Managerial Accounting

Freestone Company is considering buying Machine B to replace Machine A. Both machines have the same remaining useful life and will perform the same tasks. However, it is expected that B will require less direct labor usage to operate the machine than does A. B will also increase production, generating additional contribution margin from product sales for the company. For this decision problem, which of the following factors is (are) relevant?

I. Original cost of Machine A

II. Contribution Margin from sales generated by each machine

III. Cost to purchase Machine B

IV. Cost of direct labor to operate each machine

a. Only I, III, and IV

b. Only II, III, and IV

c. Only I and III

d. I, II, III, and IV are all relevant

Homework Answers

Request Answer!

We need at least 10 more requests to produce the answer.

0 / 10 have requested this problem solution

The more requests, the faster the answer.

1. Working capital needed for a new project is treated: a. as a cash inflow...

1. Working capital needed for a new project is treated: a. as a cash inflow now and as a cash outflow when the project ends. b. as a cash outflow now and as a cash inflow when the project ends. c. only as a cash outflow now. 2. Which of the following is not an example of a cash outflow for a proposed machine purchase? a. Salvage value at the end of its useful life b. Initial investment (cost)...

Managerial Accounting Question

TufStuff, Inc., sells a wide range of drums, bins, boxes, and other containers that are used in the chemical industry. One of the company’s products is a heavy-duty corrosion-resistant metal drum, called the WVD drum, used to store toxic wastes. Production is constrained by the capacity of an automated welding machine that is used to make precision welds. A total of 2,140 hours of welding time is available annually on the machine. Because each drum requires 0.4 hours of welding...

16sb Please show full calculation, TIA! ---- 1. ABC Company produces a product that currently sells...

16sb Please show full calculation, TIA! ---- 1. ABC Company produces a product that currently sells for $72 per unit. Current production costs per unit include the following: Direct materials = $20 Variable overhead = $10 Direct labor = $24 Fixed overhead = $10 Total production costs = $64 ABC has received a special pricing offer from a nonprofit organization to buy 3,000 units at $60 per unit. ABC is currently operating at full production capacity. Identify...

Clinton Truck Corp. is evaluating whether it should replace a 10-year old equipment. Because this is...

Clinton Truck Corp. is evaluating whether it should replace a 10-year old equipment. Because this is a replacement type of project, you set out to estimate relevant cash flows assuming the replacement decision is made. What cash flows do you think are valid and relevant in the initial period, i.e. period 0? I. Purchase cost of a new machine alone II. Sales price of the old machine alone III. Potential cost savings from using the new machine IV. After-tax salvage...

3. Charlie Corporation is considering buying a new donut maker. This machine will replace an old...

3. Charlie Corporation is considering buying a new donut maker. This machine will replace an old donut maker that still has a useful life of 6 years. The new machine will cost $3,600 a year to operate, as opposed to the old machine, which costs $3,800 per year to operate. Also, because of increased capacity, an additional 20,000 donuts a year can be produced. The company makes a contribution margin of $0.10 per donut. The old machine can be sold...

3. Charlie Corporation is considering buying a new donut maker. This machine will replace an old donut maker that still has a useful life of 6 years. The new machine will cost $3,600 a year to operate, as opposed to the old machine, which costs $3,800 per year to operate. Also, because of increased capacity, an additional 20,000 donuts a year can be produced. The company makes a contribution margin of $0.10 per donut. The old machine can be sold...

John has been requested to determine the amount of fixed assets that is required to support...

John has been requested to determine the amount of fixed assets that is required to support each dollar of sales for his firm. To perform this task, the information he needs to collect include the firm's : I. current amount of current assets II. current level of current liabilities III. current level of interest expenses IV. maximum sales over the past 10 year sales Multiple Choice I, II, and III only II, III, and IV only I and III only...

