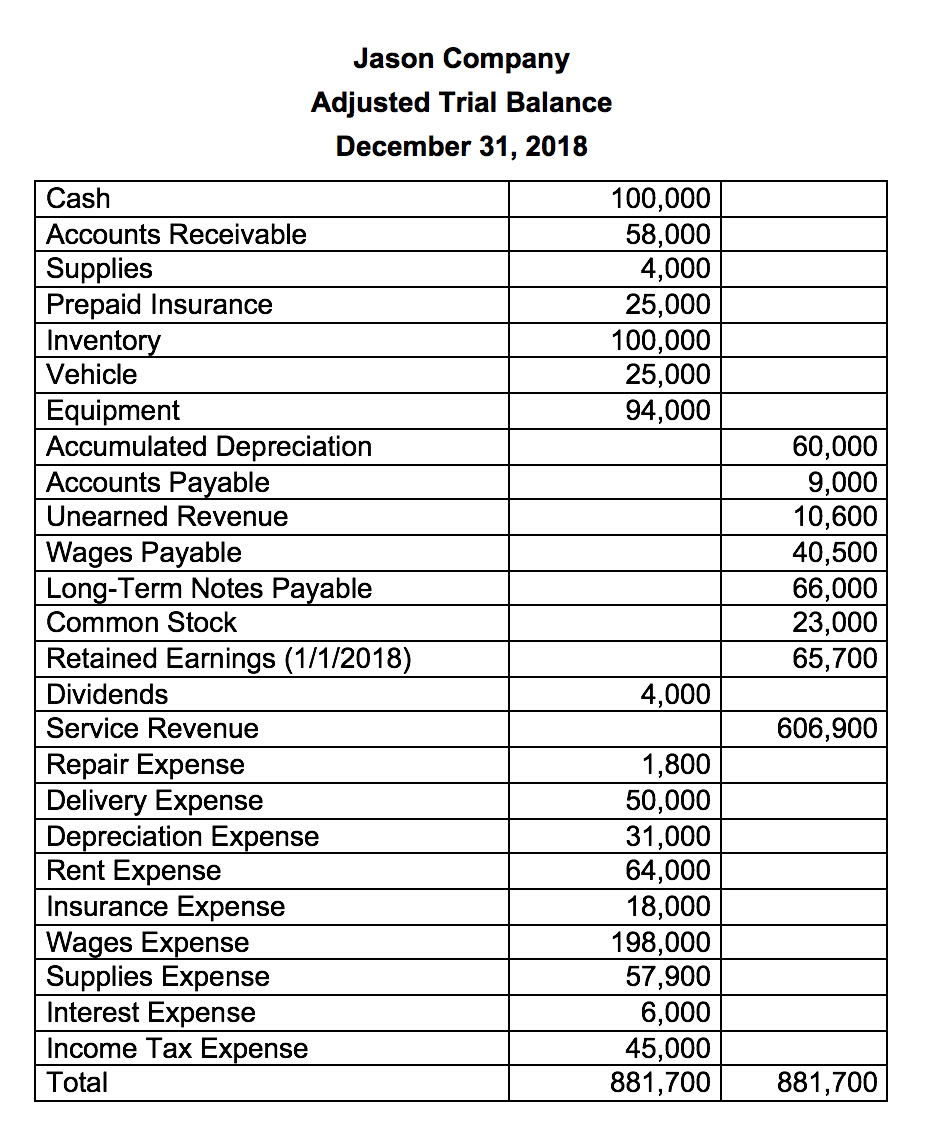

What is Net Income for the period ending December 31, 2018?

What is Ending Retained Earnings for the period ending December 31, 2018?

What is Total Current Assets as of December 31, 2018?

What is Total Current Liabilities as of December 31, 2018?

What is Total Stockholders' Equity as of December 31, 2018?

What is Total Assets as of December 31, 2018?

Homework Answers

Add Answer to:

What is Net Income for the period ending December 31, 2018?

What is Ending Retained Earnings...

Laurel Company Adjusted Trial Balance December 31, 2018 80,000 38,000 4,000 25.000 96,400 25,000 94.000 Cash...

Laurel Company Adjusted Trial Balance December 31, 2018 80,000 38,000 4,000 25.000 96,400 25,000 94.000 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 60,000 29,000 23.000 40.500 16,000 23,000 65.700 4,000 606,900 3,800 50,000 31,000 64,000 38.000 198,000 57,900 10,000...

