Suppose that the marginal cost of mining gold is constant at $300 per ounce and the...

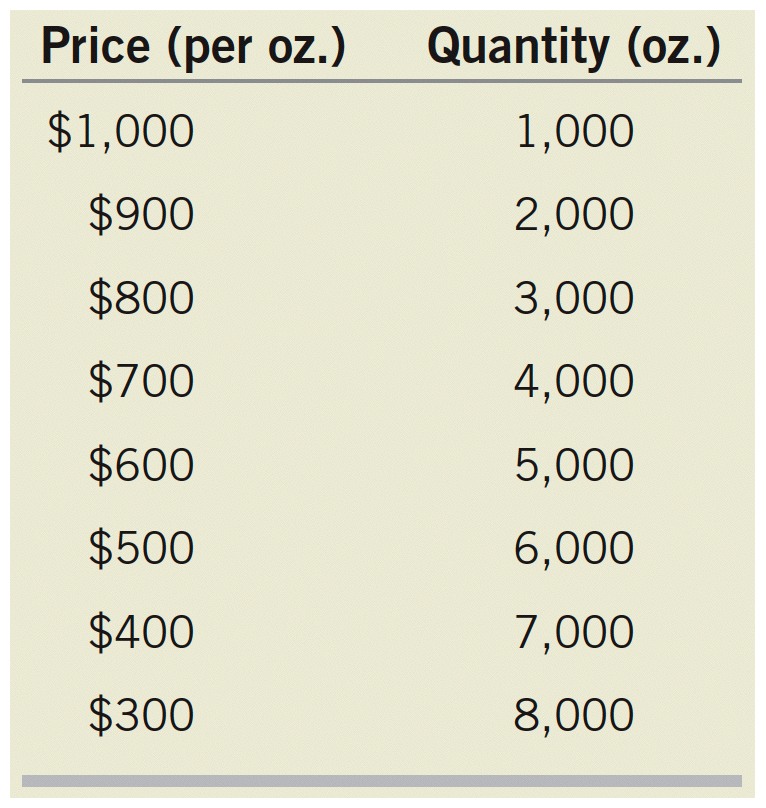

Suppose that the marginal cost of mining gold is constant at $300 per ounce and the demand schedule is as follows:

| PRICE (per oz.) | QUANTITY (per oz.) |

| $1000 | 1000 |

| $900 | 2000 |

| $800 | 3000 |

| $700 | 4000 |

| $600 | 5000 |

| $500 | 6000 |

| $400 | 7000 |

| $300 | 8000 |

a.) If the number of supplies is large, what would be the price and quantity?

b.) If there is only one supplier, what would be the price and quantity?

c.) If there are only two suppliers and they form a cartel, what would be the price and quantity?

d.) Suppose that one of the two cartel memebers in part (c) decides to increase its production by 1,000 ounces while the other member keeps its production constant. What will happen to the revenues of both firms?

Homework Answers

Add Answer to:

Suppose that the marginal cost of mining gold is constant

at $300 per ounce and the...

Suppose that the marginal cost of mining gold is constant at $300 per ounce and the demand schedule is as follows:

Suppose that the marginal cost of mining gold is constant at $300 per ounce and the demand schedule is as follows: 1st attemptPart 1 (1.4 points)See HintIf the number of suppliers is large, what would be the price of gold? $ per ounce What would be the quantity? oz. Part 2 (1.4 points)See HintIf there is only one supplier, what would be the price of gold? $ per ounce What would be the quantity? oz. Part 3 (1.4 points)See HintIf there are only two suppliers and they form a cartel, what would be the price...