Managerial Accounting

Make a business analysis of the production/manufacturing company which producing on ajob order costing, with hypothetically created data. The reporting period is monthly. All datawhich was hypothesized cannot be zero. Business analysis during the month through thestages of completion as follows :1. Determine in the beginning period: raw materials, work in process and finished goods *)2. Determine in the ending period: raw materials, work in process and finished goods *)3. Determine the purchase of raw materials (only direct material) for...

le considered when analyzing an the nature and conditions of governmental regulations the involvement and relations...

le considered when analyzing an the nature and conditions of governmental regulations the involvement and relations, if any, with labor unions the development of new technologies relevant to the industry the extent of competition within the industry IV. A) B) I, II and IV only II, III and IV only I, II and Ill only I, II, III and IV D) The following information is available for the Oil Creek Corporation and Accounts Receivable $19,000 Sales $195,000 Current assets $36,000...

le considered when analyzing an the nature and conditions of governmental regulations the involvement and relations, if any, with labor unions the development of new technologies relevant to the industry the extent of competition within the industry IV. A) B) I, II and IV only II, III and IV only I, II and Ill only I, II, III and IV D) The following information is available for the Oil Creek Corporation and Accounts Receivable $19,000 Sales $195,000 Current assets $36,000...

Managerial Accounting

. For your first assignment, management has provided the following revenue and cost information: High End Set Economical Set Sales price $3,500 per unit $1,000 per unit Labor $875 per unit $250 per unit Materials $1,400 per unit $300 per unit Direct fixed costs $25,000 per month $16,500 per month Allocated fixed costs $85,000 per month $85,000 per month They want a better understanding of their business to make budgeting and sales goals decisions and have asked you to determine...

Help!! (managerial accounting)

