Homework Answers

hope you liked my answer and

if you do don't forget to give a Thumb's Up.

hope you liked my answer and

if you do don't forget to give a Thumb's Up.

Add Answer to:

could you plz help me with question number 5, I did question 1

through 4 I...

Can you please help me solve this?

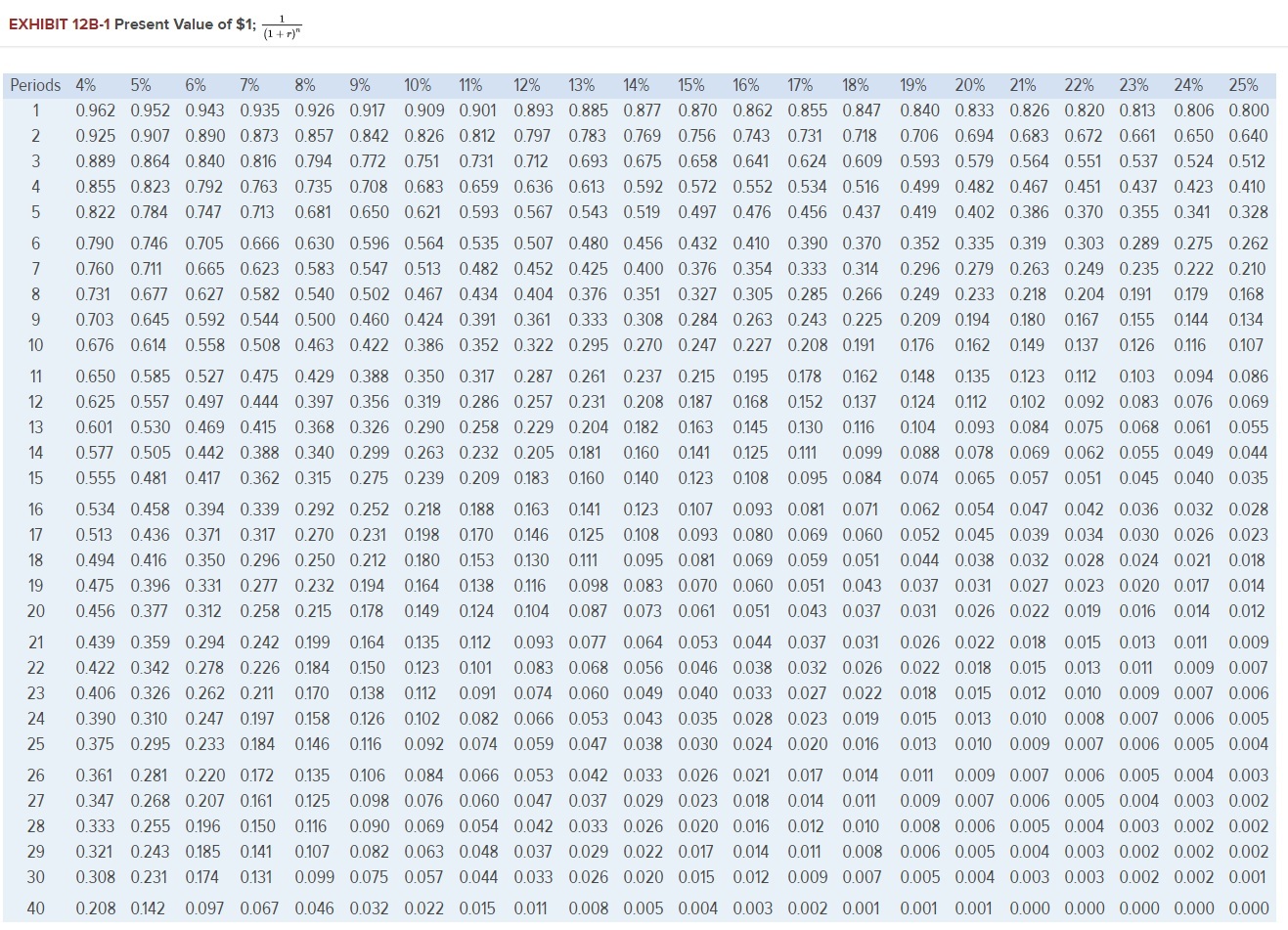

Integration Exercise 7 Capital Budgeting, Return on Investment, Residual Income [LO 10-1, LO 10-2, LO 12-2]Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store’s product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At...

