Homework Answers

Add Answer to:

Survey of Accounting Class 24 Packet Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've...

Survey of Accounting Class 24 Packet Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've...

Survey of Accounting Class 24 Packet Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods, CIC is currently considering expanding operations. The first expansion plan-which we've worked on in a previous class-calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost $4.289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would allow...

Survey of Accounting Class 24 Packet Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods, CIC is currently considering expanding operations. The first expansion plan-which we've worked on in a previous class-calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost $4.289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would allow...

Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods, CIC is currently considering exp...

Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods, CIC is currently considering expanding operations. The first expansion plan—which we've worked on in a previous class—calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost $4,289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would allow CIC to use the new building...

Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods, CIC is currently considering expanding operations. The first expansion plan—which we've worked on in a previous class—calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost $4,289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would allow CIC to use the new building...

Semester Case - Cowboy Ice Cream, Inc. As CIC considers expanding by adding a fixed location,...

Semester Case - Cowboy Ice Cream, Inc. As CIC considers expanding by adding a fixed location, W.1. realizes that budgeting properly for inventory is more important than ever. As you know from prior work, the wholesale division of CIC began January with 1.250 units of inventory at a cost of $4.00 per unit. During the first six months of the current year, CIC recorded the following transactions related to inventory for the wholesale division: Sales (units) Month Beginning inventory January...

Semester Case - Cowboy Ice Cream, Inc. As CIC considers expanding by adding a fixed location, W.1. realizes that budgeting properly for inventory is more important than ever. As you know from prior work, the wholesale division of CIC began January with 1.250 units of inventory at a cost of $4.00 per unit. During the first six months of the current year, CIC recorded the following transactions related to inventory for the wholesale division: Sales (units) Month Beginning inventory January...

Semester Case - Cowboy Ice Cream, Inc. Assuming the expansion of CIC takes place, W.L. is trying to prepare...

Semester Case - Cowboy Ice Cream, Inc. Assuming the expansion of CIC takes place, W.L. is trying to prepare a sales budget for the year following the expansion. Currently he's working on data for the wholesale division. Using the information compiled above, complete the following. Assume that selling and administrative expenses are 15% of sales revenue. During the first six months of the year, the price charged averaged $7.75 per unit. Round all computations to the nearest whole dollar. First...

Semester Case - Cowboy Ice Cream, Inc. Assuming the expansion of CIC takes place, W.L. is trying to prepare a sales budget for the year following the expansion. Currently he's working on data for the wholesale division. Using the information compiled above, complete the following. Assume that selling and administrative expenses are 15% of sales revenue. During the first six months of the year, the price charged averaged $7.75 per unit. Round all computations to the nearest whole dollar. First...

Metal Works Inc makes a wide variety of heavy duty metal ornaments that are highly sort...

Metal Works Inc makes a wide variety of heavy duty metal ornaments that are highly sort after in the home gardens. The company has done very well in recent years, and has just committed to paying out a $2 dividend on each of their outstanding 50,000 shares. Building on recent success the company is considering diversifying into the production of lighter and more delicate ornaments for inside the home, however the company recognises that to do so will require the...

Please show cash flows, NPV, IRR, and payback period Sneaker 2013 The business case team had...

Please show cash flows, NPV, IRR, and payback period

Sneaker 2013 The business case team had compiled the following baseline information surrounding the Sneaker 2013 project: 1. The life of the Sneaker 2013 project was expected to be six years. Assume the analysis took place at the end of 2012. 2. The suggested retail price of the shoe was $190. Gross margins for high-end athletic footwear averaged about 40% at the retail level, meaning each pair sold would net New...

Please show cash flows, NPV, IRR, and payback period

Sneaker 2013 The business case team had compiled the following baseline information surrounding the Sneaker 2013 project: 1. The life of the Sneaker 2013 project was expected to be six years. Assume the analysis took place at the end of 2012. 2. The suggested retail price of the shoe was $190. Gross margins for high-end athletic footwear averaged about 40% at the retail level, meaning each pair sold would net New...

