Herman has agreed to repay a debt by using the following repayment schedule. Starting today, he...

Herman has agreed to repay a debt by using the following repayment schedule. Starting today, he will make $100 payments at the beginning of each month for the next two-and-a-half years. He will then pay nothing for the next two years. Finally, after four-and-a-half years, he will make $200 payments at the beginning of each month for one year, which will pay off his debt completely. For the first four-and-a-half years, the interest on the debt is 9% compounded monthly. For the final year, the interest is lowered to 8.5% compounded monthly. Find the size of Herman’s debt. Round your answer to the nearest dollar.

Homework Answers

Loan value is PV of all the future cash flows

PV of $100 for 2.5 yrs $2,697.59 =-PV(9%/12,30,100,,1)

PV of $200 for last yrs $1,542.58 =-PV(8.5%/12,12,200,,1)/(1+9%/12)^54

Loan value $4,240.17

Rounding off = $4240.

Add Answer to:

Herman has agreed to repay a debt by using the following

repayment schedule. Starting today, he...

Please show the work, thanks! 8. Herman has agreed to repay a debt by using the...

Please show the work, thanks!

8. Herman has agreed to repay a debt by using the following repayment schedule. Starting today, he will make $100 payments at the beginning of each month for the next two-and-a-half years. He will then pay nothing for the next two years. Finally, after four-and-a-half years, he will make $200 payments at the beginning of each month for one year, which will pay off his debt completely. For the first four-and-a-half years, the interest on...

Please show the work, thanks!

8. Herman has agreed to repay a debt by using the following repayment schedule. Starting today, he will make $100 payments at the beginning of each month for the next two-and-a-half years. He will then pay nothing for the next two years. Finally, after four-and-a-half years, he will make $200 payments at the beginning of each month for one year, which will pay off his debt completely. For the first four-and-a-half years, the interest on...

on present value of annuity sheila davidson borrowered money from her credit union and agreed to...

on present value of annuity sheila davidson borrowered money

from her credit union and agreed to repay the loan in blended

monthly payments of $161.75 over a 4 year period. interest on the

loan was 9% compounded monthly

Business Math 2 G6 e https//clansroom.google.com/1//MauoOTO3MOYEMDa c) How much interest will there be? On present value of annuity Sheila davidson borrowed money from her credit union and agreed to repay the loan in blended monthly payments of $161.75 over a 4 year...

on present value of annuity sheila davidson borrowered money

from her credit union and agreed to repay the loan in blended

monthly payments of $161.75 over a 4 year period. interest on the

loan was 9% compounded monthly

Business Math 2 G6 e https//clansroom.google.com/1//MauoOTO3MOYEMDa c) How much interest will there be? On present value of annuity Sheila davidson borrowed money from her credit union and agreed to repay the loan in blended monthly payments of $161.75 over a 4 year...

4. Mr. Jones is in debt. He owes Mr. James an amount of $235,000. To repay...

4. Mr. Jones is in debt. He owes Mr. James an amount of $235,000. To repay this debt he is to pay an amount of X for the next 7 years and an amount of 2X for the following 15 years. All payments are made at the end of the year. The annual interest rate is 12%. Calculate X.

4. Mr. Jones is in debt. He owes Mr. James an amount of $235,000. To repay this debt he is to pay an amount of X for the next 7 years and an amount of 2X for the following 15 years. All payments are made at the end of the year. The annual interest rate is 12%. Calculate X.

You borrowed $70,000 in student loans. You plan to make monthly payments to repay the debt....

You borrowed $70,000 in student loans. You plan to make monthly payments to repay the debt. The interest rate is fixed at 3.3% APR (with monthly compounding). a) If the loans are for 10 years, find the monthly payment. b) Suppose that you decide to pay $300 more per month instead of the required monthly payment. How long will it take to pay off the loan?

This problem has three questions. Make sure to answer all three questions. For the following problem,...

