Homework Answers

The formulla for Amount of coumpound intertest is A = P ( 1+r)n

Now here A= 48* $161.7 , r = 1/12 and n = 48

thuss P = 48* $161.7 / ( 1 + 1/12) 48

= 5422.383

B) Now she did not make it in the first year and credit union demanded full so she will pay have to pay the period into the

sum for each period ie, 161.7 * 12 = 1940.4

C) If situation B occurs cost of the loan wont change much except for the simple interest gained on the monthly payments so it would be Simple interest on 1940.4 if payments would have been monthly.

i.e approximately 1/2 *9/100 * 1940 i.e 87.3

D If she missed 1st 11 payments she would have to pay 161.7 * 12 + Simple interest

i,e 2022.3

E The % of loan cost that is payed because of missed payments is

for 9% interest rate the payment is 1940 so for 2022 the equivalent % is 9.38%

So 0.38% additional interest is payed because of the missed payments

Add Answer to:

on present value of annuity sheila davidson borrowered money

from her credit union and agreed to...

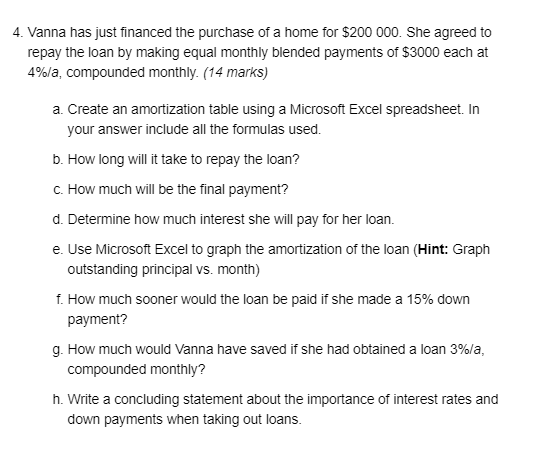

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. (14 marks) Create an amortization table using a Microsoft Excel spreadsheet. In y

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. a. Create an amortization table using a Microsoft Excel spreadsheet. In your answer include all the formulas used.b.How long will it take to repay the loan?c. How much will be the final payment?d. Determine how much interest she will pay for her loan.e. Use Microsoft Excel to graph the amortization...

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. a. Create an amortization table using a Microsoft Excel spreadsheet. In your answer include all the formulas used.b.How long will it take to repay the loan?c. How much will be the final payment?d. Determine how much interest she will pay for her loan.e. Use Microsoft Excel to graph the amortization...

Olivia deposited $800 at her local credit union in a savings account at the rate of...

Olivia deposited $800 at her local credit union in a savings account at the rate of 6.2% paid as simple interest. She will earn Interest once a year for the next 7 years. If she were to make no additional deposits or withdrawals, how much money would the credit union owe Olivia in 7 years? O $1,218.88 $852.68 $1,147.20 $149.60 Now, assume that Olivia's credit union pays a compound interest rate of 6.2% compounded annually. All other things being equal,...

Olivia deposited $800 at her local credit union in a savings account at the rate of 6.2% paid as simple interest. She will earn Interest once a year for the next 7 years. If she were to make no additional deposits or withdrawals, how much money would the credit union owe Olivia in 7 years? O $1,218.88 $852.68 $1,147.20 $149.60 Now, assume that Olivia's credit union pays a compound interest rate of 6.2% compounded annually. All other things being equal,...

Question 4: Application of Time Value of Money to Mortgages (30 marks) Shanna wants to buy...

Question 4: Application of Time Value of Money to Mortgages (30 marks) Shanna wants to buy a house costing $325,000 and has obtained a loan from TD Bank. A minimum down payment of 15% would be required and the bank will provide the difference. Her grandparent have told her that they will cover her down payment. a. TD Bank has quoted her mortgage interest rate is 4.5%; this rate would be compounded semi- annually, while her payments would be made...

Question 4: Application of Time Value of Money to Mortgages (30 marks) Shanna wants to buy a house costing $325,000 and has obtained a loan from TD Bank. A minimum down payment of 15% would be required and the bank will provide the difference. Her grandparent have told her that they will cover her down payment. a. TD Bank has quoted her mortgage interest rate is 4.5%; this rate would be compounded semi- annually, while her payments would be made...

On January 1, LaQuita bought an used car for $7,200 and agreed to pay for it...