Integration Exercise 7 Capital Budgeting, Return on Investment, Residual Income [LO 10-1, LO 10-2, LO 12-2]Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store’s product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At...

Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering...

Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store's product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an Increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store manager believes that the economic surge will...

Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store's product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an Increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store manager believes that the economic surge will...

Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering...

Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store’s product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store manager believes that the economic surge will...

WLC Company is a company in Franklin, WI. It is a merchandiser with multiple store locations....

WLC Company is a company in Franklin, WI. It is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store’s product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store...

I really need a help please. Thank you. Required information The Foundational 15 [LO10-1, LO10-2] [The...

I really need a help please. Thank you.

Required information The Foundational 15 [LO10-1, LO10-2] [The following information applies to the questions displayed below.) Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets $1,000,000 300,000 700,000 500,000 $ 200,000 $ 625,000 At the beginning of this year, the company has a $120,000 investment opportunity with the following cost and revenue characteristics: $200,000 BAR Sales Contribution margin...

I really need a help please. Thank you.

Required information The Foundational 15 [LO10-1, LO10-2] [The following information applies to the questions displayed below.) Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets $1,000,000 300,000 700,000 500,000 $ 200,000 $ 625,000 At the beginning of this year, the company has a $120,000 investment opportunity with the following cost and revenue characteristics: $200,000 BAR Sales Contribution margin...

PROBLEM 13-17 Net Present Value Analysis; Internal Rate of Return; Simple Rate of Return [LO13-2, LO13-3,...

PROBLEM 13-17 Net Present Value Analysis; Internal Rate of Return; Simple Rate of Return [LO13-2, LO13-3, L013-6] Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely deter- mined by his division's return on investment (ROI), which has been above 20% each of the last three years. Casey is considering a capital budgeting project that would require a $3,500,000 invest- ment in equipment with a useful life of five years and no salvage value, Pigeon...

PROBLEM 13-17 Net Present Value Analysis; Internal Rate of Return; Simple Rate of Return [LO13-2, LO13-3, L013-6] Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely deter- mined by his division's return on investment (ROI), which has been above 20% each of the last three years. Casey is considering a capital budgeting project that would require a $3,500,000 invest- ment in equipment with a useful life of five years and no salvage value, Pigeon...

Exercise 14-9 (Algo) Net Present Value Analysis and Simple Rate of Return [LO14-2, LO14-6]

Exercise 14-9 (Algo) Net Present Value Analysis and Simple Rate of Return [LO14-2, LO14-6]Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division’s return on investment (ROI), which has been above 20% each of the last three years. Derrick is considering a capital budgeting project that would require a $3,700,000 investment in equipment with a useful life of five years and no salvage value. Holston Company’s discount rate is 16%. The...

Exercise 14-9 (Algo) Net Present Value Analysis and Simple Rate of Return [LO14-2, LO14-6]Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division’s return on investment (ROI), which has been above 20% each of the last three years. Derrick is considering a capital budgeting project that would require a $3,700,000 investment in equipment with a useful life of five years and no salvage value. Holston Company’s discount rate is 16%. The...

Homework #12 -Chapter #13 i Submit Saved Help Save & Exit Check my work Derrick Iverson...

Homework #12 -Chapter #13 i Submit Saved Help Save & Exit Check my work Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 20% each of the last three years. Derrick is considering a capital budgeting project that would require a $3,300,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 17%....

Homework #12 -Chapter #13 i Submit Saved Help Save & Exit Check my work Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 20% each of the last three years. Derrick is considering a capital budgeting project that would require a $3,300,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 17%....

Required information The Foundational 15 [LO10-1, LO10-2] [The following information applies to the questions displayed below.]...

Required information The Foundational 15 [LO10-1, LO10-2] [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year’s operations: Sales $ 1,000,000 Variable expenses 300,000 Contribution margin 700,000 Fixed expenses 500,000 Net operating income $ 200,000 Average operating assets $ 625,000 At the beginning of this year, the company has a $120,000 investment opportunity with the following cost and revenue characteristics: Sales $ 200,000 Contribution margin ratio 60 % of sales Fixed expenses...

