Homework Answers

| Note payable and corresponding merchandise purchases would be recorded at present value of future amount payable. | |||||||||||

| In this case payments are made at year end and we need to calculate present value and thus we would use PVA of $1 table and PV table | |||||||||||

| Calculations are shown below | |||||||||||

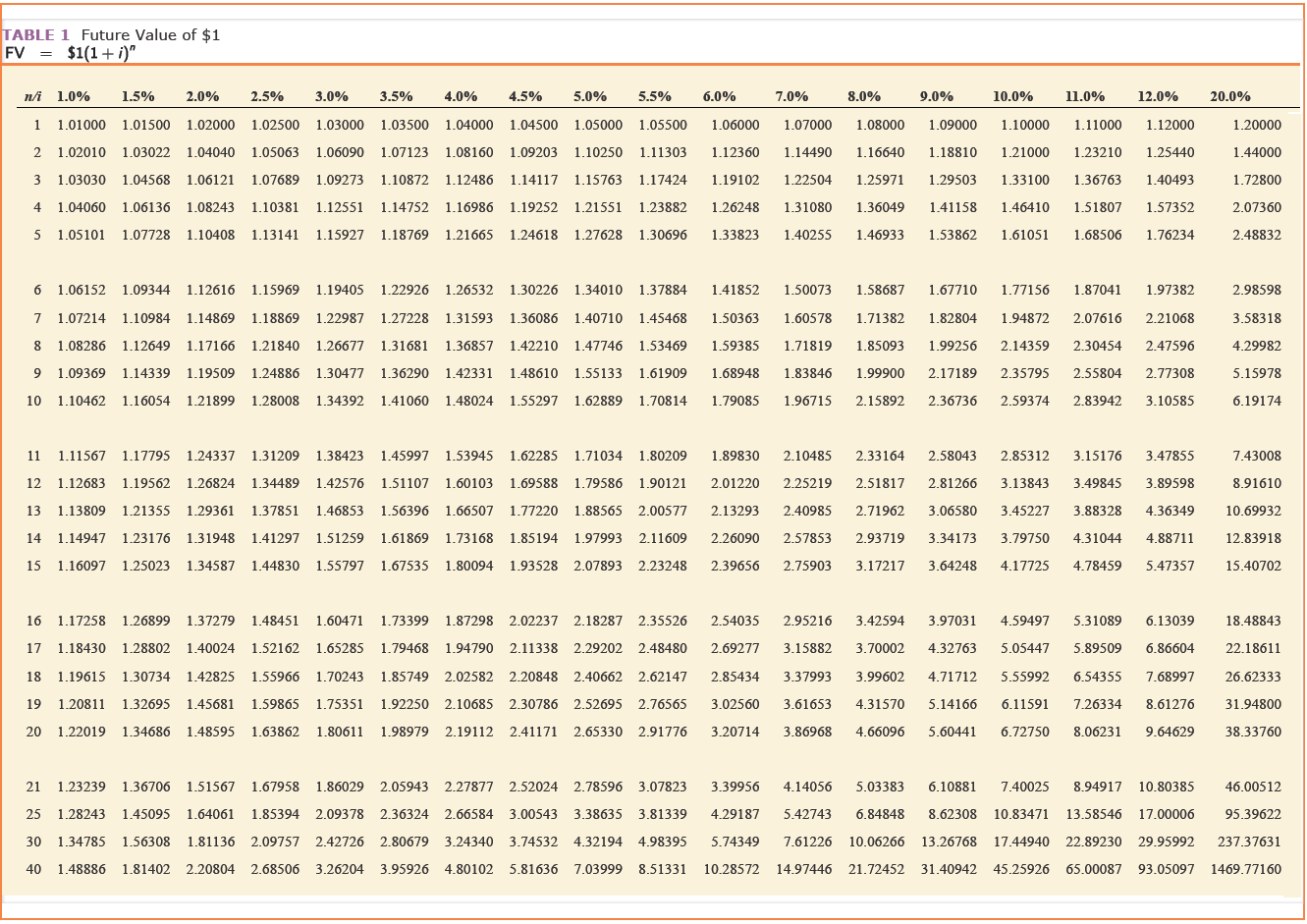

| Tables values are based on: | |||||||||||

| n= | 5 | ||||||||||

| i= | 9% | ||||||||||

| Cash flow | Amount | Present value | |||||||||

| Payments | 40000 | $155,586 | 40000*3.88965 | ||||||||

| Lump sum | 300000 | $194,979 | 300000*0.64993 | ||||||||

| Amount recorded | $350,565 | ||||||||||

| Present value of annuity payment is calculated using PVA of $1 table. In i=9% column, n=5 years would give discount factor of 3.88965 | |||||||||||

| Present value of lumpsum payment is calculated using PV of $1 table. In i=9% column, n=5 years would give discount factor of 0.64993 | |||||||||||

| Thus, amount would be recorded at $350,565. | |||||||||||

Add Answer to:

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $32,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $220,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $32,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $220,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2020, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing...

