On January 2, 2020, Kingbird Inc. sells goods to Blossom Company in exchange for a zero-interest-bearing note with a face value of $8,140, with payment due in 12 months. The fair value of the goods at the date of sale is $7,400 (cost $6,900). Assume that

Homework Answers

| Date | Account Titles | Debit | Credit |

| Jan. 2 | Accounts Receivable | $ 7,400 | |

| Sales Revenue | $ 7,400 | ||

| Jan. 2 | Cost of Goods Sold | $ 6,900 | |

| Merchandise Inventory | $ 6,900 |

Revenue recognized in 2020 = $8140

Interest Rate = ($8140-7400) / 7400 = 10%

If you have any query, kindly comment with your query and please mark thumbs up.

Add Answer to:

On January 2, 2020, Kingbird Inc. sells goods to Blossom Company in exchange for a zero-interest-bearing note with a face value of $8,140, with payment due in 12 months. The fair value of the goods at the date of sale is $7,400 (cost $6,900). Assume that

On January 2, 2020, Stellar Inc. sells goods to Geo Company in exchange for a zero-interest-bearing note with face value of $9,300, with payment due in 12 months. The fair value of the goods at the date of sale is $8,400 (cost $5,040).

Kingbird Corporation issued a 5-year, $68,000, zero-interest-bearing note to Garcia Company on January 1, 2020, and...

