Stock mispricing evaluation

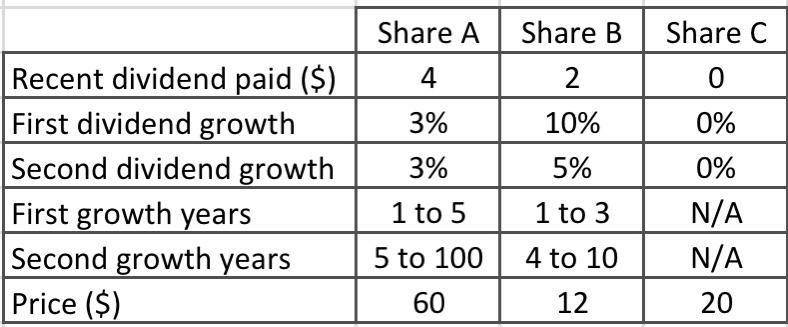

Thomas is currently analyzing the following shares.

He believes that required rate of equity return is 13% per year.

a) Evaluate potential mispricing from those 3 shares

b) Explain further consideration when Thomas attempts to value those shares

Homework Answers

Request Answer!

We need at least 10 more requests to produce the answer.

0 / 10 have requested this problem solution

The more requests, the faster the answer.

Assignment Stock Valuation 1. (Common stock valuation) Wayne, Inc.'s outstanding common stock is currently selling...

Assignment Stock Valuation 1. (Common stock valuation) Wayne, Inc.'s outstanding common stock is currently selling in the market for $33. Dividends of S2 30per share were paid last year, return on equity is 20 percent, and its retention rate is 25 percent. a. What is the value of the stock to you, given a 15percent requiredrate of rectum? b. Should you purchase this stock? 2. (Measuring growth) Thomas, Inc.'s return on equity is 13 percent and management has plans to...

Assignment Stock Valuation 1. (Common stock valuation) Wayne, Inc.'s outstanding common stock is currently selling in the market for $33. Dividends of S2 30per share were paid last year, return on equity is 20 percent, and its retention rate is 25 percent. a. What is the value of the stock to you, given a 15percent requiredrate of rectum? b. Should you purchase this stock? 2. (Measuring growth) Thomas, Inc.'s return on equity is 13 percent and management has plans to...

Terri Allessandro has an opportunity to make any of the following investments: The purchase price, the...

Terri Allessandro has an opportunity to make any of the following investments: The purchase price, the lump-sum future value, and the year of receipt are given below for each investment. Terri can earn a rate of return of 8% on investments similar to those currently under consideration. Evaluate each investment to determine whether it is satisfactory, and make an investment recommendation to Terri. The present value, PV, at 8% required return of the income from Investment A is $ ....

Terri Allessandro has an opportunity to make any of the following investments: The purchase price, the lump-sum future value, and the year of receipt are given below for each investment. Terri can earn a rate of return of 8% on investments similar to those currently under consideration. Evaluate each investment to determine whether it is satisfactory, and make an investment recommendation to Terri. The present value, PV, at 8% required return of the income from Investment A is $ ....

You are interested in purchasing the common stock of Azure Corporation. The firm recently paid a...

You are interested in purchasing the common stock of Azure Corporation. The firm recently paid a dividend of $3.00 per share. It expects its earnings and hence its dividends—to grow at a rate of 6.1% for the foreseeable future. Currently, similar-risk stocks have required returns of 9.6%. a. Given the preceding data, calculate the present value of this security. Use the constant-growth dividend model (Equation 8.8) to find the stock value. b. One year later, your broker offers to sell...

You are interested in purchasing the common stock of Azure Corporation. The firm recently paid a dividend of $3.00 per share. It expects its earnings and hence its dividends—to grow at a rate of 6.1% for the foreseeable future. Currently, similar-risk stocks have required returns of 9.6%. a. Given the preceding data, calculate the present value of this security. Use the constant-growth dividend model (Equation 8.8) to find the stock value. b. One year later, your broker offers to sell...

Stock valuation at Rayari, INC. Ragan, Inc., was founded nine years ago by brother and sister...

