20,100 Interest expense 6,000 Salaries expense 60,500 Merchandise inventory, beginning 61,500 Salaries payable 2,500 Merchandise inventory, ending 42,000 Sales 325,000 O. G. Pogo, capital 105,000 Sales discounts 14,000 O. G. Pogo, drawings 42,200 Sales returns and allowances 20,100 Purchases 213,000 Unearned sales revenue 4,500 (a) Prepare...

The following information was taken from the accounting records of Northern Lights for the month of...

The following information was taken from the accounting records of Northern Lights for the month of October, 20--: Sales $344,000 Sales Returns and Allowances 3,410 Sales Discounts 370 Purchases 194,500 Purchases Returns and Allowances 9,740 Purchases Discounts 5,560 Freight-In 1,580 Merchandise Inventory, October 1 42,000 Merchandise Inventory, October 31 33,000 Complete a partial income statement for the month of October, showing gross profit. Northern Lights Income Statement (partial) For the month ended October 31, 20- Sales Sales returns and allowances...

The following information was taken from the accounting records of Northern Lights for the month of October, 20--: Sales $344,000 Sales Returns and Allowances 3,410 Sales Discounts 370 Purchases 194,500 Purchases Returns and Allowances 9,740 Purchases Discounts 5,560 Freight-In 1,580 Merchandise Inventory, October 1 42,000 Merchandise Inventory, October 31 33,000 Complete a partial income statement for the month of October, showing gross profit. Northern Lights Income Statement (partial) For the month ended October 31, 20- Sales Sales returns and allowances...

The following information was taken from the accounting records of Bryan’s Auto Part for the month...

The following information was taken from the accounting records of Bryan’s Auto Part for the month of March, 20--: Sales $450,000 Sales Returns and Allowances 2,410 Sales Discounts 960 Purchases 185,000 Purchases Returns and Allowances 8,540 Purchases Discounts 6,560 Freight-In 2,225 Merchandise Inventory, March 1 48,000 Merchandise Inventory, March 31 28,000 Complete a partial income statement for the month of March, showing gross profit. Sales Sales returns and allowances Sales discounts Net sales Cost of goods sold:...

PRACTICE PROBLEM - PERIODIC Adjustment Data: For the Year Ended December 31, 2014 1) A physical merchandise inventory t...

PRACTICE PROBLEM - PERIODIC Adjustment Data: For the Year Ended December 31, 2014 1) A physical merchandise inventory taken on December 31 amounted to $8,000 2) Accrued Salesman Salary, $7,000 3) The store machinery purchased has an estimated useful life of 5 years 4) Unusued office supplies at year end $3,000. Required a) Prepare Worksheet as of December 31, 2014 - Place accounts in Financial Statement Order d) Prepare All Financial Statements (Income Statement, Capital Statement, Balance Sheet) e) Prepare...

PRACTICE PROBLEM - PERIODIC Adjustment Data: For the Year Ended December 31, 2014 1) A physical merchandise inventory taken on December 31 amounted to $8,000 2) Accrued Salesman Salary, $7,000 3) The store machinery purchased has an estimated useful life of 5 years 4) Unusued office supplies at year end $3,000. Required a) Prepare Worksheet as of December 31, 2014 - Place accounts in Financial Statement Order d) Prepare All Financial Statements (Income Statement, Capital Statement, Balance Sheet) e) Prepare...

Exercise 5A-8 Presented below is information related to Swifty Co. for the month of January 2017....

Exercise 5A-8 Presented below is information related to Swifty Co. for the month of January 2017. Beginning inventory Ending inventory Purchases Freight-in Purchase discounts Purchase returns and allowances $28,000 25,000 222,000 6,000 6,000 10,000 Insurance expense Rent expense Salaries and wages expense Sales returns and allowances Sales revenue $13,000 20,000 52,000 14,000 413,000 Prepare the necessary closing entries. (Credit account titles are automatically indented when the amount is not indent manually. If no entry is required, select "No entry for...

Exercise 5A-8 Presented below is information related to Swifty Co. for the month of January 2017. Beginning inventory Ending inventory Purchases Freight-in Purchase discounts Purchase returns and allowances $28,000 25,000 222,000 6,000 6,000 10,000 Insurance expense Rent expense Salaries and wages expense Sales returns and allowances Sales revenue $13,000 20,000 52,000 14,000 413,000 Prepare the necessary closing entries. (Credit account titles are automatically indented when the amount is not indent manually. If no entry is required, select "No entry for...

Tippah Antiques uses the periodic inventory system to account for its inventory transactions. The following account...

