Nathan has a loan of $6000 to repay, with an interest rate of 8% compounded monthly....

Nathan has a loan of $6000 to repay, with an interest rate of 8% compounded monthly. Nathan planned to make $150 payments at the end of each month to repay his loan, but is considering only $100 per month. How many additional months will it take to repay the loan if he pays $100 per month instead of $150?

(Hint: Round each term in months up to a whole number before finding the difference.)

Homework Answers

Answer-

Loan amount to be repaid = PV = $ 6000

FVuture Value = $ 0

Interest rate = YTM = 8 % compounded monthly

YTM = 8 % / 12 = 0.667

Using financial calculator we input the values

Payments = PMT = $ 150

Number of months = N = ?

N = 46.68 months = 47 months

Payments = PMT = $100

Number of months = N =?

N = 76.89 months = 77 months

Therefore the additional months it will take to repay

the loan if he pays $100 per month instead of $150

= 77 months - 47 months = 30 months

Add Answer to:

Nathan has a loan of $6000 to repay, with an interest rate of 8%

compounded monthly....

1. Shirley wants to go on a trip to Hawaii. She budgets that she can save...

1. Shirley wants to go on a trip to Hawaii. She budgets that she can save $108 at the end of every month, and interest in her account is 8% compounded biweekly. By looking at prices, she knows that the trip will cost her $4813 total. How long in years (round to two decimal places) will it take before she can go on her trip? 2. Joey buys a new Honda civic for $18997. He agrees to payments at the...

Monthly payments were originally calculated to repay a $38,000 loan at 8.8% compounded monthly over a...

Monthly payments were originally calculated to repay a $38,000 loan at 8.8% compounded monthly over a 13-year period. After one year, the debtor took advantage of an option in the loan contract to increase the loan payments by 15%. How much sooner will the loan be paid off? (Do not round intermediate calculations. Round up the number of payments.) The loan will be paid off year(s) and month(s) sooner.

3. Lynn borrows $5,000 at 15%/year compounded monthly. She wishes to repay the loan with 12...

3. Lynn borrows $5,000 at 15%/year compounded monthly. She wishes to repay the loan with 12 end-of- month payments. She wishes to make her first payment 3 months after receiving the $5,000. She also wishes that, after the first payment, the size of each payment be 10% greater than the previous payment. What is the size of her sixth payment?

3. Lynn borrows $5,000 at 15%/year compounded monthly. She wishes to repay the loan with 12 end-of- month payments. She wishes to make her first payment 3 months after receiving the $5,000. She also wishes that, after the first payment, the size of each payment be 10% greater than the previous payment. What is the size of her sixth payment?

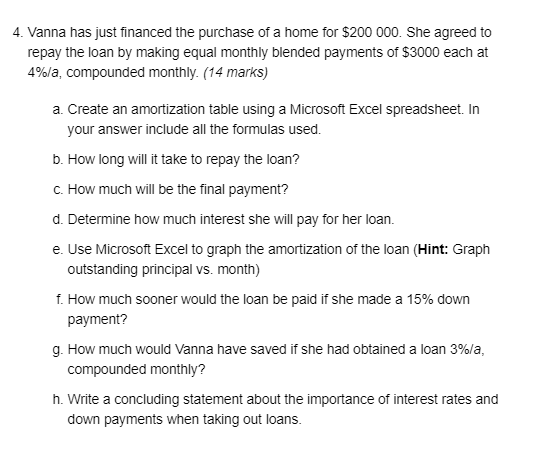

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. (14 marks) Create an amortization table using a Microsoft Excel spreadsheet. In y

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. a. Create an amortization table using a Microsoft Excel spreadsheet. In your answer include all the formulas used.b.How long will it take to repay the loan?c. How much will be the final payment?d. Determine how much interest she will pay for her loan.e. Use Microsoft Excel to graph the amortization...

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. a. Create an amortization table using a Microsoft Excel spreadsheet. In your answer include all the formulas used.b.How long will it take to repay the loan?c. How much will be the final payment?d. Determine how much interest she will pay for her loan.e. Use Microsoft Excel to graph the amortization...

A student takes out a college loan of $6000 at an annual percentage rate of 5%,...

A student takes out a college loan of $6000 at an annual percentage rate of 5%, compounded monthly. a. If the student makes payments of $800 per month, how much, to the nearest dollar, does the student owe after 4 months? Don't round until the end. Enter an integer or decimal number [more.. b. After how many months will the loan be paid off?

A student takes out a college loan of $6000 at an annual percentage rate of 5%, compounded monthly. a. If the student makes payments of $800 per month, how much, to the nearest dollar, does the student owe after 4 months? Don't round until the end. Enter an integer or decimal number [more.. b. After how many months will the loan be paid off?

Consider a $15,000 loan with an annual interest rate of 9%, a term of four years,...

Consider a $15,000 loan with an annual interest rate of 9%, a term of four years, anda monthly payment of A (5 points) What is the amount of the monthly payment? a. (10 points) Ifyou pay $750 per month, how many months will it take to repay the loan? b. (10 points) If you pay $750 per month on this loan, how much will the final payment C. be?

