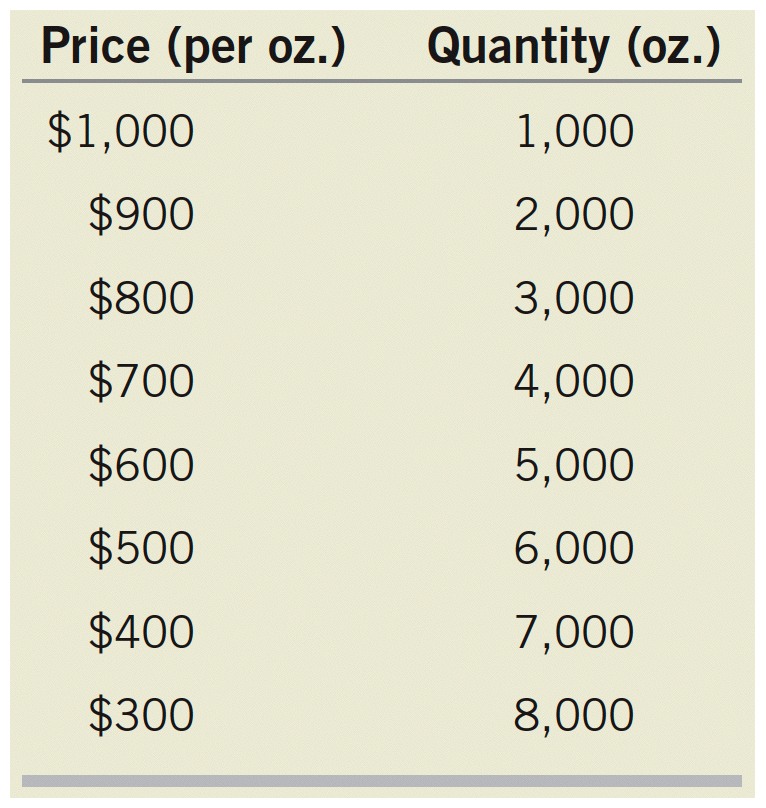

Suppose that the marginal cost of mining gold is constant at $300 per ounce and the demand schedule is as follows:

Suppose that the marginal cost of mining gold is constant at $300 per ounce and the demand schedule is as follows:

1st attempt If the number of suppliers is large, what would be the price of gold? If there is only one supplier, what would be the price of gold? If there are only two suppliers and they form a cartel, what would be the price of gold? Suppose that one of the two cartel members in Part 3 decides to increase its production by 1,000 ounces while the other member keeps its production constant. What will happen to the revenues of both firms?Part 1 (1.4 points)

$ per ounce

$ per ounce

What would be the quantity?  oz.

oz. Part 2 (1.4 points)

$ per ounce

$ per ounce

What would be the quantity?  oz.

oz. Part 3 (1.4 points)

$ per ounce

$ per ounce

Assuming the two suppliers each produce equal amounts, how much gold would each supplier produce?  oz.

oz. Part 4 (0.7 point)

Homework Answers

Add Answer to:

Suppose that the marginal cost of mining gold is constant at $300 per ounce and the demand schedule is as follows:

Suppose that the marginal cost of mining gold is constant at $300 per ounce and the...

Suppose that the marginal cost of mining gold is constant at $300 per ounce and the demand schedule is as follows: PRICE (per oz.) QUANTITY (per oz.) $1000 1000 $900 2000 $800 3000 $700 4000 $600 5000 $500 6000 $400 7000 $300 8000 a.) If the number of supplies is large, what would be the price and quantity? b.) If there is only one supplier, what would be the price and quantity? c.) If there are only two suppliers and...

Consider a market with demand function D(p)=10-p and firms with constant marginal cost MC=1. Assume that...

Consider a market with demand function D(p)=10-p and firms with

constant marginal cost MC=1. Assume that there is no fixed cost and

thus C(q1)=q1and C(q2)=q2

2. Suppose the owners of the two firms meet together secretly and agree to form a cartel. They choose a total level of production that maximizes their joint profits. They agree to split production and thus profits) equally (a) Suppose that both firms abide by their secret agreement. How much will each firm produce? What...