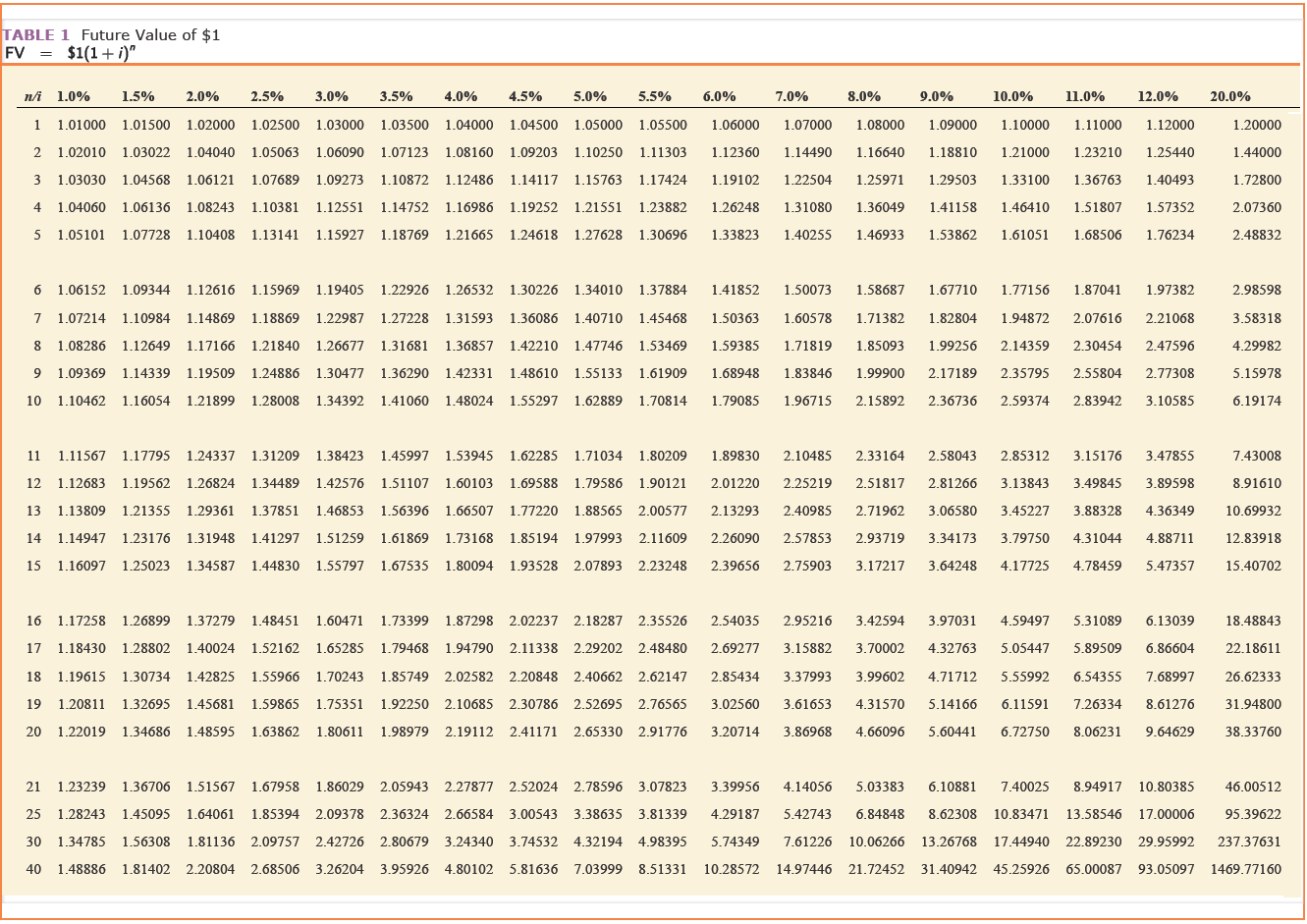

Kingbird Corporation issued a 5-year, $68,000,

zero-interest-bearing note to Garcia Company on January 1, 2020,

and received cash of $68,000. In addition, Kingbird agreed to sell

merchandise to Garcia at an amount less than regular selling price

over the 5-year period. The market rate of interest for similar

notes is 12%.

Prepare Kingbird Corporation’s January 1 journal entry.

(Round present value factor calculations to 5 decimal

places, e.g. 1.25124 and final answer to 0 decimal places, e.g.

38,548. If no...

Kingbird Corporation issued a 5-year, $68,000,

zero-interest-bearing note to Garcia Company on January 1, 2020,

and received cash of $68,000. In addition, Kingbird agreed to sell

merchandise to Garcia at an amount less than regular selling price

over the 5-year period. The market rate of interest for similar

notes is 12%.

Prepare Kingbird Corporation’s January 1 journal entry.

(Round present value factor calculations to 5 decimal

places, e.g. 1.25124 and final answer to 0 decimal places, e.g.

38,548. If no...

Frank Ricard Inc. sells inventory on January 1st 2020 in exchange for a $2,000 note, due...

Frank Ricard Inc. sells inventory on January 1st 2020 in exchange for a $2,000 note, due in 2 years (i.e., zero interest bearing). The effective interest rate for this note is 10 percent Prepare all journal entries related to note and any related interest from January 1st, through the repayment on January 1st 2022.

On January 1, Pina Colada Corp. lent $38,000 to Kingbird, Inc., accepting Kingbird’s $50,578, three-year, zero-interest-bearing note. The implied interest is 10%.

On January 1 , Pina Colada Corp. lent \(\$ 38,000\) to Kingbird, Inc., accepting Kingbird's \(\$ 50,578,\) three-year, zero-interest bearing note. The implied interest is \(10 \%\).(a)Prepare Pina's journal entries for the initial transaction, recognition of interest each year assuming use of the effective interest method, and the collection of \(\$ 50,578\) at maturity. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles...

On January 1 , Pina Colada Corp. lent \(\$ 38,000\) to Kingbird, Inc., accepting Kingbird's \(\$ 50,578,\) three-year, zero-interest bearing note. The implied interest is \(10 \%\).(a)Prepare Pina's journal entries for the initial transaction, recognition of interest each year assuming use of the effective interest method, and the collection of \(\$ 50,578\) at maturity. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles...

On January 1, 2020, Kingbird, Inc. issued $2,680,000 face value, 12%, 10-year bonds at $2,534,577. This price resulted...

On January 1, 2020, Kingbird, Inc. issued $2,680,000 face value, 12%, 10-year bonds at $2,534,577. This price resulted in an effective-interest rate of 13% on the bonds. Kingbird uses the effective interest method to amortize bond premium or discount. The bonds pay annual interest on January 1. Prepare the journal entry to record the issuance of the bonds on January 1, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account...