On January 1, LaQuita bought an used car for $7,200 and agreed to pay for it as follows: 1/3 down payment, the balance to be paid in 36 equal monthly payments, the first payment due February 1, an annual interest rate of 9% compounded monthly. a. What is the amount of LaQuita's monthly payment b. During the summer LaQuita made enough money to pay off the entire balance due on the car as of October 1 (October 1 payment plus...

On January 1, LaQuita bought an used car for $7,200 and agreed to pay for it as follows: 1/3 down payment, the balance to be paid in 36 equal monthly payments, the first payment due February 1, an annual interest rate of 9% compounded monthly. a. What is the amount of LaQuita's monthly payment b. During the summer LaQuita made enough money to pay off the entire balance due on the car as of October 1 (October 1 payment plus...

How much is the equivalent present value in year 0 for a 5-year annuity, starting at...

How much is the equivalent present value in year 0 for a 5-year annuity, starting at the end of year 1 with $10,000 at end of each year, at an annual interest rate at 8% per year, compounded quarterly? An amortized loan is the arrangement that you pay same amount at the end of each period and you pay off the loan after the last payment. If the beginning amount of a 5-year loan is $10,000, the nominal annual interest...

1. Shirley wants to go on a trip to Hawaii. She budgets that she can save...

1. Shirley wants to go on a trip to Hawaii. She budgets that she can save $108 at the end of every month, and interest in her account is 8% compounded biweekly. By looking at prices, she knows that the trip will cost her $4813 total. How long in years (round to two decimal places) will it take before she can go on her trip? 2. Joey buys a new Honda civic for $18997. He agrees to payments at the...

TIME VALUE OF MONEY 32. Future Value of si John and Mary Rich invested $15,000 in...

TIME VALUE OF MONEY 32. Future Value of si John and Mary Rich invested $15,000 in a savings account paying 5.25% interest at the time their son, Mike, was born. The money is to be used by Mike for his college education. On his 18 birthday, Mike withdraws the money from his savings account. How much did Mike withdraw from his account? A. $42,755.32 B. $30,345.27 C. $35,233.89 D $37,678.11 33. Future Value of Annuity of Si John and Char...

TIME VALUE OF MONEY 32. Future Value of si John and Mary Rich invested $15,000 in a savings account paying 5.25% interest at the time their son, Mike, was born. The money is to be used by Mike for his college education. On his 18 birthday, Mike withdraws the money from his savings account. How much did Mike withdraw from his account? A. $42,755.32 B. $30,345.27 C. $35,233.89 D $37,678.11 33. Future Value of Annuity of Si John and Char...

Some years ago, Penny purchased the car of her dreams for $25,000 by paying 20% down...

Some years ago, Penny purchased the car of her dreams for $25,000 by paying 20% down at purchase time and taking a $20,000, 5 years, 6% per year, compounded monthly loan with 60 monthly payments of $3866.66 each. She is examining her loan situation and would like to have some specific information. Help her obtain the following: (a) Verification of the current monthly payment amount. (b) Total amount she will pay over 5 years. (c) Total interest she will pay...

please help, show work. 5.) Jennifer has been given money for her birthday. She puts her...

please help, show work. 5.) Jennifer has been given money for her birthday. She puts her money in a savings account offers an annual interest rate of 4.50%, compounded monthly. What is the effective annual rate (EAR) on the saving account? 6.) An individual invests $10,000 today in an investment that is expected to be worth $20,000 in 6 years. What annualized rate of return is the investor expecting to receive on the investment? 7.) A college graduate just bought...

Shirley, a recent college graduate, excitedly described to her older sister the $1,510 sofa, table, and chairs she foun...

Shirley, a recent college graduate, excitedly described to her older sister the $1,510 sofa, table, and chairs she found today. However, when asked she could not tell her sister which interest calculation method was to be used on her credit-based purchase. Calculate the monthly payments and total cost for a bank loan assuming aone-year repayment period and 13.25 percent interest. Now, assume the store uses the add-on method of interest calculation. Calculate the monthly payment and total cost with a...

Most questions answered within 3 hours.

-

Break-even time. Hampton Corporation’s research

and development department is presenting a proposal for new product

research....

asked 1 minute ago -

At Lake Itasca in Minnesota, the Mississippi river is only 25.0

feet wide. If you are...

asked 2 minutes ago -

A 2.0 μF parallel-plate air-filled capacitor is connected

across a 10 V battery.