Tippah Antiques uses the periodic inventory system to account for its inventory transactions. The following account titles and balances were drawn from Tippah’s records for Year 2: beginning balance in inventory, $42,000; purchases, $128,000; purchase returns and allowances, $12,000; sales, $520,000; sales returns and allowances, $3,900; freight-in, $1,000; and operating expenses, $130,000. A physical count indicated that $26,000 of merchandise was on hand at the end of the accounting period. Required a. Prepare a schedule of cost of goods sold....

Tippah Antiques uses the periodic inventory system to account for its inventory transactions. The following account titles and balances were drawn from Tippah’s records for Year 2: beginning balance in inventory, $42,000; purchases, $128,000; purchase returns and allowances, $12,000; sales, $520,000; sales returns and allowances, $3,900; freight-in, $1,000; and operating expenses, $130,000. A physical count indicated that $26,000 of merchandise was on hand at the end of the accounting period. Required a. Prepare a schedule of cost of goods sold....

The following is the trial balance of Oriole Corporation at December 31, 2020. A physical count...

The following is the trial balance of Oriole Corporation

at December 31, 2020.

A physical count of inventory on December 31 resulted in

an inventory amount of $172,800; thus, cost of goods sold for 2020

is $1,741,500.

Credits $27,000 48,600 432,000 48,600 2,970,000 132,300 75,600 189,000 ORIOLE CORPORATION TRIAL BALANCE DECEMBER 31, 2020 Debits Purchase Discounts Cash $512,190 Accounts Receivable 283,500 Rent Revenue Retained Earnings Salaries and Wages Payable Sales Revenue Notes Receivable 297,000 Accounts Payable Accumulated Depreciation-Equipment Sales Discounts...

The following is the trial balance of Oriole Corporation

at December 31, 2020.

A physical count of inventory on December 31 resulted in

an inventory amount of $172,800; thus, cost of goods sold for 2020

is $1,741,500.

Credits $27,000 48,600 432,000 48,600 2,970,000 132,300 75,600 189,000 ORIOLE CORPORATION TRIAL BALANCE DECEMBER 31, 2020 Debits Purchase Discounts Cash $512,190 Accounts Receivable 283,500 Rent Revenue Retained Earnings Salaries and Wages Payable Sales Revenue Notes Receivable 297,000 Accounts Payable Accumulated Depreciation-Equipment Sales Discounts...

Flowers are Heaven's accounts at April 30, 2020, included the following used balances The physical count...

Flowers are Heaven's accounts at April 30, 2020, included the following used balances The physical count of Inventory showed 8,000 of Inventory on hand. This is the only adjustmeded (Click the icon to view the unadjusted balances) Required a. Journalkre the adjustment for inventory shrinkage Include an explanation Flowers Heaven wes the perpetual Inventory system b. Journalire the closing entries for the appropriate accounts c. Compute the gross margin Unadjusted balances -X Requirement a Journalire the adjustment for inventory shrinkage...

Flowers are Heaven's accounts at April 30, 2020, included the following used balances The physical count of Inventory showed 8,000 of Inventory on hand. This is the only adjustmeded (Click the icon to view the unadjusted balances) Required a. Journalkre the adjustment for inventory shrinkage Include an explanation Flowers Heaven wes the perpetual Inventory system b. Journalire the closing entries for the appropriate accounts c. Compute the gross margin Unadjusted balances -X Requirement a Journalire the adjustment for inventory shrinkage...

Reagan Corporation is a wholesale distributor of truck replacement parts. Initial amounts taken from Reagan's records...

Reagan Corporation is a wholesale distributor of truck

replacement parts. Initial amounts taken from Reagan's records are

as follows:

Inventory at December 31 (based on a physical count

of goods in Reagan's warehouse on December 31)

$1,290,000

Accounts payable at December 31:

Vendor

Terms

Amount

Baker Company

2%, 10 days, net 30

$

273,000

Charlie Company

Net 30

218,000

Dolly Company

Net 30

308,000

Eagler Company

Net 30

233,000

Full Company

Net 30

–

Greg Company

Net 30

–

Accounts...

Reagan Corporation is a wholesale distributor of truck

replacement parts. Initial amounts taken from Reagan's records are

as follows:

Inventory at December 31 (based on a physical count

of goods in Reagan's warehouse on December 31)

$1,290,000

Accounts payable at December 31:

Vendor

Terms

Amount

Baker Company

2%, 10 days, net 30

$

273,000

Charlie Company

Net 30

218,000

Dolly Company

Net 30

308,000

Eagler Company

Net 30

233,000

Full Company

Net 30

–

Greg Company

Net 30

–

Accounts...

