What is the NPV and IRR of this project?

ABC MANUFACTURING INC.

ABC Manufacturing Inc., a firm based in California has spent $750,000 to develop a new,

efficient vacuum cleaner. The firm has also spent another $250,000 on market research to

estimate possible sales of this new vacuum, and the market research firm has given them the

following figures:

Year 1 – 60,000 units

Year 2 – 100,000 units

Year 3 – 150,000 units

Year 4 – 70,000 units

Year 5 – 50,000 units

The variable costs of manufacturing are $175 per unit in year 1 and the fixed costs of operations

are $3.5 million a year. The sales price per unit will be $475 per unit in year 1. Both sales price

and variable costs are estimated to increase by 5% (rounded off to the nearest whole dollar). The

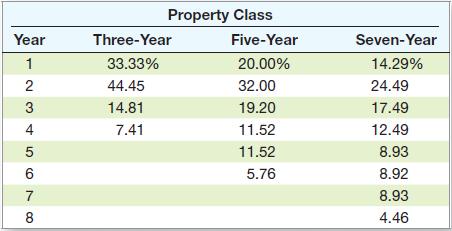

necessary equipment can be purchased for $30 million and will be depreciated on a seven-year

MACRS schedule. The salvage value at the end of 5 years is believed to be $5 million. Initial net

working capital is $4 million to start – and will be 20% of sales for each year from years 2

through 5, to be budgeted for at the end of the previous year. ABC has a 35% corporate tax rate

and a 12% required rate of return.

NOTE: This is an EXCEL-based task – BOTH tasks must be submitted as Excel uploads in the

respective drop box; in Task 2 please create separate sheets for questions 1 and 2.

For Task 1:

1. What is the NPV of this project?

2. What is the IRR of this project?

3. Should ABC produce this vacuum cleaner?

For Task 2:

1. How sensitive is the NPV to changes in the price per unit of this vacuum?

2. How sensitive is the NPV to changes in the quantity sold of this vacuum?

3. Should ABC produce this vacuum cleaner, given 1 and 2 above?

Homework Answers

Request Answer!

We need at least 7 more requests to produce the answer.

3 / 10 have requested this problem solution

The more requests, the faster the answer.

What is the NPV and IRR of this project?

ABC Manufacturing Inc., a firm based in California has spent $750,000 to develop a new,efficient vacuum cleaner. The firm has also spent another $250,000 on market research toestimate possible sales of this new vacuum, and the market research firm has given them thefollowing figures:Year 1 – 60,000 unitsYear 2 – 100,000 unitsYear 3 – 150,000 unitsYear 4 – 70,000 unitsYear 5 – 50,000 unitsThe variable costs of manufacturing are $175 per unit in year 1 and the fixed costs of...

NPV, IRR

Fairweather Company has decided to sell an improved design of surf boards. The boards will sell for $790 per set and have a variable cost of $390 per set. The company has spent $149,000 for a marketing study that determined the company will sell 53,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 9,400 sets of its high-priced boards. The high-priced boards sell at $1,090 and have variable costs of $690....

Please help me find the Cash Flow,NPV and IRR Assumptions Advertising Increase Per Year $2,000,000 Capital...

Please help me find the Cash Flow,NPV and IRR

Assumptions Advertising Increase Per Year $2,000,000 Capital Expenditures $4,000,000 One-Time Development Expenses $1,500,000 5-Year Depreciation Schedule Discount Rate 8% Tax 40% Base Case Cannibalization (Basic) 15%% Base Case Cannibalization (Premium) |(50% + 60%/2) = 55% Base Case Cannibalization (Advanced)|(65% + 75% /2) = 70% Base Case Marketing Per Year 6,000,000 Premium Product Basic Product Exhibit 6 Gross Profit Comparison Advanced Seal Per unit revenue and costs Revenue $22 Cost of goods...

Please help me find the Cash Flow,NPV and IRR

Assumptions Advertising Increase Per Year $2,000,000 Capital Expenditures $4,000,000 One-Time Development Expenses $1,500,000 5-Year Depreciation Schedule Discount Rate 8% Tax 40% Base Case Cannibalization (Basic) 15%% Base Case Cannibalization (Premium) |(50% + 60%/2) = 55% Base Case Cannibalization (Advanced)|(65% + 75% /2) = 70% Base Case Marketing Per Year 6,000,000 Premium Product Basic Product Exhibit 6 Gross Profit Comparison Advanced Seal Per unit revenue and costs Revenue $22 Cost of goods...