Suppose that the marginal cost of mining gold is constant at $300 per ounce and the demand schedule is as follows: 1st attemptPart 1 (1.4 points)See HintIf the number of suppliers is large, what would be the price of gold? $ per ounce What would be the quantity? oz. Part 2 (1.4 points)See HintIf there is only one supplier, what would be the price of gold? $ per ounce What would be the quantity? oz. Part 3 (1.4 points)See HintIf there are only two suppliers and they form a cartel, what would be the price...

the marginal cost of sheep and lamb production is contant at $1000 per animal. If there...

the marginal cost of sheep and lamb production is

contant at $1000 per animal. If there were only one supplier of

sheep and lambs what would be the equilibrium price?

a 8000

b7000

c6000

d5000

e none

20. 21. Table 17.09 is Price Quantity $8000 7000 6000 5000 4000 5000 6000 7000 8000 9000 10,000 11,000 12,000 estion: 3000 nt at 2000 ve, 1000 e table 17.09 as a reference to answer

the marginal cost of sheep and lamb production is

contant at $1000 per animal. If there were only one supplier of

sheep and lambs what would be the equilibrium price?

a 8000

b7000

c6000

d5000

e none

20. 21. Table 17.09 is Price Quantity $8000 7000 6000 5000 4000 5000 6000 7000 8000 9000 10,000 11,000 12,000 estion: 3000 nt at 2000 ve, 1000 e table 17.09 as a reference to answer

A gold mining firm sells futures contracts worth 1000 ounces at a price of $700 per...

A gold mining firm sells futures contracts worth 1000 ounces at a price of $700 per ounce for maturity one year from today. If gold futures prices increase to $702 per ounce, what is the cash flow to the producer? O A. $702,000 ○ B. -S2000 C. $700,000 O D. $0 O E. $2000

A gold mining firm sells futures contracts worth 1000 ounces at a price of $700 per ounce for maturity one year from today. If gold futures prices increase to $702 per ounce, what is the cash flow to the producer? O A. $702,000 ○ B. -S2000 C. $700,000 O D. $0 O E. $2000

Hugh, Frank, and Luis are the only three buyers of gold in a small mining town....

Hugh, Frank, and Luis are the only three buyers of gold in a small mining town. Their inverse demand functions for gold are as follows: Hugh: p = 128.00 – 64.00 l , Frank: p = 96.00 – 48.00 xlf, Luis: p = 8.00 – 4.00 x QL. QhQF, and QL are the quantities (in ounces) demanded by Hugh, Frank, and Luis, respectively. Below, give all answers to two decimals. v 1st attempt Part 1 (1 point) Suppose the price...

Hugh, Frank, and Luis are the only three buyers of gold in a small mining town. Their inverse demand functions for gold are as follows: Hugh: p = 128.00 – 64.00 l , Frank: p = 96.00 – 48.00 xlf, Luis: p = 8.00 – 4.00 x QL. QhQF, and QL are the quantities (in ounces) demanded by Hugh, Frank, and Luis, respectively. Below, give all answers to two decimals. v 1st attempt Part 1 (1 point) Suppose the price...

YES 22. Use table 17.09 as a reference to anawer the following stant at 81,000 per...

YES 22. Use table 17.09 as a reference to anawer the following stant at 81,000 per animal. If the market was perfeety Tthe marginal coat of sheep and lamb production is 5oo0 bompetitive, what would be the equilibrium priceT 6000 a. $5,000 b. $4,000 ?. 83.000 $2,000 $1,000 7000 6000 5000 4000 7000 8000 9000 10,000 23. Use table 17.09 as a reference to answer the following question: 3000 The marginal cost of sheep and lamb production is constant at...

YES 22. Use table 17.09 as a reference to anawer the following stant at 81,000 per animal. If the market was perfeety Tthe marginal coat of sheep and lamb production is 5oo0 bompetitive, what would be the equilibrium priceT 6000 a. $5,000 b. $4,000 ?. 83.000 $2,000 $1,000 7000 6000 5000 4000 7000 8000 9000 10,000 23. Use table 17.09 as a reference to answer the following question: 3000 The marginal cost of sheep and lamb production is constant at...

Production Possibility Frontier - Country X A B 15,1 10,6 09 Watches daily production с 4...

Production Possibility Frontier - Country X A B 15,1 10,6 09 Watches daily production с 4 F 15,4 10,4 Nw D 18, 2 1 E 0 20,0 20 25 10 15 MP3 Players Daily production Consider the graph of the production possibility frontier for country X. What is a combination of MP3 players and watches that would be inefficient production for country X? ОА О Е OF Question 8 1 pts Market for Used Cars 9000 8000 7000 6000 5000...