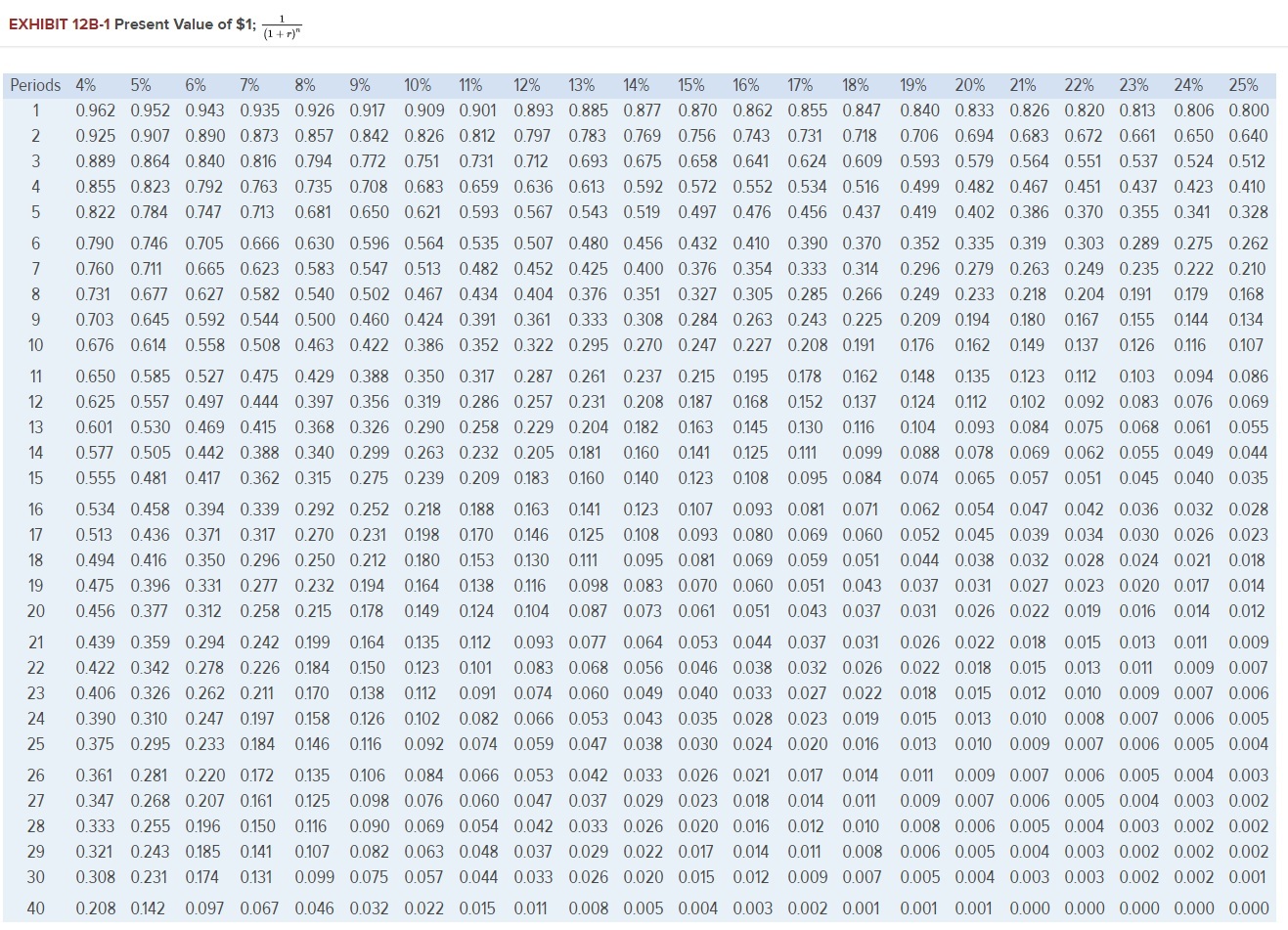

The Sweetwater Candy Company would like to buy a new machine that would automatically “dip” chocolates. The dipping operation currently is done largely by hand. The machine the company is considering costs $180,000. The manufacturer estimates that the machine would be usable for five years but would require the replacement of several key parts at the end of the third year. These parts would cost $9,900, including installation. After five years, the machine could be sold for $5,000. The company estimates...

The Sweetwater Candy Company would like to buy a new machine that would automatically “dip” chocolates. The dipping operation currently is done largely by hand. The machine the company is considering costs $180,000. The manufacturer estimates that the machine would be usable for five years but would require the replacement of several key parts at the end of the third year. These parts would cost $9,900, including installation. After five years, the machine could be sold for $5,000. The company estimates...

Most questions answered within 3 hours.

-

1/ Using ________________ as they are intended is the best

guarantee for consistency and forward compatibility....

asked 9 minutes ago -

Portfolio theory

Given the following information about firm A and the

market:δ

E (Rm)= 12 per...

asked 6 minutes ago -

Albert files his income tax return (showing a total tax of

$23,000) 5½ months after the...

asked 10 minutes ago -

This exercise involves you using imagination and logical

reasoning to occupy the mindset of a visualiser...

asked 20 minutes ago -

What kinds of storage have you seen in use during your own

lifetime?

asked 21 minutes ago -

Practicing Acid Base Calculations

Cameco in Port Hope, Ontario uses hydrofluoric acid to make a

uranium...

asked 28 minutes ago -

The gross payoffs (X) from the investment have the following

probability mass function.

x

p(x)

0...

asked 35 minutes ago -

In an aqueous mixture of aluminum, lead, and iron salts, which

of these will be reduced...

asked 52 minutes ago -

The probability of college students in the US is given by P(A)=

0.06. The probability of...

asked 34 minutes ago -

Water is needed to supply a canal system, which may require up

to 30m3 s -1...

asked 39 minutes ago -

A stubborn dog is being walked on a leash by its owner. At one

point, the...

asked 44 minutes ago -

To convert the money spent on the basket to a useable figure,

economists arbitrarily choose the...

asked 44 minutes ago

3. Charlie Corporation is considering buying a new donut maker. This machine will replace an old donut maker that still has a useful life of 6 years. The new machine will cost $3,600 a year to operate, as opposed to the old machine, which costs $3,800 per year to operate. Also, because of increased capacity, an additional 20,000 donuts a year can be produced. The company makes a contribution margin of $0.10 per donut. The old machine can be sold...

3. Charlie Corporation is considering buying a new donut maker. This machine will replace an old donut maker that still has a useful life of 6 years. The new machine will cost $3,600 a year to operate, as opposed to the old machine, which costs $3,800 per year to operate. Also, because of increased capacity, an additional 20,000 donuts a year can be produced. The company makes a contribution margin of $0.10 per donut. The old machine can be sold...

le considered when analyzing an the nature and conditions of governmental regulations the involvement and relations, if any, with labor unions the development of new technologies relevant to the industry the extent of competition within the industry IV. A) B) I, II and IV only II, III and IV only I, II and Ill only I, II, III and IV D) The following information is available for the Oil Creek Corporation and Accounts Receivable $19,000 Sales $195,000 Current assets $36,000...

le considered when analyzing an the nature and conditions of governmental regulations the involvement and relations, if any, with labor unions the development of new technologies relevant to the industry the extent of competition within the industry IV. A) B) I, II and IV only II, III and IV only I, II and Ill only I, II, III and IV D) The following information is available for the Oil Creek Corporation and Accounts Receivable $19,000 Sales $195,000 Current assets $36,000...