Corporate finance

Q.1:-Claross, Inc. wishes to determine the relevant operating cash flows associated with the proposed purchase of a newpiece of equipment having an installed cost of $10 million and falling into the 5-year MACRS asset class. The firm's financial analyst estimated that the relevant timehorizon for analysis is6 years. She expectsthe revenues attributable to the equipment to be $15.8 million in the first year and to increase at 5% per year through year 6. Similarly,she estimates all expenses otherthan depreciation attributableto theequipment to total $12.2 million in the first year and to increase by 4% per year through year6. She plans toignore any cash flows after year 6. The firm has a marginal tax rate of 40% and its required return on the equipment investment is 13%. (Note: Round all cash flow calculations to the nearest $0.01 million.)

Homework Answers

“Incremental cash flow”:

“Incremental cash flow” is termed as additional cash flow earned from new business operations. The positive outcome of “incremental cash flow” helps to understand the potential of investment to generate income. Hence, the organization will accept new project if the result shows the positive values.

“Net present value” (NPV):

Net present value” is the “present value” of cash inflow expected for a future period after deducting cost. Hence, NPV is the net “present value” of cash inflow minus “present value” of cash outflow

a)

Formulas to calculate the “incremental cash flow”:

“Earnings Before Depreciation and Tax” (EBDT) is calculated by deducting expenses from revenue. The depreciation is calculated under the method of “Modified Accelerated Cost-Recovery System “(MACRS) is given below.

EBDT = Revenue - Expense

Earnings After Tax (EAT) is calculated by deducting tax (40%) from (Earning Before Tax) EBT. EBT is the value derived from deducting (Earnings Before Depreciation and Tax) EBDT from depreciation.

EAT = EBDT - Depreciation -Tax

Total cash inflow is the sum of EAT and depreciation.

Total cash flow = EAT + Depreciation

Calculate depreciation for 6 years:

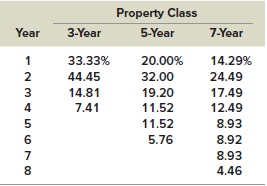

The “Modified Accelerated Cost-Recovery System” (MACRS) table is used to calculate depreciation. Refer to table number 9.1 to understand the yearly rate of depreciation (Rate column).

Year | Rate | Cost | Depreciation

|

1 | 0.2000 | 10.0 | 2.00 |

2 | 0.3200 | 10.0 | 3.20 |

3 | 0.1920 | 10.0 | 1.92 |

4 | 0.1152 | 10.0 | 1.15 |

5 | 0.1152 | 10.0 | 1.15 |

6 | 0.0576 | 10.0 | 0.58 |

Total | 10.00 |

Calculate the “incremental cash flow”:

It is given that expected revenue for the first year is $15.80 million and an increase of 5% revenue each year. The expense for the first year is $12.20 million and an increase of expense 5% for each year.

Year: | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

Amount in millions ($) | |||||||

Initial- investment | -10 | ||||||

Revenue (5% per year) | 15.80 | 16.59 | 17.42 | 18.29 | 19.21 | 20.17 | |

Less: Expenses (4% per year) | 12.20 | 12.69 | 13.20 | 13.72 | 14.27 | 14.84 | |

EBDT | 3.60 | 3.90 | 4.22 | 4.57 | 4.94 | 5.33 | |

Less: Depreciation* | 2.00 | 3.20 | 1.92 | 1.15 | 1.15 | 0.58 | |

EBT | 1.60 | 0.70 | 2.30 | 3.42 | 3.79 | 4.75 | |

Less: Taxes (40% from EBT) | 0.64 | 0.28 | 0.92 | 1.37 | 1.52 | 1.90 | |

EAT | 0.96 | 0.42 | 1.38 | 2.05 | 2.27 | 2.85 | |

Add Depreciation* | 2.00 | 3.20 | 1.92 | 1.15 | 1.15 | 0.58 | |

Total cash flow | -10 | 2.96 | 3.62 | 3.30 | 3.20 | 3.42 | 3.43 |

Hence, “incremental cash flows” are $2.96 million for the first year, $3.62 million for the second year, $3.30 million for the third year, $3.20 millionfor fourth year, $3.42 million for the fifth year, $3.43 million, and for the sixth year.