Westerville company reported the following results from last year's operations

Westerville Company reported the following results from last year’s operations: Sales $ 1,400,000 Variable expenses 680,000 Contribution margin 720,000 Fixed expenses 440,000 Net operating income $ 280,000 Average operating assets $ 875,000 This year, the company has a $300,000 investment opportunity with the following cost and revenue characteristics: Sales $ 480,000 Contribution margin ratio 80 % of sales Fixed expenses $ 336,000 The company’s minimum required rate of return is 15%. Required: 1. What is last year’s margin? 2. What...

Most questions answered within 3 hours.

-

Little’s Law: Val d’Costa is a world famous ski village in the

French Alps. Because of...

asked 22 minutes ago -

Find the absolute error D for the calculation if A + B/C=D A=

9.4 +/- 0.4...

asked 36 minutes ago -

New Air Heating and Cooling, manufactures furnaces and central

air units. The company pride itself on...

asked 49 minutes ago -

A coach uses a new technique to train gymnasts. Seven

gymnasts were randomly selected and their...

asked 2 hours ago -

While rotating the tires on your car you notice a rock [mass =

0.1 Kg] stuck...

asked 4 hours ago -

Using MARS simulator, write MIPS programs according to

the following scenarios: Receive a positive integer number...

asked 6 hours ago -

An object in front of a concave mirror has a real image that is

11.5 cm...

asked 6 hours ago -

Consider the reaction, C3 H8 + O2 --> CO2 + H2O. How many

moles of O2...

asked 8 hours ago -

You and your opponent both roll a fair die. If you both roll the

same number,...

asked 8 hours ago -

In a study of the accuracy of fast food drive-through orders,

Restaurant A had 257 accurate...

asked 8 hours ago -

Identify and describe in detail the four categories of

institutions that could be included in a...

asked 8 hours ago -

In python

class Customer:

def __init__(self, customer_id, last_name, first_name, phone_number, address):

self._customer_id = int(customer_id)

self._last_name =...

asked 9 hours ago

Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store's product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an Increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store manager believes that the economic surge will...

Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store's product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an Increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store manager believes that the economic surge will...

I really need a help please. Thank you.

Required information The Foundational 15 [LO10-1, LO10-2] [The following information applies to the questions displayed below.) Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets $1,000,000 300,000 700,000 500,000 $ 200,000 $ 625,000 At the beginning of this year, the company has a $120,000 investment opportunity with the following cost and revenue characteristics: $200,000 BAR Sales Contribution margin...

I really need a help please. Thank you.

Required information The Foundational 15 [LO10-1, LO10-2] [The following information applies to the questions displayed below.) Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets $1,000,000 300,000 700,000 500,000 $ 200,000 $ 625,000 At the beginning of this year, the company has a $120,000 investment opportunity with the following cost and revenue characteristics: $200,000 BAR Sales Contribution margin...

PROBLEM 13-17 Net Present Value Analysis; Internal Rate of Return; Simple Rate of Return [LO13-2, LO13-3, L013-6] Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely deter- mined by his division's return on investment (ROI), which has been above 20% each of the last three years. Casey is considering a capital budgeting project that would require a $3,500,000 invest- ment in equipment with a useful life of five years and no salvage value, Pigeon...

PROBLEM 13-17 Net Present Value Analysis; Internal Rate of Return; Simple Rate of Return [LO13-2, LO13-3, L013-6] Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely deter- mined by his division's return on investment (ROI), which has been above 20% each of the last three years. Casey is considering a capital budgeting project that would require a $3,500,000 invest- ment in equipment with a useful life of five years and no salvage value, Pigeon...

Homework #12 -Chapter #13 i Submit Saved Help Save & Exit Check my work Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 20% each of the last three years. Derrick is considering a capital budgeting project that would require a $3,300,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 17%....

Homework #12 -Chapter #13 i Submit Saved Help Save & Exit Check my work Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 20% each of the last three years. Derrick is considering a capital budgeting project that would require a $3,300,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 17%....