Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering...

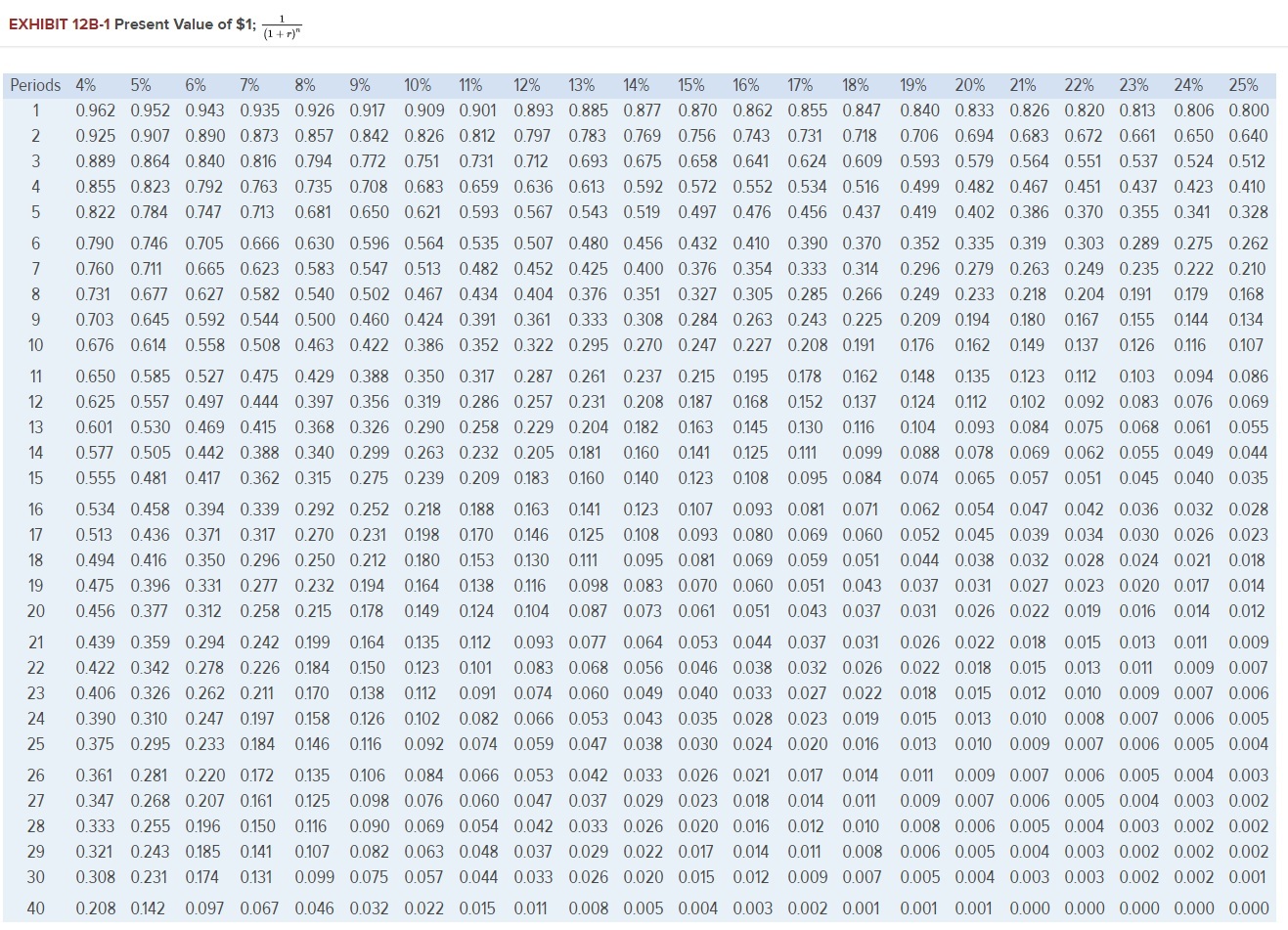

Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store’s product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store manager believes that the economic surge will subside; therefore, she will release the additional investment in working capital. The store manager’s pay raises are largely determined by her store’s return on investment (ROI), which has exceeded 22% each of the last three years. Click here to view Exhibit 13B-1 to determine the appropriate discount factor(s) using table. Required: 1. Assuming the company’s discount rate is 16%, calculate the net present value of the store manager’s investment opportunity. 2. Calculate the annual margin, turnover, and return on investment (ROI) provided by the store manager’s investment opportunity. 3. Assuming that the company’s minimum required rate of return is 16%, calculate the residual income earned by the store manager’s investment opportunity for each of years 1 through 3. 4. Do you think the store manager would choose to pursue this investment opportunity? Do you think the company would want the store manager to pursue it? the margin is not 35.70 and the turnover is not 400,000

Homework Answers

1.)

The NPV is $49,410

2.)

The total margin return and roi cannot be found out as the information has not been provided. The following are the marginal (increased) amounts for the investment opportunity.

Annual Margin is $150,000

Turnover is $400,000

And ROI is 18.75%

3,)

$22,000 is the residual income the final $800,000 is just divestment of the working capital.

4.)

The store manager would not want to pursue it because, his return for this particular investment opportunity is lower than his average of 22% (18,75%) and hence would bring his ROI down.

[As we don't know the current position, we cannot find exactly by how much, it would be less]

The company however would want the manager to pursue it, as it will earn the additional marginal income of $49,410 as it's Required rate of return is lower (16%)

Good Luck

Add Answer to:

Simmons Company is a merchandiser with multiple store locations.

One of its store managers is considering...

WLC Company is a company in Franklin, WI. It is a merchandiser with multiple store locations....

WLC Company is a company in Franklin, WI. It is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store’s product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store...

Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering...

Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store's product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an Increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store manager believes that the economic surge will...

Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store's product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an Increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store manager believes that the economic surge will...

Can you please help me solve this?

Integration Exercise 7 Capital Budgeting, Return on Investment, Residual Income [LO 10-1, LO 10-2, LO 12-2]Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store’s product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At...

Integration Exercise 7 Capital Budgeting, Return on Investment, Residual Income [LO 10-1, LO 10-2, LO 12-2]Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store’s product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At...

could you plz help me with question number 5, I did question 1 through 4 I...

could you plz help me with question number 5, I did question 1

through 4 I hope my answers are correct! you can see the answer it

is in excel pic

A с . о EF 1 1) Calculate net present value of store managers Investment Investment Year 0 Year 1 Year 2 Year 3 Total 3 Amount to be invested $(800,000.00) $ (800,000.00) 4 Annual cash Inflow $ 400,000.00 $ 400,000.00 $ 400,000.00 $1,200,000.00 5 Annual cash Outflow $(250,000.00)...

could you plz help me with question number 5, I did question 1

through 4 I hope my answers are correct! you can see the answer it

is in excel pic

A с . о EF 1 1) Calculate net present value of store managers Investment Investment Year 0 Year 1 Year 2 Year 3 Total 3 Amount to be invested $(800,000.00) $ (800,000.00) 4 Annual cash Inflow $ 400,000.00 $ 400,000.00 $ 400,000.00 $1,200,000.00 5 Annual cash Outflow $(250,000.00)...

Westerville Company reported the following results from last year’s operations: Sales $ 1,000,000 Variable expenses 300,000...

Westerville Company reported the following results from last year’s operations: Sales $ 1,000,000 Variable expenses 300,000 Contribution margin 700,000 Fixed expenses 500,000 Net operating income $ 200,000 Average operating assets $ 625,000 At the beginning of this year, the company has a $120,000 investment opportunity with the following cost and revenue characteristics: Sales $ 200,000 Contribution margin ratio 60 % of sales Fixed expenses $ 90,000 The company’s minimum required rate of return is 15%. 8. If the company pursues...

Westerville company reported the following results from last year's operations

Westerville Company reported the following results from last year’s operations: Sales $ 1,400,000 Variable expenses 680,000 Contribution margin 720,000 Fixed expenses 440,000 Net operating income $ 280,000 Average operating assets $ 875,000 This year, the company has a $300,000 investment opportunity with the following cost and revenue characteristics: Sales $ 480,000 Contribution margin ratio 80 % of sales Fixed expenses $ 336,000 The company’s minimum required rate of return is 15%. Required: 1. What is last year’s margin? 2. What...

Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined...

Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division’s return on investment (ROI), which has been above 20% each of the last three years. Derrick is considering a capital budgeting project that would require a $3,050,000 investment in equipment with a useful life of five years and no salvage value. Holston Company’s discount rate is 16%. The project would provide net operating income each year for five years as follows:...

Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined...

Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division’s return on investment (ROI), which has been above 24% each of the last three years. Casey is considering a capital budgeting project that would require a $4,300,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company’s discount rate is 20%. The project would provide net operating income each year for five years as follows:...

Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his divisi...

Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 20% each of the last three years. Derrick is considering a capital budgeting project that would require a $3,200,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 18%. The project would provide net operating income each year for five years as follows:...

Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 20% each of the last three years. Derrick is considering a capital budgeting project that would require a $3,200,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 18%. The project would provide net operating income each year for five years as follows:...

Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division’s...

Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division’s return on investment (ROI), which has been above 24% each of the last three years. Casey is considering a capital budgeting project that would require a $4,800,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company’s discount rate is 20%. The project would provide net operating income each year for five years as follows:...

Most questions answered within 3 hours.

-

Determine the temperature (in Celsius) at which 1.00 mole of an

ideal gas will have a...

asked 19 minutes ago -

Japan’s combination of X and Y

Canada’s combination of X and Y

100x and 0y

50x...

asked 12 minutes ago -

[1] Household statistics include individuals living alone or in

groups in:

A) apartments.

B) military barracks....

asked 22 minutes ago -

What is the % w/v when 80 mL of a 2.0% solution is mixed with 50...

asked 26 minutes ago -

How can I solve the following using a TI83

Claim: Most adults would erase all of...

asked 38 minutes ago -

Analysis of 3-ethyl-3-buten-2-ol gave C, 72.13%; H, 11.92%.

Calculate the percent deviation of these results from...

asked 35 minutes ago -

Which VALS segment is most likely to have a top of the line

brand new (2015)...

asked 39 minutes ago -

Write a program to score the paper-rock-scissor game. Each of

two users types in either P,R...

asked 59 minutes ago -

Calculate the equillibrium constent K for a redox reaction that

has E°cell = -.98 V at...

asked 1 hour ago -

A concave spherical mirror has a radius of curvature of

magnitude 19.6 cm.

(a) Find the...

asked 1 hour ago -

3. draw a diagram of the magnetic field:

a. around a long straight wire with a...

asked 1 hour ago -

If you titrated 30.0 mL of 0.1 M HCl with 0.1 M NaOH, indicate

the approximate...

asked 1 hour ago

Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store's product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an Increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store manager believes that the economic surge will...

Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store's product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an Increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store manager believes that the economic surge will...

could you plz help me with question number 5, I did question 1

through 4 I hope my answers are correct! you can see the answer it

is in excel pic

A с . о EF 1 1) Calculate net present value of store managers Investment Investment Year 0 Year 1 Year 2 Year 3 Total 3 Amount to be invested $(800,000.00) $ (800,000.00) 4 Annual cash Inflow $ 400,000.00 $ 400,000.00 $ 400,000.00 $1,200,000.00 5 Annual cash Outflow $(250,000.00)...

could you plz help me with question number 5, I did question 1

through 4 I hope my answers are correct! you can see the answer it

is in excel pic

A с . о EF 1 1) Calculate net present value of store managers Investment Investment Year 0 Year 1 Year 2 Year 3 Total 3 Amount to be invested $(800,000.00) $ (800,000.00) 4 Annual cash Inflow $ 400,000.00 $ 400,000.00 $ 400,000.00 $1,200,000.00 5 Annual cash Outflow $(250,000.00)...

Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 20% each of the last three years. Derrick is considering a capital budgeting project that would require a $3,200,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 18%. The project would provide net operating income each year for five years as follows:...

Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 20% each of the last three years. Derrick is considering a capital budgeting project that would require a $3,200,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 18%. The project would provide net operating income each year for five years as follows:...