Homework Answers

a.) Annual depreciation is calculate as: 310000/8 = 38750

For next six year it is calculated as follow:(All values are in $)

|

Year |

Depreciation base | Percentage Depreciation | Annual Depreciation |

| 1 | 310000 | 12.5% | 38750 |

| 2 | 271250 | 14.28% | 38750 |

| 3 | 232500 | 16.67% | 38750 |

| 4 | 193750 | 20% | 38750 |

| 5 | 155000 | 25% | 38750 |

| 6 | 116250 | 33.33% | 38750 |

Note: 1. Depreciation base for 2nd year is calculated (310000-38750=271250) and vice versa.

2. Percentage Depreciation is calculated as: (38750/310000=12.5%) for 1st year and vice versa.

b.) The annual cash flow for each year are as follow

| Year | Calculation | Cash flow |

| 1 | 206000-51500 | 154500 |

| 2 | 174000-43500 | 130500 |

| 3 | 144000-36000 | 108000 |

| 4 | 129000-32250 | 96750 |

| 5 | 102000-25500 | 76500 |

| 6 | 92000-23000+130000 | 199000 |

Formula for calculating cash flow: EBDAT-Tax income (206000-(206000*0.25))

c.) Weighted average cost of capital:(0.50*0.17+0.10*0.1240+0.083*0.40*(1-0.25)) = 12.23%

d 1.) Net present value:

| Year | Cash flow | Working capital | PV at 12.23% | PV |

| 1 | 154500 | 0.891 | 137659.5 | |

| 2 | 130500 | 0.793 | 103486.5 | |

| 3 | 108000 | 0.707 | 76356 | |

| 4 | 96750 | 0.630 | 60952.5 | |

| 5 | 76500 | 0.561 | 42916.5 | |

| 6 | 92000 | 130000 | 0.500 | 99500 |

| Total Present Value | 520871 |

Net present value: 520871-310000 = $210871.

d 2 .) Yes. DataPoint should purchase the new equipment.

Add Answer to:

DataPoint Engineering is considering the purchase of a new piece of equipment for $310,000. It has...

DataPoint Engineering is considering the purchase of a new piece of equipment for $370,000. It has...

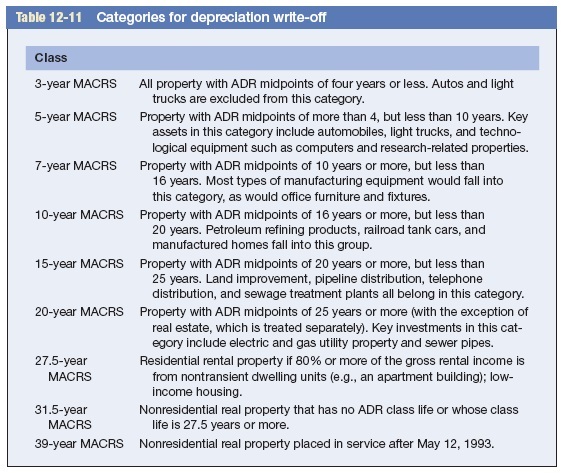

DataPoint Engineering is considering the purchase of a new piece of equipment for $370,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $190,000 in nondepreciable working capital. $67,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece of equipment for $330,000. It has...

DataPoint Engineering is considering the purchase of a new piece of equipment for $330,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $150,000 in nondepreciable working capital. $57,500 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has...

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $170,000 in nondepreciable working capital. $62,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12-12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $170,000 in nondepreciable working capital. $62,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12-12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece of equipment for $310,000. It has...

DataPoint Engineering is considering the purchase of a new piece

of equipment for $310,000. It has an eight-year midpoint of its

asset depreciation range (ADR). It will require an additional

initial investment of $130,000 in nondepreciable working capital.

Fifty-two thousand dollars of this investment will be recovered

after the sixth year and will provide additional cash flow for that

year. Income before depreciation and taxes for the next six are

shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece

of equipment for $310,000. It has an eight-year midpoint of its

asset depreciation range (ADR). It will require an additional

initial investment of $130,000 in nondepreciable working capital.

Fifty-two thousand dollars of this investment will be recovered

after the sixth year and will provide additional cash flow for that

year. Income before depreciation and taxes for the next six are

shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece of equipment for $360,000. It has...

DataPoint Engineering is considering the purchase of a new piece of equipment for $360,000. It has an eight year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $180,000 in nondepreciable working capital. Sixty-five thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12-11. Table...

DataPoint Engineering is considering the purchase of a new piece of equipment for $360,000. It has an eight year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $180,000 in nondepreciable working capital. Sixty-five thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12-11. Table...

DataPoint Engineering is considering the purchase of a new piece of equipment for $255,000. It has...

DataPoint Engineering is considering the purchase of a new piece of equipment for $255,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $250,000 in nondepreciable working capital. Eighty-two thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12-11 Table 12-12....