Stock valuation at Rayari, INC. Ragan, Inc., was founded nine years ago by brother and sister Carrington and Genevieve Ragan. The company manufactures and installs commercial heating, ventilation, and cooling (HVAC) units. Ragan, Inc., has experienced rapid growth because of a proprietary technology that increases the energy efficiency of its units. The company is equally owned by Carrington and Genevieve. The original partnership agreement between the siblings gave each 50,000 shares of stock. In the event either wished to sell...

Stock valuation at Rayari, INC. Ragan, Inc., was founded nine years ago by brother and sister Carrington and Genevieve Ragan. The company manufactures and installs commercial heating, ventilation, and cooling (HVAC) units. Ragan, Inc., has experienced rapid growth because of a proprietary technology that increases the energy efficiency of its units. The company is equally owned by Carrington and Genevieve. The original partnership agreement between the siblings gave each 50,000 shares of stock. In the event either wished to sell...

Blossom Inc.'s common shares currently sell for $35 each. The firm's management believes that its shares...

Blossom Inc.'s common shares currently sell for $35 each. The firm's management believes that its shares should really sell for $50 each. The firm just paid an annual dividend of $2 per share and management expects those dividends to increase by 5 percent per year forever (and this is common knowledge to the market) (a1) What is the current cost of common equity for the firm? (Round final answer to 2 decimal places, e.g. 15.25%.) The current cost of common...

Blossom Inc.'s common shares currently sell for $35 each. The firm's management believes that its shares should really sell for $50 each. The firm just paid an annual dividend of $2 per share and management expects those dividends to increase by 5 percent per year forever (and this is common knowledge to the market) (a1) What is the current cost of common equity for the firm? (Round final answer to 2 decimal places, e.g. 15.25%.) The current cost of common...

Watson Thomas is planning to value BCC Corporation, a provider of a variety of industrial metals and minerals

Watson Thomas is planning to value BCC Corporation, a provider of a variety of industrial metals and minerals. Thomas uses a single-stage FCFF approach. The financial information Thomas has assembled for his valuation is as follows: I. The company has 1,852 million shares outstanding. II. The market value of its debt is $3.192 billion. III. The FCFF is currently S1.1559 billion. IV. The equity beta is 0.90; the equity risk premium is 5.5 percent; the risk-free rate is 5.5 percent. V. The before-tax cost of...

UL QUESTIUNS - February, 2020 Question 2019, STM bought 720 shares of Grace and Glory stock...

UL QUESTIUNS - February, 2020 Question 2019, STM bought 720 shares of Grace and Glory stock at 300 per share. tal dividend of €800,000 by the end of the year. On 31 July 2019, STM On the 14 February 2019, STM STM received a total dividen stock sells at e411 per share. À Find the total investment How much did SIM earn in capital gain iWhat is the dividend per share? jy. What is the total return in percentage? V....

UL QUESTIUNS - February, 2020 Question 2019, STM bought 720 shares of Grace and Glory stock at 300 per share. tal dividend of €800,000 by the end of the year. On 31 July 2019, STM On the 14 February 2019, STM STM received a total dividen stock sells at e411 per share. À Find the total investment How much did SIM earn in capital gain iWhat is the dividend per share? jy. What is the total return in percentage? V....

1)Common stock valuelong dashVariable growth Lawrence Industries' most recent annual dividend was $1.77 per share (D0equals$...

1)Common stock valuelong dashVariable growth Lawrence Industries' most recent annual dividend was $1.77 per share (D0equals$ 1.77), and the firm's required return is 15%. Find the market value of Lawrence's shares when dividends are expected to grow at 8% annually for 3 years, followed by a 5% constant annual growth rate in years 4 to infinity. The market value of Lawrence's shares is $ nothing. (Round to the nearest cent.) 2)Integrativel- Risk and Valuation Hamlin Steel Company wishes to determine...

Big Dawg Incorporated is trying to estimate its cost of equity capital. The firm believes its...

Big Dawg Incorporated is trying to estimate its cost of equity capital. The firm believes its beta is 0.94. The current risk free rate in the economy is 1.58%, while the market portfolio risk premium is 5.00%. What is an estimate for the equity cost of capital? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) A company has issued 100,953.00 shares of preferred...

