1.) Capital budgeting is concerned with: a.) managing a firm's cash budgeting procedures b.) whether a...

1.) Capital budgeting is concerned with:

a.) managing a firm's cash budgeting procedures

b.) whether a company's assets should be financed with debt or equity

c.) planning sales of a corporation's equity capital

d.) what long-term investments a firm should undertake

2.) A "normal" yield curve is

a.) upward sloping

b.) downward sloping, then upward sloping

c.) downward sloping

d.) upward sloping, then downward sloping

Homework Answers

1) d) what long-term investments a firm should undertake

Capital budgeting always concerned with evaluating the projects or long term investments based on their profitability and choosing them

2) a)Upward sloping

In normal yeild curve, short term debt instruments will have lower yeild than long term debt instruments whose credit quality is same, which gives upward sloping curve

Add Answer to:

1.) Capital budgeting is concerned with:

a.) managing a firm's cash budgeting procedures

b.) whether a...

Operating activities are concerned with ______. a. determining whether a company’s assets should be financed with...

Operating activities are concerned with ______. a. determining whether a company’s assets should be financed with debt or equity b. managing a firm’s cash budgeting procedures c. managing a firm’s working capital d. planning sales of a corporation’s equity capital

Capital Budgeting Analysis : A firm is planning a new project that is projected to yield cash flo...

Capital Budgeting Analysis : A firm is planning a new project that is projected to yield cash flows of - $595,000 in Year 1, $586,000 per year in Years 2 through 5, and $578,000 in Years 6 through 11. This investment will cost the company $2,580,000 today (initial outlay). We assume that the firm's cost of capital is 11%. (1) Draw a timeline to show the cash flows of the project. (2) Compute the project’s payback period, net present value...

10. Ierust Plus and decisions Suppose that a firm is facing an upward-sloping yield curve and...

10. Ierust Plus and decisions Suppose that a firm is facing an upward-sloping yield curve and needs to borrow money to invest in production. Does this mean that the firm should consider borrowing only at short-term rates? No, the firm needs to take the volatility of short-term rates into account. Yes, using short-term financing will give the firm the lowest possible interest rate over the life of the project. No, an upward-sloping yield curve means that the firm will get...

10. Ierust Plus and decisions Suppose that a firm is facing an upward-sloping yield curve and needs to borrow money to invest in production. Does this mean that the firm should consider borrowing only at short-term rates? No, the firm needs to take the volatility of short-term rates into account. Yes, using short-term financing will give the firm the lowest possible interest rate over the life of the project. No, an upward-sloping yield curve means that the firm will get...

When firms make capital budgeting decisions, they should concern themselves with incremental cash flows, not net...

When firms make capital budgeting decisions, they should concern themselves with incremental cash flows, not net income, when evaluating projects. To determine the incremental cash flows associated with a capital project, an analyst should include all of the following except: The project's financing costs The project's depreciation expense Changes in net working capital associated with the project The project's fixed-asset expenditures O Indirect cash flows often affect a firm's capital budgeting decisions. However, some of these indirect cash flows are...

When firms make capital budgeting decisions, they should concern themselves with incremental cash flows, not net income, when evaluating projects. To determine the incremental cash flows associated with a capital project, an analyst should include all of the following except: The project's financing costs The project's depreciation expense Changes in net working capital associated with the project The project's fixed-asset expenditures O Indirect cash flows often affect a firm's capital budgeting decisions. However, some of these indirect cash flows are...

23. Capital structure decisions refer to the: A. dividend yield of the firm's stock B. blend...

23. Capital structure decisions refer to the: A. dividend yield of the firm's stock B. blend of equity and debe used by the fim C. capital gains available on the firms stock D. maturity date for the firm's securities 24. If the line measuring a stock's historic returns against the market's historic returns has a slope greater than 1.0, then the: A. stock is currently underpriced B, market risk peemium is increasing. C. stock has a significant amount of unique...