Laurel Company Adjusted Trial Balance December 31, 2018 80,000 38,000 4,000 25.000 96,400 25,000 94.000 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 60,000 29,000 23.000 40.500 16,000 23,000 65.700 4,000 606,900 3,800 50,000 31,000 64,000 38.000 198,000 57,900 10,000...

Jung Company Adjusted Trial Balance December 31, 2018 | 115,000 21,000 3,000 36,000 110,000 15,000 65.000...

Jung Company Adjusted Trial Balance December 31, 2018 | 115,000 21,000 3,000 36,000 110,000 15,000 65.000 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 35,000 8,000 15,900 1,000 47,000 35,000 55,100 4,000 480,000 8,000 42,000 6,000 55,000 10,000 140,000 13,000...

Jung Company Adjusted Trial Balance December 31, 2018 | 115,000 21,000 3,000 36,000 110,000 15,000 65.000 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 35,000 8,000 15,900 1,000 47,000 35,000 55,100 4,000 480,000 8,000 42,000 6,000 55,000 10,000 140,000 13,000...

Jung Company Adjusted Trial Balance December 31, 2018 | 115,000 21,000 3,000 36,000 110.000 15,000 65,000...

Jung Company Adjusted Trial Balance December 31, 2018 | 115,000 21,000 3,000 36,000 110.000 15,000 65,000 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 35,000 8.000 15,900 1,000 47,000 35,000 55,100 4,000 480,000 8,000 | 42,000 6.000 55.000 10.000 140,000...

Jung Company Adjusted Trial Balance December 31, 2018 | 115,000 21,000 3,000 36,000 110.000 15,000 65,000 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 35,000 8.000 15,900 1,000 47,000 35,000 55,100 4,000 480,000 8,000 | 42,000 6.000 55.000 10.000 140,000...

prepare the statement of retained earnings of the year ending December 31, 2018 2. Prepare the...

prepare the statement of retained earnings of the year ending

December 31, 2018

2. Prepare the statement of retained earnings for the year ending December 31, 2018 3. Prepare the classified balance sheet as of December 31, 2018. Use the report form. Requirement 2. Prepare the statement of retained earnings for the year ending December 31, 2018. (Use a minus sign or parentheses to show a net loss Boston Advertising Services Statement of Retained Earnings Year Ended December 31, 2018...

prepare the statement of retained earnings of the year ending

December 31, 2018

2. Prepare the statement of retained earnings for the year ending December 31, 2018 3. Prepare the classified balance sheet as of December 31, 2018. Use the report form. Requirement 2. Prepare the statement of retained earnings for the year ending December 31, 2018. (Use a minus sign or parentheses to show a net loss Boston Advertising Services Statement of Retained Earnings Year Ended December 31, 2018...

• Income Statement for the year ending December 31, 2019 • Statement of Retained Earnings for...

• Income Statement for the year ending December 31, 2019

• Statement of Retained Earnings for the year ending December

31, 2019

• Statement of Stockholders Equity for the year ending

December 31, 2019

• Balance Sheet at December 31, 2019

• Statement of Cash Flows for the year ending December 31,

2018

Note: For Earnings per Share (EPS) calculations, use 10,000

shares of common stock as the weighted average number of shares

outstanding.

Credit Debit 64. 200 2000 5,000...

• Income Statement for the year ending December 31, 2019

• Statement of Retained Earnings for the year ending December

31, 2019

• Statement of Stockholders Equity for the year ending

December 31, 2019

• Balance Sheet at December 31, 2019

• Statement of Cash Flows for the year ending December 31,

2018

Note: For Earnings per Share (EPS) calculations, use 10,000

shares of common stock as the weighted average number of shares

outstanding.

Credit Debit 64. 200 2000 5,000...

The following is the adjusted trial balance of Marie, Inc., at December 31, 2018, the end...

The following is the adjusted trial balance of Marie, Inc., at December 31, 2018, the end of the current year. The retained earnings balance was $11,500 at January 1, 2018, the beginning of the current year. Marie, Inc. Adjusted Trial Balance December 31, 2018 Accounts Debit Credit Cash $83,600 Accounts Receivable 29,000 Prepaid Insurance 3,500 Office Supplies 3,200 Building 207,000 Accumulated Depreciation—Building $26,500 Land 47,000 Accounts Payable 25,000 Salaries Payable 5,000 Unearned Revenue 27,000 Mortgage Payable 103,000 Common Stock 16,000...

prepare an income statement for the year ending 12/31/19; retained earnings statement for the year ended;...

