Monthly payments were originally calculated to repay a $38,000 loan at 8.8% compounded monthly over a...

|

Monthly payments were originally calculated to repay a $38,000 loan at 8.8% compounded monthly over a 13-year period. After one year, the debtor took advantage of an option in the loan contract to increase the loan payments by 15%. How much sooner will the loan be paid off? (Do not round intermediate calculations. Round up the number of payments.) |

| The loan will be paid off year(s) and month(s) sooner. |

Homework Answers

Add Answer to:

Monthly payments were

originally calculated to repay a $38,000 loan at 8.8% compounded

monthly over a...

Your firm has taken out a $ 483,000 loan with 8.8 % APR (compounded monthly) for...

Your firm has taken out a $ 483,000 loan with 8.8 % APR (compounded monthly) for some commercial property. As is common in commercial real estate, the loan is a 5-year loan based on a 15-year amortization. This means that your loan payments will be calculated as if you will take 15years to pay off the loan, but you actually must do so in 5years. To do this, you will make 59 equal payments based on the 15-year amortization schedule...

A $152,000 mortgage loan at 4.8% compounded monthly requires monthly payments during its 25-year amortization period....

A $152,000 mortgage loan at 4.8% compounded monthly requires monthly payments during its 25-year amortization period. (Do not round the intermediate calculations. Round your answers to 2 decimal places.) a. Calculate the monthly payments rounded to the cent. PMT is $ b. Calculate the balance owing on the loan after eight years using the Retrospective Method. After 8 years of payments, the balance outstanding on the loan is $

A $152,000 mortgage loan at 4.8% compounded monthly requires monthly payments during its 25-year amortization period. (Do not round the intermediate calculations. Round your answers to 2 decimal places.) a. Calculate the monthly payments rounded to the cent. PMT is $ b. Calculate the balance owing on the loan after eight years using the Retrospective Method. After 8 years of payments, the balance outstanding on the loan is $

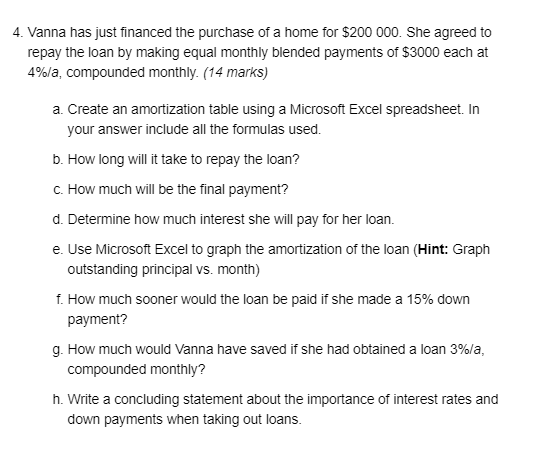

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. (14 marks) Create an amortization table using a Microsoft Excel spreadsheet. In y

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. a. Create an amortization table using a Microsoft Excel spreadsheet. In your answer include all the formulas used.b.How long will it take to repay the loan?c. How much will be the final payment?d. Determine how much interest she will pay for her loan.e. Use Microsoft Excel to graph the amortization...

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. a. Create an amortization table using a Microsoft Excel spreadsheet. In your answer include all the formulas used.b.How long will it take to repay the loan?c. How much will be the final payment?d. Determine how much interest she will pay for her loan.e. Use Microsoft Excel to graph the amortization...

Nathan has a loan of $6000 to repay, with an interest rate of 8% compounded monthly....

Nathan has a loan of $6000 to repay, with an interest rate of 8% compounded monthly. Nathan planned to make $150 payments at the end of each month to repay his loan, but is considering only $100 per month. How many additional months will it take to repay the loan if he pays $100 per month instead of $150? (Hint: Round each term in months up to a whole number before finding the difference.)

The interest rate for the first five years of an $100,000 mortgage loan is 9.4% compounded...

