Homework Answers

We are required to calculate present values as on January 1,2021.

Annual payments of $21,000 each are to be made on every December 31, beginning December 31,2021 and going up to December 31,2025.

So, this is an ordinary annuity of $21,000 for a period of 5 years (n=5).Further, interest rate is given as 11% (i=11%)

Further, at the end of 5 years, on December 31,2025, a lumpsum of $110,000 is payable. Here also, n=5 years, i = 11%

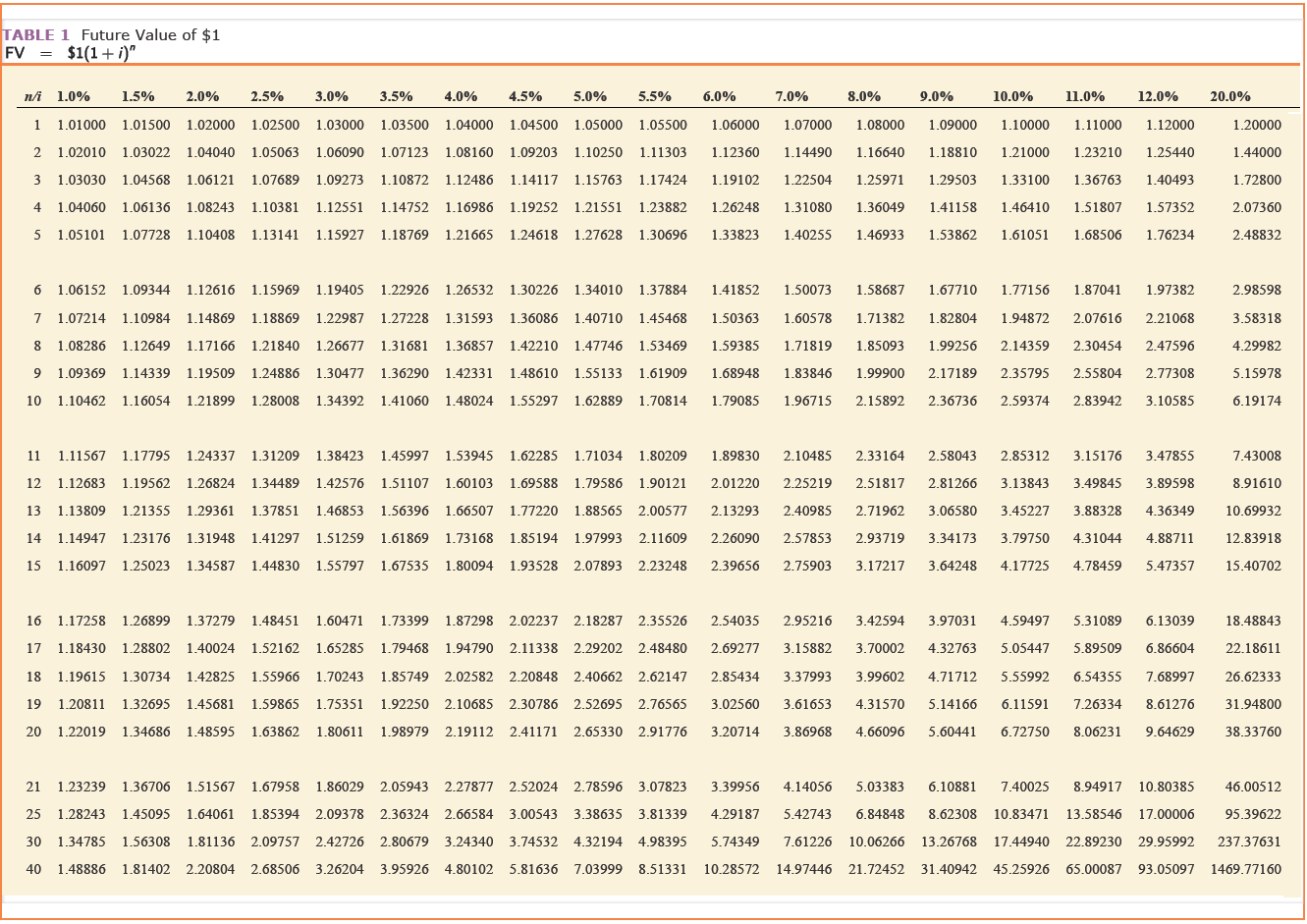

Now, using the present value tables, we get Present value interest factor for an ordinary annuity(PVIFA) at i=11% and n=5 as 3.696, and Present value interest factor (PVIF) for lumpsum at i=11% for n=5 years as 0.593.