On January 1, 2020, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $31,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $210,000 on December 31, 2025. An 11% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $33,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $230,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. Required: Calculate the amount at which Barrett should record the note payable and corresponding merchandise purchased on January 1, 2021. Table value are based...

Problem 5-9 (Algo) Noninterest-bearing note; annuity and lump-sum payment [LO5-3, 5-8] On January 1, 2021, The...

Problem 5-9 (Algo) Noninterest-bearing note; annuity and lump-sum payment [LO5-3, 5-8] On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $21,000 on each December 31 beginning on December 31, 2021, and a lump sum payment of $110,000 on December 31, 2025. An 11% interest rate properly reflects the time value of money in this situation. ((FV of $1. PV of $1. FVA of $1. PVA of $1....

Problem 5-9 (Algo) Noninterest-bearing note; annuity and lump-sum payment [LO5-3, 5-8] On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $21,000 on each December 31 beginning on December 31, 2021, and a lump sum payment of $110,000 on December 31, 2025. An 11% interest rate properly reflects the time value of money in this situation. ((FV of $1. PV of $1. FVA of $1. PVA of $1....

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $4,200 on each September 30, beginning on September 30, 2024. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar amount.) Required: Calculate the amount at which...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $7,200 on each September 30, beginning on September 30, 2024. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar amount.) Required: Calculate the amount at which...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $7,600 on each September 30, beginning on September 30, 2024. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar amount.) Required: Calculate the amount at which...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2018. Payment was made in the...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2018. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $6,400 on each September 30, beginning on September 30, 2021. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at which Lincoln should record the note payable and corresponding purchases...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2018. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $6,400 on each September 30, beginning on September 30, 2021. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at which Lincoln should record the note payable and corresponding purchases...

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

The Field Detergent Company sold merchandise to the Abel Company on June 30, 2021. Payment was...

The Field Detergent Company sold merchandise to the Abel Company on June 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Abel to pay $85,000 on June 30, 2023. Assume that a 10% interest rate properly reflects the time value of money in this situation. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at...

The Field Detergent Company sold merchandise to the Abel Company on June 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Abel to pay $85,000 on June 30, 2023. Assume that a 10% interest rate properly reflects the time value of money in this situation. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at...

Most questions answered within 3 hours.

-

Design a series of crosses in which you can tell a fly with a

lobe allele,...

asked 2 minutes ago -

Write a java program that allows the user to input 20 double

type numbers to an...

asked 10 minutes ago -

A box of mass m = 2.00 kg is positioned on a ramp at an angle...

asked 13 minutes ago -

Wheel A has three times the moment of inertia about its axis of

rotation as wheel...

asked 18 minutes ago -

A boy pulls a 20.0-kg box with a 160-N force at 39° above a

horizontal surface....

asked 18 minutes ago -

Determine if a 10-ft. long 6 x14 beam is adequate to support a

dead load wD=...

asked 20 minutes ago -

A distribution of values is normal with a mean of 157.8 and a

standard deviation of...

asked 49 minutes ago -

Suppose the demand for crossing the Brooklyn Bridge is given by

Q = 10,000 - 1000P....

asked 53 minutes ago -

Assume that we are in a Heckscher Ohlin world: 2 Two countries:

Home (H) and Foreign...

asked 54 minutes ago -

A nationally known supermarket decided to promote its own brand

of soft drinks on TV for...

asked 1 hour ago -

A bond issued by IBM on December 1, 1996, is scheduled to mature

on December 1,...

asked 1 hour ago -

Answer questions 17-19 below using the following information: A

firm is producing in the short-run (with...

asked 1 hour ago

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $32,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $220,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $32,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $220,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

Problem 5-9 (Algo) Noninterest-bearing note; annuity and lump-sum payment [LO5-3, 5-8] On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $21,000 on each December 31 beginning on December 31, 2021, and a lump sum payment of $110,000 on December 31, 2025. An 11% interest rate properly reflects the time value of money in this situation. ((FV of $1. PV of $1. FVA of $1. PVA of $1....

Problem 5-9 (Algo) Noninterest-bearing note; annuity and lump-sum payment [LO5-3, 5-8] On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $21,000 on each December 31 beginning on December 31, 2021, and a lump sum payment of $110,000 on December 31, 2025. An 11% interest rate properly reflects the time value of money in this situation. ((FV of $1. PV of $1. FVA of $1. PVA of $1....

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2018. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $6,400 on each September 30, beginning on September 30, 2021. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at which Lincoln should record the note payable and corresponding purchases...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2018. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $6,400 on each September 30, beginning on September 30, 2021. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at which Lincoln should record the note payable and corresponding purchases...

The Field Detergent Company sold merchandise to the Abel Company on June 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Abel to pay $85,000 on June 30, 2023. Assume that a 10% interest rate properly reflects the time value of money in this situation. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at...

The Field Detergent Company sold merchandise to the Abel Company on June 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Abel to pay $85,000 on June 30, 2023. Assume that a 10% interest rate properly reflects the time value of money in this situation. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at...