Homework Answers

Option A:

Option A is most accurate since the value of a firm depends on its ability to generate cash flow that is available to distribute to the company's investors, including creditors and stockholders.

second part:

B.A financial asset is considered to have value only if it has the ability to generate positive cash flows.

A financial asset will have value only if it can generate future positive cash flows.

For valuation purposes the cost at which the asset is acquired is not relevant.

The ability of the asset to generate future cash flows is relevant for valuation purposes.

Add Answer to:

The primary objective of the corporate management team is to maximize shareholder wealth. The company's board...

5. Free cash flow and financial statements Aa Aa The primary objective of the corporate management team is to maximize shareholder wealth. The company's board of directors and the shareholders ev...

5. Free cash flow and financial statements Aa Aa The primary objective of the corporate management team is to maximize shareholder wealth. The company's board of directors and the shareholders evaluate and review managerial actions based on the growth in the value of the irm Based on your understanding of what determines a firm's value, review the following: What does the value of a firm depend on? The ability to generate cash flow that is available to distribute to the...

5. Free cash flow and financial statements Aa Aa The primary objective of the corporate management team is to maximize shareholder wealth. The company's board of directors and the shareholders evaluate and review managerial actions based on the growth in the value of the irm Based on your understanding of what determines a firm's value, review the following: What does the value of a firm depend on? The ability to generate cash flow that is available to distribute to the...

If a company’s board of directors wants management to maximize shareholder wealth, should the CEO’s compensation...

If a company’s board of directors wants management to maximize shareholder wealth, should the CEO’s compensation be set as a fixed dollar amount, or should the compensation depend on how well the firm performs? If it is to be based on performance, how should performance be measured? Would it be easier to measure performance by the growth rate in reported profits or the growth rate in the stock’s intrinsic value? Which would be the better performance measure? Why? (250 words)

Based on your understanding of what determines a firm's value, review the following What does the...

Based on your understanding of what determines a firm's value, review the following What does the value of a firm depend on? Option A The ability to generate cash flow that is available to distribute to the company's investors, including creditors and stockholders The ability to generate cash flow that is available to distribute to the company's stockholders only Option B Which of the options is most accurate? Option A O Option B When determining the value of a firm,...

Based on your understanding of what determines a firm's value, review the following What does the value of a firm depend on? Option A The ability to generate cash flow that is available to distribute to the company's investors, including creditors and stockholders The ability to generate cash flow that is available to distribute to the company's stockholders only Option B Which of the options is most accurate? Option A O Option B When determining the value of a firm,...

Remember that the primary goal of a firm is to maximize shareholder wealth by increasing the...

Remember that the primary goal of a firm is to maximize shareholder wealth by increasing the firm's intrinsic value. It is thus important to understand the impact of distributions-both in the form of dividends or stock repurchases on the firm's value. Consider the following situation: Elle is a financial analyst in Demo You Ine's. As part of her analysis of the annual distribution policy and its impact on the firm's value, she makes the following calculations and observations: • The...

Remember that the primary goal of a firm is to maximize shareholder wealth by increasing the firm's intrinsic value. It is thus important to understand the impact of distributions-both in the form of dividends or stock repurchases on the firm's value. Consider the following situation: Elle is a financial analyst in Demo You Ine's. As part of her analysis of the annual distribution policy and its impact on the firm's value, she makes the following calculations and observations: • The...

4. Debt management ratios Aa Aa E Companies have the opportunity to use varying amounts of...

4. Debt management ratios Aa Aa E Companies have the opportunity to use varying amounts of different sources of financing to acquire their assets, including internal and external sources, and debt (borrowed) and equity funds. Which of the following is considered a financially leveraged firm? O A company that uses debt to finance some of its assets O A company that uses only equity to finance its assets Which of the following is true about the leveraging effect? Using leverage...

4. Debt management ratios Aa Aa E Companies have the opportunity to use varying amounts of different sources of financing to acquire their assets, including internal and external sources, and debt (borrowed) and equity funds. Which of the following is considered a financially leveraged firm? O A company that uses debt to finance some of its assets O A company that uses only equity to finance its assets Which of the following is true about the leveraging effect? Using leverage...

Debt (or leverage) management ratios Companies have the opportunity to use varying amounts of different sources...

Debt (or leverage) management ratios Companies have the opportunity to use varying amounts of different sources of financing, including internal and external sources, to acquire their assets, debt (borrowed) funds, and equity funds. Which of the following is considered a financially leveraged firm? A company that uses only equity to finance its assets A company that uses debt to finance some of its assets Which of the following is true about the leveraging effect? Using leverage reduces a firm’s potential...

