Determine the net present value. (Use the WACC from part c rounded to 2 decimal places as a percent as the cost of capital (e.g., 12.34%). Do not round any other intermediate calculations. Round your answer to 2 decimal places.)

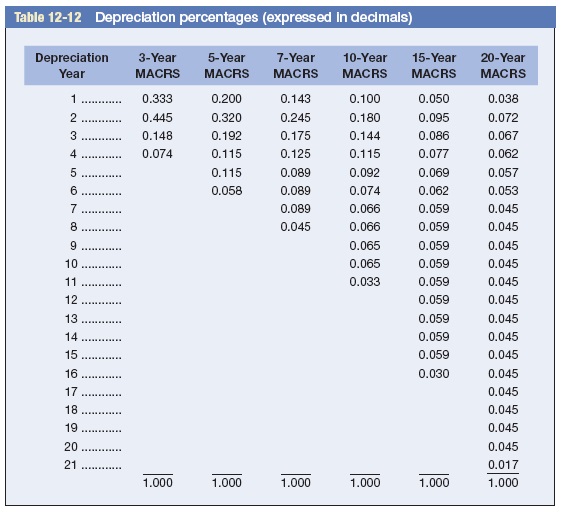

DataPoint Engineering is considering the purchase of a new piece of equipment for $210,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $110,000 in nondepreciable working capital. $27,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods.

| Year | Amount | ||||

| 1 | $ | 176,000 | |||

| 2 | 154,000 | ||||

| 3 | 124,000 | ||||

| 4 | 109,000 | ||||

| 5 | 92,000 | ||||

| 6 | 82,000 | ||||

The tax rate is 25 percent. The cost of capital must be computed based on the following:

| Cost (aftertax) | Weights | ||||||||

| Debt | Kd | 6.40 | % | 40 | % | ||||

| Preferred stock | Kp | 10.40 | 10 | ||||||

| Common equity (retained earnings) | Ke | 13.00 | 50 | ||||||

Determine the net present value. (Use the WACC from part c rounded to 2 decimal places as a percent as the cost of capital (e.g., 12.34%). Do not round any other intermediate calculations. Round your answer to 2 decimal places.)

Homework Answers

SOLUTION:-

Add Answer to:

Determine the net present value. (Use the WACC from part c rounded to 2 decimal places as a percent as the cost of capital (e.g., 12.34%). Do not round any other intermediate calculations. Round your answer to 2 decimal places.)

Please evaluate below questions. d-1. Determine the net present value. (Use the WACC from part c...

Please evaluate below questions. d-1. Determine the net present

value. (Use the WACC from part c rounded to 2 decimal places as a

percent as the cost of capital (e.g., 12.34%). Do not round any

other intermediate calculations. Round your answer to 2 decimal

places.)

1/(1+0.1306)^1 = 0.88448611356

1/(1+0.1306)^2 = 0.78231568509

1/(1+0.1306)^3 = 0.69194735989

1/(1+0.1306)^4 = 0.61201783114

1/(1+0.1306)^5 = 0.5413212729

1/(1+0.1306)^6 = 0.47879114886

170000 * 0.88448611356 = 150362.64

155300 * 0.78231568509 = 121493.63

122880 * 0.69194735989 = 85026.49

105662.5 *...

Please evaluate below questions. d-1. Determine the net present

value. (Use the WACC from part c rounded to 2 decimal places as a

percent as the cost of capital (e.g., 12.34%). Do not round any

other intermediate calculations. Round your answer to 2 decimal

places.)

1/(1+0.1306)^1 = 0.88448611356

1/(1+0.1306)^2 = 0.78231568509

1/(1+0.1306)^3 = 0.69194735989

1/(1+0.1306)^4 = 0.61201783114

1/(1+0.1306)^5 = 0.5413212729

1/(1+0.1306)^6 = 0.47879114886

170000 * 0.88448611356 = 150362.64

155300 * 0.78231568509 = 121493.63

122880 * 0.69194735989 = 85026.49

105662.5 *...

