Homework Answers

16.Correct answer is option (A),pay more in income taxes than debt financed firm

Explanation:- When debt will be used for financing then there will be interest expense and it is tax deductible .But on the other hand equity dividend is not tax deductible .Therefore equity financed firm will pay more taxes.

17.Correct answer is option (A)

Decrease fixed assets

Explanation:- When fixed assets are decreased it means fixed asset sold then cash inflow will happen and cash will increase.

When account payable decreased ,it means we have paid amount due to trade payables and hence cash will decrease

Pay dividend is obviously lead to decrease in cash because cash will be paid to shareholders

Repurchase of common stock will also lead to decrease in cash because firm will be required to pay amount to sharehokders for repurchasing.

Add Answer to:

16 $ 17

16. An equity-financed firm will A. pay more in income taxes than a...

Problem 20-01 Firm A has $9,200 in assets entirely financed with equity. Firm B also has $9,200 i...

Problem 20-01 Firm A has $9,200 in assets entirely financed with equity. Firm B also has $9,200 in assets, but these assets are financed by $4,600 in debt (with a 10 percent rate of interest) and $4,600 in equity. Both firms sell 11,000 units of output at $3.00 per unit. The variable costs of production are $1, and fixed production costs are $14,000. (To ease the calculation, assume no income tax.) a. What is the operating income (EBID for both...

Problem 20-01 Firm A has $9,200 in assets entirely financed with equity. Firm B also has $9,200 in assets, but these assets are financed by $4,600 in debt (with a 10 percent rate of interest) and $4,600 in equity. Both firms sell 11,000 units of output at $3.00 per unit. The variable costs of production are $1, and fixed production costs are $14,000. (To ease the calculation, assume no income tax.) a. What is the operating income (EBID for both...

14. A particular security's default risk premium is 3 percent. For all securities, the inflation risk...

14. A particular security's default risk premium is 3 percent. For all securities, the inflation risk premium is 2 percent and the real interest rate is 2.25 percent. The security's liquidity risk premium is 0.75 percent and maturity risk premium is 0.90 percent. The security has no special covenants. What is the security's equilibrium rate of return? A. 1.78 percent B. 3.95 percent C. 8.90 percent D. 17.8 percent 17. Which of the following activities result in an increase in...

14. A particular security's default risk premium is 3 percent. For all securities, the inflation risk premium is 2 percent and the real interest rate is 2.25 percent. The security's liquidity risk premium is 0.75 percent and maturity risk premium is 0.90 percent. The security has no special covenants. What is the security's equilibrium rate of return? A. 1.78 percent B. 3.95 percent C. 8.90 percent D. 17.8 percent 17. Which of the following activities result in an increase in...

16 and 17 please. first photo has numbers Income Statement Net sales $5,800 Less: Cost of...

16 and 17 please. first photo has numbers

Income Statement Net sales $5,800 Less: Cost of goods sold 3,850 Less: Depreciation 460 Earnings before interest and taxes 1,490 Less: Interest paid 270 Taxable income $1,220 Less: Taxes 320 Net income Dividends $630 Cash Accounts rec. Inventory Total Net fixed assets Total assets Balance Sheet $ 630 Accounts payable 810 Long-term debt 540 Common stock $1,980 Retained earnings 4.930 $6.910 Total liab. & equity S 850 3,010 2,200 850 $6.910 5...

16 and 17 please. first photo has numbers

Income Statement Net sales $5,800 Less: Cost of goods sold 3,850 Less: Depreciation 460 Earnings before interest and taxes 1,490 Less: Interest paid 270 Taxable income $1,220 Less: Taxes 320 Net income Dividends $630 Cash Accounts rec. Inventory Total Net fixed assets Total assets Balance Sheet $ 630 Accounts payable 810 Long-term debt 540 Common stock $1,980 Retained earnings 4.930 $6.910 Total liab. & equity S 850 3,010 2,200 850 $6.910 5...