EXHIBIT 14-26 Summary of Analytical Measures Ratios or Other Measurements Method of Computation Significance Measures of...

EXHIBIT 14-26 Summary of Analytical Measures Ratios or Other Measurements Method of Computation Significance Measures of short-term liquidi Current ratio ab Current Liabilities Quick ratio A measure of short-term debt Current Liabilities A measure of short-term debt tes the cash generated by operations Indicates ability to cover currently maturing Indicates how quickly receivables are collected Indicates in d ons Average Inventory to sell the a 365 Days Days to Sell I Free cash flow Net Cash from Debt ratic ion...

EXHIBIT 14-26 Summary of Analytical Measures Ratios or Other Measurements Method of Computation Significance Measures of short-term liquidi Current ratio ab Current Liabilities Quick ratio A measure of short-term debt Current Liabilities A measure of short-term debt tes the cash generated by operations Indicates ability to cover currently maturing Indicates how quickly receivables are collected Indicates in d ons Average Inventory to sell the a 365 Days Days to Sell I Free cash flow Net Cash from Debt ratic ion...

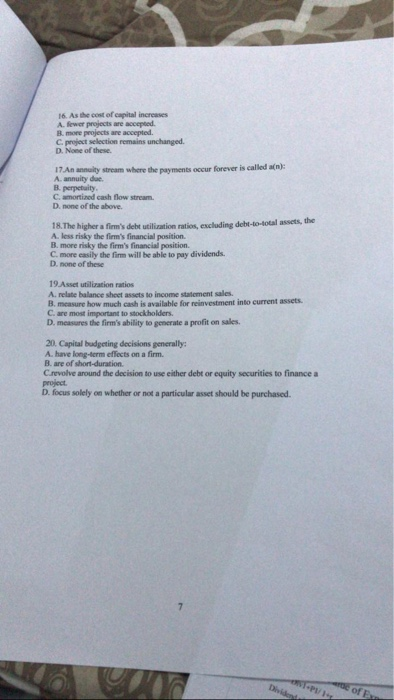

16. As the cost of capital increases A fewer projects are accepted B. more projects are...

16. As the cost of capital increases A fewer projects are accepted B. more projects are accepted. C. project selection remains unchanged. D. None of these 17.An annulty stream where the payments occur forever is called an): A. annuity due B. perpetuity. C. amortized cash flow stream D. none of the above. 18. The higher a firm's debt utilization ratios, excluding debt-to-total assets A less risky the firm's financial position. B. more risky the firm's financial position C. more easily...

16. As the cost of capital increases A fewer projects are accepted B. more projects are accepted. C. project selection remains unchanged. D. None of these 17.An annulty stream where the payments occur forever is called an): A. annuity due B. perpetuity. C. amortized cash flow stream D. none of the above. 18. The higher a firm's debt utilization ratios, excluding debt-to-total assets A less risky the firm's financial position. B. more risky the firm's financial position C. more easily...

MULTIPLE CHOICE: 1. What is the long-run objective of financial management? A. Maximize earnings per share B. Maximize...

MULTIPLE CHOICE: 1. What is the long-run objective of financial management? A. Maximize earnings per share B. Maximize the value of the firm's common stock C. Maximize return on investment D. Maximize market share 2. Which of the following statement (in general) is correct? A. A low receivables turnover is desirable B. The lower the total debt-to-equity ratio, the lower the financial risk for a firm C. An increase in net profit margin with no change in sales or assets means a weaker ROI...

11. Dividends, repurchases, and firm value Remember that the primary goal of a firm is to...

11. Dividends, repurchases, and firm value Remember that the primary goal of a firm is to maximize shareholder wealth by increasing the firm's intrinsic value. It is thus important to understand the impact of distributions- both in the form of dividends or stock repurchases-on the firm's value. Consider the following situation Rihana is a financial analyst in BTR Warehousing. As part of her analysis of the annual distribution policy and its impact on the firm's value, she makes the following...

11. Dividends, repurchases, and firm value Remember that the primary goal of a firm is to maximize shareholder wealth by increasing the firm's intrinsic value. It is thus important to understand the impact of distributions- both in the form of dividends or stock repurchases-on the firm's value. Consider the following situation Rihana is a financial analyst in BTR Warehousing. As part of her analysis of the annual distribution policy and its impact on the firm's value, she makes the following...

Most questions answered within 3 hours.