QUESTION 1 Tri-coat Paints' stock has a current market value of $50 per share with an...

QUESTION 1 Tri-coat Paints' stock has a current market value of $50 per share with an expected earnings per share of $3.64 next year. Instructions What should be the present value of its growth opportunities (PVGO) if the required return is | 9%? Assume that there is no mispricing. QUESTION 2 The market consensus is that Analog Electronic Corporation has an ROE of 9%, has a beta of the stock of 1.30, and plans to maintain indefinitely its traditional plowback...

QUESTION 1 Tri-coat Paints' stock has a current market value of $50 per share with an expected earnings per share of $3.64 next year. Instructions What should be the present value of its growth opportunities (PVGO) if the required return is | 9%? Assume that there is no mispricing. QUESTION 2 The market consensus is that Analog Electronic Corporation has an ROE of 9%, has a beta of the stock of 1.30, and plans to maintain indefinitely its traditional plowback...

Most questions answered within 3 hours.

-

Calculate the activity of a pure 5.8-μg sample of 3215P

(T12=1.23×106s).

asked 3 minutes ago -

What personality theory and test might a psychologist use for a

small group of elders between...

asked 6 minutes ago -

When five capacitors with equal capacitances are connected in

series, the equivalent capacitance of the combination...

asked 10 minutes ago -

1.

A corporation manufactures two variants of the same product:

Deluxe (D) and Classic (C). The...

asked 13 minutes ago -

A survey of undergraduate students in the School of Business at

Northern University revealed the following...

asked 24 minutes ago -

If a random variable Xhas the gamma distribution with α= 2and β

= 1,

(a) What...

asked 24 minutes ago -

What are some of the main differences in emails sent to

1) a classmate and 2)...

asked 28 minutes ago -

Networks have a ‘dual' property’. They provide information that

allows us to estimate our location. But...

asked 35 minutes ago -

Using Mathematica programming -- I need the program to run 8

times and get 8 different...

asked 43 minutes ago -

The survival to sexual maturity rates for genotypes A1A1, A1A2,

and A2A2 are 90%, 85%, &...

asked 37 minutes ago -

1-Imagine you're named an Economic Advisor to the

president of a very poor and backward country...

asked 41 minutes ago -

1.Explain the diffrence between equity finance and

debt finance with example?

By which one sales bonds...

asked 44 minutes ago

Assignment Stock Valuation 1. (Common stock valuation) Wayne, Inc.'s outstanding common stock is currently selling in the market for $33. Dividends of S2 30per share were paid last year, return on equity is 20 percent, and its retention rate is 25 percent. a. What is the value of the stock to you, given a 15percent requiredrate of rectum? b. Should you purchase this stock? 2. (Measuring growth) Thomas, Inc.'s return on equity is 13 percent and management has plans to...

Assignment Stock Valuation 1. (Common stock valuation) Wayne, Inc.'s outstanding common stock is currently selling in the market for $33. Dividends of S2 30per share were paid last year, return on equity is 20 percent, and its retention rate is 25 percent. a. What is the value of the stock to you, given a 15percent requiredrate of rectum? b. Should you purchase this stock? 2. (Measuring growth) Thomas, Inc.'s return on equity is 13 percent and management has plans to...

Terri Allessandro has an opportunity to make any of the following investments: The purchase price, the lump-sum future value, and the year of receipt are given below for each investment. Terri can earn a rate of return of 8% on investments similar to those currently under consideration. Evaluate each investment to determine whether it is satisfactory, and make an investment recommendation to Terri. The present value, PV, at 8% required return of the income from Investment A is $ ....

Terri Allessandro has an opportunity to make any of the following investments: The purchase price, the lump-sum future value, and the year of receipt are given below for each investment. Terri can earn a rate of return of 8% on investments similar to those currently under consideration. Evaluate each investment to determine whether it is satisfactory, and make an investment recommendation to Terri. The present value, PV, at 8% required return of the income from Investment A is $ ....