The interest rate for the first five years of an $100,000 mortgage loan is 9.4% compounded semiannually. Monthly payments are calculated using a 20-year amortization. a. What will be the principal balance at the end of the five-year term? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Principal balance $ b. What will be the monthly payments if the loan is renewed at 6.8% compounded semiannually (and the original amortization period is continued)?...

1. A construction company borrows $100,000 to purchase equipment with a promise to repay the loan...

1. A construction company borrows $100,000 to purchase equipment with a promise to repay the loan with equal monthly payments over a 6-year period. a. Draw the cash flow diagram b. At an interest rate of 8% compounded monthly, what are the annual payments to pay off the loan in full?

1. A construction company borrows $100,000 to purchase equipment with a promise to repay the loan with equal monthly payments over a 6-year period. a. Draw the cash flow diagram b. At an interest rate of 8% compounded monthly, what are the annual payments to pay off the loan in full?

Cloverdale Nurseries obtained a $78,000 loan at 9.3% compounded monthly to build an additional greenhouse. Monthly...

Cloverdale Nurseries obtained a $78,000 loan at 9.3% compounded monthly to build an additional greenhouse. Monthly payments were calculated to amortize the loan over six years. Construct a partial amortization schedule showing details of the first two payments, Payments 44 and 45, and the last two payments. (Do not round intermediate calculations and round your answers to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required.) Payment number Payment Interest portion Principal portion Principal...

Cloverdale Nurseries obtained a $78,000 loan at 9.3% compounded monthly to build an additional greenhouse. Monthly payments were calculated to amortize the loan over six years. Construct a partial amortization schedule showing details of the first two payments, Payments 44 and 45, and the last two payments. (Do not round intermediate calculations and round your answers to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required.) Payment number Payment Interest portion Principal portion Principal...

The interest rate on a $60,000 loan is 9.1% compounded semiannually. Quarterly payments will pay off...

The interest rate on a $60,000 loan is 9.1% compounded semiannually. Quarterly payments will pay off the loan in fifteen years. (Do not round intermediate calculations and round your final answers to 2 decimal places.) a. Calculate the interest component of Payment 13. Interest $ b. Calculate the principal component of Payment 52. Principal $ c. Calculate the total interest in Payments 39 to 50 inclusive. Total interest d. Calculate the reduction of principal in Year 4. Principal reduction $

The interest rate on a $60,000 loan is 9.1% compounded semiannually. Quarterly payments will pay off the loan in fifteen years. (Do not round intermediate calculations and round your final answers to 2 decimal places.) a. Calculate the interest component of Payment 13. Interest $ b. Calculate the principal component of Payment 52. Principal $ c. Calculate the total interest in Payments 39 to 50 inclusive. Total interest d. Calculate the reduction of principal in Year 4. Principal reduction $

The interest rate on a $64,000 loan is 9.6% compounded semiannually. Quarterly payments will pay off...

The interest rate on a $64,000 loan is 9.6% compounded semiannually. Quarterly payments will pay off the loan in fifteen years. (Do not round intermediate calculations and round your final answers to 2 decimal places.) a. Calculate the interest component of Payment 13. Interest $ b. Calculate the principal component of Payment 52. Principal $ c. Calculate the total interest in Payments 41 to 50 inclusive. Total interest $ d. Calculate the reduction of principal in Year...

Dominic borrows 7200 dollars today, and agrees to repay the loan by making annual interest payments...

Dominic borrows 7200 dollars today, and agrees to repay the loan by making annual interest payments to the lender, and by also accumulating a sinking fund with increasing annual deposits to repay the principal. The interest rate on the loan is 8.8 percent, and the interest paid on the sinking fund is 6.7 percent, both effective. If the loan is to be settled 15 years from now, and the sinking fund deposits increase by 7 dollars per year, what is...

Most questions answered within 3 hours.