This problem has three questions. Make sure to answer all three questions. For the following problem, assume that all debts and payments are incurred at the end of the month and that interest is compounded monthly. Assume that retirement savings are invested in the stock market and earn an annual interest rate of 11%, which is compounded monthly. . Big Spender James gets a credit card at the beginning of his freshman year. • He adds $693 of credit card...

This problem has three questions. Make sure to answer all three questions. For the following problem, assume that all debts and payments are incurred at the end of the month and that interest is compounded monthly. Assume that retirement savings are invested in the stock market and earn an annual interest rate of 11%, which is compounded monthly. . Big Spender James gets a credit card at the beginning of his freshman year. • He adds $693 of credit card...

Problem 3 (Required, 25 marks) Recently, Mr. A has 2 outstanding loans: • Loan A -...

Problem 3 (Required, 25 marks) Recently, Mr. A has 2 outstanding loans: • Loan A - He needs to repay $1720 at the end of every month and there are 36 repayments remaining. The loan charges interest at an annual nominal interest rate 12% compounded monthly Loan B - He needs to repay an amount X at the end of every month and there are 36 repayments remaining. The loan charges interest at an annual nominal interest rate 18% compounded...

Problem 3 (Required, 25 marks) Recently, Mr. A has 2 outstanding loans: • Loan A - He needs to repay $1720 at the end of every month and there are 36 repayments remaining. The loan charges interest at an annual nominal interest rate 12% compounded monthly Loan B - He needs to repay an amount X at the end of every month and there are 36 repayments remaining. The loan charges interest at an annual nominal interest rate 18% compounded...

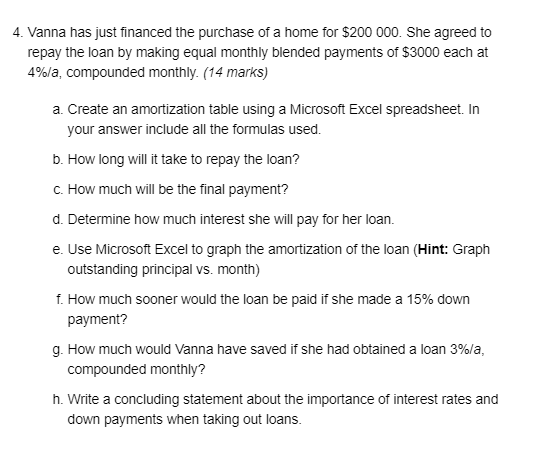

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. (14 marks) Create an amortization table using a Microsoft Excel spreadsheet. In y

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. a. Create an amortization table using a Microsoft Excel spreadsheet. In your answer include all the formulas used.b.How long will it take to repay the loan?c. How much will be the final payment?d. Determine how much interest she will pay for her loan.e. Use Microsoft Excel to graph the amortization...

Vanna has just financed the purchase of a home for $200 000. She agreed to repay the loan by making equal monthly blended payments of $3000 each at 4%/a, compounded monthly. a. Create an amortization table using a Microsoft Excel spreadsheet. In your answer include all the formulas used.b.How long will it take to repay the loan?c. How much will be the final payment?d. Determine how much interest she will pay for her loan.e. Use Microsoft Excel to graph the amortization...

Jack wants to buy a boat today today but has realised that if he takes out...

Jack wants to buy a boat today today but has realised that if he takes out a loan he can only repay $800 quarterly, with payments made at the beginning of each quarter, over the next 5 years. How much can he spend on his boat today if the interest rate is 13.4% per annum compounded quarterly? Select one: a. $11911.92 b. $11525.80 c. $3159.94 d. $2786.54

This Question: 1 pt This Test: 50 pts possible Betore-tax cost of debt and after-tax cost...

This Question: 1 pt This Test: 50 pts possible Betore-tax cost of debt and after-tax cost of debt David Abbot i bank, and to repay the koan he will make 360 monthly payments (principal and interest) of $1,161.11 per month over the next 30 years. David can s buying a new house, and he is taking out a 30-year mortgage. David will borrow $209,000 from a payments on his mortgage from his taxable income, and a. What is the before-tax...

