2. To record the payment from Seneca

Homework Answers

Answer :

1) journal entry at January 1, 2021 to record the sale :

| Date | Account | Debit | Credit |

| Jan 1, 2021 | Note receivable | $38,000 | |

| Revenue | $38,000 |

2) Journal entry at December 31, 2021 to record the payment from seneca :

| Date | Account | Debit | Credit |

| Dec 31, 2021 | cash | $41,800 | |

| Note receivable | $38,000 | ||

| Accrued Interest ($38,000 × 10%) | $3,800 |

Add Answer to:

2. To record the payment from Seneca

Arctic Cat sold Seneca Motor Sports a shipment of...

On January 1, 2020, Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have...

On January 1, 2020, Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $44,000. Because of limited space, Seneca wanted to delay delivery until December 31, 2020 but offered to make up-front payment (in full) on January 1, 2020. Arctic agreed and as a concession reduced the sales price to $40,000 since Seneca paid 12 months in advance of delivery. So, the contract was: Seneca pays $40.000 cash to Arctic Cat on...

On January 1, 2020, Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $44,000. Because of limited space, Seneca wanted to delay delivery until December 31, 2020 but offered to make up-front payment (in full) on January 1, 2020. Arctic agreed and as a concession reduced the sales price to $40,000 since Seneca paid 12 months in advance of delivery. So, the contract was: Seneca pays $40.000 cash to Arctic Cat on...

IU с D E А B Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles...

IU с D E А B Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles at an agreed-upon price of $38,000. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $41,800 on December 31, 2021. Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10% Required: 1. Prepare Artic Cat's journal entries at January 1,...

IU с D E А B Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles at an agreed-upon price of $38,000. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $41,800 on December 31, 2021. Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10% Required: 1. Prepare Artic Cat's journal entries at January 1,...

A10 fx D E А B On January 1, 2020, Arctic Cat sold Seneca Motor Sports...

A10 fx D E А B On January 1, 2020, Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $44,000. Because of limited space, Seneca wanted to delay delivery until December 31, 2020 but offered to make up-front payment in full) on January 1, 2020. Arctic agreed and as a concession reduced the sales price to $40,000 since Seneca paid 12 months in advance of delivery. So, the contract was: Seneca pays...

A10 fx D E А B On January 1, 2020, Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $44,000. Because of limited space, Seneca wanted to delay delivery until December 31, 2020 but offered to make up-front payment in full) on January 1, 2020. Arctic agreed and as a concession reduced the sales price to $40,000 since Seneca paid 12 months in advance of delivery. So, the contract was: Seneca pays...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $46,200 on a future date. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 9%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value...