Production Possibility Frontier - Country X A B 15,1 10,6 09 Watches daily production с 4 F 15,4 10,4 Nw D 18, 2 1 E 0 20,0 20 25 10 15 MP3 Players Daily production Consider the graph of the production possibility frontier for country X. What is a combination of MP3 players and watches that would be inefficient production for country X? ОА О Е OF Question 8 1 pts Market for Used Cars 9000 8000 7000 6000 5000...

4. The oll cartel The Organization of Petroleum Exporting Countries (OPEC) is a group of 12...

4. The oll cartel The Organization of Petroleum Exporting Countries (OPEC) is a group of 12 member countries that formed a cartel to sel petroleum on the world market. They support prices higher than would exist under more competitive conditions to maximize member nation profits and restrict competition among themselves via production quotas. Suppose that OPEC does not exist and that the 12 oil-producing nations compete in the world market, which is perfectly competitive. On the following graph, use the...

4. The oll cartel The Organization of Petroleum Exporting Countries (OPEC) is a group of 12 member countries that formed a cartel to sel petroleum on the world market. They support prices higher than would exist under more competitive conditions to maximize member nation profits and restrict competition among themselves via production quotas. Suppose that OPEC does not exist and that the 12 oil-producing nations compete in the world market, which is perfectly competitive. On the following graph, use the...

Hugh, Frank, and Luis are the only three buyers of gold in a small mining town....

Hugh, Frank, and Luis are the only three buyers of gold in a small mining town. Their inverse demand functions for gold are as follows: Hugh: p = 192.00 - 32.00 x QH, Frank: p = 144.00 - 24.00 XOF Luis: p = 12.00 - 2.00 x QL. QhQF, and QL are the quantities (in ounces) demanded by Hugh, Frank, and Luis, respectively. Below,give all answers to two decimals. 2nd attempt Part 1 (1 point) Feedback See Hint Suppose the...

Hugh, Frank, and Luis are the only three buyers of gold in a small mining town. Their inverse demand functions for gold are as follows: Hugh: p = 192.00 - 32.00 x QH, Frank: p = 144.00 - 24.00 XOF Luis: p = 12.00 - 2.00 x QL. QhQF, and QL are the quantities (in ounces) demanded by Hugh, Frank, and Luis, respectively. Below,give all answers to two decimals. 2nd attempt Part 1 (1 point) Feedback See Hint Suppose the...

2. Suppose that the private cost of gold per ounce is given by the equation $...

2. Suppose that the private cost of gold per ounce is given by the equation $ - 100 + 20 and Marginal Social Benefit for gold is given by the equation $ = 600-0.50 a. Suppose that each ounce of gold produced is accompanied by an external cost of $100 due to future impacts on a downstream laundry. i. Solve for the socially optimal quantity of gold. ii. Solve for the unregulated market quantity of gold. iii. Produce one fully...

2. Suppose that the private cost of gold per ounce is given by the equation $ - 100 + 20 and Marginal Social Benefit for gold is given by the equation $ = 600-0.50 a. Suppose that each ounce of gold produced is accompanied by an external cost of $100 due to future impacts on a downstream laundry. i. Solve for the socially optimal quantity of gold. ii. Solve for the unregulated market quantity of gold. iii. Produce one fully...

Prema purchased 27 ounces of gold in 2005 for $447 per ounce in order to try...

Prema purchased 27 ounces of gold in 2005 for $447 per ounce in order to try to diversify her investment portfolio. She sold a third of her holdings in gold in 2009 at a price $850 per ounce. She sold the rest of her gold holdings in 2010 for $1,129 per ounce. What would her profit have been if she sold all the gold holdings in 2009?

Most questions answered within 3 hours.

-

At 1 bar, how much energy is required to heat 61.0 g of H2O(s)

at −12.0...

asked 11 minutes ago -

Find the mixed-strategy equilibrium to the Battle of the sexes

game in Figure 5.1 below

Hockey...

asked 13 minutes ago -

Use the following information to answer the next three

questions.