prepare an income statement for the year ending 12/31/19; retained

earnings statement for the year ended; classified balance sheet

Accounts Payable Accounts Receivable $5000 21,500 35,000 2000 Accumulated Depreciation - Equipment Additional Paid-in-Capital Common Stock Cash Common Stock Depreciation Expense Dividends paid Equipment Insurance Expense Interest Expense Interest payable Notes payable (due 12/31/23) Prepaid Insurance Rent Expense Retained Earnings Salaries and Wages Payable Salaries Expense Service Revenue Supplies Supplies Expense Unearned Service Revenue 11,350 8,000 7000 10,000 60,000 850 150...

prepare an income statement for the year ending 12/31/19; retained

earnings statement for the year ended; classified balance sheet

Accounts Payable Accounts Receivable $5000 21,500 35,000 2000 Accumulated Depreciation - Equipment Additional Paid-in-Capital Common Stock Cash Common Stock Depreciation Expense Dividends paid Equipment Insurance Expense Interest Expense Interest payable Notes payable (due 12/31/23) Prepaid Insurance Rent Expense Retained Earnings Salaries and Wages Payable Salaries Expense Service Revenue Supplies Supplies Expense Unearned Service Revenue 11,350 8,000 7000 10,000 60,000 850 150...

Prepare an income statement and a retained earnings statement for the 2 months ended December 31,...

Prepare an income statement and a retained earnings statement

for the 2 months ended December 31, 2017, The note payable has a

stated interest rate of 6%, and the principal and interest are due

on November 16, 2019.

RUUSU 11al Dalal December 31, 2017 Debit Credit Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Equipment NT$1,180 875 350 1,210 1,200 NT$ 40 Accounts Payable Salaries and Wages Payable Unearned Service Revenue Notes Payable 300 2,000 Interest Payable 15 800...

Prepare an income statement and a retained earnings statement

for the 2 months ended December 31, 2017, The note payable has a

stated interest rate of 6%, and the principal and interest are due

on November 16, 2019.

RUUSU 11al Dalal December 31, 2017 Debit Credit Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Equipment NT$1,180 875 350 1,210 1,200 NT$ 40 Accounts Payable Salaries and Wages Payable Unearned Service Revenue Notes Payable 300 2,000 Interest Payable 15 800...

White Gloves Company has journalized the adjusting entries for the period ending December 31, 2018, and...

White Gloves Company has journalized the adjusting entries for the period ending December 31, 2018, and posted the adjustments to the following T-accounts (Click the icon to view the T-accounts) Using this data, prepare an adjusted trial balance White Gloves Company Adjusted Trial Balance December 31, 2018 Balance Debit Credit Account Title Cash Office Supplies Prepaid Insurance Equipment Accumulated Depreciation--Equipment Accounts Payable Salaries Payable Unearned Revenue Mary Cantal White Gloves Company has journalized the adjusting entries for the period ending...

White Gloves Company has journalized the adjusting entries for the period ending December 31, 2018, and posted the adjustments to the following T-accounts (Click the icon to view the T-accounts) Using this data, prepare an adjusted trial balance White Gloves Company Adjusted Trial Balance December 31, 2018 Balance Debit Credit Account Title Cash Office Supplies Prepaid Insurance Equipment Accumulated Depreciation--Equipment Accounts Payable Salaries Payable Unearned Revenue Mary Cantal White Gloves Company has journalized the adjusting entries for the period ending...

Selected accounts for Kebby Photography at December 31, 2018, follow: Retained Earnings 49,000 Service Revenue Dividends...

Selected accounts for Kebby Photography at December 31, 2018, follow: Retained Earnings 49,000 Service Revenue Dividends 14,000 33,000 4,500 Salaries Expense 31,800 1,400 Supplies Expense 2,700 Depreciation Expense-Building 7,000 Depreciation Expense-Furniture 1,500 Requirements 1. Journalize Kebby Photography's closing entries at December 31, 2018. 2. Determine Kebby Photography's ending Retained Earnings balance at December 31, 2018.

Selected accounts for Kebby Photography at December 31, 2018, follow: Retained Earnings 49,000 Service Revenue Dividends 14,000 33,000 4,500 Salaries Expense 31,800 1,400 Supplies Expense 2,700 Depreciation Expense-Building 7,000 Depreciation Expense-Furniture 1,500 Requirements 1. Journalize Kebby Photography's closing entries at December 31, 2018. 2. Determine Kebby Photography's ending Retained Earnings balance at December 31, 2018.

Most questions answered within 3 hours.