EMU Electronics

Emu Electronics is an electronics manufacturer located in Box Hill, Victoria. The company’s managing director is Shelly Chan, who inherited the company from her father. The company originally repaired radios and other household appliances when it was founded more than 50 years ago. Over the years, the company has expanded, and it is now a reputable manufacturer of various specialty electronic items. Robert McCanless, a recent MBA graduate, has been hired by the company in the finance department.One of the...

a. What is the profitability index of the project? 1.30 b. What is the IRR of the proje...

a.

What is the profitability index of the project?

1.30

b.

What is the IRR of the project?

28.31%

c.

What is the NPV of the project?

$ 18,096,790.85

d.

How sensitive is the NPV to changes in the price of the new

PDA?

e.

How sensitive is the NPV to changes in the quantity sold?

I want to make sure a b and c are correct and need d and e

$ Equipment Pretax salvage value $ R&D 32,500,000...

a.

What is the profitability index of the project?

1.30

b.

What is the IRR of the project?

28.31%

c.

What is the NPV of the project?

$ 18,096,790.85

d.

How sensitive is the NPV to changes in the price of the new

PDA?

e.

How sensitive is the NPV to changes in the quantity sold?

I want to make sure a b and c are correct and need d and e

$ Equipment Pretax salvage value $ R&D 32,500,000...

EMU ELECTRONICS Emu Electronics is an electronics manufacturer located in Box Hill, Victoria. The company’s managing...

EMU ELECTRONICS Emu Electronics is an electronics manufacturer located in Box Hill, Victoria. The company’s managing director is Shelly Chan, who inherited the company from her father. The company originally repaired radios and other household appliances when it was founded more than 50 years ago. Over the years, the company has expanded, and it is now a reputable manufacturer of various specialty electronic items. Robert McCanless, a recent graduate, has been hired by the company in the finance department. One...

NPV/IRR

Aria Acoustics, Inc. (AAI), projects unit sales for a new seven-octave voice emulation implant as follows: YearUnit Sales174,800287,8003107,250499,700568,200 Production of the implants will require $1,950,000 in net working capital to start and additional net working capital investments each year equal to 20 percent of the projected sales increase for the following year. Total fixed costs are $4,100,000 per year, variable production costs are $264 per unit, and the units are priced at $402 each. The equipment needed to begin production has an...

Aria Acoustics, Inc. (AAI), projects unit sales for a new seven-octave voice emulation implant as follows: YearUnit Sales174,800287,8003107,250499,700568,200 Production of the implants will require $1,950,000 in net working capital to start and additional net working capital investments each year equal to 20 percent of the projected sales increase for the following year. Total fixed costs are $4,100,000 per year, variable production costs are $264 per unit, and the units are priced at $402 each. The equipment needed to begin production has an...

(Please show work on excel) We are evaluating a project that costs $1,68 million has a...

(Please show work on excel) We are evaluating a project that costs $1,68 million has a six-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 90,000 units per year. Price per unit is $37.95, variable cost per unit is $23.20, and fixed costs are $815,000 per year. The tax rate is 21 percent, and we require a return of 11 percent on this project. Calculate...

NPV & IRR case

Later, the company is considering the purchase of machinery and equipment to set up a line to produce a combination washer-dryer. They have given you the following information to analyze the project on a 5-year timeline: Initial cash outlay is $150,000, no residual value.Sales price is expected to be $2,250 per unit, with $595 per unit in labor expense and $795 per unit in materials.Direct fixed costs are estimated to run $20,750 per month.Cost of capital is 8%, and the required...

Scenario Analysis Consider a 4-year project with the following information. Initial investment = $420,000; straight-lin...

Scenario Analysis

Consider a 4-year project with the following information. Initial investment = $420,000; straight-line depreciation over the 4-year life No salvage value Quantity sold = 110,000 units Price per unit = $23 Tax rate = 34 percent Variable costs per unit = $19 Discount rate = 10 percent Fixed costs = $190,000 1. How sensitive is OCF to changes in quantity sold? ii. How sensitive is NPV to changes in quantity sold?

Scenario Analysis

Consider a 4-year project with the following information. Initial investment = $420,000; straight-line depreciation over the 4-year life No salvage value Quantity sold = 110,000 units Price per unit = $23 Tax rate = 34 percent Variable costs per unit = $19 Discount rate = 10 percent Fixed costs = $190,000 1. How sensitive is OCF to changes in quantity sold? ii. How sensitive is NPV to changes in quantity sold?