Most questions answered within 3 hours.

-

Enter your answer in the provided box. To what fraction of its

original volume, Vfinal/Vinitial, must...

asked 32 minutes ago -

Can you figure out if any R functions used to subset a time

series 1 or...

asked 57 minutes ago -

Which of the following is correct?

A. APC + MPS = 1

B. APS + MPS...

asked 1 hour ago -

Given a regression sum of squares equal to 2373.59 and a total

sum of squares equal...

asked 2 hours ago -

Compare and contrast the linear motion and angular motion

equations F ma and . That is,...

asked 1 hour ago -

Now that this course has taken you on a journey of introduction

to the world of...

asked 2 hours ago -

The sandwich maker of the EE-Cole-Eye Sandwich Truck was just

fired (for a reason described below)...

asked 4 hours ago -

Name the following coordination compounds using systematic

nomenclature.

1. [Co(H2O)6]Cl2:

2. [Cr(NH3)6](NO3)3:

3. K4[Fe(CN)6]:

4. Na[Au(CN)4]:...

asked 4 hours ago -

Propose an efficient synthesis of 2-Bromo-5-nitrotoluene from

benzene. Hint: 3 steps. Consider directing effects of substituents....

asked 6 hours ago -

This assignment will explore the impact of corporate decisions

on a local versus a global perspective....

asked 5 hours ago -

Given the function below, F(w,x,y,z)= x’z+w’z’+w’y

a) draw a logic diagram for an implementation which uses...

asked 5 hours ago -

Most political philosophers believe we have a duty to obey laws,

even if the laws in...

asked 6 hours ago

The following information was taken from the accounting records of Northern Lights for the month of October, 20--: Sales $344,000 Sales Returns and Allowances 3,410 Sales Discounts 370 Purchases 194,500 Purchases Returns and Allowances 9,740 Purchases Discounts 5,560 Freight-In 1,580 Merchandise Inventory, October 1 42,000 Merchandise Inventory, October 31 33,000 Complete a partial income statement for the month of October, showing gross profit. Northern Lights Income Statement (partial) For the month ended October 31, 20- Sales Sales returns and allowances...

The following information was taken from the accounting records of Northern Lights for the month of October, 20--: Sales $344,000 Sales Returns and Allowances 3,410 Sales Discounts 370 Purchases 194,500 Purchases Returns and Allowances 9,740 Purchases Discounts 5,560 Freight-In 1,580 Merchandise Inventory, October 1 42,000 Merchandise Inventory, October 31 33,000 Complete a partial income statement for the month of October, showing gross profit. Northern Lights Income Statement (partial) For the month ended October 31, 20- Sales Sales returns and allowances...

PRACTICE PROBLEM - PERIODIC Adjustment Data: For the Year Ended December 31, 2014 1) A physical merchandise inventory taken on December 31 amounted to $8,000 2) Accrued Salesman Salary, $7,000 3) The store machinery purchased has an estimated useful life of 5 years 4) Unusued office supplies at year end $3,000. Required a) Prepare Worksheet as of December 31, 2014 - Place accounts in Financial Statement Order d) Prepare All Financial Statements (Income Statement, Capital Statement, Balance Sheet) e) Prepare...

PRACTICE PROBLEM - PERIODIC Adjustment Data: For the Year Ended December 31, 2014 1) A physical merchandise inventory taken on December 31 amounted to $8,000 2) Accrued Salesman Salary, $7,000 3) The store machinery purchased has an estimated useful life of 5 years 4) Unusued office supplies at year end $3,000. Required a) Prepare Worksheet as of December 31, 2014 - Place accounts in Financial Statement Order d) Prepare All Financial Statements (Income Statement, Capital Statement, Balance Sheet) e) Prepare...

Exercise 5A-8 Presented below is information related to Swifty Co. for the month of January 2017. Beginning inventory Ending inventory Purchases Freight-in Purchase discounts Purchase returns and allowances $28,000 25,000 222,000 6,000 6,000 10,000 Insurance expense Rent expense Salaries and wages expense Sales returns and allowances Sales revenue $13,000 20,000 52,000 14,000 413,000 Prepare the necessary closing entries. (Credit account titles are automatically indented when the amount is not indent manually. If no entry is required, select "No entry for...

Exercise 5A-8 Presented below is information related to Swifty Co. for the month of January 2017. Beginning inventory Ending inventory Purchases Freight-in Purchase discounts Purchase returns and allowances $28,000 25,000 222,000 6,000 6,000 10,000 Insurance expense Rent expense Salaries and wages expense Sales returns and allowances Sales revenue $13,000 20,000 52,000 14,000 413,000 Prepare the necessary closing entries. (Credit account titles are automatically indented when the amount is not indent manually. If no entry is required, select "No entry for...