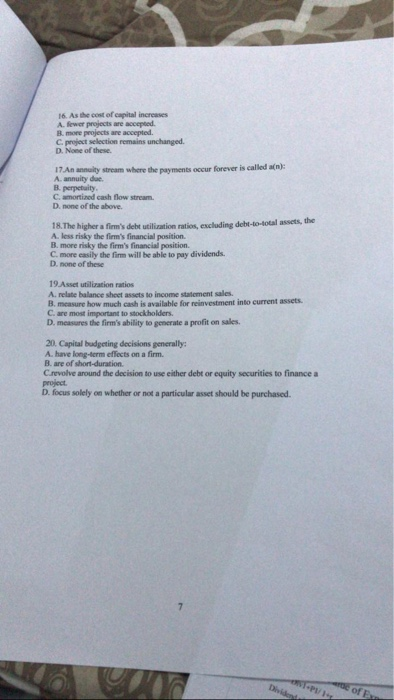

16. As the cost of capital increases A fewer projects are accepted B. more projects are...

16. As the cost of capital increases A fewer projects are accepted B. more projects are accepted. C. project selection remains unchanged. D. None of these 17.An annulty stream where the payments occur forever is called an): A. annuity due B. perpetuity. C. amortized cash flow stream D. none of the above. 18. The higher a firm's debt utilization ratios, excluding debt-to-total assets A less risky the firm's financial position. B. more risky the firm's financial position C. more easily...

16. As the cost of capital increases A fewer projects are accepted B. more projects are accepted. C. project selection remains unchanged. D. None of these 17.An annulty stream where the payments occur forever is called an): A. annuity due B. perpetuity. C. amortized cash flow stream D. none of the above. 18. The higher a firm's debt utilization ratios, excluding debt-to-total assets A less risky the firm's financial position. B. more risky the firm's financial position C. more easily...

Alex, Inc. is financed 100% with equity. The firm has 100,000 shares of stock outstanding with...

Alex, Inc. is financed 100% with equity. The firm has 100,000 shares of stock outstanding with a market price of $5 per share. Total earnings for the most recent year are $50,000. The firm has $25,000 excess cash. It is considering using this excess cash to pay it out as dividend or use it to repurchase $25,000 of its own stock. The firm has other assets worth $475,000 (at market value). For each of the questions that follow, assume no...

Alex, Inc. is financed 100% with equity. The firm has 100,000 shares of stock outstanding with a market price of $5 per share. Total earnings for the most recent year are $50,000. The firm has $25,000 excess cash. It is considering using this excess cash to pay it out as dividend or use it to repurchase $25,000 of its own stock. The firm has other assets worth $475,000 (at market value). For each of the questions that follow, assume no...

You are analyzing a firm that is financed with 65 percent debt and 35 percent equity....

You are analyzing a firm that is financed with 65 percent debt and 35 percent equity. The current cost of debt financing is 10 percent, but due to a recent downgrade by the rating agencies, the firm's cost of debt is expected to increase to 12 percent immediately. How will this increase change the firm's weighted average cost of capital if you ignore taxes? (Round answer to 2 decimal places, eg. 15.25%.) Ignoring taxes firm's weighted average cost of capital...

You are analyzing a firm that is financed with 65 percent debt and 35 percent equity. The current cost of debt financing is 10 percent, but due to a recent downgrade by the rating agencies, the firm's cost of debt is expected to increase to 12 percent immediately. How will this increase change the firm's weighted average cost of capital if you ignore taxes? (Round answer to 2 decimal places, eg. 15.25%.) Ignoring taxes firm's weighted average cost of capital...

2020 Less Taxes ( 21 percent) Net Income Less: Preferred stock dividends Net income available to...

2020 Less Taxes ( 21 percent) Net Income Less: Preferred stock dividends Net income available to common stockholders Less Common stock dividends Addition to retained earnings Per common share data Earnings per share (EPS) Dividends per share DPS) Book value per share (BVPS) Market value price per share (MVPS) $ 872 $ $26.850 $22550 GARNERS' PLATOON MENTAL HEALTH CARE, INC. Statement of Cash Flows for Year Ending December 31, 2021 (in millions of dollars Section A Cash flows from operating...

2020 Less Taxes ( 21 percent) Net Income Less: Preferred stock dividends Net income available to common stockholders Less Common stock dividends Addition to retained earnings Per common share data Earnings per share (EPS) Dividends per share DPS) Book value per share (BVPS) Market value price per share (MVPS) $ 872 $ $26.850 $22550 GARNERS' PLATOON MENTAL HEALTH CARE, INC. Statement of Cash Flows for Year Ending December 31, 2021 (in millions of dollars Section A Cash flows from operating...

River Cruises is all-equity-financed. Suppose it now issues $ 450,000 of debt at an interest rate of 10%

4. River Cruises is all-equity-financed. Suppose it now issues $ 450,000 of debt at an interest rate of 10% and uses the proceeds to repurchase 45,000 shares. Assume that the firm pays no taxes and that debt finance has no impact on firm value. Rework showed below by selecting values per each scenario and account to show how earnings per share and share return vary with operating income after the financing. 5. Dunet is financed 40% by debt yielding 8%. Investors...