Most questions answered within 3 hours.

-

The equation for a firm’s short-run total cost is STC = 10 + 5q

+ 0.1q^2....

asked 2 minutes ago -

How can a cell gain energy while folding proteins in

the periplasm?

asked 14 minutes ago -

Let X~UNIF(0,1), and Y=-lnX. Then what is the density function

of Y where nonzero?

asked 15 minutes ago -

For the following Motivational Theories, please pick ONE THEORY

to answer the following 2 questions. (10...

asked 22 minutes ago -

What is the energy change when the temperature of 11.7 grams

of gaseous xenon is decreased...

asked 25 minutes ago -

The probability of buying a movie ticket with a popcorn coupon

is 0.608. If you buy...

asked 27 minutes ago -

Suppose you earned a $335,000 bonus this year and invested it at

8.25% per year. How...

asked 31 minutes ago -

The following are body mass index (BMI) scores measured in 12

patients who are free of...

asked 37 minutes ago -

How would I go about fully explaining this essay

question, as well as what would be...

asked 34 minutes ago -

Soft Touch Company was started several years ago by two golf

instructors. The company’s comparative balance...

asked 36 minutes ago -

What difference might it make if the records you are sorting

are very large or very...

asked 35 minutes ago -

1) Solid potassium carbonate is slowly added to 150 mL of a

0.0546 M nickel(II) acetate...

asked 42 minutes ago

Please help me find the Cash Flow,NPV and IRR

Assumptions Advertising Increase Per Year $2,000,000 Capital Expenditures $4,000,000 One-Time Development Expenses $1,500,000 5-Year Depreciation Schedule Discount Rate 8% Tax 40% Base Case Cannibalization (Basic) 15%% Base Case Cannibalization (Premium) |(50% + 60%/2) = 55% Base Case Cannibalization (Advanced)|(65% + 75% /2) = 70% Base Case Marketing Per Year 6,000,000 Premium Product Basic Product Exhibit 6 Gross Profit Comparison Advanced Seal Per unit revenue and costs Revenue $22 Cost of goods...

Please help me find the Cash Flow,NPV and IRR

Assumptions Advertising Increase Per Year $2,000,000 Capital Expenditures $4,000,000 One-Time Development Expenses $1,500,000 5-Year Depreciation Schedule Discount Rate 8% Tax 40% Base Case Cannibalization (Basic) 15%% Base Case Cannibalization (Premium) |(50% + 60%/2) = 55% Base Case Cannibalization (Advanced)|(65% + 75% /2) = 70% Base Case Marketing Per Year 6,000,000 Premium Product Basic Product Exhibit 6 Gross Profit Comparison Advanced Seal Per unit revenue and costs Revenue $22 Cost of goods...

a.

What is the profitability index of the project?

1.30

b.

What is the IRR of the project?

28.31%

c.

What is the NPV of the project?

$ 18,096,790.85

d.

How sensitive is the NPV to changes in the price of the new

PDA?

e.

How sensitive is the NPV to changes in the quantity sold?

I want to make sure a b and c are correct and need d and e

$ Equipment Pretax salvage value $ R&D 32,500,000...

a.

What is the profitability index of the project?

1.30

b.

What is the IRR of the project?

28.31%

c.

What is the NPV of the project?

$ 18,096,790.85

d.

How sensitive is the NPV to changes in the price of the new

PDA?

e.

How sensitive is the NPV to changes in the quantity sold?

I want to make sure a b and c are correct and need d and e

$ Equipment Pretax salvage value $ R&D 32,500,000...

Scenario Analysis

Consider a 4-year project with the following information. Initial investment = $420,000; straight-line depreciation over the 4-year life No salvage value Quantity sold = 110,000 units Price per unit = $23 Tax rate = 34 percent Variable costs per unit = $19 Discount rate = 10 percent Fixed costs = $190,000 1. How sensitive is OCF to changes in quantity sold? ii. How sensitive is NPV to changes in quantity sold?

Scenario Analysis

Consider a 4-year project with the following information. Initial investment = $420,000; straight-line depreciation over the 4-year life No salvage value Quantity sold = 110,000 units Price per unit = $23 Tax rate = 34 percent Variable costs per unit = $19 Discount rate = 10 percent Fixed costs = $190,000 1. How sensitive is OCF to changes in quantity sold? ii. How sensitive is NPV to changes in quantity sold?