On January 1, 2020, Kingbird, Inc. issued $2,680,000 face value, 12%, 10-year bonds at $2,534,577. This price resulted in an effective-interest rate of 13% on the bonds. Kingbird uses the effective interest method to amortize bond premium or discount. The bonds pay annual interest on January 1. Prepare the journal entry to record the issuance of the bonds on January 1, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account...

Carla Vista Company sells goods that cost $255,000 to Martinez Company for $405,000 on January 2, 2020. The sales price includes an installation fee, which is valued at $33,200. The fair value of the goods is $381,800. The goods were delivered on March 1,

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

Most questions answered within 3 hours.

-

Twitter Users and News: A poll conducted in 2013 found that 52%

of U.S. adult Twitter...

asked 2 minutes ago -

How

would I know whether a given amino acid has an ionizable group or

not? please...

asked 10 minutes ago -

True or false?

True False The function of the enzyme acyl CoA

synthetase is the ATP-dependent coupling...

asked 10 minutes ago -

Nadia Corporation adjusts its debt so that its interest coverage

(EBIT/Interest) remains constant at 3. Nadia’s...

asked 12 minutes ago -

In a clinical trial, 20 out of 600 patients taking a

prescription drug complained of flulike...

asked 18 minutes ago -

7. How many types of nuclear processes can produce energy? 8.

How many types of radioactive...

asked 22 minutes ago -

For both the Sn2 and Sn1 reaction

conditions:

Structure | Rxn (Y/N) at room T° Rxn...

asked 23 minutes ago -

11. In cell N2, enter a formula using the IF function and a

structured reference to...

asked 22 minutes ago -

There is X-linked mutations in flies in this example. You need

to determine the inheritence pattern...

asked 24 minutes ago -

1) There is a 5.0 μC charge at each of 3 corners of a square

(each...

asked 35 minutes ago -

A study of 420,095 cell phone users found that

134 of them developed cancer of the...

asked 39 minutes ago -

2.50 g of NH4Cl is added to 12.9 g of water. Calculate the

molality of the...

asked 42 minutes ago

Kingbird Corporation issued a 5-year, $68,000,

zero-interest-bearing note to Garcia Company on January 1, 2020,

and received cash of $68,000. In addition, Kingbird agreed to sell

merchandise to Garcia at an amount less than regular selling price

over the 5-year period. The market rate of interest for similar

notes is 12%.

Prepare Kingbird Corporation’s January 1 journal entry.

(Round present value factor calculations to 5 decimal

places, e.g. 1.25124 and final answer to 0 decimal places, e.g.

38,548. If no...

Kingbird Corporation issued a 5-year, $68,000,

zero-interest-bearing note to Garcia Company on January 1, 2020,

and received cash of $68,000. In addition, Kingbird agreed to sell

merchandise to Garcia at an amount less than regular selling price

over the 5-year period. The market rate of interest for similar

notes is 12%.

Prepare Kingbird Corporation’s January 1 journal entry.

(Round present value factor calculations to 5 decimal

places, e.g. 1.25124 and final answer to 0 decimal places, e.g.

38,548. If no...

On January 1, 2020, Kingbird, Inc. issued $2,680,000 face value, 12%, 10-year bonds at $2,534,577. This price resulted in an effective-interest rate of 13% on the bonds. Kingbird uses the effective interest method to amortize bond premium or discount. The bonds pay annual interest on January 1. Prepare the journal entry to record the issuance of the bonds on January 1, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account...

On January 1, 2020, Kingbird, Inc. issued $2,680,000 face value, 12%, 10-year bonds at $2,534,577. This price resulted in an effective-interest rate of 13% on the bonds. Kingbird uses the effective interest method to amortize bond premium or discount. The bonds pay annual interest on January 1. Prepare the journal entry to record the issuance of the bonds on January 1, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account...