QUESTION 5

As of today, the...

asked 19 minutes ago -

Using the specific identification method: Date Units purchased

Cost per unit Ending inventory March 1 15...

asked 21 minutes ago -

PLEASE HELP, NO ONE IS ANSWERING MY QUESTION AND IT IS SUE TODAY

WORTH 20% OF...

asked 36 minutes ago -

α = 0.0007889 T, I = 2.9 A

Other Magnetic Fields: First, based on your

value...

asked 35 minutes ago -

This assignment is a continuation of the 2nd one. You as a HR

Manager, select an...

asked 38 minutes ago -

Hastings Entertainment has a beta of 0.64. If the market return

is expected to be 13.80...

asked 49 minutes ago -

9. Depository institutions are always:

a. illiquid

b. profitable

c. insolvent

d. all of the above...

asked 57 minutes ago -

Use AstroTurf Company's income statement below to answer the

following two questions. Answer these questions with...

asked 57 minutes ago -

How is a firm's task

environment different from its general environment? Provide

examples of both types...

asked 55 minutes ago -

What is one reason Innovators can adopt innovations so

early?

Group of answer choices

they are...

asked 57 minutes ago

the marginal cost of sheep and lamb production is

contant at $1000 per animal. If there were only one supplier of

sheep and lambs what would be the equilibrium price?

a 8000

b7000

c6000

d5000

e none

20. 21. Table 17.09 is Price Quantity $8000 7000 6000 5000 4000 5000 6000 7000 8000 9000 10,000 11,000 12,000 estion: 3000 nt at 2000 ve, 1000 e table 17.09 as a reference to answer

the marginal cost of sheep and lamb production is

contant at $1000 per animal. If there were only one supplier of

sheep and lambs what would be the equilibrium price?

a 8000

b7000

c6000

d5000

e none

20. 21. Table 17.09 is Price Quantity $8000 7000 6000 5000 4000 5000 6000 7000 8000 9000 10,000 11,000 12,000 estion: 3000 nt at 2000 ve, 1000 e table 17.09 as a reference to answer

A gold mining firm sells futures contracts worth 1000 ounces at a price of $700 per ounce for maturity one year from today. If gold futures prices increase to $702 per ounce, what is the cash flow to the producer? O A. $702,000 ○ B. -S2000 C. $700,000 O D. $0 O E. $2000

A gold mining firm sells futures contracts worth 1000 ounces at a price of $700 per ounce for maturity one year from today. If gold futures prices increase to $702 per ounce, what is the cash flow to the producer? O A. $702,000 ○ B. -S2000 C. $700,000 O D. $0 O E. $2000

Hugh, Frank, and Luis are the only three buyers of gold in a small mining town. Their inverse demand functions for gold are as follows: Hugh: p = 128.00 – 64.00 l , Frank: p = 96.00 – 48.00 xlf, Luis: p = 8.00 – 4.00 x QL. QhQF, and QL are the quantities (in ounces) demanded by Hugh, Frank, and Luis, respectively. Below, give all answers to two decimals. v 1st attempt Part 1 (1 point) Suppose the price...

Hugh, Frank, and Luis are the only three buyers of gold in a small mining town. Their inverse demand functions for gold are as follows: Hugh: p = 128.00 – 64.00 l , Frank: p = 96.00 – 48.00 xlf, Luis: p = 8.00 – 4.00 x QL. QhQF, and QL are the quantities (in ounces) demanded by Hugh, Frank, and Luis, respectively. Below, give all answers to two decimals. v 1st attempt Part 1 (1 point) Suppose the price...

YES 22. Use table 17.09 as a reference to anawer the following stant at 81,000 per animal. If the market was perfeety Tthe marginal coat of sheep and lamb production is 5oo0 bompetitive, what would be the equilibrium priceT 6000 a. $5,000 b. $4,000 ?. 83.000 $2,000 $1,000 7000 6000 5000 4000 7000 8000 9000 10,000 23. Use table 17.09 as a reference to answer the following question: 3000 The marginal cost of sheep and lamb production is constant at...

