Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January...

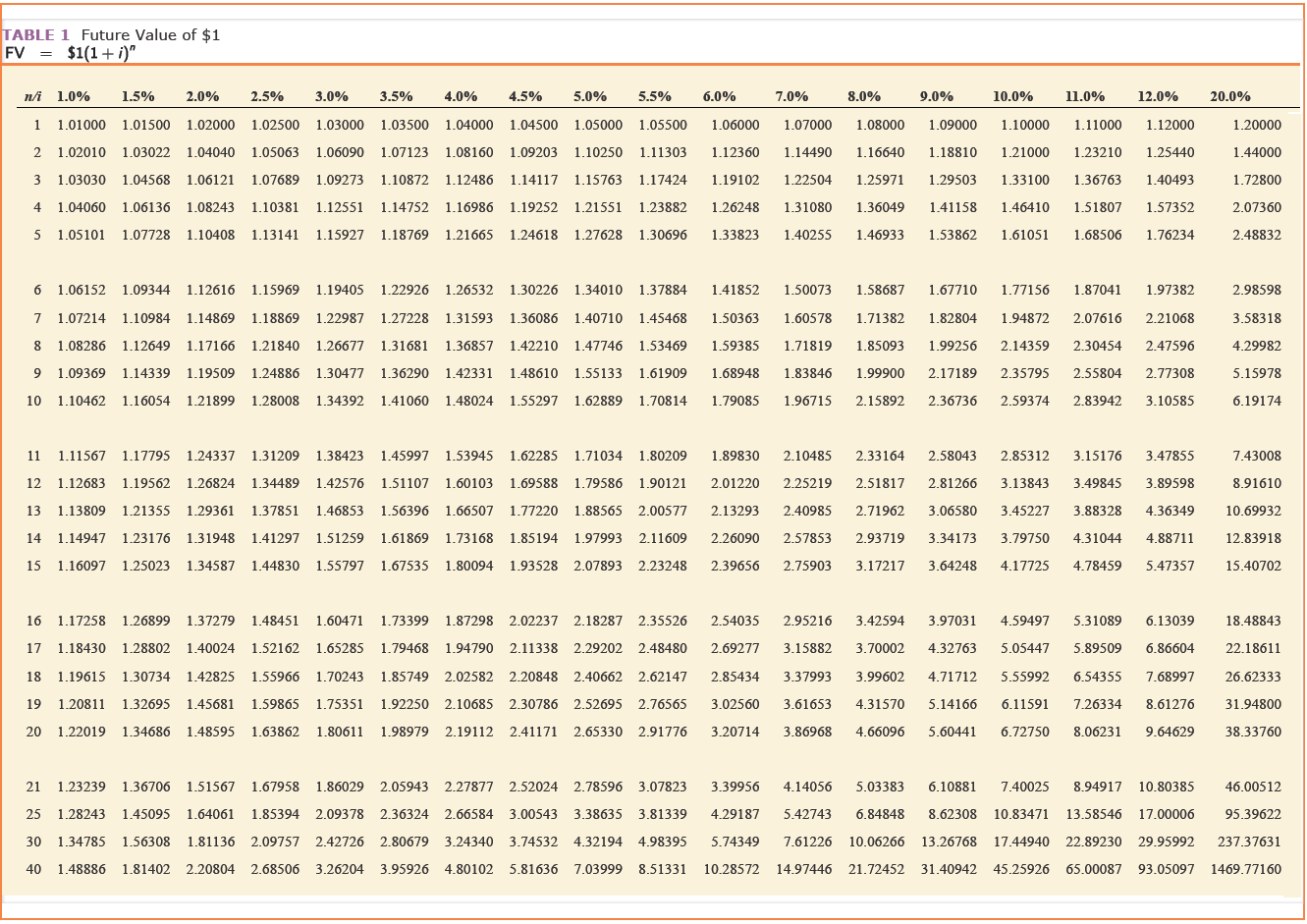

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $46,200 on a future date. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 9%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Assume the note indicates that Seneca is to pay Arctic the $46,200 due on the note on December 31, 2021. Prepare the journal entry for Arctic to record the sale on January 1, 2021. Assume the same facts as in requirement 1, and prepare the journal entry for Arctic to record collection of the payment on December 31, 2021. Assume instead that Seneca is to pay Arctic the $46,200 due on the note on December 31, 2022. Prepare the journal entry for Arctic to record the sale on January 1, 2021. Assume instead that Arctic does not view the time value of money component of this arrangement to be significant, and that the note indicates that Seneca is to pay Arctic the $46,200 due on the note on December 31, 2021. Prepare the journal entry for Arctic to record the sale on January 1, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar amount.)