DataPoint Engineering is considering the purchase of a new piece of equipment for $370,000. It has...

DataPoint Engineering is considering the purchase of a new piece of equipment for $370,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $190,000 in nondepreciable working capital. $67,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece of equipment for $310,000. It has...

DataPoint Engineering is considering the purchase of a new piece of equipment for $310,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $130,000 in nondepreciable working capital. Fifty-two thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece of equipment for $310,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $130,000 in nondepreciable working capital. Fifty-two thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece of equipment for $330,000. It has...

DataPoint Engineering is considering the purchase of a new piece of equipment for $330,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $150,000 in nondepreciable working capital. $57,500 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has...

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $170,000 in nondepreciable working capital. $62,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12-12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $170,000 in nondepreciable working capital. $62,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12-12. Use Appendix...

Compare the present value of the incremental benefits (j) to the net cost of the new equipment (e). (Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round your answer to the nearest whole dollar.)

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $78,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $34,800. A new piece of equipment will cost $230,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost savings for the next six years. Use Table 12–12. Use Appendix B for an approximate answer but calculate your final answer using...

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $78,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $34,800. A new piece of equipment will cost $230,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost savings for the next six years. Use Table 12–12. Use Appendix B for an approximate answer but calculate your final answer using...

DataPoint Engineering is considering the purchase of a new piece of equipment for $310,000. It has...

DataPoint Engineering is considering the purchase of a new piece

of equipment for $310,000. It has an eight-year midpoint of its

asset depreciation range (ADR). It will require an additional

initial investment of $130,000 in nondepreciable working capital.

Fifty-two thousand dollars of this investment will be recovered

after the sixth year and will provide additional cash flow for that

year. Income before depreciation and taxes for the next six are

shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece

of equipment for $310,000. It has an eight-year midpoint of its

asset depreciation range (ADR). It will require an additional

initial investment of $130,000 in nondepreciable working capital.

Fifty-two thousand dollars of this investment will be recovered

after the sixth year and will provide additional cash flow for that

year. Income before depreciation and taxes for the next six are

shown in the following table. Use Table 12–11, Table 12–12....

Please remember to round your answer to two decimal places. Problem 11-03 Net Salvage Value Allen...

Please remember to round your answer to two decimal places. Problem 11-03 Net Salvage Value Allen Air Lines must liquidate some equipment that is being replaced. The equipment originally cost $20 million, of which 85% has been depreciated. The used equipment can be sold today for $6 million, and its tax rate is 30%. What is the equipment's after-tax net salvage value? Write out your answer completely. For example, 2 million should be entered as 2,000,000. $________ Problem 11-06 New-Project...

A firm offers terms of 2/15, net 45. a. What effective annual interest rate does the firm earn when a customer does not take the discount? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.

A firm offers terms of 2/15, net 45.a.What effective annual interest rate does the firm earn when a customer does not take the discount? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)b.What effective annual interest rate does the firm earn if the discount is changed to 3 percent? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)c.What effective annual interest rate...

What is the present value of a cash flow stream of $1,000 per year annually for 15 years that then grows at 2.0 percent per year forever when the discount rate is 8 percent? (Round intermediate calculations and final answer to 2 decimal places.)

What is the present value of a cash flow stream of $1,000 per year annually for 15 years that then grows at 2.0 percent per year forever when the discount rate is 8 percent? (Round intermediate calculations and final answer to 2 decimal places.)A security analyst has regressed the monthly returns on Exxon Mobil equity shares over the past five years against those on the Standard & Poor’s 500 stock index over the same period. The resulting regression equation is rEM = 0.02...

What is the present value of a cash flow stream of $1,000 per year annually for 15 years that then grows at 2.0 percent per year forever when the discount rate is 8 percent? (Round intermediate calculations and final answer to 2 decimal places.)A security analyst has regressed the monthly returns on Exxon Mobil equity shares over the past five years against those on the Standard & Poor’s 500 stock index over the same period. The resulting regression equation is rEM = 0.02...

