Please evaluate below questions. d-1. Determine the net present value. (Use the WACC from part c rounded to 2 decimal places as a percent as the cost of capital (e.g., 12.34%). Do not round any other intermediate calculations. Round your answer to 2 decimal places.)

1/(1+0.1306)^1 = 0.88448611356

1/(1+0.1306)^2 = 0.78231568509

1/(1+0.1306)^3 = 0.69194735989

1/(1+0.1306)^4 = 0.61201783114

1/(1+0.1306)^5 = 0.5413212729

1/(1+0.1306)^6 = 0.47879114886

170000 * 0.88448611356 = 150362.64

155300 * 0.78231568509 = 121493.63

122880 * 0.69194735989 = 85026.49

105662.5 * 0.61201783114 = 64667.33

85412.5 * 0.61201783114 = 52273.97

125495 * 0.47879114886 = 60085.90

150362.64 + 121493.63 + 85026.49 + 64667.33 + 52273.97 + 60085.9 = 533909.96

NPV = 533909.96 - 440000 = 93909.96 <----------------------------Please confirm if this is correct answer

Homework Answers

Detailed answer is provided in the hand the hand written notes below.

Add Answer to:

Please evaluate below questions. d-1. Determine the net present

value. (Use the WACC from part c...

Determine the net present value. (Use the WACC from part c rounded to 2 decimal places as a percent as the cost of capital (e.g., 12.34%). Do not round any other intermediate calculations. Round your answer to 2 decimal places.)

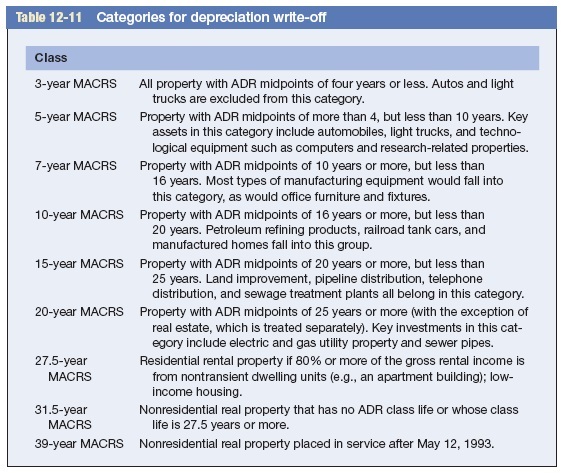

DataPoint Engineering is considering the purchase of a new piece of equipment for $210,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $110,000 in nondepreciable working capital. $27,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix B for an approximate...

DataPoint Engineering is considering the purchase of a new piece of equipment for $210,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $110,000 in nondepreciable working capital. $27,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix B for an approximate...

DataPoint Engineering is considering the purchase of a new piece of equipment for $310,000. It has...

DataPoint Engineering is considering the purchase of a new piece of equipment for $310,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $130,000 in nondepreciable working capital. Fifty-two thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece of equipment for $310,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $130,000 in nondepreciable working capital. Fifty-two thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has...

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $170,000 in nondepreciable working capital. $62,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12-12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $170,000 in nondepreciable working capital. $62,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12-12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece of equipment for $370,000. It has...

DataPoint Engineering is considering the purchase of a new piece of equipment for $370,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $190,000 in nondepreciable working capital. $67,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece of equipment for $330,000. It has...

DataPoint Engineering is considering the purchase of a new piece of equipment for $330,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $150,000 in nondepreciable working capital. $57,500 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix...

Would you please resolve questions H, I. J-1. J-2, K-1, and K-2? Rest of the answers...

Would you please resolve questions H, I. J-1. J-2, K-1, and K-2?

Rest of the answers are already resolved.

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $96,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $43,800. A new piece of equipment will cost $210,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost...

Would you please resolve questions H, I. J-1. J-2, K-1, and K-2?

Rest of the answers are already resolved.

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $96,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $43,800. A new piece of equipment will cost $210,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost...

DataPoint Engineering is considering the purchase of a new piece of equipment for $310,000. It has...

DataPoint Engineering is considering the purchase of a new piece

of equipment for $310,000. It has an eight-year midpoint of its

asset depreciation range (ADR). It will require an additional

initial investment of $130,000 in nondepreciable working capital.

Fifty-two thousand dollars of this investment will be recovered

after the sixth year and will provide additional cash flow for that

year. Income before depreciation and taxes for the next six are

shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece

of equipment for $310,000. It has an eight-year midpoint of its

asset depreciation range (ADR). It will require an additional

initial investment of $130,000 in nondepreciable working capital.

Fifty-two thousand dollars of this investment will be recovered

after the sixth year and will provide additional cash flow for that

year. Income before depreciation and taxes for the next six are

shown in the following table. Use Table 12–11, Table 12–12....

Questions a-e are already complete and correct. Please answer parts f, g, h, i, j1-2, and...

Questions a-e are already complete and correct. Please answer

parts f, g, h, i, j1-2, and k1.

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $64,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $27,800. A new piece of equipment will cost $154,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost savings for...

Questions a-e are already complete and correct. Please answer

parts f, g, h, i, j1-2, and k1.

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $64,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $27,800. A new piece of equipment will cost $154,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost savings for...

I answered part A, I need B and C please Problem 9-23 Depreciation and Project Value...

