Homework Answers

You have asked multiple unrelated questions in the same post. I have addressed the first question, that I feel has complete information and hence can be solved. Please post the balance questions, separately, one by one.

Add Answer to:

Part C: 1. Computrek has made arrangements with AFG to pay $40 000 May 1. a....

As part of the purchase of a home on January 1, 2014, you negotiated a mortgage...

As part of the purchase of a home on January 1, 2014, you negotiated a mortgage in the amount of $110 000. The amortization period for calculation of the level payments (principal and interest) was 25 years and the initial interest rate was 6% compounded semi-annually. (Do not round intermediate calculations. Round your answers to 2 decimal places.) a) What was the initial monthly payment? b) During 2014–2018 inclusive (and January 1, 2019) all monthly mortgage payments were made as...

Problem 1 (Required, 25 marks) A borrower has borrowed $2000000 from the bank. It is given...

Problem 1 (Required, 25 marks) A borrower has borrowed $2000000 from the bank. It is given that the loan charges interest at an annual effective interest rate 16.0755% and compound interest is assumed. (a) Suppose that the borrower decides to repay the loan by 180 monthly payments made at the end of every month, (i) Using retrospective method, calculate the outstanding balance at 60th repayment date. (ii) Calculate the interest due and principal repaid in 120th repayment. (b) Suppose that...

Problem 1 (Required, 25 marks) A borrower has borrowed $2000000 from the bank. It is given that the loan charges interest at an annual effective interest rate 16.0755% and compound interest is assumed. (a) Suppose that the borrower decides to repay the loan by 180 monthly payments made at the end of every month, (i) Using retrospective method, calculate the outstanding balance at 60th repayment date. (ii) Calculate the interest due and principal repaid in 120th repayment. (b) Suppose that...

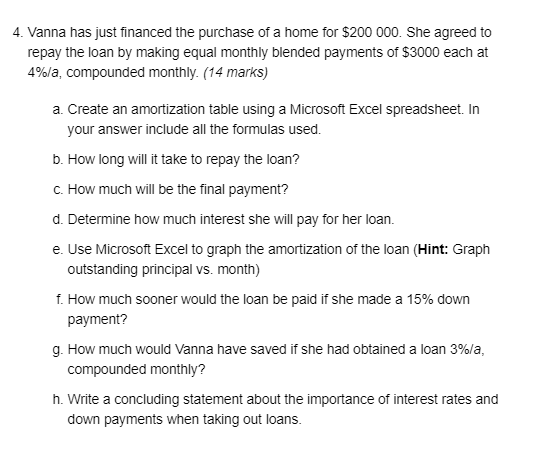

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. (14 marks) Create an amortization table using a Microsoft Excel spreadsheet. In y

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. a. Create an amortization table using a Microsoft Excel spreadsheet. In your answer include all the formulas used.b.How long will it take to repay the loan?c. How much will be the final payment?d. Determine how much interest she will pay for her loan.e. Use Microsoft Excel to graph the amortization...

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. a. Create an amortization table using a Microsoft Excel spreadsheet. In your answer include all the formulas used.b.How long will it take to repay the loan?c. How much will be the final payment?d. Determine how much interest she will pay for her loan.e. Use Microsoft Excel to graph the amortization...

which option is correct without explanation 11 If a company borrows $100 000 at an interest...

which option is correct without explanation

11 If a company borrows $100 000 at an interest rate of 20% per year, compounded semi-annually and makes payments of $15,000 every 6 months, the length of time required for the company to pay off the loan is closest to A. 7 years B, 9 years C. Less than 6 years D. More than 10 years 12.lfi-10%, the value ofXìn the following CFD is closest to: A, 826 В. 1085 C, 268 D....

which option is correct without explanation

11 If a company borrows $100 000 at an interest rate of 20% per year, compounded semi-annually and makes payments of $15,000 every 6 months, the length of time required for the company to pay off the loan is closest to A. 7 years B, 9 years C. Less than 6 years D. More than 10 years 12.lfi-10%, the value ofXìn the following CFD is closest to: A, 826 В. 1085 C, 268 D....

On January 1, LaQuita bought an used car for $7,200 and agreed to pay for it...

On January 1, LaQuita bought an used car for $7,200 and agreed to pay for it as follows: 1/3 down payment, the balance to be paid in 36 equal monthly payments, the first payment due February 1, an annual interest rate of 9% compounded monthly. a. What is the amount of LaQuita's monthly payment b. During the summer LaQuita made enough money to pay off the entire balance due on the car as of October 1 (October 1 payment plus...