Finding for “incremental cash flow”:

The “incremental cash flow” is positive for all the given years. Moreover, it shows an increasing trend from year to year. Hence, this investment can generate good incremental inflows. So, this investment is recommended.

b)

Formula to calculate NPV:

NPV is the value derived by deducting net cash inflow from the outflow. It is calculated by dividing net cash flow from one plus rate of return powered with a number of periods. Then, the value of net cash inflow is deducted from the initial investment.

Here,

R refers to “Rate of return”

T refers to the “Number of periods”

Excel formula is substituted for the above formula to calculate NPV. It is calculated through the excel function PV (Present value).

.

.

Here,

“rate” refers to “Rate of return”

“nper” refers to “Number of time periods”

“pmt” refers to “Current payment” (investment)

“fv” refers to “Future value”

Calculate NPV using Excel function:

Therefore, the NPV at 13% is $3.21.

“Internal Rate of Return” (IRR)

IRR is a “rate” at which “present value” of cash inflow and “present value” of cash outflow are equal. Up to that rate the investor will get positive NPV. The higher IRR projects will provide higher return rate for a project. Therefore, higher value of IRR means highly profitable.

Formula to calculate IRR:

The IRR is calculated using an excel formula. The formula is IRR (values[cash flows],guess).

Here,

Values refer to cash flows

guess refers to a probable value or zero

Calculate IRR using Excel formula:

Hence, IRR is 24%.

c)

Analysis of findings:

The above calculation shows $3.21 as NPV and 24% as IRR. NPV is $3.21 million under the discount rate of 13%. This means the current discount rate of the company is at 11% less than the discount rate to reach the break-even point. So, this investment is more profitable and safe for investors as per the NPV and IRR. Therefore, this investment can be accepted. It is favorable for CS Company to purchase new equipment in the next five years.

Finance

The following information will tell us if the CUBE project can increase the market value of Cool Stuff, Inc. Equipment to produce CUBE will cost $750 million and an area of the current plant will have to be renovated at a cost of $50 million to accommodate it. The area to be renovated is valued at $10 million but a competing team has identified a Chinese firm willing to pay $1 million per year to lease the space. The engineering...

Corporate Finance Projected Cash Flow Evaluation

Aria Acoustics, Inc., (AAI) projects unit sales for a new seven-octave voice emulation implant as follows: YearUnit Sales1109,5002128,5003116,500499,500585,500 Production of the implants will require $1,530,000 in net working capital to start and additional net-working capital investments each year equal to 10 percent of the projected sales increase for the following year. Total fixed costs are $1,380,000 per year, variable production costs are $228 per unit, and the units are priced at $348 each. The equipment needed to begin production has an...

Aria Acoustics, Inc., (AAI) projects unit sales for a new seven-octave voice emulation implant as follows: YearUnit Sales1109,5002128,5003116,500499,500585,500 Production of the implants will require $1,530,000 in net working capital to start and additional net-working capital investments each year equal to 10 percent of the projected sales increase for the following year. Total fixed costs are $1,380,000 per year, variable production costs are $228 per unit, and the units are priced at $348 each. The equipment needed to begin production has an...

Question Help P11-29 (similar to) Integrative-Complete investment decision Wells Printing is considering the purchase of a...

Question Help P11-29 (similar to) Integrative-Complete investment decision Wells Printing is considering the purchase of a new printing press. The total installed cost of the press is $2.27 million. This outlay would be partially offset by the sale of an existing press. The old press has zero book value, cost $0.97 million 10 years ago, and can be sold currently for $1.23 million before taxes. As a result of acquisition of the new press, sales in each of the next...