23. Capital structure decisions refer to the: A. dividend yield of the firm's stock B. blend of equity and debe used by the fim C. capital gains available on the firms stock D. maturity date for the firm's securities 24. If the line measuring a stock's historic returns against the market's historic returns has a slope greater than 1.0, then the: A. stock is currently underpriced B, market risk peemium is increasing. C. stock has a significant amount of unique...

Simply Cayenne Company: A Comprehensive Case In Measuring A Firm's Cost Of Capital (Boudreaux, D., S. Rao, and P...

Simply Cayenne Company: A Comprehensive Case In Measuring A Firm's Cost Of Capital (Boudreaux, D., S. Rao, and P. Das, 2014) THE CASE Patricia Hotard, the Chief Executive Officer of Simply Cayenne Refining and Processing Company (SCRPC), picked up the telephone to call Jimmy Breez, the firm's financial manager. Breez had sent her an email earlier that morning suggesting that the capital budgeting committee should get together prior to the scheduled Investment Decision Committee meeting that is in one week...

Simply Cayenne Company: A Comprehensive Case In Measuring A Firm's Cost Of Capital (Boudreaux, D., S. Rao, and P. Das, 2014) THE CASE Patricia Hotard, the Chief Executive Officer of Simply Cayenne Refining and Processing Company (SCRPC), picked up the telephone to call Jimmy Breez, the firm's financial manager. Breez had sent her an email earlier that morning suggesting that the capital budgeting committee should get together prior to the scheduled Investment Decision Committee meeting that is in one week...

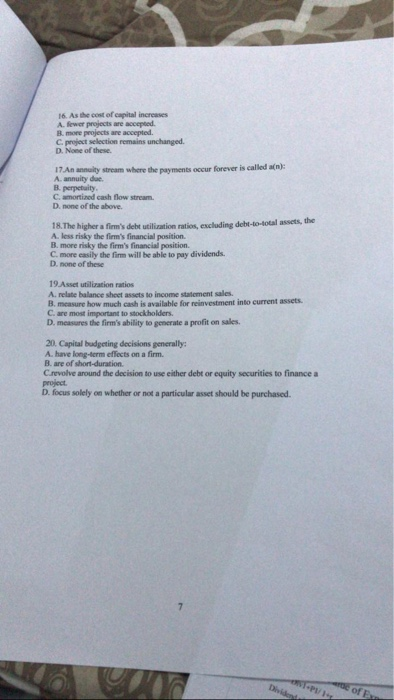

16. As the cost of capital increases A fewer projects are accepted B. more projects are...

16. As the cost of capital increases A fewer projects are accepted B. more projects are accepted. C. project selection remains unchanged. D. None of these 17.An annulty stream where the payments occur forever is called an): A. annuity due B. perpetuity. C. amortized cash flow stream D. none of the above. 18. The higher a firm's debt utilization ratios, excluding debt-to-total assets A less risky the firm's financial position. B. more risky the firm's financial position C. more easily...

16. As the cost of capital increases A fewer projects are accepted B. more projects are accepted. C. project selection remains unchanged. D. None of these 17.An annulty stream where the payments occur forever is called an): A. annuity due B. perpetuity. C. amortized cash flow stream D. none of the above. 18. The higher a firm's debt utilization ratios, excluding debt-to-total assets A less risky the firm's financial position. B. more risky the firm's financial position C. more easily...

One of the most important financial management activities that a firm undertakes is its evaluation and...

One of the most important financial management activities that a firm undertakes is its evaluation and allocation of investment funds to support its future survival and growth. These activities may be motivated by the desire to expand the firm's revenues, reduce its costs, or satisfy its mandatory or voluntary legal, health, and safety requirements. They may have, more or less, multiyear effects on the organization and may or may not be considered as capital budgeting activities. Capital budgeting is the...