Consider a $15,000 loan with an annual interest rate of 9%,...

Consider a $15,000 loan with an annual interest rate of 9%, a term of four years, anda monthly payment of A (5 points) What is the amount of the monthly payment? a. (10 points) Ifyou pay $750 per month, how many months will it take to repay the loan? b. (10 points) If you pay $750 per month on this loan, how much will the final payment C. be?

Consider a $15,000 loan with an annual interest rate of 9%,...

(1 point) Recall that the formula for a simple interest amortized loan, with initial loan value Vo, monthly payments of size m, with interest compounded n times per year for t years at annual interes...

(1 point) Recall that the formula for a simple interest amortized loan, with initial loan value Vo, monthly payments of size m, with interest compounded n times per year for t years at annual interest rate r is rtn.t rt Ben buys his $230,000 home and, after the $40,000 down payment, finances the remainder with a simple interest amortized loan. Ben can pay at most $1,200 per month for the loan, on which the lender has set an annual rate...

(1 point) Recall that the formula for a simple interest amortized loan, with initial loan value Vo, monthly payments of size m, with interest compounded n times per year for t years at annual interest rate r is rtn.t rt Ben buys his $230,000 home and, after the $40,000 down payment, finances the remainder with a simple interest amortized loan. Ben can pay at most $1,200 per month for the loan, on which the lender has set an annual rate...

Karmen borrowed $5378.00 compounded semi-annually to help finance her education. She contracted to repay the loan i...

Karmen borrowed $5378.00 compounded semi-annually to help finance her education. She contracted to repay the loan in semi-annual payments of $259.00 each. If the payments are due at the end of every 6 months and interest is 6% compounded semi-annually, how long will Karmen have to make semi-annual payments? State your answer in years and months (from 0 to 11 months) month(s). year(s) and Karmen will have to make payments for

Karmen borrowed $5378.00 compounded semi-annually to help finance her...

Karmen borrowed $5378.00 compounded semi-annually to help finance her education. She contracted to repay the loan in semi-annual payments of $259.00 each. If the payments are due at the end of every 6 months and interest is 6% compounded semi-annually, how long will Karmen have to make semi-annual payments? State your answer in years and months (from 0 to 11 months) month(s). year(s) and Karmen will have to make payments for

Karmen borrowed $5378.00 compounded semi-annually to help finance her...

Q1 Mr. Smith borrowed $189,500 at 3.75% per year compounded monthly. Loan is for 20 years....

Q1 Mr. Smith borrowed $189,500 at 3.75% per year compounded monthly. Loan is for 20 years. Compute the monthly payment. Q2 For the same loan in Q1, compute how many months it will take to pay the loan off, if Mr. Smith pays $100 extra to the monthly amount you computed earlier

Q1 Mr. Smith borrowed $189,500 at 3.75% per year compounded monthly. Loan is for 20 years. Compute the monthly payment. Q2 For the same loan in Q1, compute how many months it will take to pay the loan off, if Mr. Smith pays $100 extra to the monthly amount you computed earlier

2. You take out a home loan of $500 000, which will be repaid in 40 level payments at the end of each six-month period,...

2. You take out a home loan of $500 000, which will be repaid in 40 level payments at the end of each six-month period, starting in six months. The annual interest rate is 5% (a) Compute the size of the repayments if interest is compounded every six months. (b) Suppose instead that interest is compounded monthly but repay- ments are still made every six months. Determine the equivalent annual interest rate for payments made every six months and find...

2. You take out a home loan of $500 000, which will be repaid in 40 level payments at the end of each six-month period, starting in six months. The annual interest rate is 5% (a) Compute the size of the repayments if interest is compounded every six months. (b) Suppose instead that interest is compounded monthly but repay- ments are still made every six months. Determine the equivalent annual interest rate for payments made every six months and find...

Most questions answered within 3 hours.

-

MATLAB

write a MATLAB function (1) output a third-order polynomial

function with the coefficients as the...

asked 18 seconds ago -

A z-score

communicates a raw score’s "relative standing"

under the normal curve in relation to:

asked 8 minutes ago -

An object is vibrating on a spring with the following equation

of motion:

?=(30 ??)cos((2?)/(160)?)

a)...

asked 8 minutes ago -

Vulcan Flyovers offers scenic overflights of Mount St. Helens,

the volcano in Washington State that explosively...

asked 10 minutes ago -

If organizations do not adapt fast enough and move incrementally

from the twentieth-century model to the...

asked 11 minutes ago -

A helium balloon with 2.5L of gas has a gauge pressure of 10,000

Pa. The balloon...

asked 15 minutes ago -

What is responsible for Jupiter's enormous magnetic field?

asked 31 minutes ago -

At the end of the year, a company offered to buy 5,000 units of

a product...

asked 32 minutes ago -

Implement C++ program for each of the following.