Question Help P11-29 (similar to) Integrative-Complete investment decision Wells Printing is considering the purchase of a new printing press. The total installed cost of the press is $2.27 million. This outlay would be partially offset by the sale of an existing press. The old press has zero book value, cost $0.97 million 10 years ago, and can be sold currently for $1.23 million before taxes. As a result of acquisition of the new press, sales in each of the next...

1. Assume that you are analyzing a proposed asset acquisition where the assets will cost $5...

1. Assume that you are analyzing a proposed asset acquisition where the assets will cost $5 million, plus $200,000 to have them delivered and installed. The project will result in sales of 6000 units in the first year of operations. The sales price will be $190 per unit and the operating costs (excluding depreciation) will be $140 per unit. The assets will be depreciated using the MACRS 5-year rates. The project will require a level of net working capital of...

QUESTION 41 2 po Cuda Marine Engines, Inc. must develop the relevant cash flows for a...

QUESTION 41 2 po Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule; depreciation for years! through 6 is 20%, 32%, 19% 12%, 12% and 5%, respectively. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years...

QUESTION 41 2 po Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule; depreciation for years! through 6 is 20%, 32%, 19% 12%, 12% and 5%, respectively. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years...

Finance Case Analysis

Case Background Davis Printer Inc. is a midsized printer manufacturer. The company president is Sherry Davis, who inherited the company. When it was founded over 50 years ago, the company originally repaired printers and other household appliances. Over the years, the company expanded into manufacturing and is now a reputable manufacture of various printers and cartridges. Jason Smith, a recent finance graduate, has been hired as a financial analyst by the company’s finance department. One of the major revenue-producing items manufactured by Davis...

Chap 12- Handout 1 12.2 Analysis of an Expansion Project Fxed Asset Purchase + Investment in...

Chap 12- Handout 1 12.2 Analysis of an Expansion Project Fxed Asset Purchase + Investment in NOWC SALES COGS DEP EBIT SALES COGS DEP SALES Opportunity Cost Total Initial Outiay NOPAT-EBIT NOPAT . EBIT(1M NOPAT-EBTan NOPAT DEP OCF NOPAT + DEP OCF NOPAT + DEP OCF Cthr OCF Recoup NOwc +ATSV Total Teminal CF FCF Timeline Terminal Year FCFs Total Terminal CF FCFo Total initial 0. You are to evaluate an expansion project for your firm. Last year, the firm...

Chap 12- Handout 1 12.2 Analysis of an Expansion Project Fxed Asset Purchase + Investment in NOWC SALES COGS DEP EBIT SALES COGS DEP SALES Opportunity Cost Total Initial Outiay NOPAT-EBIT NOPAT . EBIT(1M NOPAT-EBTan NOPAT DEP OCF NOPAT + DEP OCF NOPAT + DEP OCF Cthr OCF Recoup NOwc +ATSV Total Teminal CF FCF Timeline Terminal Year FCFs Total Terminal CF FCFo Total initial 0. You are to evaluate an expansion project for your firm. Last year, the firm...

Finance

The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $940,000, and it would cost another $22,000 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $582,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $12,500. The sprayer would not change revenues, but...

The Ocean City Water Park is considering the purchase of a new log flume ride. The...

The Ocean City Water Park is considering the purchase of a new log flume ride. The cost to purchase the equipment is $1,800,000 and it will cost an additional $180,000 to have it installed. The equipment has an expected life of 6 years, and it will be depreciated using a MACRS 5-year class life. Management expects to run about 250 rides per day, with each ride averaging 8 riders. The season will last for 120 days per year. In the...

Finance

The Electronics Machines Corporation (EMC) is considering buying a $300,000 piece of equipment that could raise EMC’s sales revenues by $1 million the first year, $2 million the second year, and $1.8 million the third year. The cost of the piece of equipment can be fully depreciated over the three-year investment according to the straight-line method with no residual value. Incremental operating expenses are estimated at 90 percent of sales, excluding depreciation expense.Working capital required to support the project’s sales...