4. River Cruises is all-equity-financed. Suppose it now issues $ 450,000 of debt at an interest rate of 10% and uses the proceeds to repurchase 45,000 shares. Assume that the firm pays no taxes and that debt finance has no impact on firm value. Rework showed below by selecting values per each scenario and account to show how earnings per share and share return vary with operating income after the financing. 5. Dunet is financed 40% by debt yielding 8%. Investors...

Wigdor Manufacturing is currently all equity financed, has EBIT of $2 million, and is in the...

Wigdor Manufacturing is currently all equity financed, has EBIT of $2 million, and is in the 34% tax bracket. Louis, the company's founder, is the lone shareholder. 26. If the firm were to convert $4 million of equity into debt at a cost of 10%, what would be the total cash flow to Louis if he holds all the debt? Compare this to Louis' total cash flow if the firm remains unlevered. Assume no personal taxes. 27. Assume that all...

Wigdor Manufacturing is currently all equity financed, has EBIT of $2 million, and is in the 34% tax bracket. Louis, the company's founder, is the lone shareholder. 26. If the firm were to convert $4 million of equity into debt at a cost of 10%, what would be the total cash flow to Louis if he holds all the debt? Compare this to Louis' total cash flow if the firm remains unlevered. Assume no personal taxes. 27. Assume that all...

The Miller-Modigliani Arguments Firm U is all-equity financed, while Firm L is both debt- and equity-financed....

The Miller-Modigliani Arguments Firm U is all-equity financed, while Firm L is both debt- and equity-financed. The following table gives some relevant data on the two firms: (No Taxes) Firm U Firm L Annual expected future cash flow $5 M $5 M Cost of equity (rE) 15% 16% Market value of debt (D) 0 $15 M Cost of debt (rD) N/A 12% Market value of equity (E) ? ? Market value of the firm (V) ? ? Weighted average...

Most questions answered within 3 hours.

-

1. In a labor market, marginal cost for a firm is

____________.

a. recruiting cost

b....

asked 28 minutes ago -

On January 1, 2019, ABC Company issued $60,000,000 of 20-year,

10.5% bonds when the market rate...

asked 52 minutes ago -

39.4% of US homes continue to use a landline in addition to cell

phone service. 3...

asked 1 hour ago -

Starting with benzene, synthesize 1-phenyl-1-butyne.

Show intermediates and reagents.

asked 2 hours ago -

Create a 32-run crossed array design with six control factors

and two noise factors such that...

asked 3 hours ago -

A 500g sample of sand from source A has the following amounts

retained on each sieve....

asked 3 hours ago -

In

your own words, please explain the essay by John Keynes wrote "The

End of Laissez...

asked 3 hours ago -

How are the matrix and pixels related? Why are smaller

pixels better for diagnostic quality?

asked 3 hours ago -

2. An AC generator has 80 rectangular loops on

its armature. Each loop is 11 cm...

asked 3 hours ago -

Please help me with this question. Consider Aldi’s current and

potential geographic markets (see Exhibit 4...

asked 3 hours ago -

What are the main components of the fermentation process and

give an explanation of each? Include...

asked 3 hours ago -

Explain which types of cells in the body (belonging to which

organs, etc.) are sensitive to...

asked 3 hours ago

Problem 20-01 Firm A has $9,200 in assets entirely financed with equity. Firm B also has $9,200 in assets, but these assets are financed by $4,600 in debt (with a 10 percent rate of interest) and $4,600 in equity. Both firms sell 11,000 units of output at $3.00 per unit. The variable costs of production are $1, and fixed production costs are $14,000. (To ease the calculation, assume no income tax.) a. What is the operating income (EBID for both...

Problem 20-01 Firm A has $9,200 in assets entirely financed with equity. Firm B also has $9,200 in assets, but these assets are financed by $4,600 in debt (with a 10 percent rate of interest) and $4,600 in equity. Both firms sell 11,000 units of output at $3.00 per unit. The variable costs of production are $1, and fixed production costs are $14,000. (To ease the calculation, assume no income tax.) a. What is the operating income (EBID for both...

14. A particular security's default risk premium is 3 percent. For all securities, the inflation risk premium is 2 percent and the real interest rate is 2.25 percent. The security's liquidity risk premium is 0.75 percent and maturity risk premium is 0.90 percent. The security has no special covenants. What is the security's equilibrium rate of return? A. 1.78 percent B. 3.95 percent C. 8.90 percent D. 17.8 percent 17. Which of the following activities result in an increase in...

14. A particular security's default risk premium is 3 percent. For all securities, the inflation risk premium is 2 percent and the real interest rate is 2.25 percent. The security's liquidity risk premium is 0.75 percent and maturity risk premium is 0.90 percent. The security has no special covenants. What is the security's equilibrium rate of return? A. 1.78 percent B. 3.95 percent C. 8.90 percent D. 17.8 percent 17. Which of the following activities result in an increase in...