Homework Answers

List of Journal entries under different assumptions --

|

Sl |

Assumption |

Date |

Account details |

DR |

CR |

|

1 |

Time-value is significant. Amt receivable on 31-Dec-2021 |

01-01-2021 |

Seneca Motor Sports (Customer) |

46,200 |

|

|

To Sales (46200 / 1.09) |

42,385 |

||||

|

To Deferred Interest Income |

3,815 |

||||

|

2 |

As before/ Collection received on 31-Dec-2021 |

12-31-2021 |

Bank |

46,200 |

|

|

To Seneca Motor Sports (Customer) |

46,200 |

||||

|

12-31-2021 |

Deferred Interest Income |

3,815 |

|||

|

Interest Income |

3,815 |

||||

|

3 |

Time-value is significant. Amt receivable on 31-Dec-2022 |

01-01-2021 |

Seneca Motor Sports (Customer) |

46,200 |

|

|

To Sales (46200 / 1.09)/1.09 |

38,886 |

||||

|

To Deferred Interest Income |

7,314 |

||||

|

4 |

Time Value is not significant |

01-01-2021 |

Seneca Motor Sports (Customer) |

46,200 |

|

|

To Sales (46200 / 1.09)/1.09 |

46,200 |

||||

Add Answer to:

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles.

The snowmobiles were delivered on January...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $46,200 on a future date. Unless informed otherwise, assume tha

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $46,200 on a future date. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 9%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $46,200 on a future date. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 9%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $32,500. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant, and that the relevant interest rate is 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $38,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time ey component of this arrangement to be significant, and that the relevant interest rate is 5%. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $38,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time ey component of this arrangement to be significant, and that the relevant interest rate is 5%. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $30,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant, and that the relevant interest rate is 11%. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $30,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant, and that the relevant interest rate is 11%. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $40,400 on a future date. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 7%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $40,400 on a future date. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 7%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles.

The snowmobiles were delivered on January 1, 2021, and Arctic

received a note from Seneca indicating that Seneca will pay Arctic

$38,300 on a future date. Unless informed otherwise, assume that

Arctic views the time value of money component of this arrangement

to be significant and that the relevant interest rate is 11%. (FV

of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles.

The snowmobiles were delivered on January 1, 2021, and Arctic

received a note from Seneca indicating that Seneca will pay Arctic

$38,300 on a future date. Unless informed otherwise, assume that

Arctic views the time value of money component of this arrangement

to be significant and that the relevant interest rate is 11%. (FV

of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD...

2. To record the payment from Seneca Arctic Cat sold Seneca Motor Sports a shipment of...

2. To record the payment from Seneca

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles at an agreed-upon price of $38,000. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $41,800 on December 31, 2021. Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10% Required: 1. Prepare Artic Cat's journal entries at January...

2. To record the payment from Seneca

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles at an agreed-upon price of $38,000. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $41,800 on December 31, 2021. Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10% Required: 1. Prepare Artic Cat's journal entries at January...

IU с D E А B Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles...

IU с D E А B Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles at an agreed-upon price of $38,000. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $41,800 on December 31, 2021. Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10% Required: 1. Prepare Artic Cat's journal entries at January 1,...

IU с D E А B Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles at an agreed-upon price of $38,000. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $41,800 on December 31, 2021. Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10% Required: 1. Prepare Artic Cat's journal entries at January 1,...

On January 1, 2020, Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have...

On January 1, 2020, Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $44,000. Because of limited space, Seneca wanted to delay delivery until December 31, 2020 but offered to make up-front payment (in full) on January 1, 2020. Arctic agreed and as a concession reduced the sales price to $40,000 since Seneca paid 12 months in advance of delivery. So, the contract was: Seneca pays $40.000 cash to Arctic Cat on...

On January 1, 2020, Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $44,000. Because of limited space, Seneca wanted to delay delivery until December 31, 2020 but offered to make up-front payment (in full) on January 1, 2020. Arctic agreed and as a concession reduced the sales price to $40,000 since Seneca paid 12 months in advance of delivery. So, the contract was: Seneca pays $40.000 cash to Arctic Cat on...

Exercise 6-13 (Algo) Time value of money for deferred revenue (L06-6] Arctic Cat sold Seneca Motor...

Exercise 6-13 (Algo) Time value of money for deferred revenue (L06-6] Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $49.800 Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently Unless informed otherwise, assume that Arctic views the time honey component of this arrangement to be significant, and that the relevant interest rate is 12%, (EV of $1 PV of $1. FVA OS PVA Of $1. FVAD...

Exercise 6-13 (Algo) Time value of money for deferred revenue (L06-6] Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $49.800 Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently Unless informed otherwise, assume that Arctic views the time honey component of this arrangement to be significant, and that the relevant interest rate is 12%, (EV of $1 PV of $1. FVA OS PVA Of $1. FVAD...