YES 22. Use table 17.09 as a reference to anawer the following stant at 81,000 per animal. If the market was perfeety Tthe marginal coat of sheep and lamb production is 5oo0 bompetitive, what would be the equilibrium priceT 6000 a. $5,000 b. $4,000 ?. 83.000 $2,000 $1,000 7000 6000 5000 4000 7000 8000 9000 10,000 23. Use table 17.09 as a reference to answer the following question: 3000 The marginal cost of sheep and lamb production is constant at...

Production Possibility Frontier - Country X A B 15,1 10,6 09 Watches daily production с 4 F 15,4 10,4 Nw D 18, 2 1 E 0 20,0 20 25 10 15 MP3 Players Daily production Consider the graph of the production possibility frontier for country X. What is a combination of MP3 players and watches that would be inefficient production for country X? ОА О Е OF Question 8 1 pts Market for Used Cars 9000 8000 7000 6000 5000...

Production Possibility Frontier - Country X A B 15,1 10,6 09 Watches daily production с 4 F 15,4 10,4 Nw D 18, 2 1 E 0 20,0 20 25 10 15 MP3 Players Daily production Consider the graph of the production possibility frontier for country X. What is a combination of MP3 players and watches that would be inefficient production for country X? ОА О Е OF Question 8 1 pts Market for Used Cars 9000 8000 7000 6000 5000...

4. The oll cartel The Organization of Petroleum Exporting Countries (OPEC) is a group of 12 member countries that formed a cartel to sel petroleum on the world market. They support prices higher than would exist under more competitive conditions to maximize member nation profits and restrict competition among themselves via production quotas. Suppose that OPEC does not exist and that the 12 oil-producing nations compete in the world market, which is perfectly competitive. On the following graph, use the...

4. The oll cartel The Organization of Petroleum Exporting Countries (OPEC) is a group of 12 member countries that formed a cartel to sel petroleum on the world market. They support prices higher than would exist under more competitive conditions to maximize member nation profits and restrict competition among themselves via production quotas. Suppose that OPEC does not exist and that the 12 oil-producing nations compete in the world market, which is perfectly competitive. On the following graph, use the...

Hugh, Frank, and Luis are the only three buyers of gold in a small mining town. Their inverse demand functions for gold are as follows: Hugh: p = 192.00 - 32.00 x QH, Frank: p = 144.00 - 24.00 XOF Luis: p = 12.00 - 2.00 x QL. QhQF, and QL are the quantities (in ounces) demanded by Hugh, Frank, and Luis, respectively. Below,give all answers to two decimals. 2nd attempt Part 1 (1 point) Feedback See Hint Suppose the...

Hugh, Frank, and Luis are the only three buyers of gold in a small mining town. Their inverse demand functions for gold are as follows: Hugh: p = 192.00 - 32.00 x QH, Frank: p = 144.00 - 24.00 XOF Luis: p = 12.00 - 2.00 x QL. QhQF, and QL are the quantities (in ounces) demanded by Hugh, Frank, and Luis, respectively. Below,give all answers to two decimals. 2nd attempt Part 1 (1 point) Feedback See Hint Suppose the...

2. Suppose that the private cost of gold per ounce is given by the equation $ - 100 + 20 and Marginal Social Benefit for gold is given by the equation $ = 600-0.50 a. Suppose that each ounce of gold produced is accompanied by an external cost of $100 due to future impacts on a downstream laundry. i. Solve for the socially optimal quantity of gold. ii. Solve for the unregulated market quantity of gold. iii. Produce one fully...

2. Suppose that the private cost of gold per ounce is given by the equation $ - 100 + 20 and Marginal Social Benefit for gold is given by the equation $ = 600-0.50 a. Suppose that each ounce of gold produced is accompanied by an external cost of $100 due to future impacts on a downstream laundry. i. Solve for the socially optimal quantity of gold. ii. Solve for the unregulated market quantity of gold. iii. Produce one fully...