On January 1, 2020, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing...

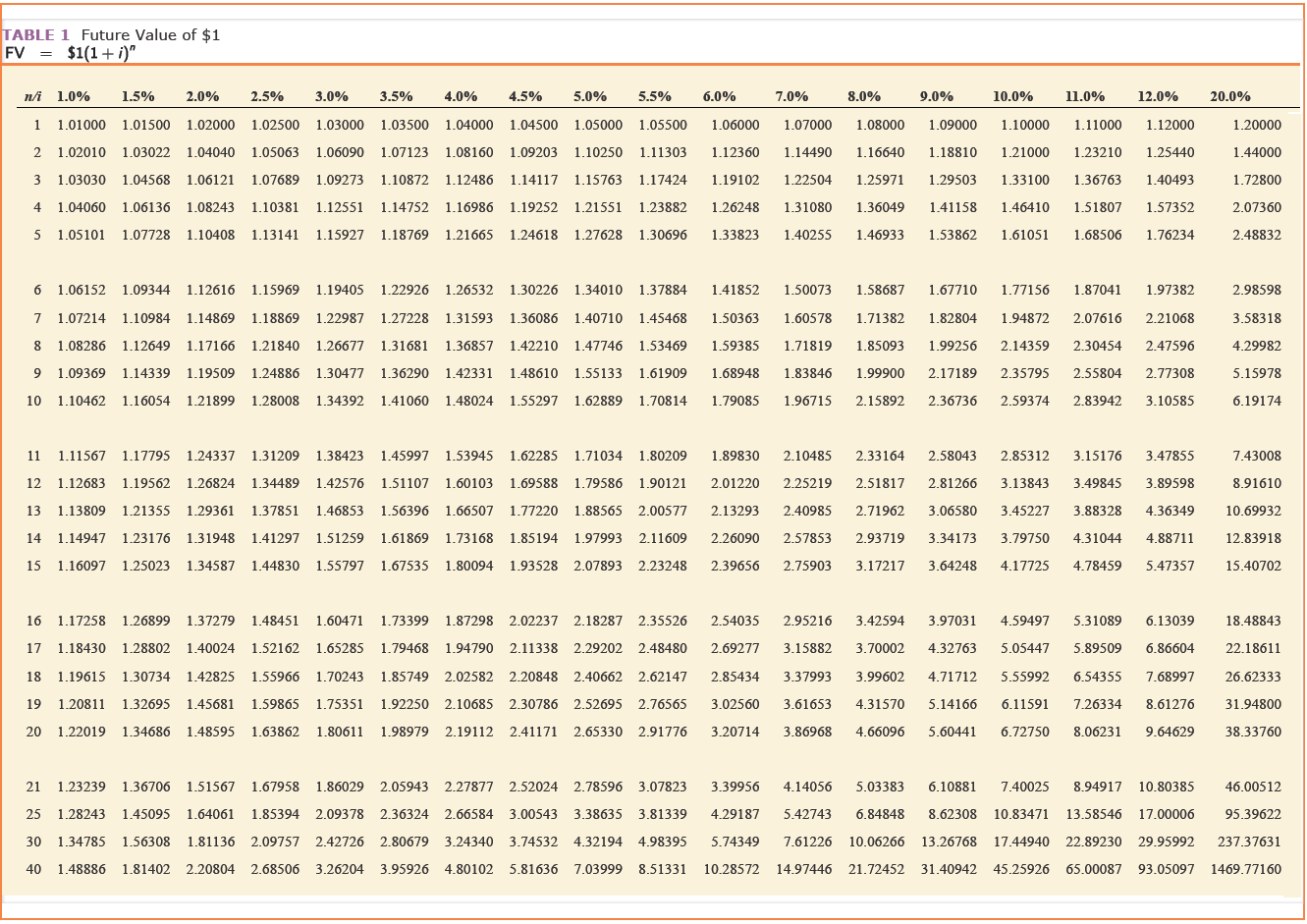

On January 1, 2020, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $31,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $210,000 on December 31, 2025. An 11% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required: Calculate the amount at which Barrett should record the note payable and corresponding merchandise purchased on January 1, 2021. (Round your final answer to nearest whole dollar amount.)

Homework Answers

| Computation of Amount of Note payable | |

| Five Annual Payment | $31,000 |

| PV of annuity of $1, n=0-4, i=11% | 4.1024 |

| Present value of Annual Payment (a) | $127,174 |

| Lump sump payment | $210,000 |

| Pvif@ 11% at end of 5 year | 0.6587 |

| Present value of Lump Sum Payment (b) | $138,327 |

|

Amount of Note Payable to be recorded (a+b) |

$265,501 |

Add Answer to:

On January 1, 2020, The Barrett Company purchased merchandise

from a supplier. Payment was a noninterest-bearing...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $40,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $300,000 on December 31, 2025. A 9% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $40,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $300,000 on December 31, 2025. A 9% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $32,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $220,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $32,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $220,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $33,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $230,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. Required: Calculate the amount at which Barrett should record the note payable and corresponding merchandise purchased on January 1, 2021. Table value are based...

Problem 5-9 (Algo) Noninterest-bearing note; annuity and lump-sum payment [LO5-3, 5-8] On January 1, 2021, The...