One of the most important financial management activities that a firm undertakes is its evaluation and allocation of investment funds to support its future survival and growth. These activities may be motivated by the desire to expand the firm's revenues, reduce its costs, or satisfy its mandatory or voluntary legal, health, and safety requirements. They may have, more or less, multiyear effects on the organization and may or may not be considered as capital budgeting activities. Capital budgeting is the...

Whitson Hog Heaven Inc. has the following capital budgeting opportunities this year. The following are the...

Whitson Hog Heaven Inc. has the following capital budgeting opportunities this year. The following are the IRR and corresponding investments required by the projects listed below: Project IRR Investment A 10% $1,000 B 13% $3.000 C 14% $2,000 D 9% $5,000 E 15% $9,000 Whitson’s balance sheet is: Assets $600,000 Liabilities: $500,000 Equity $100,000 Whitson has available to him 3 sources of debt. Short term...

choose the correct answer A-Capital Budgeting B-Cost of Capital C-Goal incongruence D-Net present value E-Gain on...

choose the correct answer A-Capital Budgeting B-Cost of Capital C-Goal incongruence D-Net present value E-Gain on disposal (sale) F-Book value G-Payback method H-Loss on disposal (sale) Choose The rate of return used by a company to determine whether or not the expected return on a potential long-term A method of evaluating investments that uses TVM to assess whether the investment's expected rate of return is The cost of a long-term asset that has not yet been depreciated; it is not...

choose the correct answer A-Capital Budgeting B-Cost of Capital C-Goal incongruence D-Net present value E-Gain on disposal (sale) F-Book value G-Payback method H-Loss on disposal (sale) Choose The rate of return used by a company to determine whether or not the expected return on a potential long-term A method of evaluating investments that uses TVM to assess whether the investment's expected rate of return is The cost of a long-term asset that has not yet been depreciated; it is not...

Most questions answered within 3 hours.

-

You capture data by having 8 people fill in 30 small dots on a

piece of...

asked 3 hours ago -

What are the z-values such that 70% of the area lies in the

middle of the...

asked 5 hours ago -

You borrow $29,500 to purchase a brand new car. The interest

rate is 6%, and the...

asked 5 hours ago -

The amount of time it takes an asteroid, whose average distance

from the Sun is 4.70...

asked 5 hours ago -

A 0.289 kg mass slides on a frictionless floor with a speed of

1.34 m/s. The...

asked 5 hours ago -

15.A box contains five red balls, three green balls, and two

yellow balls. Suppose you select...

asked 8 hours ago -

Assume you are given the following for Stackelberg industries:

Return on Assets (ROA) = 8%

Debt...

asked 6 hours ago -

an engineer proposes to use mmWave in 5G network to

increase data rate.

What are the...

asked 6 hours ago -

Explain the idea behind using SEMIJOIN in distributed

query processing.

asked 6 hours ago -

why

is context important in selecting and applying guidelines and

principles for interface design?

illustrate your...

asked 6 hours ago -

In a certain board game, a player rolls two fair six-sided dice

until the player rolls...

asked 8 hours ago -

You are going to deposit $3,200 in an account that pays .58

percent interest compounded quarterly....

asked 6 hours ago

10. Ierust Plus and decisions Suppose that a firm is facing an upward-sloping yield curve and needs to borrow money to invest in production. Does this mean that the firm should consider borrowing only at short-term rates? No, the firm needs to take the volatility of short-term rates into account. Yes, using short-term financing will give the firm the lowest possible interest rate over the life of the project. No, an upward-sloping yield curve means that the firm will get...

10. Ierust Plus and decisions Suppose that a firm is facing an upward-sloping yield curve and needs to borrow money to invest in production. Does this mean that the firm should consider borrowing only at short-term rates? No, the firm needs to take the volatility of short-term rates into account. Yes, using short-term financing will give the firm the lowest possible interest rate over the life of the project. No, an upward-sloping yield curve means that the firm will get...