Consider a market with demand function D(p)=10-p and firms with

constant marginal cost MC=1. Assume that there is no fixed cost and

thus C(q1)=q1and C(q2)=q2

2. Suppose the owners of the two firms meet together secretly and agree to form a cartel. They choose a total level of production that maximizes their joint profits. They agree to split production and thus profits) equally (a) Suppose that both firms abide by their secret agreement. How much will each firm produce? What...

Unit of Pollution Marginal Cost of damage Consider a scenario where there are 15 total units...

Unit of Pollution Marginal Cost of damage Consider a scenario where there are 15 total units of pollution occurring within a given area. The per unit cost of damage increases by $3 each time pollution increases as the pollution gets ever closer to the absorptive capacity of the environment (see the table to the left). There are three sectors in this economy each contributing 5 units of pollution. Each firm could conceivably clean up this pollution; however due to differences...

Unit of Pollution Marginal Cost of damage Consider a scenario where there are 15 total units of pollution occurring within a given area. The per unit cost of damage increases by $3 each time pollution increases as the pollution gets ever closer to the absorptive capacity of the environment (see the table to the left). There are three sectors in this economy each contributing 5 units of pollution. Each firm could conceivably clean up this pollution; however due to differences...

1. Suppose a firm’s cost of hiring another worker is $100. The firm pays an hourly...

1. Suppose a firm’s cost of hiring another worker is $100. The firm pays an hourly wage of $15 to all workers. Each additional worker adds 100 units to total production, holding constant capital and average hours per worker. If a current worker works an additional hour, holding constant capital and the number of employees, total production increases by 8. The firm faces diminishing marginal returns to workers and to hours per worker. A. Is the firm maximizing profits? Why...

BETAPHARM PROCUREMENT B. Malic Acid.The electronic auction for malic acid was producing very intriguing results. Betapharm...

BETAPHARM PROCUREMENT B. Malic Acid.The electronic auction for malic acid was producing very intriguing results. Betapharm had first requested a sealed bid for a small amount of product from the potential suppliers to learn about the price structure of the various players. Because the spread in prices was large (see Exhibit 4 in (A) case), Wilkenson decided to run an electronic auction before doing further due diligence on the suppliers. He wanted to see the proposed prices of the potential...

Part I Suppose that in the market for paper, demand is P=100 - Q. The marginal private cost of producing paper is 10+ Q...

Part I Suppose that in the market for paper, demand is P=100 - Q. The marginal private cost of producing paper is 10+ Q. However, pollution generated by the production process creates a per unit external harm (i.e., negative externality) equal to 0.5Q (i.e., the level of the externality increases with the quantity produced). 16+1,5 Q (Social cret) 10+Q (private 0 36 45 Top a) What is the (unregulated) market equilibrium and quantity if the externality is not corrected for...

Part I Suppose that in the market for paper, demand is P=100 - Q. The marginal private cost of producing paper is 10+ Q. However, pollution generated by the production process creates a per unit external harm (i.e., negative externality) equal to 0.5Q (i.e., the level of the externality increases with the quantity produced). 16+1,5 Q (Social cret) 10+Q (private 0 36 45 Top a) What is the (unregulated) market equilibrium and quantity if the externality is not corrected for...

05 Question (4 points) A video game developer hires two types of workers to develop games:...

05 Question (4 points) A video game developer hires two types of workers to develop games: game coders (x1) and game testers (x2). The developer produces games according to the following production function: y = x14x3/4, where y stands for the number of games developed per month, and X1 and x2 stand for, respectively, the number of programmers and testers hired per month. Because both types of workers freelance using their own tools, the video game developer does not require...

