Initial investment $ 300,000 Pretax salvage value $ 35,000 Cost savings per year $ &n

| Initial investment | $ 300,000 | ||

| Pretax salvage value | $ 35,000 | ||

| Cost savings per year | $ 85,000 | ||

| Working capital reduction | $ 55,000 | ||

| Tax rate | 35% | ||

| *Depreciation straight-line | |||

| over life | 5 | ||

| What is the IRR of the project? | |||

Homework Answers

Initial Investment = $300,000

Useful Life = 5 years

Annual Depreciation = Initial Investment / Useful Life

Annual Depreciation = $300,000 / 5

Annual Depreciation = $60,000

Initial Investment in NWC = -$55,000

Salvage Value = $35,000

After-tax Salvage Value = $35,000 * (1 - 0.35)

After-tax Salvage Value = $22,750

Annual OCF = Pretax Cost Saving * (1 - tax) + tax *

Depreciation

Annual OCF = $85,000 * (1 - 0.35) + 0.35 * $60,000

Annual OCF = $85,000 * 0.65 + 0.35 * $60,000

Annual OCF = $76,250

Let IRR be i%

NPV = -$300,000 + $55,000 + $76,250 * PVA of $1 (i%, 5) +

$22,750 * PV of $1 (i%, 5) - $55,000 * PV of $1 (i%, 5)

0 = -$245,000 + $76,250 * PVA of $1 (i%, 5) - $32,250 * PV of $1

(i%, 5)

Using financial calculator, i = 14.00%

IRR of the project is 14.00%

Add Answer to:

Initial investment

$ 300,000

Pretax salvage value

$ 35,000

Cost savings per year

$ &n

Initial investment $ 300,000 Pretax salvage value $ 35,000 Cost savings per year $ &n

Initial investment $ 300,000 Pretax salvage value $ 35,000 Cost savings per year $ 85,000 Working capital reduction $ 55,000 Tax rate 35% *Depreciation straight-line over life 5 What is the IRR of the project?

Telecom Italia is considering the investment in a capital project. The initial cost in year 0...

Telecom Italia is considering the investment in a capital project. The initial cost in year 0 is $130,000 to be depreciated straight over 5 years to an expected salvage value of $15,000. The firm’s tax rate is 35% and it has a 10% cost of capital (the firm's discount rate, or "hurdle" rate). For this project an additional investment in working capital of $12,000 is required and it will be recovered in full at the end of the project’s life....

Pretax Cost Savings

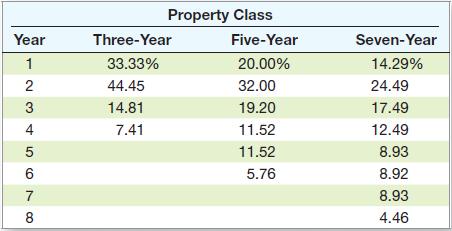

A proposed cost-saving device has an installed cost of $805,000. The device will be used in a five-year project but is classified as three-year MACRS property for tax purposes. The required initial net working capital investment is $83,000, the marginal tax rate is 24 percent, and the project discount rate is 9 percent. The device has an estimated Year 5 salvage value of $127,000. What level of pretax cost savings do we require for this project to be profitable? MACRS schedulePretax...

A proposed cost-saving device has an installed cost of $805,000. The device will be used in a five-year project but is classified as three-year MACRS property for tax purposes. The required initial net working capital investment is $83,000, the marginal tax rate is 24 percent, and the project discount rate is 9 percent. The device has an estimated Year 5 salvage value of $127,000. What level of pretax cost savings do we require for this project to be profitable? MACRS schedulePretax...

Question 3 (14 marks) A project has an initial investment of $300,000 for fixed equipment. The...

Question 3 (14 marks) A project has an initial investment of $300,000 for fixed equipment. The fixed equipment will be depreciated on a straight-line basis to zero book value over the three-year life of the project and have zero salvage value. The project also requires $38,000 initially for net working capital. All net working capital will be recovered at the end of the project. Sales from the project are expected to be $300,000 per year and operating costs amount to...

Question 3 (14 marks) A project has an initial investment of $300,000 for fixed equipment. The fixed equipment will be depreciated on a straight-line basis to zero book value over the three-year life of the project and have zero salvage value. The project also requires $38,000 initially for net working capital. All net working capital will be recovered at the end of the project. Sales from the project are expected to be $300,000 per year and operating costs amount to...

Calculate the NPV for the following capital budgeting proposal: $100,000 initial cost for equipment, straight-line depreciation...

Calculate the NPV for the following capital budgeting proposal: $100,000 initial cost for equipment, straight-line depreciation over 5 years to a zero book value, $5,000 pre-tax salvage value of equipment, 35% tax rate, $45,000 additional annual revenues, $15,000 additional annual cash expenses, $8,000 initial investment in working capital to be recouped at project end, and a cost of capital of 11%. Should the project be accepted or rejected?

Kolby’s Korndogs is looking at a new sausage system with an installed cost of $655,000. This cost will be depreciated st...

Kolby’s Korndogs is looking at a new sausage system with an installed cost of $655,000. This cost will be depreciated straight-line to zero over the project’s five-year life, at the end of which the sausage system can be scrapped for $85,000. The sausage system will save the firm $183,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $35,000. If the tax rate is 22 percent and the discount rate is...