Most questions answered within 3 hours.

-

Coca Cola’s strategy of “think local, act local” represents a

__________ approach.

Question options:

1)

transnational...

asked 31 seconds from now -

which of the following is not a category of project management

risk?

a) external

b) internal...

asked 38 minutes ago -

Focus on Critical Thinking: Are citizen suit provisions an

effective way to achieve environmental objectives? Do...

asked 1 hour ago -

Gaseous butane CH3CH22CH3 will react with gaseous oxygen O2 to

produce gaseous carbon dioxide CO2 and...

asked 1 hour ago -

Required to construct counters using synchronous sequential

logic. Use one hex digit to display the result....

asked 1 hour ago -

(Ultra) Large-Scale Systems –Characteristics?

explain in detail

How the nature of an enterprise affect complex...

asked 1 hour ago -

Some of the antibiotic susceptible strains show colonies within

the clear zone. What it does this...

asked 2 hours ago -

In the lottery game Fantasy 5 you have to select 5 numbers from

the numbers {1,2,3,.......,38,39}....

asked 2 hours ago -

A call option on Jupiter Motors stock with an exercise price of

$80 and one-year expiration...

asked 2 hours ago -

What is the disadvantage of an automated vulnerability scan tool

like Nessus?

prone to false negatives...

asked 2 hours ago -

An Atwood’s machine has m1 = 0.105 kg, m2 = 0.100 kg, hung from

a 5.00...

asked 2 hours ago -

A firm is considering a project that has the following estimated

cashflows:

Increased sales to business...

asked 2 hours ago

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $38,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time ey component of this arrangement to be significant, and that the relevant interest rate is 5%. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $38,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time ey component of this arrangement to be significant, and that the relevant interest rate is 5%. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $30,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant, and that the relevant interest rate is 11%. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $30,700. Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant, and that the relevant interest rate is 11%. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $40,400 on a future date. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 7%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $40,400 on a future date. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 7%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles.

The snowmobiles were delivered on January 1, 2021, and Arctic

received a note from Seneca indicating that Seneca will pay Arctic

$38,300 on a future date. Unless informed otherwise, assume that

Arctic views the time value of money component of this arrangement

to be significant and that the relevant interest rate is 11%. (FV

of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD...

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles.

The snowmobiles were delivered on January 1, 2021, and Arctic

received a note from Seneca indicating that Seneca will pay Arctic

$38,300 on a future date. Unless informed otherwise, assume that

Arctic views the time value of money component of this arrangement

to be significant and that the relevant interest rate is 11%. (FV

of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD...

2. To record the payment from Seneca

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles at an agreed-upon price of $38,000. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $41,800 on December 31, 2021. Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10% Required: 1. Prepare Artic Cat's journal entries at January...

2. To record the payment from Seneca

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles at an agreed-upon price of $38,000. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $41,800 on December 31, 2021. Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10% Required: 1. Prepare Artic Cat's journal entries at January...

IU с D E А B Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles at an agreed-upon price of $38,000. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $41,800 on December 31, 2021. Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10% Required: 1. Prepare Artic Cat's journal entries at January 1,...

IU с D E А B Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles at an agreed-upon price of $38,000. The snowmobiles were delivered on January 1, 2021, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $41,800 on December 31, 2021. Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10% Required: 1. Prepare Artic Cat's journal entries at January 1,...

On January 1, 2020, Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $44,000. Because of limited space, Seneca wanted to delay delivery until December 31, 2020 but offered to make up-front payment (in full) on January 1, 2020. Arctic agreed and as a concession reduced the sales price to $40,000 since Seneca paid 12 months in advance of delivery. So, the contract was: Seneca pays $40.000 cash to Arctic Cat on...

On January 1, 2020, Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $44,000. Because of limited space, Seneca wanted to delay delivery until December 31, 2020 but offered to make up-front payment (in full) on January 1, 2020. Arctic agreed and as a concession reduced the sales price to $40,000 since Seneca paid 12 months in advance of delivery. So, the contract was: Seneca pays $40.000 cash to Arctic Cat on...

Exercise 6-13 (Algo) Time value of money for deferred revenue (L06-6] Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $49.800 Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently Unless informed otherwise, assume that Arctic views the time honey component of this arrangement to be significant, and that the relevant interest rate is 12%, (EV of $1 PV of $1. FVA OS PVA Of $1. FVAD...

Exercise 6-13 (Algo) Time value of money for deferred revenue (L06-6] Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $49.800 Seneca paid for the snowmobiles on January 1, 2021, with delivery to occur subsequently Unless informed otherwise, assume that Arctic views the time honey component of this arrangement to be significant, and that the relevant interest rate is 12%, (EV of $1 PV of $1. FVA OS PVA Of $1. FVAD...