-

Write a program to solve the Josephus problem, with the following

modification:

Sample Input:

./a.out n...

asked 57 minutes ago -

At the start of a CD it is spinning at a rate of 525 rpm

(revolutions...

asked 1 hour ago -

4. Without doing any calculations, predict whether the observed

∆T would increase, decrease or remain the...

asked 2 hours ago -

Based on the range, which of the following sets of scores has

the greatest variability? 3,...

asked 3 hours ago -

Ripples in a pond travel at a velocity of 3 m/s with one peak

passing a...

asked 3 hours ago -

A man stands on the roof of a building of height 13.0 mm and

throws a...

asked 3 hours ago -

The extent to which assets are financed by borrowed funds and

other liabilities is indicated by:...

asked 4 hours ago -

Explain in detail

Germany is the fifth largest economy

explain what goods and services Germany specializes...

asked 5 hours ago -

The density of platinum is 21.45 g/mL. If a cube of platinum

with a mass of...

asked 5 hours ago -

Accounts Receivable

Sales

A/R Posting

Extended Sales Invoice

Packing Slip

Compare invoice to packing slip 2...

asked 5 hours ago -

Michaella, age 23, is a full-time law student and is claimed by

her parents as a...

asked 5 hours ago -

Why are polymers not typically casted into products?

asked 5 hours ago

Laurel Company Adjusted Trial Balance December 31, 2018 80,000 38,000 4,000 25.000 96,400 25,000 94.000 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 60,000 29,000 23.000 40.500 16,000 23,000 65.700 4,000 606,900 3,800 50,000 31,000 64,000 38.000 198,000 57,900 10,000...

Laurel Company Adjusted Trial Balance December 31, 2018 80,000 38,000 4,000 25.000 96,400 25,000 94.000 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 60,000 29,000 23.000 40.500 16,000 23,000 65.700 4,000 606,900 3,800 50,000 31,000 64,000 38.000 198,000 57,900 10,000...

Jung Company Adjusted Trial Balance December 31, 2018 | 115,000 21,000 3,000 36,000 110,000 15,000 65.000 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 35,000 8,000 15,900 1,000 47,000 35,000 55,100 4,000 480,000 8,000 42,000 6,000 55,000 10,000 140,000 13,000...

Jung Company Adjusted Trial Balance December 31, 2018 | 115,000 21,000 3,000 36,000 110,000 15,000 65.000 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 35,000 8,000 15,900 1,000 47,000 35,000 55,100 4,000 480,000 8,000 42,000 6,000 55,000 10,000 140,000 13,000...

Jung Company Adjusted Trial Balance December 31, 2018 | 115,000 21,000 3,000 36,000 110.000 15,000 65,000 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 35,000 8.000 15,900 1,000 47,000 35,000 55,100 4,000 480,000 8,000 | 42,000 6.000 55.000 10.000 140,000...

Jung Company Adjusted Trial Balance December 31, 2018 | 115,000 21,000 3,000 36,000 110.000 15,000 65,000 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 35,000 8.000 15,900 1,000 47,000 35,000 55,100 4,000 480,000 8,000 | 42,000 6.000 55.000 10.000 140,000...

prepare the statement of retained earnings of the year ending

December 31, 2018

2. Prepare the statement of retained earnings for the year ending December 31, 2018 3. Prepare the classified balance sheet as of December 31, 2018. Use the report form. Requirement 2. Prepare the statement of retained earnings for the year ending December 31, 2018. (Use a minus sign or parentheses to show a net loss Boston Advertising Services Statement of Retained Earnings Year Ended December 31, 2018...

prepare the statement of retained earnings of the year ending

December 31, 2018

2. Prepare the statement of retained earnings for the year ending December 31, 2018 3. Prepare the classified balance sheet as of December 31, 2018. Use the report form. Requirement 2. Prepare the statement of retained earnings for the year ending December 31, 2018. (Use a minus sign or parentheses to show a net loss Boston Advertising Services Statement of Retained Earnings Year Ended December 31, 2018...

• Income Statement for the year ending December 31, 2019

• Statement of Retained Earnings for the year ending December

31, 2019

• Statement of Stockholders Equity for the year ending

December 31, 2019

• Balance Sheet at December 31, 2019

• Statement of Cash Flows for the year ending December 31,

2018

Note: For Earnings per Share (EPS) calculations, use 10,000

shares of common stock as the weighted average number of shares

outstanding.

Credit Debit 64. 200 2000 5,000...

