Homework Answers

![Padmavati 4) Computation of bet prebent vake it - cost of capital is lll. APV = ($26700x 4.7122) - $356000 + $ 4800 x 0:4817]](http://img.homeworklib.com/questions/aaf45e20-2633-11ea-8d88-7f703db3fd2e.png?x-oss-process=image/resize,w_560)

Add Answer to:

PA11-1 Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO...

3 300 polnts PA11-1 Calculating Accounting Rate of Return, Payback Period, Net Present Velue, Estimating Internal...

3 300 polnts PA11-1 Calculating Accounting Rate of Return, Payback Period, Net Present Velue, Estimating Internal Rate of Return [LO 11-1, 11-2,11-3 4] Balloons By Sunset (BBS) is considering the purchase of two new hot air belloons so thet it cen expand its desert sunset tours. Various information about the propose investment follows: Initial investment ffor two hot air balloons) Useful Ife Salrage value Annual net income generated BBSs cost of capital 507.000 10 years $ 47,000 40.551 8% Assume...

3 300 polnts PA11-1 Calculating Accounting Rate of Return, Payback Period, Net Present Velue, Estimating Internal Rate of Return [LO 11-1, 11-2,11-3 4] Balloons By Sunset (BBS) is considering the purchase of two new hot air belloons so thet it cen expand its desert sunset tours. Various information about the propose investment follows: Initial investment ffor two hot air balloons) Useful Ife Salrage value Annual net income generated BBSs cost of capital 507.000 10 years $ 47,000 40.551 8% Assume...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that...

Balloons By Sunset (BBS) is considering the purchase of two new

hot air balloons so that it can expand its desert sunset tours.

Various information about the proposed investment

follows:

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $...

Balloons By Sunset (BBS) is considering the purchase of two new

hot air balloons so that it can expand its desert sunset tours.

Various information about the proposed investment

follows:

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: $ 282,000 6 years Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $ 48,000 21,714 11% Assume straight line depreciation method is used Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: $ 282,000 6 years Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $ 48,000 21,714 11% Assume straight line depreciation method is used Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $ 377,000 7 years $ 41,000 28,275 11% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $ 377,000 7 years $ 41,000 28,275 11% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunse...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: $ Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital 357,000 8 years 53,000 26,775 $ 11% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: $ Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital 357,000 8 years 53,000 26,775 $ 11% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $427,000 7 years $ 56,000 32,452 12% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of return....

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $427,000 7 years $ 56,000 32,452 12% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of return....

How do I calculate the NPV & NPV assuming 11% cost of capital?

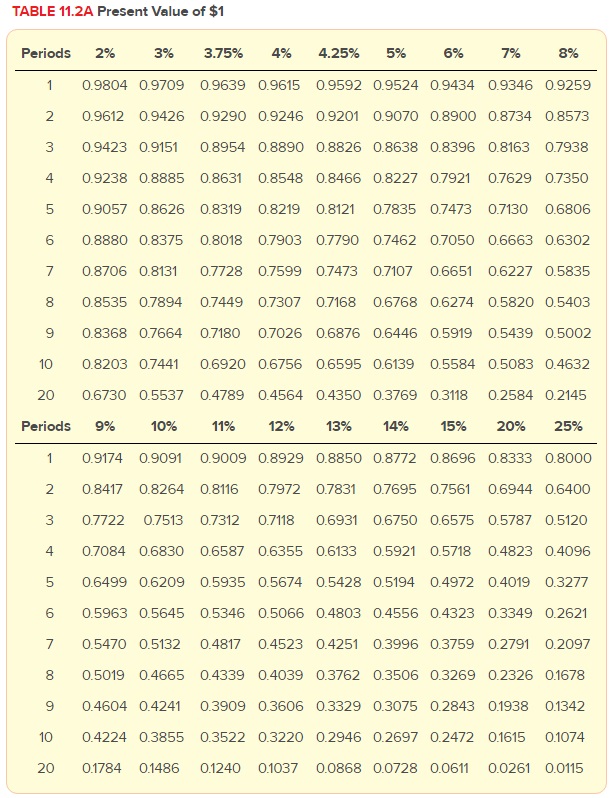

PA11-1 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4]Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided.)Initial investment (for two hot air balloons)$547,000Useful life9yearsSalvage value$52,000Annual net income...