05 Question (4 points) A video game developer hires two types of workers to develop games: game coders (x1) and game testers (x2). The developer produces games according to the following production function: y = x14x3/4, where y stands for the number of games developed per month, and X1 and x2 stand for, respectively, the number of programmers and testers hired per month. Because both types of workers freelance using their own tools, the video game developer does not require...

usion (24 points) Two firms are playing a repeated Bertrand game infinitely, each with the same marginal cost 100. The market demand function is P-400-Q. The firm who charges the lower price win...

usion (24 points) Two firms are playing a repeated Bertrand game infinitely, each with the same marginal cost 100. The market demand function is P-400-Q. The firm who charges the lower price wins the whole market. When both firms charge the same price, each gets 1/2 of the total market. I. Coll A. (6 points) What price will they choose in the stage (only one period) Nash equilibrium? What price will they choose if in the stage game (only one...

usion (24 points) Two firms are playing a repeated Bertrand game infinitely, each with the same marginal cost 100. The market demand function is P-400-Q. The firm who charges the lower price wins the whole market. When both firms charge the same price, each gets 1/2 of the total market. I. Coll A. (6 points) What price will they choose in the stage (only one period) Nash equilibrium? What price will they choose if in the stage game (only one...

How do the national income accounts change if social security payments increase? A) Consumption falls. B)...

How do the national income accounts change if social security payments increase? A) Consumption falls. B) Consumption rises. C) Savings rise. D) This change is not captured in the national income accounts. How do the national income accounts change if unemployment benefits paid to people increase? A) Consumption falls. B) Consumption rises. C) Savings rise. D) This change is not captured in the national income accounts. How do the national income accounts change if national defense spending increases? A) Government...

It's pretty much just that pages discussing the graphs and explaining their meaning. would you like...

It's pretty much just that pages discussing the graphs and

explaining their meaning. would you like to see my notes? They're

pretty similar to the graph. I wrote down my answer but I'm still

pretty confused on it.

1) Consider the figure below. FIGURE 32 Self-Reinforcing Effects and Clustering Total cost labor cos Prop cost Number of firms in cluster Profit of fimm cincter Imagine that there is a $3 per unit fall in labor costs show that change on...

It's pretty much just that pages discussing the graphs and

explaining their meaning. would you like to see my notes? They're

pretty similar to the graph. I wrote down my answer but I'm still

pretty confused on it.

1) Consider the figure below. FIGURE 32 Self-Reinforcing Effects and Clustering Total cost labor cos Prop cost Number of firms in cluster Profit of fimm cincter Imagine that there is a $3 per unit fall in labor costs show that change on...

Most questions answered within 3 hours.

-

Which of the following statements is consistent with the fact

that capital in an economy is...

asked 7 minutes ago -

Would you hire a white hat hacker or black hat hacker? What are

the pros and...

asked 12 minutes ago -

The CFO is conducting a meeting and she says "we shouldn't

accept this project because we...

asked 14 minutes ago -

How do you obtain the discount rate for an international capital

budgeting problem?

asked 11 minutes ago -

Hi, please read the entire problem.

I need help with the BusOrder class and test for...

asked 12 minutes ago -

Hello, regarding the photoelectric effect I had a couple

questions:

Red light is shining on a...

asked 29 minutes ago -

build a sample navigation Sprite in css ?

asked 27 minutes ago -

Please write a C# program for an concert sale with the

requirements below in Console Form:...

asked 30 minutes ago -

use linux follow instructions , put the commands at each step

and screenshot at each step...

asked 44 minutes ago -

Suppose producer’s production function let q(K, E) =

K0.5E0.5

Suppose producer’s cost function if w=w’ and...

asked 39 minutes ago -

Using the information given below for the fictitious country

"Alpha," find the national saving rate.

...

asked 30 minutes ago -

What is the advantage(s) of using iPS instead of ES cells for stem

cell therapies?

asked 40 minutes ago

Consider a market with demand function D(p)=10-p and firms with

constant marginal cost MC=1. Assume that there is no fixed cost and

thus C(q1)=q1and C(q2)=q2

2. Suppose the owners of the two firms meet together secretly and agree to form a cartel. They choose a total level of production that maximizes their joint profits. They agree to split production and thus profits) equally (a) Suppose that both firms abide by their secret agreement. How much will each firm produce? What...

