Homework Answers

| Present Value(PV) of Cash Flow: | ||||||||||||

| (Cash Flow)/((1+i)^N) | ||||||||||||

| i=discount rate=Cost of Capital=8%=0.08 | ||||||||||||

| N=Year of Cash Flow | ||||||||||||

| ANALYSIS OF FREEZER OPTION | ||||||||||||

| N | Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |||

| a | Cost of freezer | -$4,289 | ||||||||||

| b | Additional working capital | -$500 | ||||||||||

| c | Cash inflow per year | $9,600 | $9,676 | $9,761 | $9,857 | $9,965 | $10,086 | $10,223 | ||||

| d | Annual cash outflow | -$9,000 | -$9,000 | -$9,000 | -$9,000 | -$9,000 | -$9,000 | -$9,000 | ||||

| e | Salvage value | $300 | ||||||||||

| f | Release of additional working Capital | $500 | ||||||||||

| CF=a+b+c+d+e+f | Net Cash Flow | -$4,789 | $600 | $676 | $761 | $857 | $965 | $1,086 | $2,023 | SUM | ||

| Cumulative Net Cash Flow | -$4,789 | -$4,189 | -$3,513 | -$2,752 | -$1,895 | -$930 | $156 | $2,179 | ||||

| PV=CF/(1.08^N) | Present Value(PV) of Net Cash Flow: | -$4,789 | $556 | $580 | $604 | $630 | $657 | $684 | $1,180 | $102 | ||

| 1 | NPV=Sum of PV | Net Present Value | $102 | |||||||||

| 2 | Internal Rate of Return | 8.5% | (Using IRR function of excel over Net cash flow) | |||||||||

| 3 | Present Value Index=NPV/Initial Outlay | 0.0212 | (102/4789) | |||||||||

| 4 | Payback Period =Period at which Cumulative Net Cash Flow=0 | |||||||||||

| Payback Period =5+(930/1086)= | 5.86 | Years | ||||||||||

| ANALYSIS OF PURCHASE STAND OPTION | ||||||||||||

| N | Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |||

| a | Cost of Stand | -$7,000 | ||||||||||

| b | Additional working capital | -$500 | ||||||||||

| c | Cash inflow per year | $13,390 | $13,390 | $13,390 | $13,390 | $13,390 | $13,390 | $13,390 | ||||

| d | Annual cash outflow | -$12,000 | -$12,000 | -$12,000 | -$12,000 | -$12,000 | -$12,000 | -$12,000 | ||||

| e | Salvage value | $0 | ||||||||||

| f | Release of additional working Capital | $500 | ||||||||||

| CF=a+b+c+d+e+f | Net Cash Flow | -$7,500 | $1,390 | $1,390 | $1,390 | $1,390 | $1,390 | $1,390 | $1,890 | |||

| Cumulative Net Cash Flow | -$7,500 | -$6,110 | -$4,720 | -$3,330 | -$1,940 | -$550 | $840 | $2,730 | SUM | |||

| PV=CF/(1.08^N) | Present Value(PV) of Net Cash Flow: | -$7,500 | $1,287 | $1,192 | $1,103 | $1,022 | $946 | $876 | $1,103 | $29 | ||

| NPV=Sum of PV | Net Present Value | $29 | ||||||||||

| 2 | Internal Rate of Return | 8.11% | (Using IRR function of excel over Net cash flow) | |||||||||

| 3 | Present Value Index=NPV/Initial Outlay | 0.0038 | (29/7500) | |||||||||

| 4 | Payback Period =Period at which Cumulative Net Cash Flow=0 | |||||||||||

| Payback Period =5+(550/1390)= | 5.40 | Years | ||||||||||

| PURCHASE FREEZER OPTION IS PREFERRED | ||||||||||||

|

||||||||||||

Add Answer to:

Survey of Accounting Class 24 Packet Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've...

Survey of Accounting Class 24 Packet Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've...

Survey of Accounting Class 24 Packet Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods. CIC is currently considering expanding operations. The first expansion plan which we've worked on in a previous class-calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost 54.289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would...

Survey of Accounting Class 24 Packet Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods. CIC is currently considering expanding operations. The first expansion plan which we've worked on in a previous class-calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost 54.289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would...

Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods, CIC is currently considering exp...

Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods, CIC is currently considering expanding operations. The first expansion plan—which we've worked on in a previous class—calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost $4,289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would allow CIC to use the new building...

Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods, CIC is currently considering expanding operations. The first expansion plan—which we've worked on in a previous class—calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost $4,289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would allow CIC to use the new building...

Semester Case - Cowboy Ice Cream, Inc. As CIC considers expanding by adding a fixed location,...

Semester Case - Cowboy Ice Cream, Inc. As CIC considers expanding by adding a fixed location, W.1. realizes that budgeting properly for inventory is more important than ever. As you know from prior work, the wholesale division of CIC began January with 1.250 units of inventory at a cost of $4.00 per unit. During the first six months of the current year, CIC recorded the following transactions related to inventory for the wholesale division: Sales (units) Month Beginning inventory January...

Semester Case - Cowboy Ice Cream, Inc. As CIC considers expanding by adding a fixed location, W.1. realizes that budgeting properly for inventory is more important than ever. As you know from prior work, the wholesale division of CIC began January with 1.250 units of inventory at a cost of $4.00 per unit. During the first six months of the current year, CIC recorded the following transactions related to inventory for the wholesale division: Sales (units) Month Beginning inventory January...

Semester Case - Cowboy Ice Cream, Inc. Assuming the expansion of CIC takes place, W.L. is trying to prepare...

Semester Case - Cowboy Ice Cream, Inc. Assuming the expansion of CIC takes place, W.L. is trying to prepare a sales budget for the year following the expansion. Currently he's working on data for the wholesale division. Using the information compiled above, complete the following. Assume that selling and administrative expenses are 15% of sales revenue. During the first six months of the year, the price charged averaged $7.75 per unit. Round all computations to the nearest whole dollar. First...

Semester Case - Cowboy Ice Cream, Inc. Assuming the expansion of CIC takes place, W.L. is trying to prepare a sales budget for the year following the expansion. Currently he's working on data for the wholesale division. Using the information compiled above, complete the following. Assume that selling and administrative expenses are 15% of sales revenue. During the first six months of the year, the price charged averaged $7.75 per unit. Round all computations to the nearest whole dollar. First...

Metal Works Inc makes a wide variety of heavy duty metal ornaments that are highly sort...

Metal Works Inc makes a wide variety of heavy duty metal ornaments that are highly sort after in the home gardens. The company has done very well in recent years, and has just committed to paying out a $2 dividend on each of their outstanding 50,000 shares. Building on recent success the company is considering diversifying into the production of lighter and more delicate ornaments for inside the home, however the company recognises that to do so will require the...

Please show cash flows, NPV, IRR, and payback period Sneaker 2013 The business case team had...

Please show cash flows, NPV, IRR, and payback period

Sneaker 2013 The business case team had compiled the following baseline information surrounding the Sneaker 2013 project: 1. The life of the Sneaker 2013 project was expected to be six years. Assume the analysis took place at the end of 2012. 2. The suggested retail price of the shoe was $190. Gross margins for high-end athletic footwear averaged about 40% at the retail level, meaning each pair sold would net New...

Please show cash flows, NPV, IRR, and payback period

Sneaker 2013 The business case team had compiled the following baseline information surrounding the Sneaker 2013 project: 1. The life of the Sneaker 2013 project was expected to be six years. Assume the analysis took place at the end of 2012. 2. The suggested retail price of the shoe was $190. Gross margins for high-end athletic footwear averaged about 40% at the retail level, meaning each pair sold would net New...

Case: Investment Proposals for Ontario Coffee Home

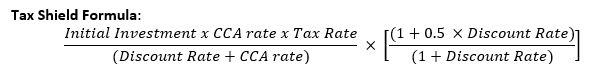

Case: Investment Proposals for Ontario Coffee HomeIt is January 1, 2019. You are a Senior Analyst at Ontario Coffee Home (OCH), one of the leading coffee chains and wholesaler of coffee/bakery products in Ontario. The CEO of Ontario Coffee Home, Jerry Donovan, has reached out to you to draft a report to evaluate two investment proposals.Requirements1. Identify which revenues and costs are relevant to your analysis, and which costs are irrelevant. Summarize all the information that will be required for each...