This Question: 1 pt This Test: 50 pts possible Betore-tax cost of debt and after-tax cost of debt David Abbot i bank, and to repay the koan he will make 360 monthly payments (principal and interest) of $1,161.11 per month over the next 30 years. David can s buying a new house, and he is taking out a 30-year mortgage. David will borrow $209,000 from a payments on his mortgage from his taxable income, and a. What is the before-tax...

Quantitative Reasoning | Module 10: Homework133 Allegra is starting a small record label and has secured...

Quantitative Reasoning | Module 10: Homework133 Allegra is starting a small record label and has secured start-up funding in the form of an interest only loan for s90,000, which hasan APR of 9.9% compounded monthly. Since the loan is interest only, she will not pay off any of the balance of the loan until it comes to term at the end of eight years. Instead, she will simply pay the monthly interest owed on the loan amount of $90,000. 4....

Quantitative Reasoning | Module 10: Homework133 Allegra is starting a small record label and has secured start-up funding in the form of an interest only loan for s90,000, which hasan APR of 9.9% compounded monthly. Since the loan is interest only, she will not pay off any of the balance of the loan until it comes to term at the end of eight years. Instead, she will simply pay the monthly interest owed on the loan amount of $90,000. 4....

Most questions answered within 3 hours.

-

The train I take into town charges less to people who ride

between 8:00 am and...

asked 2 minutes ago -

Pizza cost $5 per unit Coke cost $1 per unit You have $17 and

plan to...

asked 9 minutes ago -

Bill’s Bakery has current earnings per share of $2.42.

Current book value is $4.20 per share....

asked 8 minutes ago -

D5NS with 40 mg gentamicin IV infuse at 30 mL/h over 30 min q8h.

A volume-control...

asked 9 minutes ago -

To get a declared dividend from a company, what is the last day

that the investor...

asked 11 minutes ago -

A sample of food (1.00 g) was mixed with appropriate amount of

water and titrated using...

asked 25 minutes ago -

Conformers:

list the following substituents in order from most equatorial

position preferring to least: (CH3)3, H,...

asked 26 minutes ago -

Twenty students took a test. The average grade was 86 with a

standard deviation of 9....

asked 36 minutes ago -

NP complete problem:

Big project problem. To finish the big project, you need to

finish X...

asked 29 minutes ago -

How much is the

multiplier?. Here are some facts about the economy of Inferior.

Marginal propensity...

asked 32 minutes ago -

What’s the allocation of the purchase price between newmont merger

goldcorp?

And does the merger adhere...

asked 32 minutes ago -

I am getting an error that the variable num was not declared in

the scope on...

asked 32 minutes ago

Please show the work, thanks!

8. Herman has agreed to repay a debt by using the following repayment schedule. Starting today, he will make $100 payments at the beginning of each month for the next two-and-a-half years. He will then pay nothing for the next two years. Finally, after four-and-a-half years, he will make $200 payments at the beginning of each month for one year, which will pay off his debt completely. For the first four-and-a-half years, the interest on...

Please show the work, thanks!

8. Herman has agreed to repay a debt by using the following repayment schedule. Starting today, he will make $100 payments at the beginning of each month for the next two-and-a-half years. He will then pay nothing for the next two years. Finally, after four-and-a-half years, he will make $200 payments at the beginning of each month for one year, which will pay off his debt completely. For the first four-and-a-half years, the interest on...

on present value of annuity sheila davidson borrowered money

from her credit union and agreed to repay the loan in blended

monthly payments of $161.75 over a 4 year period. interest on the

loan was 9% compounded monthly

Business Math 2 G6 e https//clansroom.google.com/1//MauoOTO3MOYEMDa c) How much interest will there be? On present value of annuity Sheila davidson borrowed money from her credit union and agreed to repay the loan in blended monthly payments of $161.75 over a 4 year...

on present value of annuity sheila davidson borrowered money

from her credit union and agreed to repay the loan in blended

monthly payments of $161.75 over a 4 year period. interest on the

loan was 9% compounded monthly

Business Math 2 G6 e https//clansroom.google.com/1//MauoOTO3MOYEMDa c) How much interest will there be? On present value of annuity Sheila davidson borrowed money from her credit union and agreed to repay the loan in blended monthly payments of $161.75 over a 4 year...