So, present value of five payments = $21,000 * 3.696 = $77,616

Present value of lumpsum = $110,000 * 0.593 = $65,230

So, total present value of liability = $77,616 + $65,230 = $142,846

Therefore,

|

Table values are based on: |

||

|

n= |

5 |

|

|

i= |

11% |

|

|

Cash Flow |

Amount |

Present value |

|

Payments |

$21,000 |

$77,616 |

|

Lumpsum |

$110,000 |

$65,230 |

|

Amount recorded total |

$142,846 |

Add Answer to:

Problem 5-9 (Algo) Noninterest-bearing note; annuity and lump-sum payment [LO5-3, 5-8] On January 1, 2021, The...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $40,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $300,000 on December 31, 2025. A 9% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $40,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $300,000 on December 31, 2025. A 9% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $32,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $220,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $32,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $220,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2020, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing...

On January 1, 2020, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $31,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $210,000 on December 31, 2025. An 11% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $33,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $230,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. Required: Calculate the amount at which Barrett should record the note payable and corresponding merchandise purchased on January 1, 2021. Table value are based...

Exercise 5-11 (Algo) Deferred annuities [LO5-8] Lincoln Company purchased merchandise from Grandville Corp. on September 30,...

Exercise 5-11 (Algo) Deferred annuities [LO5-8] Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $8,000 on each September 30, beginning on September 30, 2024. (FV of $1. PV of $1. FVA of S1, PVA of $1. EVAD of $1 and PVAD of S1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar amount.)...

Exercise 5-11 (Algo) Deferred annuities [LO5-8] Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $8,000 on each September 30, beginning on September 30, 2024. (FV of $1. PV of $1. FVA of S1, PVA of $1. EVAD of $1 and PVAD of S1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar amount.)...

Check my work View previous attempt Exercise 5-11 (Algo) Deferred annuities (LO5-8] points Lincoln Company purchased...

Check my work View previous attempt Exercise 5-11 (Algo) Deferred annuities (LO5-8] points Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $7,800 on each September 30, beginning on September 30, 2024. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your...

Check my work View previous attempt Exercise 5-11 (Algo) Deferred annuities (LO5-8] points Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $7,800 on each September 30, beginning on September 30, 2024. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your...

CO Exercise 5-11 (Algo) Deferred annuities (LO5-8) Lincoln Company purchased merchandise from Grandville Corp. on September...

CO Exercise 5-11 (Algo) Deferred annuities (LO5-8) Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $5.600 on each September 30, beginning on September 30. 2024. (FV or $1. PV or $1. EVA of S1. PVA OR $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar...

CO Exercise 5-11 (Algo) Deferred annuities (LO5-8) Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $5.600 on each September 30, beginning on September 30. 2024. (FV or $1. PV or $1. EVA of S1. PVA OR $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar...

Problem 10-12 (Algo) Acquisition costs; lump-sum acquisition; noninterest-bearing note; Interest capitalization (LO10-1, 10-2, 10-3, 10-7] Early...

Problem 10-12 (Algo) Acquisition costs; lump-sum acquisition; noninterest-bearing note; Interest capitalization (LO10-1, 10-2, 10-3, 10-7] Early in its fiscal year ending December 31, 2021, San Antonio Outfitters finalized plans to expand operations. The first stage was completed on March 28 with the purchase of a tract of land on the outskirts of the city. The land and existing building were purchased by paying $310.000 immediately and signing a noninterest-bearing note requiring the company to pay $710.000 on March 28, 2023....

Problem 10-12 (Algo) Acquisition costs; lump-sum acquisition; noninterest-bearing note; Interest capitalization (LO10-1, 10-2, 10-3, 10-7] Early in its fiscal year ending December 31, 2021, San Antonio Outfitters finalized plans to expand operations. The first stage was completed on March 28 with the purchase of a tract of land on the outskirts of the city. The land and existing building were purchased by paying $310.000 immediately and signing a noninterest-bearing note requiring the company to pay $710.000 on March 28, 2023....