Let D = [-48, -14, -8, 0, 1,...

asked 52 minutes ago -

Consider a labor market in which LD = 400 – 4W and LS = 250 +...

asked 1 hour ago -

Let’s say you are teaching a typically-developing young child

how to eat with a spoon. Describe...

asked 50 minutes ago -

Ask Your Teacher A toy gun uses a spring to project a 5.6-g soft

rubber sphere...

asked 1 hour ago

3. Lynn borrows $5,000 at 15%/year compounded monthly. She wishes to repay the loan with 12 end-of- month payments. She wishes to make her first payment 3 months after receiving the $5,000. She also wishes that, after the first payment, the size of each payment be 10% greater than the previous payment. What is the size of her sixth payment?

3. Lynn borrows $5,000 at 15%/year compounded monthly. She wishes to repay the loan with 12 end-of- month payments. She wishes to make her first payment 3 months after receiving the $5,000. She also wishes that, after the first payment, the size of each payment be 10% greater than the previous payment. What is the size of her sixth payment?

A student takes out a college loan of $6000 at an annual percentage rate of 5%, compounded monthly. a. If the student makes payments of $800 per month, how much, to the nearest dollar, does the student owe after 4 months? Don't round until the end. Enter an integer or decimal number [more.. b. After how many months will the loan be paid off?

A student takes out a college loan of $6000 at an annual percentage rate of 5%, compounded monthly. a. If the student makes payments of $800 per month, how much, to the nearest dollar, does the student owe after 4 months? Don't round until the end. Enter an integer or decimal number [more.. b. After how many months will the loan be paid off?

Consider a $15,000 loan with an annual interest rate of 9%, a term of four years, anda monthly payment of A (5 points) What is the amount of the monthly payment? a. (10 points) Ifyou pay $750 per month, how many months will it take to repay the loan? b. (10 points) If you pay $750 per month on this loan, how much will the final payment C. be?

Consider a $15,000 loan with an annual interest rate of 9%,...

Consider a $15,000 loan with an annual interest rate of 9%, a term of four years, anda monthly payment of A (5 points) What is the amount of the monthly payment? a. (10 points) Ifyou pay $750 per month, how many months will it take to repay the loan? b. (10 points) If you pay $750 per month on this loan, how much will the final payment C. be?

Consider a $15,000 loan with an annual interest rate of 9%,...

(1 point) Recall that the formula for a simple interest amortized loan, with initial loan value Vo, monthly payments of size m, with interest compounded n times per year for t years at annual interest rate r is rtn.t rt Ben buys his $230,000 home and, after the $40,000 down payment, finances the remainder with a simple interest amortized loan. Ben can pay at most $1,200 per month for the loan, on which the lender has set an annual rate...

(1 point) Recall that the formula for a simple interest amortized loan, with initial loan value Vo, monthly payments of size m, with interest compounded n times per year for t years at annual interest rate r is rtn.t rt Ben buys his $230,000 home and, after the $40,000 down payment, finances the remainder with a simple interest amortized loan. Ben can pay at most $1,200 per month for the loan, on which the lender has set an annual rate...

Karmen borrowed $5378.00 compounded semi-annually to help finance her education. She contracted to repay the loan in semi-annual payments of $259.00 each. If the payments are due at the end of every 6 months and interest is 6% compounded semi-annually, how long will Karmen have to make semi-annual payments? State your answer in years and months (from 0 to 11 months) month(s). year(s) and Karmen will have to make payments for

Karmen borrowed $5378.00 compounded semi-annually to help finance her...

Karmen borrowed $5378.00 compounded semi-annually to help finance her education. She contracted to repay the loan in semi-annual payments of $259.00 each. If the payments are due at the end of every 6 months and interest is 6% compounded semi-annually, how long will Karmen have to make semi-annual payments? State your answer in years and months (from 0 to 11 months) month(s). year(s) and Karmen will have to make payments for

Karmen borrowed $5378.00 compounded semi-annually to help finance her...

Q1 Mr. Smith borrowed $189,500 at 3.75% per year compounded monthly. Loan is for 20 years. Compute the monthly payment. Q2 For the same loan in Q1, compute how many months it will take to pay the loan off, if Mr. Smith pays $100 extra to the monthly amount you computed earlier

Q1 Mr. Smith borrowed $189,500 at 3.75% per year compounded monthly. Loan is for 20 years. Compute the monthly payment. Q2 For the same loan in Q1, compute how many months it will take to pay the loan off, if Mr. Smith pays $100 extra to the monthly amount you computed earlier

2. You take out a home loan of $500 000, which will be repaid in 40 level payments at the end of each six-month period, starting in six months. The annual interest rate is 5% (a) Compute the size of the repayments if interest is compounded every six months. (b) Suppose instead that interest is compounded monthly but repay- ments are still made every six months. Determine the equivalent annual interest rate for payments made every six months and find...

2. You take out a home loan of $500 000, which will be repaid in 40 level payments at the end of each six-month period, starting in six months. The annual interest rate is 5% (a) Compute the size of the repayments if interest is compounded every six months. (b) Suppose instead that interest is compounded monthly but repay- ments are still made every six months. Determine the equivalent annual interest rate for payments made every six months and find...