Case: Investment Proposals for Ontario Coffee HomeIt is January 1, 2019. You are a Senior Analyst at Ontario Coffee Home (OCH), one of the leading coffee chains and wholesaler of coffee/bakery products in Ontario. The CEO of Ontario Coffee Home, Jerry Donovan, has reached out to you to draft a report to evaluate two investment proposals.Requirements1. Identify which revenues and costs are relevant to your analysis, and which costs are irrelevant. Summarize all the information that will be required for each...

Case: Investment Proposals for Ontario Coffee Home It is January 1, 2019. You are a Senior...

Case: Investment Proposals for Ontario Coffee

Home

It is January 1, 2019. You are a Senior Analyst at Ontario

Coffee Home (OCH), one of the leading coffee chains and wholesaler

of coffee/bakery products in Ontario. The CEO of Ontario Coffee

Home, Jerry Donovan, has reached out to you to draft a report to

evaluate two investment proposals.

Requirements

1. Identify which revenues

and costs are relevant to your analysis, and which costs are

irrelevant. Summarize all the information that will be...

Case: Investment Proposals for Ontario Coffee

Home

It is January 1, 2019. You are a Senior Analyst at Ontario

Coffee Home (OCH), one of the leading coffee chains and wholesaler

of coffee/bakery products in Ontario. The CEO of Ontario Coffee

Home, Jerry Donovan, has reached out to you to draft a report to

evaluate two investment proposals.

Requirements

1. Identify which revenues

and costs are relevant to your analysis, and which costs are

irrelevant. Summarize all the information that will be...

Case: Investment Proposals for Ontario Coffee Home It is January 1, 2019. You are a Senior...

Case: Investment Proposals for Ontario Coffee Home It is January 1, 2019. You are a Senior Analyst at Ontario Coffee Home (OCH), one of the leading coffee chains and wholesaler of coffee/bakery products in Ontario. The CEO of Ontario Coffee Home, Jerry Donovan, has reached out to you to draft a report to evaluate two investment proposals. Requirements 1. Identify which revenues and costs are relevant to your analysis, and which costs are irrelevant. Summarize all the information that will...

Case: Investment Proposals for Ontario Coffee Home It is January 1, 2019. You are a Senior...

Case: Investment Proposals for Ontario Coffee Home It is January 1, 2019. You are a Senior Analyst at Ontario Coffee Home (OCH), one of the leading coffee chains and wholesaler of coffee/bakery products in Ontario. The CEO of Ontario Coffee Home, Jerry Donovan, has reached out to you to draft a report to evaluate two investment proposals. Requirements 1. Identify which revenues and costs are relevant to your analysis, and which costs are irrelevant. Summarize all the information that will be...

Most questions answered within 3 hours.

-

1.

In the laws of optics experiment, a student measured the

intensity of a light source...

asked 1 minute ago -

What is the length of a box in which the minimum energy of an

electron is...

asked 3 minutes ago -

A Government of Canada bond will pay $50 at the end of every six

months for...

asked 4 minutes ago -

Researchers measured the data speeds for a particular smartphone

carrier at 50 airports. The highest speed...

asked 21 minutes ago -

Ingraham Inc. currently has $880,000 in accounts receivable, and

its days sales outstanding (DSO) is 47...

asked 22 minutes ago -

Look at sample problem 19.6 in the 8th ed Silberberg book.

Enter your answers in scientific...

asked 41 minutes ago -

A long straight wire carries a current of 5.00 A at a distance r from the...

asked 43 minutes ago -

A 125

g baseball is thrown at a speed of 127ft/sec at a batter, the ball...

asked 48 minutes ago -

If you have an eta squared of .34 and used a

between-subjects design, what does that...

asked 56 minutes ago -

*Healthcare Adminstration*

Scutchfield and Keck's Principles of Public Health Practice

4th edition

What are the differences...

asked 1 hour ago -

Find the complete optimal solution to this linear programming

problem. Max 5x + 3y s.t. 2x...

asked 1 hour ago -

The pH of an acetate buffer was determined to be 4.76. Then, a

few drops of...

asked 1 hour ago

Survey of Accounting Class 24 Packet Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods. CIC is currently considering expanding operations. The first expansion plan which we've worked on in a previous class-calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost 54.289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would...