Tippah Antiques uses the periodic inventory system to account for its inventory transactions. The following account titles and balances were drawn from Tippah’s records for Year 2: beginning balance in inventory, $42,000; purchases, $128,000; purchase returns and allowances, $12,000; sales, $520,000; sales returns and allowances, $3,900; freight-in, $1,000; and operating expenses, $130,000. A physical count indicated that $26,000 of merchandise was on hand at the end of the accounting period. Required a. Prepare a schedule of cost of goods sold....

Tippah Antiques uses the periodic inventory system to account for its inventory transactions. The following account titles and balances were drawn from Tippah’s records for Year 2: beginning balance in inventory, $42,000; purchases, $128,000; purchase returns and allowances, $12,000; sales, $520,000; sales returns and allowances, $3,900; freight-in, $1,000; and operating expenses, $130,000. A physical count indicated that $26,000 of merchandise was on hand at the end of the accounting period. Required a. Prepare a schedule of cost of goods sold....

The following is the trial balance of Oriole Corporation

at December 31, 2020.

A physical count of inventory on December 31 resulted in

an inventory amount of $172,800; thus, cost of goods sold for 2020

is $1,741,500.

Credits $27,000 48,600 432,000 48,600 2,970,000 132,300 75,600 189,000 ORIOLE CORPORATION TRIAL BALANCE DECEMBER 31, 2020 Debits Purchase Discounts Cash $512,190 Accounts Receivable 283,500 Rent Revenue Retained Earnings Salaries and Wages Payable Sales Revenue Notes Receivable 297,000 Accounts Payable Accumulated Depreciation-Equipment Sales Discounts...

The following is the trial balance of Oriole Corporation

at December 31, 2020.

A physical count of inventory on December 31 resulted in

an inventory amount of $172,800; thus, cost of goods sold for 2020

is $1,741,500.

Credits $27,000 48,600 432,000 48,600 2,970,000 132,300 75,600 189,000 ORIOLE CORPORATION TRIAL BALANCE DECEMBER 31, 2020 Debits Purchase Discounts Cash $512,190 Accounts Receivable 283,500 Rent Revenue Retained Earnings Salaries and Wages Payable Sales Revenue Notes Receivable 297,000 Accounts Payable Accumulated Depreciation-Equipment Sales Discounts...

Flowers are Heaven's accounts at April 30, 2020, included the following used balances The physical count of Inventory showed 8,000 of Inventory on hand. This is the only adjustmeded (Click the icon to view the unadjusted balances) Required a. Journalkre the adjustment for inventory shrinkage Include an explanation Flowers Heaven wes the perpetual Inventory system b. Journalire the closing entries for the appropriate accounts c. Compute the gross margin Unadjusted balances -X Requirement a Journalire the adjustment for inventory shrinkage...

Flowers are Heaven's accounts at April 30, 2020, included the following used balances The physical count of Inventory showed 8,000 of Inventory on hand. This is the only adjustmeded (Click the icon to view the unadjusted balances) Required a. Journalkre the adjustment for inventory shrinkage Include an explanation Flowers Heaven wes the perpetual Inventory system b. Journalire the closing entries for the appropriate accounts c. Compute the gross margin Unadjusted balances -X Requirement a Journalire the adjustment for inventory shrinkage...

Reagan Corporation is a wholesale distributor of truck

replacement parts. Initial amounts taken from Reagan's records are

as follows:

Inventory at December 31 (based on a physical count

of goods in Reagan's warehouse on December 31)

$1,290,000

Accounts payable at December 31:

Vendor

Terms

Amount

Baker Company

2%, 10 days, net 30

$

273,000

Charlie Company

Net 30

218,000

Dolly Company

Net 30

308,000

Eagler Company

Net 30

233,000

Full Company

Net 30

–

Greg Company

Net 30

–

Accounts...

Reagan Corporation is a wholesale distributor of truck

replacement parts. Initial amounts taken from Reagan's records are

as follows:

Inventory at December 31 (based on a physical count

of goods in Reagan's warehouse on December 31)

$1,290,000

Accounts payable at December 31:

Vendor

Terms

Amount

Baker Company

2%, 10 days, net 30

$

273,000

Charlie Company

Net 30

218,000

Dolly Company

Net 30

308,000

Eagler Company

Net 30

233,000

Full Company

Net 30

–

Greg Company

Net 30

–

Accounts...