Most questions answered within 3 hours.

-

Investor company owns 35% of investee company voting stock and

accounts for the investment under the...

asked 42 minutes ago -

The number of major faults on a randomly chosen 1 km stretch of

highway has a...

asked 1 hour ago -

Consider the competitive environment of Starbuck's, Progressive

Insurance, a manufacturing firm with low turnover, or a...

asked 1 hour ago -

3. Gains from trade

Consider two neighbouring island countries called Euphoria and

Contente. They each have...

asked 3 hours ago -

A business executive has the option to invest money in two

plans: Plan A guarantees that...

asked 6 hours ago -

Hello, can someone please help me answer this question?

How much heat is absorbed by a...

asked 6 hours ago -

. A marketing researcher conducted a survey of 25 shoppers

randomly selected at the local mall...

asked 6 hours ago -

Create an comprehensive response to the

following:

Antimicrobial agents work on a multitude of microbes (bacteria,...

asked 6 hours ago -

6.13 LAB: Step counter. Section 6.3.

A pedometer treats walking 2,000 steps as walking 1 mile....

asked 6 hours ago -

(14.2) A block of mass m = 10 kg riding on a frictionless

horizontal plane is...

asked 6 hours ago -

Use any search engine to search for articles about Starbucks

partnership with Tata Companies in India...

asked 6 hours ago -

Let’s say that for some reason Bank Excess Reserves suddenly

increase sharply. What effect would this...

asked 6 hours ago

Please evaluate below questions. d-1. Determine the net present

value. (Use the WACC from part c rounded to 2 decimal places as a

percent as the cost of capital (e.g., 12.34%). Do not round any

other intermediate calculations. Round your answer to 2 decimal

places.)

1/(1+0.1306)^1 = 0.88448611356

1/(1+0.1306)^2 = 0.78231568509

1/(1+0.1306)^3 = 0.69194735989

1/(1+0.1306)^4 = 0.61201783114

1/(1+0.1306)^5 = 0.5413212729

1/(1+0.1306)^6 = 0.47879114886

170000 * 0.88448611356 = 150362.64

155300 * 0.78231568509 = 121493.63

122880 * 0.69194735989 = 85026.49

105662.5 *...

Please evaluate below questions. d-1. Determine the net present

value. (Use the WACC from part c rounded to 2 decimal places as a

percent as the cost of capital (e.g., 12.34%). Do not round any

other intermediate calculations. Round your answer to 2 decimal

places.)

1/(1+0.1306)^1 = 0.88448611356

1/(1+0.1306)^2 = 0.78231568509

1/(1+0.1306)^3 = 0.69194735989

1/(1+0.1306)^4 = 0.61201783114

1/(1+0.1306)^5 = 0.5413212729

1/(1+0.1306)^6 = 0.47879114886

170000 * 0.88448611356 = 150362.64

155300 * 0.78231568509 = 121493.63

122880 * 0.69194735989 = 85026.49

105662.5 *...

DataPoint Engineering is considering the purchase of a new piece of equipment for $310,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $130,000 in nondepreciable working capital. Fifty-two thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece of equipment for $310,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $130,000 in nondepreciable working capital. Fifty-two thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $170,000 in nondepreciable working capital. $62,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12-12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $170,000 in nondepreciable working capital. $62,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12-12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece

of equipment for $310,000. It has an eight-year midpoint of its

asset depreciation range (ADR). It will require an additional

initial investment of $130,000 in nondepreciable working capital.

Fifty-two thousand dollars of this investment will be recovered

after the sixth year and will provide additional cash flow for that

year. Income before depreciation and taxes for the next six are

shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece

of equipment for $310,000. It has an eight-year midpoint of its

asset depreciation range (ADR). It will require an additional

initial investment of $130,000 in nondepreciable working capital.

Fifty-two thousand dollars of this investment will be recovered

after the sixth year and will provide additional cash flow for that

year. Income before depreciation and taxes for the next six are

shown in the following table. Use Table 12–11, Table 12–12....