Survey of Accounting Class 24 Packet Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods. CIC is currently considering expanding operations. The first expansion plan which we've worked on in a previous class-calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost 54.289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would...

Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods, CIC is currently considering expanding operations. The first expansion plan—which we've worked on in a previous class—calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost $4,289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would allow CIC to use the new building...

Semester Case - Cowboy Ice Cream, Inc. (CIC) As we've examined in prior class periods, CIC is currently considering expanding operations. The first expansion plan—which we've worked on in a previous class—calls for the purchase of a physical location, remodeling of that location, and purchase of a freezer. The freezer would cost $4,289, have an estimated useful life of 7 years, and have a salvage value of $300. Purchase of the freezer would allow CIC to use the new building...

Semester Case - Cowboy Ice Cream, Inc. As CIC considers expanding by adding a fixed location, W.1. realizes that budgeting properly for inventory is more important than ever. As you know from prior work, the wholesale division of CIC began January with 1.250 units of inventory at a cost of $4.00 per unit. During the first six months of the current year, CIC recorded the following transactions related to inventory for the wholesale division: Sales (units) Month Beginning inventory January...

Semester Case - Cowboy Ice Cream, Inc. As CIC considers expanding by adding a fixed location, W.1. realizes that budgeting properly for inventory is more important than ever. As you know from prior work, the wholesale division of CIC began January with 1.250 units of inventory at a cost of $4.00 per unit. During the first six months of the current year, CIC recorded the following transactions related to inventory for the wholesale division: Sales (units) Month Beginning inventory January...

Semester Case - Cowboy Ice Cream, Inc. Assuming the expansion of CIC takes place, W.L. is trying to prepare a sales budget for the year following the expansion. Currently he's working on data for the wholesale division. Using the information compiled above, complete the following. Assume that selling and administrative expenses are 15% of sales revenue. During the first six months of the year, the price charged averaged $7.75 per unit. Round all computations to the nearest whole dollar. First...

Semester Case - Cowboy Ice Cream, Inc. Assuming the expansion of CIC takes place, W.L. is trying to prepare a sales budget for the year following the expansion. Currently he's working on data for the wholesale division. Using the information compiled above, complete the following. Assume that selling and administrative expenses are 15% of sales revenue. During the first six months of the year, the price charged averaged $7.75 per unit. Round all computations to the nearest whole dollar. First...

Please show cash flows, NPV, IRR, and payback period

Sneaker 2013 The business case team had compiled the following baseline information surrounding the Sneaker 2013 project: 1. The life of the Sneaker 2013 project was expected to be six years. Assume the analysis took place at the end of 2012. 2. The suggested retail price of the shoe was $190. Gross margins for high-end athletic footwear averaged about 40% at the retail level, meaning each pair sold would net New...

Please show cash flows, NPV, IRR, and payback period

Sneaker 2013 The business case team had compiled the following baseline information surrounding the Sneaker 2013 project: 1. The life of the Sneaker 2013 project was expected to be six years. Assume the analysis took place at the end of 2012. 2. The suggested retail price of the shoe was $190. Gross margins for high-end athletic footwear averaged about 40% at the retail level, meaning each pair sold would net New...

Case: Investment Proposals for Ontario Coffee

Home

It is January 1, 2019. You are a Senior Analyst at Ontario

Coffee Home (OCH), one of the leading coffee chains and wholesaler

of coffee/bakery products in Ontario. The CEO of Ontario Coffee

Home, Jerry Donovan, has reached out to you to draft a report to

evaluate two investment proposals.

Requirements

1. Identify which revenues

and costs are relevant to your analysis, and which costs are

irrelevant. Summarize all the information that will be...

Case: Investment Proposals for Ontario Coffee

Home

It is January 1, 2019. You are a Senior Analyst at Ontario

Coffee Home (OCH), one of the leading coffee chains and wholesaler

of coffee/bakery products in Ontario. The CEO of Ontario Coffee

Home, Jerry Donovan, has reached out to you to draft a report to

evaluate two investment proposals.

Requirements

1. Identify which revenues

and costs are relevant to your analysis, and which costs are

irrelevant. Summarize all the information that will be...