You are interested in purchasing the common stock of Azure Corporation. The firm recently paid a dividend of $3.00 per share. It expects its earnings and hence its dividends—to grow at a rate of 6.1% for the foreseeable future. Currently, similar-risk stocks have required returns of 9.6%. a. Given the preceding data, calculate the present value of this security. Use the constant-growth dividend model (Equation 8.8) to find the stock value. b. One year later, your broker offers to sell...

You are interested in purchasing the common stock of Azure Corporation. The firm recently paid a dividend of $3.00 per share. It expects its earnings and hence its dividends—to grow at a rate of 6.1% for the foreseeable future. Currently, similar-risk stocks have required returns of 9.6%. a. Given the preceding data, calculate the present value of this security. Use the constant-growth dividend model (Equation 8.8) to find the stock value. b. One year later, your broker offers to sell...

Stock valuation at Rayari, INC. Ragan, Inc., was founded nine years ago by brother and sister Carrington and Genevieve Ragan. The company manufactures and installs commercial heating, ventilation, and cooling (HVAC) units. Ragan, Inc., has experienced rapid growth because of a proprietary technology that increases the energy efficiency of its units. The company is equally owned by Carrington and Genevieve. The original partnership agreement between the siblings gave each 50,000 shares of stock. In the event either wished to sell...

Stock valuation at Rayari, INC. Ragan, Inc., was founded nine years ago by brother and sister Carrington and Genevieve Ragan. The company manufactures and installs commercial heating, ventilation, and cooling (HVAC) units. Ragan, Inc., has experienced rapid growth because of a proprietary technology that increases the energy efficiency of its units. The company is equally owned by Carrington and Genevieve. The original partnership agreement between the siblings gave each 50,000 shares of stock. In the event either wished to sell...

Blossom Inc.'s common shares currently sell for $35 each. The firm's management believes that its shares should really sell for $50 each. The firm just paid an annual dividend of $2 per share and management expects those dividends to increase by 5 percent per year forever (and this is common knowledge to the market) (a1) What is the current cost of common equity for the firm? (Round final answer to 2 decimal places, e.g. 15.25%.) The current cost of common...

Blossom Inc.'s common shares currently sell for $35 each. The firm's management believes that its shares should really sell for $50 each. The firm just paid an annual dividend of $2 per share and management expects those dividends to increase by 5 percent per year forever (and this is common knowledge to the market) (a1) What is the current cost of common equity for the firm? (Round final answer to 2 decimal places, e.g. 15.25%.) The current cost of common...

UL QUESTIUNS - February, 2020 Question 2019, STM bought 720 shares of Grace and Glory stock at 300 per share. tal dividend of €800,000 by the end of the year. On 31 July 2019, STM On the 14 February 2019, STM STM received a total dividen stock sells at e411 per share. À Find the total investment How much did SIM earn in capital gain iWhat is the dividend per share? jy. What is the total return in percentage? V....

UL QUESTIUNS - February, 2020 Question 2019, STM bought 720 shares of Grace and Glory stock at 300 per share. tal dividend of €800,000 by the end of the year. On 31 July 2019, STM On the 14 February 2019, STM STM received a total dividen stock sells at e411 per share. À Find the total investment How much did SIM earn in capital gain iWhat is the dividend per share? jy. What is the total return in percentage? V....

QUESTION 1 Tri-coat Paints' stock has a current market value of $50 per share with an expected earnings per share of $3.64 next year. Instructions What should be the present value of its growth opportunities (PVGO) if the required return is | 9%? Assume that there is no mispricing. QUESTION 2 The market consensus is that Analog Electronic Corporation has an ROE of 9%, has a beta of the stock of 1.30, and plans to maintain indefinitely its traditional plowback...

QUESTION 1 Tri-coat Paints' stock has a current market value of $50 per share with an expected earnings per share of $3.64 next year. Instructions What should be the present value of its growth opportunities (PVGO) if the required return is | 9%? Assume that there is no mispricing. QUESTION 2 The market consensus is that Analog Electronic Corporation has an ROE of 9%, has a beta of the stock of 1.30, and plans to maintain indefinitely its traditional plowback...