On January 1, LaQuita bought an used car for $7,200 and agreed to pay for it as follows: 1/3 down payment, the balance to be paid in 36 equal monthly payments, the first payment due February 1, an annual interest rate of 9% compounded monthly. a. What is the amount of LaQuita's monthly payment b. During the summer LaQuita made enough money to pay off the entire balance due on the car as of October 1 (October 1 payment plus...

A company’s capital consists of 100 000 ordinary shares issued at $2 and paid up to...

A company’s capital consists of 100 000 ordinary shares issued at $2 and paid up to $1 per share. On 1 September, a first call of 50c was made on the ordinary shares. By 30 September, the call money received amounted to $45 000. No further payments were received, and on 31 October, the shares on which calls were outstanding were forfeited. On 15 November, the forfeited shares were reissued as paid to $1.50 for a payment of $1 per...

Riah wants to buy a car that costs R125 000. The deposit is R29 00 .the...

Riah wants to buy a car that costs R125 000. The deposit is R29 00 .the bank charges a once off fee of R1 140; added to the loan amount before the interest is calculated at 9;75% coumpoud per year. The administration fee is R57 per month 1. What is the total amount of the loan that Riah has to get from the bank??? 2. Write down the amonth of her monthly payment if it is R2 052; 01 plus...

On 1 July 2020 Jenny Ltd issued a prospectus to the public offering 15 million shares...

On 1 July 2020 Jenny Ltd issued a prospectus to the public offering 15 million shares at $2.00 each. The prospectus specified that $1.00 per share is to payable on application and a further $0.50 will be payable on allotment. The closing date for applications was 31 August 2020. By the closing date, applications have been received for 20 million shares. To deal with the oversubscription, the directors of Jenny Ltd decided to issue shares to all subscribers on a...

Craig borrows 6000 dollars a year to pay for college expenses, starting on September 1, 2000 - the day he starts college - and ending on September 1, 2004. (i.e. that's 5 withdrawals total). After...

Craig borrows 6000 dollars a

year to pay for college expenses, starting on September 1, 2000 -

the day he starts college - and ending on September 1, 2004. (i.e.

that's 5 withdrawals total). After graduation, he decides to go to

graduate school in mathematics, and his loans are deferred (i.e.

they still accrue interest, but no payments are due). After

graduation from graduate school, he needs to begin paying off his

loans. He will make monthly payments for 7...

Craig borrows 6000 dollars a

year to pay for college expenses, starting on September 1, 2000 -

the day he starts college - and ending on September 1, 2004. (i.e.

that's 5 withdrawals total). After graduation, he decides to go to

graduate school in mathematics, and his loans are deferred (i.e.

they still accrue interest, but no payments are due). After

graduation from graduate school, he needs to begin paying off his

loans. He will make monthly payments for 7...

Record the general journal entries. 12 donated his motor vehicle to the firm. Original cost: $15,000....

Record the general journal entries.

12 donated his motor vehicle to the firm. Original cost: $15,000. Current market value: $3,000 in exchange for ordinary shares @$1 per share 2. Arranged an interest only loan with Grand Bank for $8,000; interest at 5% p.a.; payable quarterly. Principal amount to be repaid 31 December 2022. Loan amount deposited in account today. 3. Depreciate the vehicle equally over 6 years with no residual value. This is to certify that is the holder of...

Record the general journal entries.

12 donated his motor vehicle to the firm. Original cost: $15,000. Current market value: $3,000 in exchange for ordinary shares @$1 per share 2. Arranged an interest only loan with Grand Bank for $8,000; interest at 5% p.a.; payable quarterly. Principal amount to be repaid 31 December 2022. Loan amount deposited in account today. 3. Depreciate the vehicle equally over 6 years with no residual value. This is to certify that is the holder of...

Most questions answered within 3 hours.

-

What will the standard deviation of these exam grades be? A

square bracket means inclusive, so...

asked 2 minutes ago -

Beginning Retained Earnings are $ 79 comma 000 $79,000; sales

are $ 31 comma 700 $31,700;...

asked 4 minutes ago -

Please explain/demonstrate how to use NLTK to test unigram,

bigram, and trigram character models on guessing...

asked 11 minutes ago -

what you feel is most important to you and why regarding your

typing skills?

asked 12 minutes ago -

Consider a play of the casino game `Quick Draw'. In this game, a

player pays $11...

asked 21 minutes ago -

How do the mechanical features of bone affect its roles as

repositories of phosphate and calcium,...

asked 25 minutes ago -

P agreed to buy 100 barrels of widget oil, which was stored in a

large tank...

asked 25 minutes ago -

The unstable isotope 40K is used for dating rock samples. Its

half-life is 1.28×109y. How many...

asked 28 minutes ago -

Compare and contrast constructed-response items and

selected-response items.