Most questions answered within 3 hours.

-

Wildhorse Company follows the practice of pricing its inventory

at the lower-of-cost-or-market, on an individual-item

basis....

asked 26 minutes ago -

3. (10 pts) You grow a corn crop that yields 150 bushels ac-1,

with the following...

asked 15 minutes ago -

7. The term Six Sigma refers to:

Select one:

a. The control limits established in a...

asked 24 minutes ago -

For the following reaction: A(g) + 2 B(g) ⇌ 2 C(g) Calculate the

equilibrium constant K...

asked 27 minutes ago -

Which of the following best describes tidal volume? options:

1.The amount of oxygen in the air...

asked 43 minutes ago -

1. Smaller cost distortions occur when the traditional systems'

single indirect-cost rate and the activity-cost-driver rates:...

asked 51 minutes ago -

Using either a FMECA approach or some other appropriate RCA

tool, identify five risk treatment actions...

asked 52 minutes ago -

If for a test the P-value is between 0.0025 and 0.005, what

conclusion can you draw?...

asked 1 hour ago -

Using Python. Write a function clean2(aList) that takes a list

of integers aList as argument, and...

asked 1 hour ago -

Intrapreneurship is defined as the

development of an enterprise culture with an existing (Nandan,

2009). An...

asked 1 hour ago -

QUESTION 1 Tamiflu is a drug used to treat influenza. A study

found that Tamiflu reduced...

asked 1 hour ago -

Which of the following would be less likely to be used to

allocate factory overhead when...

asked 1 hour ago

Question Help P11-29 (similar to) Integrative-Complete investment decision Wells Printing is considering the purchase of a new printing press. The total installed cost of the press is $2.27 million. This outlay would be partially offset by the sale of an existing press. The old press has zero book value, cost $0.97 million 10 years ago, and can be sold currently for $1.23 million before taxes. As a result of acquisition of the new press, sales in each of the next...

Question Help P11-29 (similar to) Integrative-Complete investment decision Wells Printing is considering the purchase of a new printing press. The total installed cost of the press is $2.27 million. This outlay would be partially offset by the sale of an existing press. The old press has zero book value, cost $0.97 million 10 years ago, and can be sold currently for $1.23 million before taxes. As a result of acquisition of the new press, sales in each of the next...

QUESTION 41 2 po Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule; depreciation for years! through 6 is 20%, 32%, 19% 12%, 12% and 5%, respectively. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years...

QUESTION 41 2 po Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule; depreciation for years! through 6 is 20%, 32%, 19% 12%, 12% and 5%, respectively. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years...

Chap 12- Handout 1 12.2 Analysis of an Expansion Project Fxed Asset Purchase + Investment in NOWC SALES COGS DEP EBIT SALES COGS DEP SALES Opportunity Cost Total Initial Outiay NOPAT-EBIT NOPAT . EBIT(1M NOPAT-EBTan NOPAT DEP OCF NOPAT + DEP OCF NOPAT + DEP OCF Cthr OCF Recoup NOwc +ATSV Total Teminal CF FCF Timeline Terminal Year FCFs Total Terminal CF FCFo Total initial 0. You are to evaluate an expansion project for your firm. Last year, the firm...

Chap 12- Handout 1 12.2 Analysis of an Expansion Project Fxed Asset Purchase + Investment in NOWC SALES COGS DEP EBIT SALES COGS DEP SALES Opportunity Cost Total Initial Outiay NOPAT-EBIT NOPAT . EBIT(1M NOPAT-EBTan NOPAT DEP OCF NOPAT + DEP OCF NOPAT + DEP OCF Cthr OCF Recoup NOwc +ATSV Total Teminal CF FCF Timeline Terminal Year FCFs Total Terminal CF FCFo Total initial 0. You are to evaluate an expansion project for your firm. Last year, the firm...