I answered part A, I need B and C please

Problem 9-23 Depreciation and Project Value (LO3) Bottoms Up Diaper Service is considering the purchase of a new industrial washer. It can purchase the washer for $3,600 and sell its old washer for $900. The new washer will last for 6 years and save $1,100 a year in expenses. The opportunity cost of capital is 20%, and the firm's tax rate is 40%. a. If the firm uses straight-line depreciation...

I answered part A, I need B and C please

Problem 9-23 Depreciation and Project Value (LO3) Bottoms Up Diaper Service is considering the purchase of a new industrial washer. It can purchase the washer for $3,600 and sell its old washer for $900. The new washer will last for 6 years and save $1,100 a year in expenses. The opportunity cost of capital is 20%, and the firm's tax rate is 40%. a. If the firm uses straight-line depreciation...

Problem 16-12 Calculating WACC [LO1] Blitz Industries has a debt-equity ratio of 1.6. Its WACC is...

Problem 16-12 Calculating WACC [LO1] Blitz Industries has a debt-equity ratio of 1.6. Its WACC is 7.8 percent, and its cost of debt is 5.5 percent. The corporate tax rate is 21 percent. a. What is the company’s cost of equity capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the company’s unlevered cost of equity capital? (Do not round intermediate calculations and enter your answer as a...

Most questions answered within 3 hours.

-

Imagine you are the owner of a small, entrepreneurial start-up.

You feel stretched to the snapping...

asked 8 minutes ago -

Hi! I need help answering this questions. Please provide an

explanation for the answer as well,...

asked 6 minutes ago -

Explain five reason why incentive plans fail

Human Resource Management

asked 10 minutes ago -

1)

Construct FSM for the following scenarios.

Input: non empty binary sequence

I) output:

Should end...

asked 6 minutes ago -

Suppose that the probability that Sally eats ice cream for

dessert is p, and the probability...

asked 16 minutes ago -

.how important is it to use data modeling when designing

databases

asked 26 minutes ago -

A

child is siitng on a swing (20kg) and the mother applies a force of

45N...

asked 25 minutes ago -

Your university is running a special offer on tuition. This

year's tuition cost is $16,000. Next...

asked 24 minutes ago -

A massless and frictionless spring stretches 4.16 cm from the

relaxed position when a 1.47 N...

asked 29 minutes ago -

The United States nickel contains about 25% nickel metal and 75%

copper metal. Could you use...

asked 51 minutes ago -

what are the debuggers in Java?

import java.text.NumberFormat;

/**

*

* This class represents a circle...

asked 58 minutes ago -

the

financial statement that sums up a firm's revenues, costs, and

profit over a period of...

asked 57 minutes ago

DataPoint Engineering is considering the purchase of a new piece of equipment for $310,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $130,000 in nondepreciable working capital. Fifty-two thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece of equipment for $310,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $130,000 in nondepreciable working capital. Fifty-two thousand dollars of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $170,000 in nondepreciable working capital. $62,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12-12. Use Appendix...

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $170,000 in nondepreciable working capital. $62,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12-12. Use Appendix...

Would you please resolve questions H, I. J-1. J-2, K-1, and K-2?

Rest of the answers are already resolved.

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $96,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $43,800. A new piece of equipment will cost $210,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost...

Would you please resolve questions H, I. J-1. J-2, K-1, and K-2?

Rest of the answers are already resolved.

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $96,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $43,800. A new piece of equipment will cost $210,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost...

DataPoint Engineering is considering the purchase of a new piece

of equipment for $310,000. It has an eight-year midpoint of its

asset depreciation range (ADR). It will require an additional

initial investment of $130,000 in nondepreciable working capital.

Fifty-two thousand dollars of this investment will be recovered

after the sixth year and will provide additional cash flow for that

year. Income before depreciation and taxes for the next six are

shown in the following table. Use Table 12–11, Table 12–12....

DataPoint Engineering is considering the purchase of a new piece

of equipment for $310,000. It has an eight-year midpoint of its

asset depreciation range (ADR). It will require an additional

initial investment of $130,000 in nondepreciable working capital.

Fifty-two thousand dollars of this investment will be recovered

after the sixth year and will provide additional cash flow for that

year. Income before depreciation and taxes for the next six are

shown in the following table. Use Table 12–11, Table 12–12....

Questions a-e are already complete and correct. Please answer

parts f, g, h, i, j1-2, and k1.

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $64,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $27,800. A new piece of equipment will cost $154,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost savings for...

Questions a-e are already complete and correct. Please answer

parts f, g, h, i, j1-2, and k1.

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $64,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $27,800. A new piece of equipment will cost $154,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost savings for...

I answered part A, I need B and C please

Problem 9-23 Depreciation and Project Value (LO3) Bottoms Up Diaper Service is considering the purchase of a new industrial washer. It can purchase the washer for $3,600 and sell its old washer for $900. The new washer will last for 6 years and save $1,100 a year in expenses. The opportunity cost of capital is 20%, and the firm's tax rate is 40%. a. If the firm uses straight-line depreciation...

I answered part A, I need B and C please

Problem 9-23 Depreciation and Project Value (LO3) Bottoms Up Diaper Service is considering the purchase of a new industrial washer. It can purchase the washer for $3,600 and sell its old washer for $900. The new washer will last for 6 years and save $1,100 a year in expenses. The opportunity cost of capital is 20%, and the firm's tax rate is 40%. a. If the firm uses straight-line depreciation...