Consider a market with demand function D(p)=10-p and firms with

constant marginal cost MC=1. Assume that there is no fixed cost and

thus C(q1)=q1and C(q2)=q2

2. Suppose the owners of the two firms meet together secretly and agree to form a cartel. They choose a total level of production that maximizes their joint profits. They agree to split production and thus profits) equally (a) Suppose that both firms abide by their secret agreement. How much will each firm produce? What...

Unit of Pollution Marginal Cost of damage Consider a scenario where there are 15 total units of pollution occurring within a given area. The per unit cost of damage increases by $3 each time pollution increases as the pollution gets ever closer to the absorptive capacity of the environment (see the table to the left). There are three sectors in this economy each contributing 5 units of pollution. Each firm could conceivably clean up this pollution; however due to differences...

Unit of Pollution Marginal Cost of damage Consider a scenario where there are 15 total units of pollution occurring within a given area. The per unit cost of damage increases by $3 each time pollution increases as the pollution gets ever closer to the absorptive capacity of the environment (see the table to the left). There are three sectors in this economy each contributing 5 units of pollution. Each firm could conceivably clean up this pollution; however due to differences...

Part I Suppose that in the market for paper, demand is P=100 - Q. The marginal private cost of producing paper is 10+ Q. However, pollution generated by the production process creates a per unit external harm (i.e., negative externality) equal to 0.5Q (i.e., the level of the externality increases with the quantity produced). 16+1,5 Q (Social cret) 10+Q (private 0 36 45 Top a) What is the (unregulated) market equilibrium and quantity if the externality is not corrected for...

Part I Suppose that in the market for paper, demand is P=100 - Q. The marginal private cost of producing paper is 10+ Q. However, pollution generated by the production process creates a per unit external harm (i.e., negative externality) equal to 0.5Q (i.e., the level of the externality increases with the quantity produced). 16+1,5 Q (Social cret) 10+Q (private 0 36 45 Top a) What is the (unregulated) market equilibrium and quantity if the externality is not corrected for...

05 Question (4 points) A video game developer hires two types of workers to develop games: game coders (x1) and game testers (x2). The developer produces games according to the following production function: y = x14x3/4, where y stands for the number of games developed per month, and X1 and x2 stand for, respectively, the number of programmers and testers hired per month. Because both types of workers freelance using their own tools, the video game developer does not require...

05 Question (4 points) A video game developer hires two types of workers to develop games: game coders (x1) and game testers (x2). The developer produces games according to the following production function: y = x14x3/4, where y stands for the number of games developed per month, and X1 and x2 stand for, respectively, the number of programmers and testers hired per month. Because both types of workers freelance using their own tools, the video game developer does not require...

usion (24 points) Two firms are playing a repeated Bertrand game infinitely, each with the same marginal cost 100. The market demand function is P-400-Q. The firm who charges the lower price wins the whole market. When both firms charge the same price, each gets 1/2 of the total market. I. Coll A. (6 points) What price will they choose in the stage (only one period) Nash equilibrium? What price will they choose if in the stage game (only one...

usion (24 points) Two firms are playing a repeated Bertrand game infinitely, each with the same marginal cost 100. The market demand function is P-400-Q. The firm who charges the lower price wins the whole market. When both firms charge the same price, each gets 1/2 of the total market. I. Coll A. (6 points) What price will they choose in the stage (only one period) Nash equilibrium? What price will they choose if in the stage game (only one...

It's pretty much just that pages discussing the graphs and

explaining their meaning. would you like to see my notes? They're

pretty similar to the graph. I wrote down my answer but I'm still

pretty confused on it.

1) Consider the figure below. FIGURE 32 Self-Reinforcing Effects and Clustering Total cost labor cos Prop cost Number of firms in cluster Profit of fimm cincter Imagine that there is a $3 per unit fall in labor costs show that change on...

It's pretty much just that pages discussing the graphs and

explaining their meaning. would you like to see my notes? They're

pretty similar to the graph. I wrote down my answer but I'm still

pretty confused on it.

1) Consider the figure below. FIGURE 32 Self-Reinforcing Effects and Clustering Total cost labor cos Prop cost Number of firms in cluster Profit of fimm cincter Imagine that there is a $3 per unit fall in labor costs show that change on...