Identify at least one (1) advantage and one...

asked 30 minutes ago -

A) Find the moment of inertia of a 2 meter long stick with a

mass of...

asked 29 minutes ago -

For the code below write a public static main() method

in class Student that:

- creates...

asked 31 minutes ago -

Please show all steps. Thank you

A 1.0-cm-diameter pipe widens to 2.0 cm, then narrows to...

asked 44 minutes ago

Problem 1 (Required, 25 marks) A borrower has borrowed $2000000 from the bank. It is given that the loan charges interest at an annual effective interest rate 16.0755% and compound interest is assumed. (a) Suppose that the borrower decides to repay the loan by 180 monthly payments made at the end of every month, (i) Using retrospective method, calculate the outstanding balance at 60th repayment date. (ii) Calculate the interest due and principal repaid in 120th repayment. (b) Suppose that...

Problem 1 (Required, 25 marks) A borrower has borrowed $2000000 from the bank. It is given that the loan charges interest at an annual effective interest rate 16.0755% and compound interest is assumed. (a) Suppose that the borrower decides to repay the loan by 180 monthly payments made at the end of every month, (i) Using retrospective method, calculate the outstanding balance at 60th repayment date. (ii) Calculate the interest due and principal repaid in 120th repayment. (b) Suppose that...

which option is correct without explanation

11 If a company borrows $100 000 at an interest rate of 20% per year, compounded semi-annually and makes payments of $15,000 every 6 months, the length of time required for the company to pay off the loan is closest to A. 7 years B, 9 years C. Less than 6 years D. More than 10 years 12.lfi-10%, the value ofXìn the following CFD is closest to: A, 826 В. 1085 C, 268 D....

which option is correct without explanation

11 If a company borrows $100 000 at an interest rate of 20% per year, compounded semi-annually and makes payments of $15,000 every 6 months, the length of time required for the company to pay off the loan is closest to A. 7 years B, 9 years C. Less than 6 years D. More than 10 years 12.lfi-10%, the value ofXìn the following CFD is closest to: A, 826 В. 1085 C, 268 D....

On January 1, LaQuita bought an used car for $7,200 and agreed to pay for it as follows: 1/3 down payment, the balance to be paid in 36 equal monthly payments, the first payment due February 1, an annual interest rate of 9% compounded monthly. a. What is the amount of LaQuita's monthly payment b. During the summer LaQuita made enough money to pay off the entire balance due on the car as of October 1 (October 1 payment plus...

On January 1, LaQuita bought an used car for $7,200 and agreed to pay for it as follows: 1/3 down payment, the balance to be paid in 36 equal monthly payments, the first payment due February 1, an annual interest rate of 9% compounded monthly. a. What is the amount of LaQuita's monthly payment b. During the summer LaQuita made enough money to pay off the entire balance due on the car as of October 1 (October 1 payment plus...

Craig borrows 6000 dollars a

year to pay for college expenses, starting on September 1, 2000 -

the day he starts college - and ending on September 1, 2004. (i.e.

that's 5 withdrawals total). After graduation, he decides to go to

graduate school in mathematics, and his loans are deferred (i.e.

they still accrue interest, but no payments are due). After

graduation from graduate school, he needs to begin paying off his

loans. He will make monthly payments for 7...

Craig borrows 6000 dollars a

year to pay for college expenses, starting on September 1, 2000 -

the day he starts college - and ending on September 1, 2004. (i.e.

that's 5 withdrawals total). After graduation, he decides to go to

graduate school in mathematics, and his loans are deferred (i.e.

they still accrue interest, but no payments are due). After

graduation from graduate school, he needs to begin paying off his

loans. He will make monthly payments for 7...

Record the general journal entries.

12 donated his motor vehicle to the firm. Original cost: $15,000. Current market value: $3,000 in exchange for ordinary shares @$1 per share 2. Arranged an interest only loan with Grand Bank for $8,000; interest at 5% p.a.; payable quarterly. Principal amount to be repaid 31 December 2022. Loan amount deposited in account today. 3. Depreciate the vehicle equally over 6 years with no residual value. This is to certify that is the holder of...

Record the general journal entries.

12 donated his motor vehicle to the firm. Original cost: $15,000. Current market value: $3,000 in exchange for ordinary shares @$1 per share 2. Arranged an interest only loan with Grand Bank for $8,000; interest at 5% p.a.; payable quarterly. Principal amount to be repaid 31 December 2022. Loan amount deposited in account today. 3. Depreciate the vehicle equally over 6 years with no residual value. This is to certify that is the holder of...