• Income Statement for the year ending December 31, 2019

• Statement of Retained Earnings for the year ending December

31, 2019

• Statement of Stockholders Equity for the year ending

December 31, 2019

• Balance Sheet at December 31, 2019

• Statement of Cash Flows for the year ending December 31,

2018

Note: For Earnings per Share (EPS) calculations, use 10,000

shares of common stock as the weighted average number of shares

outstanding.

Credit Debit 64. 200 2000 5,000...

prepare an income statement for the year ending 12/31/19; retained

earnings statement for the year ended; classified balance sheet

Accounts Payable Accounts Receivable $5000 21,500 35,000 2000 Accumulated Depreciation - Equipment Additional Paid-in-Capital Common Stock Cash Common Stock Depreciation Expense Dividends paid Equipment Insurance Expense Interest Expense Interest payable Notes payable (due 12/31/23) Prepaid Insurance Rent Expense Retained Earnings Salaries and Wages Payable Salaries Expense Service Revenue Supplies Supplies Expense Unearned Service Revenue 11,350 8,000 7000 10,000 60,000 850 150...

prepare an income statement for the year ending 12/31/19; retained

earnings statement for the year ended; classified balance sheet

Accounts Payable Accounts Receivable $5000 21,500 35,000 2000 Accumulated Depreciation - Equipment Additional Paid-in-Capital Common Stock Cash Common Stock Depreciation Expense Dividends paid Equipment Insurance Expense Interest Expense Interest payable Notes payable (due 12/31/23) Prepaid Insurance Rent Expense Retained Earnings Salaries and Wages Payable Salaries Expense Service Revenue Supplies Supplies Expense Unearned Service Revenue 11,350 8,000 7000 10,000 60,000 850 150...

Prepare an income statement and a retained earnings statement

for the 2 months ended December 31, 2017, The note payable has a

stated interest rate of 6%, and the principal and interest are due

on November 16, 2019.

RUUSU 11al Dalal December 31, 2017 Debit Credit Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Equipment NT$1,180 875 350 1,210 1,200 NT$ 40 Accounts Payable Salaries and Wages Payable Unearned Service Revenue Notes Payable 300 2,000 Interest Payable 15 800...

Prepare an income statement and a retained earnings statement

for the 2 months ended December 31, 2017, The note payable has a

stated interest rate of 6%, and the principal and interest are due

on November 16, 2019.

RUUSU 11al Dalal December 31, 2017 Debit Credit Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Equipment NT$1,180 875 350 1,210 1,200 NT$ 40 Accounts Payable Salaries and Wages Payable Unearned Service Revenue Notes Payable 300 2,000 Interest Payable 15 800...

White Gloves Company has journalized the adjusting entries for the period ending December 31, 2018, and posted the adjustments to the following T-accounts (Click the icon to view the T-accounts) Using this data, prepare an adjusted trial balance White Gloves Company Adjusted Trial Balance December 31, 2018 Balance Debit Credit Account Title Cash Office Supplies Prepaid Insurance Equipment Accumulated Depreciation--Equipment Accounts Payable Salaries Payable Unearned Revenue Mary Cantal White Gloves Company has journalized the adjusting entries for the period ending...

White Gloves Company has journalized the adjusting entries for the period ending December 31, 2018, and posted the adjustments to the following T-accounts (Click the icon to view the T-accounts) Using this data, prepare an adjusted trial balance White Gloves Company Adjusted Trial Balance December 31, 2018 Balance Debit Credit Account Title Cash Office Supplies Prepaid Insurance Equipment Accumulated Depreciation--Equipment Accounts Payable Salaries Payable Unearned Revenue Mary Cantal White Gloves Company has journalized the adjusting entries for the period ending...

Selected accounts for Kebby Photography at December 31, 2018, follow: Retained Earnings 49,000 Service Revenue Dividends 14,000 33,000 4,500 Salaries Expense 31,800 1,400 Supplies Expense 2,700 Depreciation Expense-Building 7,000 Depreciation Expense-Furniture 1,500 Requirements 1. Journalize Kebby Photography's closing entries at December 31, 2018. 2. Determine Kebby Photography's ending Retained Earnings balance at December 31, 2018.

Selected accounts for Kebby Photography at December 31, 2018, follow: Retained Earnings 49,000 Service Revenue Dividends 14,000 33,000 4,500 Salaries Expense 31,800 1,400 Supplies Expense 2,700 Depreciation Expense-Building 7,000 Depreciation Expense-Furniture 1,500 Requirements 1. Journalize Kebby Photography's closing entries at December 31, 2018. 2. Determine Kebby Photography's ending Retained Earnings balance at December 31, 2018.