16 and 17 please. first photo has numbers

Income Statement Net sales $5,800 Less: Cost of goods sold 3,850 Less: Depreciation 460 Earnings before interest and taxes 1,490 Less: Interest paid 270 Taxable income $1,220 Less: Taxes 320 Net income Dividends $630 Cash Accounts rec. Inventory Total Net fixed assets Total assets Balance Sheet $ 630 Accounts payable 810 Long-term debt 540 Common stock $1,980 Retained earnings 4.930 $6.910 Total liab. & equity S 850 3,010 2,200 850 $6.910 5...

16 and 17 please. first photo has numbers

Income Statement Net sales $5,800 Less: Cost of goods sold 3,850 Less: Depreciation 460 Earnings before interest and taxes 1,490 Less: Interest paid 270 Taxable income $1,220 Less: Taxes 320 Net income Dividends $630 Cash Accounts rec. Inventory Total Net fixed assets Total assets Balance Sheet $ 630 Accounts payable 810 Long-term debt 540 Common stock $1,980 Retained earnings 4.930 $6.910 Total liab. & equity S 850 3,010 2,200 850 $6.910 5...

Alex, Inc. is financed 100% with equity. The firm has 100,000 shares of stock outstanding with a market price of $5 per share. Total earnings for the most recent year are $50,000. The firm has $25,000 excess cash. It is considering using this excess cash to pay it out as dividend or use it to repurchase $25,000 of its own stock. The firm has other assets worth $475,000 (at market value). For each of the questions that follow, assume no...

Alex, Inc. is financed 100% with equity. The firm has 100,000 shares of stock outstanding with a market price of $5 per share. Total earnings for the most recent year are $50,000. The firm has $25,000 excess cash. It is considering using this excess cash to pay it out as dividend or use it to repurchase $25,000 of its own stock. The firm has other assets worth $475,000 (at market value). For each of the questions that follow, assume no...

You are analyzing a firm that is financed with 65 percent debt and 35 percent equity. The current cost of debt financing is 10 percent, but due to a recent downgrade by the rating agencies, the firm's cost of debt is expected to increase to 12 percent immediately. How will this increase change the firm's weighted average cost of capital if you ignore taxes? (Round answer to 2 decimal places, eg. 15.25%.) Ignoring taxes firm's weighted average cost of capital...

You are analyzing a firm that is financed with 65 percent debt and 35 percent equity. The current cost of debt financing is 10 percent, but due to a recent downgrade by the rating agencies, the firm's cost of debt is expected to increase to 12 percent immediately. How will this increase change the firm's weighted average cost of capital if you ignore taxes? (Round answer to 2 decimal places, eg. 15.25%.) Ignoring taxes firm's weighted average cost of capital...

2020 Less Taxes ( 21 percent) Net Income Less: Preferred stock dividends Net income available to common stockholders Less Common stock dividends Addition to retained earnings Per common share data Earnings per share (EPS) Dividends per share DPS) Book value per share (BVPS) Market value price per share (MVPS) $ 872 $ $26.850 $22550 GARNERS' PLATOON MENTAL HEALTH CARE, INC. Statement of Cash Flows for Year Ending December 31, 2021 (in millions of dollars Section A Cash flows from operating...

2020 Less Taxes ( 21 percent) Net Income Less: Preferred stock dividends Net income available to common stockholders Less Common stock dividends Addition to retained earnings Per common share data Earnings per share (EPS) Dividends per share DPS) Book value per share (BVPS) Market value price per share (MVPS) $ 872 $ $26.850 $22550 GARNERS' PLATOON MENTAL HEALTH CARE, INC. Statement of Cash Flows for Year Ending December 31, 2021 (in millions of dollars Section A Cash flows from operating...

Wigdor Manufacturing is currently all equity financed, has EBIT of $2 million, and is in the 34% tax bracket. Louis, the company's founder, is the lone shareholder. 26. If the firm were to convert $4 million of equity into debt at a cost of 10%, what would be the total cash flow to Louis if he holds all the debt? Compare this to Louis' total cash flow if the firm remains unlevered. Assume no personal taxes. 27. Assume that all...

Wigdor Manufacturing is currently all equity financed, has EBIT of $2 million, and is in the 34% tax bracket. Louis, the company's founder, is the lone shareholder. 26. If the firm were to convert $4 million of equity into debt at a cost of 10%, what would be the total cash flow to Louis if he holds all the debt? Compare this to Louis' total cash flow if the firm remains unlevered. Assume no personal taxes. 27. Assume that all...