DataPoint Engineering is considering the purchase of a new piece of equipment for $255,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $250,000 in nondepreciable working capital. Eighty-two thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12-11 Table 12-12....

Please evaluate below questions. d-1. Determine the net present value. (Use the WACC from part c...

Please evaluate below questions. d-1. Determine the net present

value. (Use the WACC from part c rounded to 2 decimal places as a

percent as the cost of capital (e.g., 12.34%). Do not round any

other intermediate calculations. Round your answer to 2 decimal

places.)

1/(1+0.1306)^1 = 0.88448611356

1/(1+0.1306)^2 = 0.78231568509

1/(1+0.1306)^3 = 0.69194735989

1/(1+0.1306)^4 = 0.61201783114

1/(1+0.1306)^5 = 0.5413212729

1/(1+0.1306)^6 = 0.47879114886

170000 * 0.88448611356 = 150362.64

155300 * 0.78231568509 = 121493.63

122880 * 0.69194735989 = 85026.49

105662.5 *...

Please evaluate below questions. d-1. Determine the net present

value. (Use the WACC from part c rounded to 2 decimal places as a

percent as the cost of capital (e.g., 12.34%). Do not round any

other intermediate calculations. Round your answer to 2 decimal

places.)

1/(1+0.1306)^1 = 0.88448611356

1/(1+0.1306)^2 = 0.78231568509

1/(1+0.1306)^3 = 0.69194735989

1/(1+0.1306)^4 = 0.61201783114

1/(1+0.1306)^5 = 0.5413212729

1/(1+0.1306)^6 = 0.47879114886

170000 * 0.88448611356 = 150362.64

155300 * 0.78231568509 = 121493.63

122880 * 0.69194735989 = 85026.49

105662.5 *...

Determine the net present value. (Use the WACC from part c rounded to 2 decimal places as a percent as the cost of capital (e.g., 12.34%). Do not round any other intermediate calculations. Round your answer to 2 decimal places.)

DataPoint Engineering is considering the purchase of a new piece of equipment for $210,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $110,000 in nondepreciable working capital. $27,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix B for an approximate...

DataPoint Engineering is considering the purchase of a new piece of equipment for $210,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $110,000 in nondepreciable working capital. $27,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix B for an approximate...

Bottoms Up Diaper Service is considering the purchase of a new industrial washer, It can Durchase...

Bottoms Up Diaper Service is considering the purchase of a new industrial washer, It can Durchase the washer for $1.800 and sell its old washer for $600. The new washer will last for 6 vears and save $500 a year in expenses. The opportunity cost of capital is 19% , and the firm's tax rate is 40% a. If the firm uses straight-line depreciation to an assumed salvage value of zero over a 6-year life. what is the annual operating...

Bottoms Up Diaper Service is considering the purchase of a new industrial washer, It can Durchase the washer for $1.800 and sell its old washer for $600. The new washer will last for 6 vears and save $500 a year in expenses. The opportunity cost of capital is 19% , and the firm's tax rate is 40% a. If the firm uses straight-line depreciation to an assumed salvage value of zero over a 6-year life. what is the annual operating...

Gluon Inc. is considering the purchase of a new high pressure glueball. It can purchase the...

Gluon Inc. is considering the purchase of a new high pressure glueball. It can purchase the glueball for $200,000 and sell its old low- pressure glueball, which is fully depreciated, for $36,000. The new equipment has a 10-year useful life and will save $44,000 a year in expenses. The opportunity cost of capital is 8%, and the firm's tax rate is 21%. What is the equivalent annual saving from the purchase if Gluon can depreciate 100% of the investment immediately....

Gluon Inc. is considering the purchase of a new high pressure glueball. It can purchase the glueball for $200,000 and sell its old low- pressure glueball, which is fully depreciated, for $36,000. The new equipment has a 10-year useful life and will save $44,000 a year in expenses. The opportunity cost of capital is 8%, and the firm's tax rate is 21%. What is the equivalent annual saving from the purchase if Gluon can depreciate 100% of the investment immediately....

Most questions answered within 3 hours.

-

In Visual Basic 2017, Write a complete Main method that prints

Hello, world to the screen....

asked 5 minutes ago -

a) Find the pressure difference on an airplane wing if air flows

over the upper surface...

asked 11 minutes ago -

Write an assessment of the current business analysis of Hilton

Worldwide using Porters 5 Forces analysis.

asked 21 minutes ago -

i need help on this

Chapter 9 Section 3 Question 1:

Rudy puts this poster, with...

asked 30 minutes ago -

True or false Assembly x86

41. _____ The program counter is a pointer to the

instruction....

asked 31 minutes ago -

You have conducted an experiment to try to demonstrate that

growth factor receptor X protein (GFRX)...

asked 46 minutes ago -

The Gross Profit ratio for 2014 is 57.07%

Assume that Campbell's net sales for the first...

asked 45 minutes ago -

Thoroughly discuss the various current and proposed solutions to

anthropogenic influences resulting in Global Climate Change....