Problem 5-9 (Algo) Noninterest-bearing note; annuity and lump-sum payment [LO5-3, 5-8] On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $21,000 on each December 31 beginning on December 31, 2021, and a lump sum payment of $110,000 on December 31, 2025. An 11% interest rate properly reflects the time value of money in this situation. ((FV of $1. PV of $1. FVA of $1. PVA of $1....

Problem 5-9 (Algo) Noninterest-bearing note; annuity and lump-sum payment [LO5-3, 5-8] On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $21,000 on each December 31 beginning on December 31, 2021, and a lump sum payment of $110,000 on December 31, 2025. An 11% interest rate properly reflects the time value of money in this situation. ((FV of $1. PV of $1. FVA of $1. PVA of $1....

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2018. Payment was made in the...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2018. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $6,400 on each September 30, beginning on September 30, 2021. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at which Lincoln should record the note payable and corresponding purchases...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2018. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $6,400 on each September 30, beginning on September 30, 2021. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at which Lincoln should record the note payable and corresponding purchases...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $4,200 on each September 30, beginning on September 30, 2024. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar amount.) Required: Calculate the amount at which...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $7,200 on each September 30, beginning on September 30, 2024. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar amount.) Required: Calculate the amount at which...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $7,600 on each September 30, beginning on September 30, 2024. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answer to nearest whole dollar amount.) Required: Calculate the amount at which...

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

The Field Detergent Company sold merchandise to the Abel Company on June 30, 2021. Payment was...

The Field Detergent Company sold merchandise to the Abel Company on June 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Abel to pay $85,000 on June 30, 2023. Assume that a 10% interest rate properly reflects the time value of money in this situation. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at...

The Field Detergent Company sold merchandise to the Abel Company on June 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Abel to pay $85,000 on June 30, 2023. Assume that a 10% interest rate properly reflects the time value of money in this situation. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at...

Most questions answered within 3 hours.

-

The mass spectrum of an organic compound shows the relative

abundances of M to be 53.76%...

asked 16 minutes ago -

Coca Cola’s strategy of “think local, act local” represents a

__________ approach.

Question options:

1)

transnational...

asked 36 minutes ago -

which of the following is not a category of project management

risk?

a) external

b) internal...

asked 1 hour ago -

Focus on Critical Thinking: Are citizen suit provisions an

effective way to achieve environmental objectives? Do...

asked 1 hour ago -

Gaseous butane CH3CH22CH3 will react with gaseous oxygen O2 to

produce gaseous carbon dioxide CO2 and...

asked 2 hours ago -

Required to construct counters using synchronous sequential

logic. Use one hex digit to display the result....

asked 2 hours ago -

(Ultra) Large-Scale Systems –Characteristics?

explain in detail

How the nature of an enterprise affect complex...

asked 2 hours ago -

Some of the antibiotic susceptible strains show colonies within

the clear zone. What it does this...

asked 2 hours ago -

In the lottery game Fantasy 5 you have to select 5 numbers from

the numbers {1,2,3,.......,38,39}....

asked 2 hours ago -

A call option on Jupiter Motors stock with an exercise price of

$80 and one-year expiration...

asked 2 hours ago -

What is the disadvantage of an automated vulnerability scan tool

like Nessus?

prone to false negatives...

asked 2 hours ago -

An Atwood’s machine has m1 = 0.105 kg, m2 = 0.100 kg, hung from

a 5.00...

asked 2 hours ago

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $40,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $300,000 on December 31, 2025. A 9% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $40,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $300,000 on December 31, 2025. A 9% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $32,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $220,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $32,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $220,000 on December 31, 2025. A 12% interest rate properly reflects the time value of money in this situation. ((FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the...

Problem 5-9 (Algo) Noninterest-bearing note; annuity and lump-sum payment [LO5-3, 5-8] On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $21,000 on each December 31 beginning on December 31, 2021, and a lump sum payment of $110,000 on December 31, 2025. An 11% interest rate properly reflects the time value of money in this situation. ((FV of $1. PV of $1. FVA of $1. PVA of $1....

Problem 5-9 (Algo) Noninterest-bearing note; annuity and lump-sum payment [LO5-3, 5-8] On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $21,000 on each December 31 beginning on December 31, 2021, and a lump sum payment of $110,000 on December 31, 2025. An 11% interest rate properly reflects the time value of money in this situation. ((FV of $1. PV of $1. FVA of $1. PVA of $1....

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2018. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $6,400 on each September 30, beginning on September 30, 2021. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at which Lincoln should record the note payable and corresponding purchases...

Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2018. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $6,400 on each September 30, beginning on September 30, 2021. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at which Lincoln should record the note payable and corresponding purchases...

The Field Detergent Company sold merchandise to the Abel Company on June 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Abel to pay $85,000 on June 30, 2023. Assume that a 10% interest rate properly reflects the time value of money in this situation. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at...

The Field Detergent Company sold merchandise to the Abel Company on June 30, 2021. Payment was made in the form of a noninterest-bearing note requiring Abel to pay $85,000 on June 30, 2023. Assume that a 10% interest rate properly reflects the time value of money in this situation. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at...