The initial investment for this project will be $2.4 million. This amount is for depreciable equipment,...

The initial investment for this project will be $2.4 million. This amount is for depreciable equipment, which will be depreciated over 4 years using the straight-line method to zero book value. A working capital investment of $300,000 will also be made at the beginning of the project (Time T=0). The entire working capital investment will be recovered at the end of the project. Initial marketing studies suggest that Earnings before Depreciation and Taxes for 6 years will be as shown...

Francis, LLC is considering a 4-year project with an initial cost of $120,000. The equipment depreciation is straight-li...

Francis, LLC is considering a 4-year project with an initial cost of $120,000. The equipment depreciation is straight-line to zero over the life of the project. The firm believes that they can sell the equipment for the salvage value of $40,000 at the end of the project. The tax rate is 40%. The project requires no additional working capital over the life of the project. Annual operating cash flows are $48,000. Assuming a required rate of return of 10%, what...

Tax Impact Capital Investment Projects typically have 4 major categories: 1. Initial Investment: Cash outflow to...

Tax Impact Capital Investment Projects typically have 4 major categories: 1. Initial Investment: Cash outflow to purchase a new machine and the working capital cash outflows (if any) at year o 2. Current disposal of old machine and the effects of gain/loss from sales old machine on tax paid or tax savings (in case of sold of old machine) at year 0. 3. Annual net cash flow from operations: difference between net cash flows under old machine and new machine...

Tax Impact Capital Investment Projects typically have 4 major categories: 1. Initial Investment: Cash outflow to purchase a new machine and the working capital cash outflows (if any) at year o 2. Current disposal of old machine and the effects of gain/loss from sales old machine on tax paid or tax savings (in case of sold of old machine) at year 0. 3. Annual net cash flow from operations: difference between net cash flows under old machine and new machine...

A machine has an initial cost of $10,000 and a salvage value of $2,000 after a...

A machine has an initial cost of $10,000 and a salvage value of $2,000 after a 5 year life. Annual benefits from using the machine are $5000 and the annual cost of operation is $1800. The tax rate is 50%. Assume straight line depreciation. Find the IRR? Show full steps, and equations, neatly, thanks

Most questions answered within 3 hours.

-

Calculate the pH of each of the following solutions.

0.50 M HBr

3.1×10−4 M KOH

4.2×10−5...

asked 2 hours ago -

For the year ended December 31, Depot Max’s cost of merchandise

sold was $85,600. Inventory at the...

asked 2 hours ago -

Week 10 - Professional Memo Assignment

Professional Memo Assignment

Your mission for this week, should you...

asked 2 hours ago -

Write a Python program that stores the data for each

player on the team, and it...

asked 3 hours ago -

In

the last 3 months, mike never knows when he is going to get his

allowance...

asked 3 hours ago -

Is Ca(OH)2 a Bronsted base, Lewis base, or both? Why?

asked 3 hours ago -

1A- Why don’t voters complain about U.S. tariffs on imported

sugar?

Because sugar is only a...

asked 3 hours ago -

Cash Payback Period

Primera Banco is evaluating two capital investment proposals for

a drive-up ATM kiosk,...

asked 3 hours ago -

Create a button in Swift (Xcode) that will create a charge,

create a charge using Stripe's...

asked 3 hours ago -

The reaction rate of CO and NO2 in the reaction

CO(g) + NO2(g) → CO2(g) +...

asked 3 hours ago -

Imagine that a chemist puts 6.40 mol each of

C3H8 and O2 in a 1.00-L container...

asked 3 hours ago -

How much money should be invested today in order to have $8340

at the end of...

asked 3 hours ago

Question 3 (14 marks) A project has an initial investment of $300,000 for fixed equipment. The fixed equipment will be depreciated on a straight-line basis to zero book value over the three-year life of the project and have zero salvage value. The project also requires $38,000 initially for net working capital. All net working capital will be recovered at the end of the project. Sales from the project are expected to be $300,000 per year and operating costs amount to...

Question 3 (14 marks) A project has an initial investment of $300,000 for fixed equipment. The fixed equipment will be depreciated on a straight-line basis to zero book value over the three-year life of the project and have zero salvage value. The project also requires $38,000 initially for net working capital. All net working capital will be recovered at the end of the project. Sales from the project are expected to be $300,000 per year and operating costs amount to...

Tax Impact Capital Investment Projects typically have 4 major categories: 1. Initial Investment: Cash outflow to purchase a new machine and the working capital cash outflows (if any) at year o 2. Current disposal of old machine and the effects of gain/loss from sales old machine on tax paid or tax savings (in case of sold of old machine) at year 0. 3. Annual net cash flow from operations: difference between net cash flows under old machine and new machine...

Tax Impact Capital Investment Projects typically have 4 major categories: 1. Initial Investment: Cash outflow to purchase a new machine and the working capital cash outflows (if any) at year o 2. Current disposal of old machine and the effects of gain/loss from sales old machine on tax paid or tax savings (in case of sold of old machine) at year 0. 3. Annual net cash flow from operations: difference between net cash flows under old machine and new machine...