asked 50 minutes ago -

BLOG EXERCISE: You are writing a weekly intranet blog for the

CEO of a large Canadian...

asked 53 minutes ago -

calculate ΔGrxn at 36 ∘C. N2O4(g)→2NO2(g)

asked 53 minutes ago -

Present and Future Values of Single Cash Flows for Different

Periods

Find the following values, using...

asked 56 minutes ago -

Which types of mutations in DNA can lead to the translation of a

non-functional protein product?...

asked 55 minutes ago

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $170,000 in nondepreciable working capital. $62,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12-12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $170,000 in nondepreciable working capital. $62,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12-12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece

of equipment for $310,000. It has an eight-year midpoint of its

asset depreciation range (ADR). It will require an additional

initial investment of $130,000 in nondepreciable working capital.

Fifty-two thousand dollars of this investment will be recovered

after the sixth year and will provide additional cash flow for that

year. Income before depreciation and taxes for the next six are

shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece

of equipment for $310,000. It has an eight-year midpoint of its

asset depreciation range (ADR). It will require an additional

initial investment of $130,000 in nondepreciable working capital.

Fifty-two thousand dollars of this investment will be recovered

after the sixth year and will provide additional cash flow for that

year. Income before depreciation and taxes for the next six are

shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece of equipment for $360,000. It has an eight year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $180,000 in nondepreciable working capital. Sixty-five thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12-11. Table...

DataPoint Engineering is considering the purchase of a new piece of equipment for $360,000. It has an eight year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $180,000 in nondepreciable working capital. Sixty-five thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12-11. Table...

DataPoint Engineering is considering the purchase of a new piece of equipment for $255,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $250,000 in nondepreciable working capital. Eighty-two thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12-11 Table 12-12....

DataPoint Engineering is considering the purchase of a new piece of equipment for $255,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $250,000 in nondepreciable working capital. Eighty-two thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12-11 Table 12-12....

Please evaluate below questions. d-1. Determine the net present

value. (Use the WACC from part c rounded to 2 decimal places as a

percent as the cost of capital (e.g., 12.34%). Do not round any

other intermediate calculations. Round your answer to 2 decimal

places.)

1/(1+0.1306)^1 = 0.88448611356

1/(1+0.1306)^2 = 0.78231568509

1/(1+0.1306)^3 = 0.69194735989

1/(1+0.1306)^4 = 0.61201783114

1/(1+0.1306)^5 = 0.5413212729

1/(1+0.1306)^6 = 0.47879114886

170000 * 0.88448611356 = 150362.64

155300 * 0.78231568509 = 121493.63

122880 * 0.69194735989 = 85026.49

105662.5 *...

Please evaluate below questions. d-1. Determine the net present

value. (Use the WACC from part c rounded to 2 decimal places as a

percent as the cost of capital (e.g., 12.34%). Do not round any

other intermediate calculations. Round your answer to 2 decimal

places.)

1/(1+0.1306)^1 = 0.88448611356

1/(1+0.1306)^2 = 0.78231568509

1/(1+0.1306)^3 = 0.69194735989

1/(1+0.1306)^4 = 0.61201783114

1/(1+0.1306)^5 = 0.5413212729

1/(1+0.1306)^6 = 0.47879114886

170000 * 0.88448611356 = 150362.64

155300 * 0.78231568509 = 121493.63

122880 * 0.69194735989 = 85026.49

105662.5 *...

Bottoms Up Diaper Service is considering the purchase of a new industrial washer, It can Durchase the washer for $1.800 and sell its old washer for $600. The new washer will last for 6 vears and save $500 a year in expenses. The opportunity cost of capital is 19% , and the firm's tax rate is 40% a. If the firm uses straight-line depreciation to an assumed salvage value of zero over a 6-year life. what is the annual operating...

Bottoms Up Diaper Service is considering the purchase of a new industrial washer, It can Durchase the washer for $1.800 and sell its old washer for $600. The new washer will last for 6 vears and save $500 a year in expenses. The opportunity cost of capital is 19% , and the firm's tax rate is 40% a. If the firm uses straight-line depreciation to an assumed salvage value of zero over a 6-year life. what is the annual operating...

Gluon Inc. is considering the purchase of a new high pressure glueball. It can purchase the glueball for $200,000 and sell its old low- pressure glueball, which is fully depreciated, for $36,000. The new equipment has a 10-year useful life and will save $44,000 a year in expenses. The opportunity cost of capital is 8%, and the firm's tax rate is 21%. What is the equivalent annual saving from the purchase if Gluon can depreciate 100% of the investment immediately....

Gluon Inc. is considering the purchase of a new high pressure glueball. It can purchase the glueball for $200,000 and sell its old low- pressure glueball, which is fully depreciated, for $36,000. The new equipment has a 10-year useful life and will save $44,000 a year in expenses. The opportunity cost of capital is 8%, and the firm's tax rate is 21%. What is the equivalent annual saving from the purchase if Gluon can depreciate 100% of the investment immediately....