4. Mr. Jones is in debt. He owes Mr. James an amount of $235,000. To repay this debt he is to pay an amount of X for the next 7 years and an amount of 2X for the following 15 years. All payments are made at the end of the year. The annual interest rate is 12%. Calculate X.

4. Mr. Jones is in debt. He owes Mr. James an amount of $235,000. To repay this debt he is to pay an amount of X for the next 7 years and an amount of 2X for the following 15 years. All payments are made at the end of the year. The annual interest rate is 12%. Calculate X.

This problem has three questions. Make sure to answer all three questions. For the following problem, assume that all debts and payments are incurred at the end of the month and that interest is compounded monthly. Assume that retirement savings are invested in the stock market and earn an annual interest rate of 11%, which is compounded monthly. . Big Spender James gets a credit card at the beginning of his freshman year. • He adds $693 of credit card...

This problem has three questions. Make sure to answer all three questions. For the following problem, assume that all debts and payments are incurred at the end of the month and that interest is compounded monthly. Assume that retirement savings are invested in the stock market and earn an annual interest rate of 11%, which is compounded monthly. . Big Spender James gets a credit card at the beginning of his freshman year. • He adds $693 of credit card...

Problem 3 (Required, 25 marks) Recently, Mr. A has 2 outstanding loans: • Loan A - He needs to repay $1720 at the end of every month and there are 36 repayments remaining. The loan charges interest at an annual nominal interest rate 12% compounded monthly Loan B - He needs to repay an amount X at the end of every month and there are 36 repayments remaining. The loan charges interest at an annual nominal interest rate 18% compounded...

Problem 3 (Required, 25 marks) Recently, Mr. A has 2 outstanding loans: • Loan A - He needs to repay $1720 at the end of every month and there are 36 repayments remaining. The loan charges interest at an annual nominal interest rate 12% compounded monthly Loan B - He needs to repay an amount X at the end of every month and there are 36 repayments remaining. The loan charges interest at an annual nominal interest rate 18% compounded...

This Question: 1 pt This Test: 50 pts possible Betore-tax cost of debt and after-tax cost of debt David Abbot i bank, and to repay the koan he will make 360 monthly payments (principal and interest) of $1,161.11 per month over the next 30 years. David can s buying a new house, and he is taking out a 30-year mortgage. David will borrow $209,000 from a payments on his mortgage from his taxable income, and a. What is the before-tax...

This Question: 1 pt This Test: 50 pts possible Betore-tax cost of debt and after-tax cost of debt David Abbot i bank, and to repay the koan he will make 360 monthly payments (principal and interest) of $1,161.11 per month over the next 30 years. David can s buying a new house, and he is taking out a 30-year mortgage. David will borrow $209,000 from a payments on his mortgage from his taxable income, and a. What is the before-tax...

Quantitative Reasoning | Module 10: Homework133 Allegra is starting a small record label and has secured start-up funding in the form of an interest only loan for s90,000, which hasan APR of 9.9% compounded monthly. Since the loan is interest only, she will not pay off any of the balance of the loan until it comes to term at the end of eight years. Instead, she will simply pay the monthly interest owed on the loan amount of $90,000. 4....

Quantitative Reasoning | Module 10: Homework133 Allegra is starting a small record label and has secured start-up funding in the form of an interest only loan for s90,000, which hasan APR of 9.9% compounded monthly. Since the loan is interest only, she will not pay off any of the balance of the loan until it comes to term at the end of eight years. Instead, she will simply pay the monthly interest owed on the loan amount of $90,000. 4....