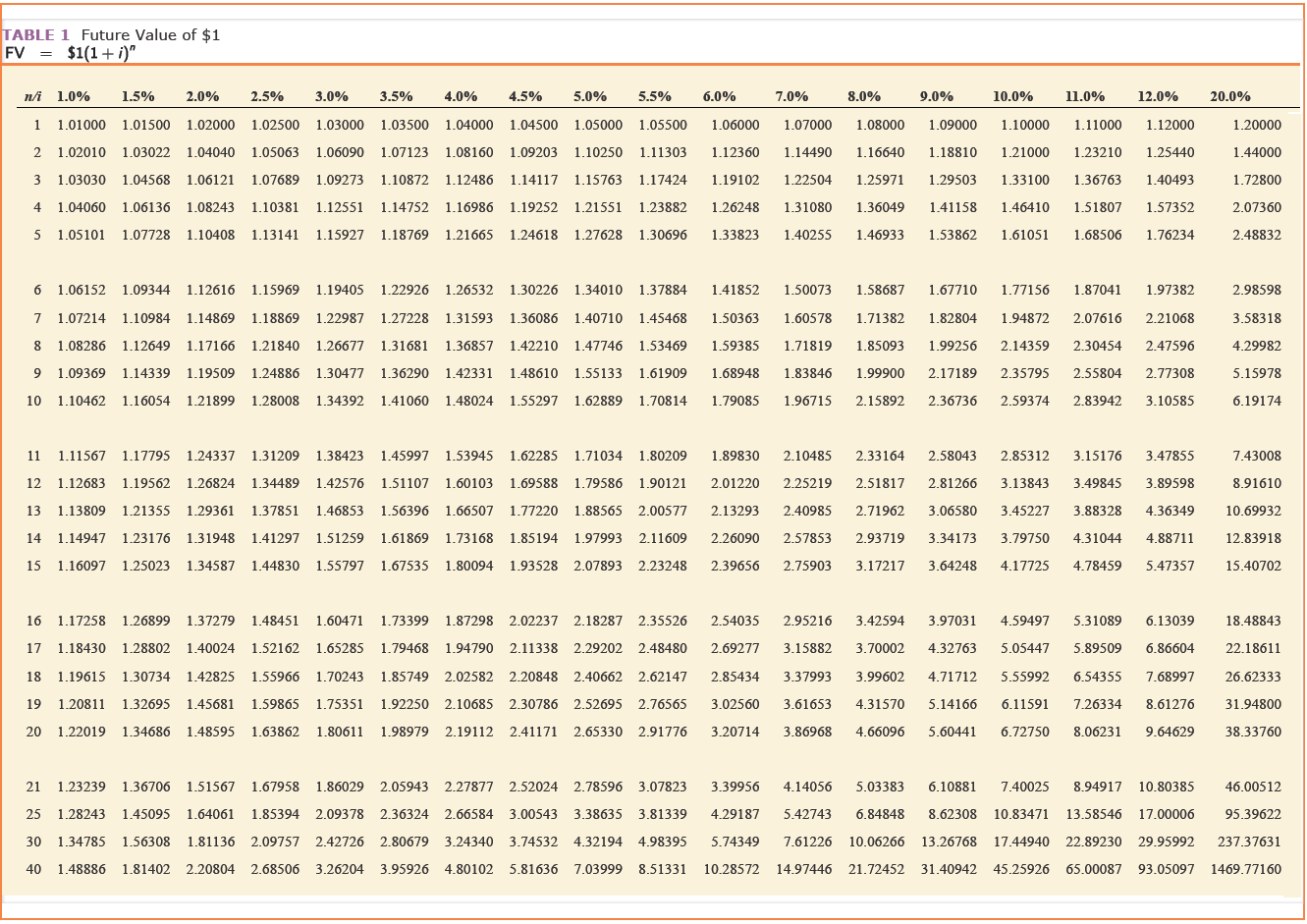

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $38,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time ey component of this arrangement to be significant, and that the relevant interest rate is 5%. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $38,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time ey component of this arrangement to be significant, and that the relevant interest rate is 5%. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $32,500. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant, and that the relevant interest rate is 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $46,200 on a future date. Unless informed otherwise, assume tha

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $46,200 on a future date. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 9%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $46,200 on a future date. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 9%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $30,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant, and that the relevant interest rate is 11%. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $30,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant, and that the relevant interest rate is 11%. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate...

Exercise 6-13 (Algo) Time value of money for deferred revenue (L06-6] Arctic Cat sold Seneca Motor...

Exercise 6-13 (Algo) Time value of money for deferred revenue (L06-6] Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $49.800 Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently Unless informed otherwise, assume that Arctic views the time honey component of this arrangement to be significant, and that the relevant interest rate is 12%, (EV of $1 PV of $1. FVA OS PVA Of $1. FVAD...

Exercise 6-13 (Algo) Time value of money for deferred revenue (L06-6] Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $49.800 Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently Unless informed otherwise, assume that Arctic views the time honey component of this arrangement to be significant, and that the relevant interest rate is 12%, (EV of $1 PV of $1. FVA OS PVA Of $1. FVAD...

Exercise 6-13 (Algo) Time value of money for deferred revenue [LO6-6] Arctic Cat sold Seneca Motor...

Exercise 6-13 (Algo) Time value of money for deferred revenue [LO6-6] Arctic Cat sold Seneca Motor Sports a shipment of snowmobi les that have a fair market value of $31,800. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant, and that the relevant interest rate is 6%. (FV of $1 PV of $1, FVA of $1...

Exercise 6-13 (Algo) Time value of money for deferred revenue [LO6-6] Arctic Cat sold Seneca Motor Sports a shipment of snowmobi les that have a fair market value of $31,800. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant, and that the relevant interest rate is 6%. (FV of $1 PV of $1, FVA of $1...

Most questions answered within 3 hours.