PA11-1 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4]Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided.)Initial investment (for two hot air balloons)$547,000Useful life9yearsSalvage value$52,000Annual net income...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital S S 497.000 9 years 47.000 40,754 10% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital S S 497.000 9 years 47.000 40,754 10% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $ 414,000 8 years $ 46,000 38,088 10% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $ 414,000 8 years $ 46,000 38,088 10% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

PA11-1 Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return...

PA11-1 Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: $ 507,000 9 years $ 48,000 40,560 9% Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital Assume straight...

PA11-1 Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: $ 507,000 9 years $ 48,000 40,560 9% Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital Assume straight...

Most questions answered within 3 hours.

-

The pH of a sample of water from a river is 5.0. A

sample of effluent from...

asked 34 minutes ago -

At the beginning of the period, the Fabricating Department

budgeted direct labor of $136,500 and equipment...

asked 1 hour ago -

Please answer all

____ 28. Rent control is usually

justified on the grounds that it protects...

asked 1 hour ago -

PARTS A-D HAVE BEEN ANSWERED. WAS TOLD TO REPOST. ONLY ANSWER

PARTS E and F.

A...

asked 1 hour ago -

2) You are given the task of finding a representation for a

circle in a drawing...

asked 2 hours ago -

STUDY QUESTION: Does use of diet drug fen-phen

(fenfluramine-phentermine) cause valvular heart disease?

HINT: Valvular heart...

asked 2 hours ago -

1. An object weighing 40 N rests on a surface. The coefficient

of friction is 0.35....

asked 3 hours ago -

Investor company owns 35% of investee company voting stock and

accounts for the investment under the...

asked 4 hours ago -

The number of major faults on a randomly chosen 1 km stretch of

highway has a...

asked 5 hours ago -

Consider the competitive environment of Starbuck's, Progressive

Insurance, a manufacturing firm with low turnover, or a...

asked 5 hours ago -

3. Gains from trade

Consider two neighbouring island countries called Euphoria and

Contente. They each have...

asked 7 hours ago -

A business executive has the option to invest money in two

plans: Plan A guarantees that...

asked 10 hours ago

3 300 polnts PA11-1 Calculating Accounting Rate of Return, Payback Period, Net Present Velue, Estimating Internal Rate of Return [LO 11-1, 11-2,11-3 4] Balloons By Sunset (BBS) is considering the purchase of two new hot air belloons so thet it cen expand its desert sunset tours. Various information about the propose investment follows: Initial investment ffor two hot air balloons) Useful Ife Salrage value Annual net income generated BBSs cost of capital 507.000 10 years $ 47,000 40.551 8% Assume...

3 300 polnts PA11-1 Calculating Accounting Rate of Return, Payback Period, Net Present Velue, Estimating Internal Rate of Return [LO 11-1, 11-2,11-3 4] Balloons By Sunset (BBS) is considering the purchase of two new hot air belloons so thet it cen expand its desert sunset tours. Various information about the propose investment follows: Initial investment ffor two hot air balloons) Useful Ife Salrage value Annual net income generated BBSs cost of capital 507.000 10 years $ 47,000 40.551 8% Assume...

Balloons By Sunset (BBS) is considering the purchase of two new

hot air balloons so that it can expand its desert sunset tours.

Various information about the proposed investment

follows:

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $...

Balloons By Sunset (BBS) is considering the purchase of two new

hot air balloons so that it can expand its desert sunset tours.

Various information about the proposed investment

follows:

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: $ 282,000 6 years Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $ 48,000 21,714 11% Assume straight line depreciation method is used Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: $ 282,000 6 years Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $ 48,000 21,714 11% Assume straight line depreciation method is used Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $ 377,000 7 years $ 41,000 28,275 11% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $ 377,000 7 years $ 41,000 28,275 11% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: $ Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital 357,000 8 years 53,000 26,775 $ 11% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: $ Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital 357,000 8 years 53,000 26,775 $ 11% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $427,000 7 years $ 56,000 32,452 12% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of return....

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $427,000 7 years $ 56,000 32,452 12% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of return....

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital S S 497.000 9 years 47.000 40,754 10% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital S S 497.000 9 years 47.000 40,754 10% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $ 414,000 8 years $ 46,000 38,088 10% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $ 414,000 8 years $ 46,000 38,088 10% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of...

PA11-1 Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: $ 507,000 9 years $ 48,000 40,560 9% Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital Assume straight...

PA11-1 Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: $ 507,000 9 years $ 48,000 40,560 9% Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital Assume straight...