When firms make capital budgeting decisions, they should concern themselves with incremental cash flows, not net income, when evaluating projects. To determine the incremental cash flows associated with a capital project, an analyst should include all of the following except: The project's financing costs The project's depreciation expense Changes in net working capital associated with the project The project's fixed-asset expenditures O Indirect cash flows often affect a firm's capital budgeting decisions. However, some of these indirect cash flows are...

When firms make capital budgeting decisions, they should concern themselves with incremental cash flows, not net income, when evaluating projects. To determine the incremental cash flows associated with a capital project, an analyst should include all of the following except: The project's financing costs The project's depreciation expense Changes in net working capital associated with the project The project's fixed-asset expenditures O Indirect cash flows often affect a firm's capital budgeting decisions. However, some of these indirect cash flows are...

23. Capital structure decisions refer to the: A. dividend yield of the firm's stock B. blend of equity and debe used by the fim C. capital gains available on the firms stock D. maturity date for the firm's securities 24. If the line measuring a stock's historic returns against the market's historic returns has a slope greater than 1.0, then the: A. stock is currently underpriced B, market risk peemium is increasing. C. stock has a significant amount of unique...

23. Capital structure decisions refer to the: A. dividend yield of the firm's stock B. blend of equity and debe used by the fim C. capital gains available on the firms stock D. maturity date for the firm's securities 24. If the line measuring a stock's historic returns against the market's historic returns has a slope greater than 1.0, then the: A. stock is currently underpriced B, market risk peemium is increasing. C. stock has a significant amount of unique...

Simply Cayenne Company: A Comprehensive Case In Measuring A Firm's Cost Of Capital (Boudreaux, D., S. Rao, and P. Das, 2014) THE CASE Patricia Hotard, the Chief Executive Officer of Simply Cayenne Refining and Processing Company (SCRPC), picked up the telephone to call Jimmy Breez, the firm's financial manager. Breez had sent her an email earlier that morning suggesting that the capital budgeting committee should get together prior to the scheduled Investment Decision Committee meeting that is in one week...

Simply Cayenne Company: A Comprehensive Case In Measuring A Firm's Cost Of Capital (Boudreaux, D., S. Rao, and P. Das, 2014) THE CASE Patricia Hotard, the Chief Executive Officer of Simply Cayenne Refining and Processing Company (SCRPC), picked up the telephone to call Jimmy Breez, the firm's financial manager. Breez had sent her an email earlier that morning suggesting that the capital budgeting committee should get together prior to the scheduled Investment Decision Committee meeting that is in one week...

One of the most important financial management activities that a firm undertakes is its evaluation and allocation of investment funds to support its future survival and growth. These activities may be motivated by the desire to expand the firm's revenues, reduce its costs, or satisfy its mandatory or voluntary legal, health, and safety requirements. They may have, more or less, multiyear effects on the organization and may or may not be considered as capital budgeting activities. Capital budgeting is the...

One of the most important financial management activities that a firm undertakes is its evaluation and allocation of investment funds to support its future survival and growth. These activities may be motivated by the desire to expand the firm's revenues, reduce its costs, or satisfy its mandatory or voluntary legal, health, and safety requirements. They may have, more or less, multiyear effects on the organization and may or may not be considered as capital budgeting activities. Capital budgeting is the...

choose the correct answer A-Capital Budgeting B-Cost of Capital C-Goal incongruence D-Net present value E-Gain on disposal (sale) F-Book value G-Payback method H-Loss on disposal (sale) Choose The rate of return used by a company to determine whether or not the expected return on a potential long-term A method of evaluating investments that uses TVM to assess whether the investment's expected rate of return is The cost of a long-term asset that has not yet been depreciated; it is not...

choose the correct answer A-Capital Budgeting B-Cost of Capital C-Goal incongruence D-Net present value E-Gain on disposal (sale) F-Book value G-Payback method H-Loss on disposal (sale) Choose The rate of return used by a company to determine whether or not the expected return on a potential long-term A method of evaluating investments that uses TVM to assess whether the investment's expected rate of return is The cost of a long-term asset that has not yet been depreciated; it is not...