-

A project has an initial cost of $55,000, expected net cash

inflows of $11,000 per year...

asked 13 minutes ago -

Design a series of crosses in which you can tell a fly with a

lobe allele,...

asked 17 minutes ago -

Write a java program that allows the user to input 20 double

type numbers to an...

asked 25 minutes ago -

A box of mass m = 2.00 kg is positioned on a ramp at an angle...

asked 28 minutes ago -

Wheel A has three times the moment of inertia about its axis of

rotation as wheel...

asked 33 minutes ago -

A boy pulls a 20.0-kg box with a 160-N force at 39° above a

horizontal surface....

asked 33 minutes ago -

Determine if a 10-ft. long 6 x14 beam is adequate to support a

dead load wD=...

asked 35 minutes ago -

A distribution of values is normal with a mean of 157.8 and a

standard deviation of...

asked 1 hour ago -

Suppose the demand for crossing the Brooklyn Bridge is given by

Q = 10,000 - 1000P....

asked 1 hour ago -

Assume that we are in a Heckscher Ohlin world: 2 Two countries:

Home (H) and Foreign...

asked 1 hour ago -

A nationally known supermarket decided to promote its own brand

of soft drinks on TV for...

asked 1 hour ago -

A bond issued by IBM on December 1, 1996, is scheduled to mature

on December 1,...

asked 1 hour ago

On January 1, 2020, Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $44,000. Because of limited space, Seneca wanted to delay delivery until December 31, 2020 but offered to make up-front payment (in full) on January 1, 2020. Arctic agreed and as a concession reduced the sales price to $40,000 since Seneca paid 12 months in advance of delivery. So, the contract was: Seneca pays $40.000 cash to Arctic Cat on...

On January 1, 2020, Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $44,000. Because of limited space, Seneca wanted to delay delivery until December 31, 2020 but offered to make up-front payment (in full) on January 1, 2020. Arctic agreed and as a concession reduced the sales price to $40,000 since Seneca paid 12 months in advance of delivery. So, the contract was: Seneca pays $40.000 cash to Arctic Cat on...

IU с D E А B Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles at an agreed-upon price of $38,000. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $41,800 on December 31, 2021. Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10% Required: 1. Prepare Artic Cat's journal entries at January 1,...

IU с D E А B Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles at an agreed-upon price of $38,000. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $41,800 on December 31, 2021. Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10% Required: 1. Prepare Artic Cat's journal entries at January 1,...

A10 fx D E А B On January 1, 2020, Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $44,000. Because of limited space, Seneca wanted to delay delivery until December 31, 2020 but offered to make up-front payment in full) on January 1, 2020. Arctic agreed and as a concession reduced the sales price to $40,000 since Seneca paid 12 months in advance of delivery. So, the contract was: Seneca pays...

A10 fx D E А B On January 1, 2020, Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $44,000. Because of limited space, Seneca wanted to delay delivery until December 31, 2020 but offered to make up-front payment in full) on January 1, 2020. Arctic agreed and as a concession reduced the sales price to $40,000 since Seneca paid 12 months in advance of delivery. So, the contract was: Seneca pays...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $38,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time ey component of this arrangement to be significant, and that the relevant interest rate is 5%. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $38,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time ey component of this arrangement to be significant, and that the relevant interest rate is 5%. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $30,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant, and that the relevant interest rate is 11%. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $30,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant, and that the relevant interest rate is 11%. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate...

Exercise 6-13 (Algo) Time value of money for deferred revenue (L06-6] Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $49.800 Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently Unless informed otherwise, assume that Arctic views the time honey component of this arrangement to be significant, and that the relevant interest rate is 12%, (EV of $1 PV of $1. FVA OS PVA Of $1. FVAD...

Exercise 6-13 (Algo) Time value of money for deferred revenue (L06-6] Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $49.800 Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently Unless informed otherwise, assume that Arctic views the time honey component of this arrangement to be significant, and that the relevant interest rate is 12%, (EV of $1 PV of $1. FVA OS PVA Of $1. FVAD...

Exercise 6-13 (Algo) Time value of money for deferred revenue [LO6-6] Arctic Cat sold Seneca Motor Sports a shipment of snowmobi les that have a fair market value of $31,800. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant, and that the relevant interest rate is 6%. (FV of $1 PV of $1, FVA of $1...

Exercise 6-13 (Algo) Time value of money for deferred revenue [LO6-6] Arctic Cat sold Seneca Motor Sports a shipment of snowmobi les that have a fair market value of $31,800. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant, and that the relevant interest rate is 6%. (FV of $1 PV of $1, FVA of $1...