Case: Investment Proposals for Ontario Coffee Home

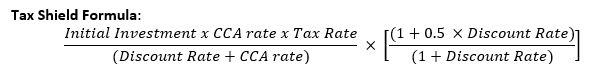

Case: Investment Proposals for Ontario Coffee HomeIt is January 1, 2019. You are a Senior Analyst at Ontario Coffee Home (OCH), one of the leading coffee chains and wholesaler of coffee/bakery products in Ontario. The CEO of Ontario Coffee Home, Jerry Donovan, has reached out to you to draft a report to evaluate two investment proposals.Requirements1. Identify which revenues and costs are relevant to your analysis, and which costs are irrelevant. Summarize all the information that will be required for each...

Case: Investment Proposals for Ontario Coffee HomeIt is January 1, 2019. You are a Senior Analyst at Ontario Coffee Home (OCH), one of the leading coffee chains and wholesaler of coffee/bakery products in Ontario. The CEO of Ontario Coffee Home, Jerry Donovan, has reached out to you to draft a report to evaluate two investment proposals.Requirements1. Identify which revenues and costs are relevant to your analysis, and which costs are irrelevant. Summarize all the information that will be required for each...

Case: Investment Proposals for Ontario Coffee Home It is January 1, 2019. You are a Senior...

Case: Investment Proposals for Ontario Coffee

Home

It is January 1, 2019. You are a Senior Analyst at Ontario

Coffee Home (OCH), one of the leading coffee chains and wholesaler

of coffee/bakery products in Ontario. The CEO of Ontario Coffee

Home, Jerry Donovan, has reached out to you to draft a report to

evaluate two investment proposals.

Requirements

1. Identify which revenues

and costs are relevant to your analysis, and which costs are

irrelevant. Summarize all the information that will be...

Case: Investment Proposals for Ontario Coffee

Home

It is January 1, 2019. You are a Senior Analyst at Ontario

Coffee Home (OCH), one of the leading coffee chains and wholesaler

of coffee/bakery products in Ontario. The CEO of Ontario Coffee

Home, Jerry Donovan, has reached out to you to draft a report to

evaluate two investment proposals.

Requirements

1. Identify which revenues

and costs are relevant to your analysis, and which costs are

irrelevant. Summarize all the information that will be...

Case: Investment Proposals for Ontario Coffee Home It is January 1, 2019. You are a Senior...

Case: Investment Proposals for Ontario Coffee Home It is January 1, 2019. You are a Senior Analyst at Ontario Coffee Home (OCH), one of the leading coffee chains and wholesaler of coffee/bakery products in Ontario. The CEO of Ontario Coffee Home, Jerry Donovan, has reached out to you to draft a report to evaluate two investment proposals. Requirements 1. Identify which revenues and costs are relevant to your analysis, and which costs are irrelevant. Summarize all the information that will...

Case: Investment Proposals for Ontario Coffee Home It is January 1, 2019. You are a Senior...

Case: Investment Proposals for Ontario Coffee Home It is January 1, 2019. You are a Senior Analyst at Ontario Coffee Home (OCH), one of the leading coffee chains and wholesaler of coffee/bakery products in Ontario. The CEO of Ontario Coffee Home, Jerry Donovan, has reached out to you to draft a report to evaluate two investment proposals. Requirements 1. Identify which revenues and costs are relevant to your analysis, and which costs are irrelevant. Summarize all the information that will be...

Most questions answered within 3 hours.

-

Calculate the molality, mole-fraction and percent mass of 28.9M

HF at 25 degrees Celcius of the...

asked 4 minutes ago -

A developmental psychologist believes that children raised in

bilingual families will have higher verbal fluency at...

asked 10 minutes ago -

A fast food meal has 5660 kJ of energy. A person uses energy at

a rate...

asked 22 minutes ago -

The pKb for a generic amine(R-NH2)) in

aqueous solution is 6.30. What is its pKa?

asked 24 minutes ago -

The following reactions have the indicated equilibrium constants

at a particular temperature: N2(g) + O2(g) ⇌...

asked 26 minutes ago -

Please Help ASAP.

1Consider the below code which iterates over a linked

list of n nodes...

asked 42 minutes ago -

Determine the air to fuel ratio of:

Canadian natural gas, with 93.9% methane, 4.2% ethane, 0.3%...

asked 43 minutes ago -

A manufacturer of power tools claims that the average amount of

time required to assemble their...

asked 45 minutes ago -

"electron-withdrawing substituents on carbon encourage back

donation", then on the next page he says that "greater...

asked 56 minutes ago -

On December 31, 2016, the shareholders’ equity section of the

balance sheet of R & L...

asked 1 hour ago -

16.7

At t=0s a small "upward" (positive y) pulse centered at x = 5.0

m is...

asked 1 hour ago -

Twitter Users and News: A poll conducted in 2013 found that 52%

of U.S. adult Twitter...

asked 1 hour ago

Survey of Accounting Class 24 Packet Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods, CIC is currently considering expanding operations. The first expansion plan-which we've worked on in a previous class-calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost $4.289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would allow...