-

Which of the following best describes tidal volume? options:

1.The amount of oxygen in the air...

asked 5 minutes ago -

1. Smaller cost distortions occur when the traditional systems'

single indirect-cost rate and the activity-cost-driver rates:...

asked 13 minutes ago -

Using either a FMECA approach or some other appropriate RCA

tool, identify five risk treatment actions...

asked 14 minutes ago -

If for a test the P-value is between 0.0025 and 0.005, what

conclusion can you draw?...

asked 26 minutes ago -

Using Python. Write a function clean2(aList) that takes a list

of integers aList as argument, and...

asked 32 minutes ago -

Intrapreneurship is defined as the

development of an enterprise culture with an existing (Nandan,

2009). An...

asked 45 minutes ago -

QUESTION 1 Tamiflu is a drug used to treat influenza. A study

found that Tamiflu reduced...

asked 49 minutes ago -

Which of the following would be less likely to be used to

allocate factory overhead when...

asked 55 minutes ago -

Transverse pulses travel with a speed of 195 m/s along a taut

copper wire whose diameter...

asked 54 minutes ago -

Sampling for Engineers Homework question 11.51

Suppose that Y1;Y2;Y3;Y4 denote a random sample from a

Poisson(θ)...

asked 57 minutes ago -

Which of the following is cleaved by regulated intramembrane

proteolysis (RIP)? Select any/all answers that apply....

asked 57 minutes ago -

Random characters You decide to create a program characters.py

that fills a two-dimensional list with random...

asked 1 hour ago

A $152,000 mortgage loan at 4.8% compounded monthly requires monthly payments during its 25-year amortization period. (Do not round the intermediate calculations. Round your answers to 2 decimal places.) a. Calculate the monthly payments rounded to the cent. PMT is $ b. Calculate the balance owing on the loan after eight years using the Retrospective Method. After 8 years of payments, the balance outstanding on the loan is $

A $152,000 mortgage loan at 4.8% compounded monthly requires monthly payments during its 25-year amortization period. (Do not round the intermediate calculations. Round your answers to 2 decimal places.) a. Calculate the monthly payments rounded to the cent. PMT is $ b. Calculate the balance owing on the loan after eight years using the Retrospective Method. After 8 years of payments, the balance outstanding on the loan is $

1. A construction company borrows $100,000 to purchase equipment with a promise to repay the loan with equal monthly payments over a 6-year period. a. Draw the cash flow diagram b. At an interest rate of 8% compounded monthly, what are the annual payments to pay off the loan in full?

1. A construction company borrows $100,000 to purchase equipment with a promise to repay the loan with equal monthly payments over a 6-year period. a. Draw the cash flow diagram b. At an interest rate of 8% compounded monthly, what are the annual payments to pay off the loan in full?

Cloverdale Nurseries obtained a $78,000 loan at 9.3% compounded monthly to build an additional greenhouse. Monthly payments were calculated to amortize the loan over six years. Construct a partial amortization schedule showing details of the first two payments, Payments 44 and 45, and the last two payments. (Do not round intermediate calculations and round your answers to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required.) Payment number Payment Interest portion Principal portion Principal...

Cloverdale Nurseries obtained a $78,000 loan at 9.3% compounded monthly to build an additional greenhouse. Monthly payments were calculated to amortize the loan over six years. Construct a partial amortization schedule showing details of the first two payments, Payments 44 and 45, and the last two payments. (Do not round intermediate calculations and round your answers to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required.) Payment number Payment Interest portion Principal portion Principal...

The interest rate on a $60,000 loan is 9.1% compounded semiannually. Quarterly payments will pay off the loan in fifteen years. (Do not round intermediate calculations and round your final answers to 2 decimal places.) a. Calculate the interest component of Payment 13. Interest $ b. Calculate the principal component of Payment 52. Principal $ c. Calculate the total interest in Payments 39 to 50 inclusive. Total interest d. Calculate the reduction of principal in Year 4. Principal reduction $

The interest rate on a $60,000 loan is 9.1% compounded semiannually. Quarterly payments will pay off the loan in fifteen years. (Do not round intermediate calculations and round your final answers to 2 decimal places.) a. Calculate the interest component of Payment 13. Interest $ b. Calculate the principal component of Payment 52. Principal $ c. Calculate the total interest in Payments 39 to 50 inclusive. Total interest d. Calculate the reduction of principal in Year 4. Principal reduction $