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $4,200 on each September 30, beginning on September 30, 2024. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar amount.) Required: Calculate the amount at which...

Most questions answered within 3 hours.

-

C++ program 2D array of intergers

Initialize the 2-D array of integers detailed

below.

{ 25,...

asked 1 minute ago -

What is the difference between a shift of the

supply/demand and move along the supply/demand line?...

asked 3 minutes ago -

Find the demand equation using the given information. (Let

x be the number of items.)

A...

asked 17 minutes ago -

Calculate the rate constant k for the reaction at the

temperatures of 50.0°C & 60.0°C. By...

asked 24 minutes ago -

You have a data file with 2 columns of data (One control and One

experimental). One...

asked 32 minutes ago -

4. Here is a function that is either a demand function or a

supply function (but...

asked 42 minutes ago -

c++

modify the attached unsorted linked list class into a sorted linked

list class

#include <iostream>...

asked 47 minutes ago -

True or False : If we believe that the effect of advertising for

a vacation resort...

asked 1 hour ago -

Observer A stands at the top of the cliff and throws a ball

straight upwards with...

asked 1 hour ago -

Witness Manufacturing produces two types of cameras: 35mm and

digital. The cameras are produced using one...

asked 1 hour ago -

For the net cash flow

series, find the external rate of return (EROR) using the MIRR...

asked 1 hour ago -

The United States has a population of 327 million and has 206

million people that are...

asked 1 hour ago

![Problem 5-9 (Algo) Noninterest-bearing note; annuity and lump-sum payment [LO5-3, 5-8] On January 1, 2021, The Barrett Compan](http://img.homeworklib.com/questions/4be58790-136c-11eb-953e-3bcb270aa335.png?x-oss-process=image/resize,w_560)

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $40,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $300,000 on December 31, 2025. A 9% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $40,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $300,000 on December 31, 2025. A 9% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $32,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $220,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $32,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $220,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

Exercise 5-11 (Algo) Deferred annuities [LO5-8] Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $8,000 on each September 30, beginning on September 30, 2024. (FV of $1. PV of $1. FVA of S1, PVA of $1. EVAD of $1 and PVAD of S1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar amount.)...

Exercise 5-11 (Algo) Deferred annuities [LO5-8] Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $8,000 on each September 30, beginning on September 30, 2024. (FV of $1. PV of $1. FVA of S1, PVA of $1. EVAD of $1 and PVAD of S1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar amount.)...

Check my work View previous attempt Exercise 5-11 (Algo) Deferred annuities (LO5-8] points Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $7,800 on each September 30, beginning on September 30, 2024. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your...

Check my work View previous attempt Exercise 5-11 (Algo) Deferred annuities (LO5-8] points Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $7,800 on each September 30, beginning on September 30, 2024. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your...

CO Exercise 5-11 (Algo) Deferred annuities (LO5-8) Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $5.600 on each September 30, beginning on September 30. 2024. (FV or $1. PV or $1. EVA of S1. PVA OR $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar...

CO Exercise 5-11 (Algo) Deferred annuities (LO5-8) Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $5.600 on each September 30, beginning on September 30. 2024. (FV or $1. PV or $1. EVA of S1. PVA OR $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar...

Problem 10-12 (Algo) Acquisition costs; lump-sum acquisition; noninterest-bearing note; Interest capitalization (LO10-1, 10-2, 10-3, 10-7] Early in its fiscal year ending December 31, 2021, San Antonio Outfitters finalized plans to expand operations. The first stage was completed on March 28 with the purchase of a tract of land on the outskirts of the city. The land and existing building were purchased by paying $310.000 immediately and signing a noninterest-bearing note requiring the company to pay $710.000 on March 28, 2023....

Problem 10-12 (Algo) Acquisition costs; lump-sum acquisition; noninterest-bearing note; Interest capitalization (LO10-1, 10-2, 10-3, 10-7] Early in its fiscal year ending December 31, 2021, San Antonio Outfitters finalized plans to expand operations. The first stage was completed on March 28 with the purchase of a tract of land on the outskirts of the city. The land and existing building were purchased by paying $310.000 immediately and signing a noninterest-bearing note requiring the company to pay $710.000 on March 28, 2023....