(a) Determine the...

asked 12 minutes ago -

Write in Python This program:

1. Correct the compute_cells_state function which receives as

parameter an array...

asked 2 minutes ago -

1. What is the difference in the output layer between a neural

network used for classification,...

asked 10 minutes ago -

ECO

2013 &

asked 16 minutes ago -

Insight refers to:

a.

Adaptive decision-making

b.

Credibility and trustworthness

c.

Understanding of one's problems

d....

asked 23 minutes ago -

Explain the differences between rights and permissions within

Windows. Define the principle of least privilege and...

asked 30 minutes ago -

A solid, frictionless cylindrical reel of mass M=5.00kg and

radius R=0.55m is used to draw water...

asked 32 minutes ago -

how do radio waves get emitted from Jupiter?

- do they come from radiation from planet...

asked 33 minutes ago -

The test statistic used in the F test for the equality of two

variances is calculated...

asked 45 minutes ago -

How does neutralisation of IL-6 trans-signaling affect the

autoimmune disease and inflammation? What if the trans-signaling...

asked 35 minutes ago

Olivia deposited $800 at her local credit union in a savings account at the rate of 6.2% paid as simple interest. She will earn Interest once a year for the next 7 years. If she were to make no additional deposits or withdrawals, how much money would the credit union owe Olivia in 7 years? O $1,218.88 $852.68 $1,147.20 $149.60 Now, assume that Olivia's credit union pays a compound interest rate of 6.2% compounded annually. All other things being equal,...

Olivia deposited $800 at her local credit union in a savings account at the rate of 6.2% paid as simple interest. She will earn Interest once a year for the next 7 years. If she were to make no additional deposits or withdrawals, how much money would the credit union owe Olivia in 7 years? O $1,218.88 $852.68 $1,147.20 $149.60 Now, assume that Olivia's credit union pays a compound interest rate of 6.2% compounded annually. All other things being equal,...

Question 4: Application of Time Value of Money to Mortgages (30 marks) Shanna wants to buy a house costing $325,000 and has obtained a loan from TD Bank. A minimum down payment of 15% would be required and the bank will provide the difference. Her grandparent have told her that they will cover her down payment. a. TD Bank has quoted her mortgage interest rate is 4.5%; this rate would be compounded semi- annually, while her payments would be made...

Question 4: Application of Time Value of Money to Mortgages (30 marks) Shanna wants to buy a house costing $325,000 and has obtained a loan from TD Bank. A minimum down payment of 15% would be required and the bank will provide the difference. Her grandparent have told her that they will cover her down payment. a. TD Bank has quoted her mortgage interest rate is 4.5%; this rate would be compounded semi- annually, while her payments would be made...

On January 1, LaQuita bought an used car for $7,200 and agreed to pay for it as follows: 1/3 down payment, the balance to be paid in 36 equal monthly payments, the first payment due February 1, an annual interest rate of 9% compounded monthly. a. What is the amount of LaQuita's monthly payment b. During the summer LaQuita made enough money to pay off the entire balance due on the car as of October 1 (October 1 payment plus...

On January 1, LaQuita bought an used car for $7,200 and agreed to pay for it as follows: 1/3 down payment, the balance to be paid in 36 equal monthly payments, the first payment due February 1, an annual interest rate of 9% compounded monthly. a. What is the amount of LaQuita's monthly payment b. During the summer LaQuita made enough money to pay off the entire balance due on the car as of October 1 (October 1 payment plus...

TIME VALUE OF MONEY 32. Future Value of si John and Mary Rich invested $15,000 in a savings account paying 5.25% interest at the time their son, Mike, was born. The money is to be used by Mike for his college education. On his 18 birthday, Mike withdraws the money from his savings account. How much did Mike withdraw from his account? A. $42,755.32 B. $30,345.27 C. $35,233.89 D $37,678.11 33. Future Value of Annuity of Si John and Char...

TIME VALUE OF MONEY 32. Future Value of si John and Mary Rich invested $15,000 in a savings account paying 5.25% interest at the time their son, Mike, was born. The money is to be used by Mike for his college education. On his 18 birthday, Mike withdraws the money from his savings account. How much did Mike withdraw from his account? A. $42,755.32 B. $30,345.27 C. $35,233.89 D $37,678.11 33. Future Value of Annuity of Si John and Char...