Survey of Accounting Class 24 Packet Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods, CIC is currently considering expanding operations. The first expansion plan-which we've worked on in a previous class-calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost $4.289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would allow...

Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods, CIC is currently considering expanding operations. The first expansion plan—which we've worked on in a previous class—calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost $4,289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would allow CIC to use the new building...

Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods, CIC is currently considering expanding operations. The first expansion plan—which we've worked on in a previous class—calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost $4,289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would allow CIC to use the new building...

Semester Case - Cowboy Ice Cream, Inc. As CIC considers expanding by adding a fixed location, W.1. realizes that budgeting properly for inventory is more important than ever. As you know from prior work, the wholesale division of CIC began January with 1.250 units of inventory at a cost of $4.00 per unit. During the first six months of the current year, CIC recorded the following transactions related to inventory for the wholesale division: Sales (units) Month Beginning inventory January...

Semester Case - Cowboy Ice Cream, Inc. As CIC considers expanding by adding a fixed location, W.1. realizes that budgeting properly for inventory is more important than ever. As you know from prior work, the wholesale division of CIC began January with 1.250 units of inventory at a cost of $4.00 per unit. During the first six months of the current year, CIC recorded the following transactions related to inventory for the wholesale division: Sales (units) Month Beginning inventory January...

Semester Case - Cowboy Ice Cream, Inc. Assuming the expansion of CIC takes place, W.L. is trying to prepare a sales budget for the year following the expansion. Currently he's working on data for the wholesale division. Using the information compiled above, complete the following. Assume that selling and administrative expenses are 15% of sales revenue. During the first six months of the year, the price charged averaged $7.75 per unit. Round all computations to the nearest whole dollar. First...

Semester Case - Cowboy Ice Cream, Inc. Assuming the expansion of CIC takes place, W.L. is trying to prepare a sales budget for the year following the expansion. Currently he's working on data for the wholesale division. Using the information compiled above, complete the following. Assume that selling and administrative expenses are 15% of sales revenue. During the first six months of the year, the price charged averaged $7.75 per unit. Round all computations to the nearest whole dollar. First...

Please show cash flows, NPV, IRR, and payback period

Sneaker 2013 The business case team had compiled the following baseline information surrounding the Sneaker 2013 project: 1. The life of the Sneaker 2013 project was expected to be six years. Assume the analysis took place at the end of 2012. 2. The suggested retail price of the shoe was $190. Gross margins for high-end athletic footwear averaged about 40% at the retail level, meaning each pair sold would net New...

Please show cash flows, NPV, IRR, and payback period

Sneaker 2013 The business case team had compiled the following baseline information surrounding the Sneaker 2013 project: 1. The life of the Sneaker 2013 project was expected to be six years. Assume the analysis took place at the end of 2012. 2. The suggested retail price of the shoe was $190. Gross margins for high-end athletic footwear averaged about 40% at the retail level, meaning each pair sold would net New...

Case: Investment Proposals for Ontario Coffee

Home

It is January 1, 2019. You are a Senior Analyst at Ontario

Coffee Home (OCH), one of the leading coffee chains and wholesaler

of coffee/bakery products in Ontario. The CEO of Ontario Coffee

Home, Jerry Donovan, has reached out to you to draft a report to

evaluate two investment proposals.

Requirements

1. Identify which revenues

and costs are relevant to your analysis, and which costs are

irrelevant. Summarize all the information that will be...

Case: Investment Proposals for Ontario Coffee

Home

It is January 1, 2019. You are a Senior Analyst at Ontario

Coffee Home (OCH), one of the leading coffee chains and wholesaler

of coffee/bakery products in Ontario. The CEO of Ontario Coffee

Home, Jerry Donovan, has reached out to you to draft a report to

evaluate two investment proposals.

Requirements

1. Identify which revenues

and costs are relevant to your analysis, and which costs are

irrelevant. Summarize all the information that will be...