-

How much must I invest today if I want to withdraw 1/3 of my

original investment...

asked 26 minutes ago -

What is meant by a “term premium”?

What can explain such a premium? Is it a...

asked 2 hours ago -

23. Which molecule has only covalent bonds? A. CO2 B. Al2O3 C.

Mg3N2

24. The octet...

asked 2 hours ago -

the

total pressure for a mixture of N2O4 and NO2 is 2.20 atm. If Kp=

7.10...

asked 2 hours ago -

Delaware Corp. prepared a master budget that included $22,385

for direct materials, $28,600 for direct labor,...

asked 2 hours ago -

For pesticide HCB (hexachlorobenzene), its logarithmic partition

coefficient log Kow is 5.6. What would be the...

asked 2 hours ago -

A chemist requires 0.422 mil Na2CO3 for a reaction. How many

grams does this correspond to?

asked 2 hours ago -

If the vapor pressure of carvone is approximately 9.4 torr at 99

°C, approximately how much...

asked 3 hours ago -

A juice bottling company is carrying out a test at 10%

significance that the mean population...

asked 3 hours ago -

What is the reflectivity (in percent) needed to keep water at a

temperature near its freezing...

asked 3 hours ago -

Suppose that the average surface temperature of Earth is 300K.

Assume this is uniform over its...

asked 3 hours ago -

Draw the condensed structural formula for alkenes and alkynes or

the line-angle structural formula for cycloalkenes...

asked 3 hours ago

5. Free cash flow and financial statements Aa Aa The primary objective of the corporate management team is to maximize shareholder wealth. The company's board of directors and the shareholders evaluate and review managerial actions based on the growth in the value of the irm Based on your understanding of what determines a firm's value, review the following: What does the value of a firm depend on? The ability to generate cash flow that is available to distribute to the...

5. Free cash flow and financial statements Aa Aa The primary objective of the corporate management team is to maximize shareholder wealth. The company's board of directors and the shareholders evaluate and review managerial actions based on the growth in the value of the irm Based on your understanding of what determines a firm's value, review the following: What does the value of a firm depend on? The ability to generate cash flow that is available to distribute to the...

Based on your understanding of what determines a firm's value, review the following What does the value of a firm depend on? Option A The ability to generate cash flow that is available to distribute to the company's investors, including creditors and stockholders The ability to generate cash flow that is available to distribute to the company's stockholders only Option B Which of the options is most accurate? Option A O Option B When determining the value of a firm,...

Based on your understanding of what determines a firm's value, review the following What does the value of a firm depend on? Option A The ability to generate cash flow that is available to distribute to the company's investors, including creditors and stockholders The ability to generate cash flow that is available to distribute to the company's stockholders only Option B Which of the options is most accurate? Option A O Option B When determining the value of a firm,...

Remember that the primary goal of a firm is to maximize shareholder wealth by increasing the firm's intrinsic value. It is thus important to understand the impact of distributions-both in the form of dividends or stock repurchases on the firm's value. Consider the following situation: Elle is a financial analyst in Demo You Ine's. As part of her analysis of the annual distribution policy and its impact on the firm's value, she makes the following calculations and observations: • The...

Remember that the primary goal of a firm is to maximize shareholder wealth by increasing the firm's intrinsic value. It is thus important to understand the impact of distributions-both in the form of dividends or stock repurchases on the firm's value. Consider the following situation: Elle is a financial analyst in Demo You Ine's. As part of her analysis of the annual distribution policy and its impact on the firm's value, she makes the following calculations and observations: • The...

4. Debt management ratios Aa Aa E Companies have the opportunity to use varying amounts of different sources of financing to acquire their assets, including internal and external sources, and debt (borrowed) and equity funds. Which of the following is considered a financially leveraged firm? O A company that uses debt to finance some of its assets O A company that uses only equity to finance its assets Which of the following is true about the leveraging effect? Using leverage...

4. Debt management ratios Aa Aa E Companies have the opportunity to use varying amounts of different sources of financing to acquire their assets, including internal and external sources, and debt (borrowed) and equity funds. Which of the following is considered a financially leveraged firm? O A company that uses debt to finance some of its assets O A company that uses only equity to finance its assets Which of the following is true about the leveraging effect? Using leverage...

EXHIBIT 14-26 Summary of Analytical Measures Ratios or Other Measurements Method of Computation Significance Measures of short-term liquidi Current ratio ab Current Liabilities Quick ratio A measure of short-term debt Current Liabilities A measure of short-term debt tes the cash generated by operations Indicates ability to cover currently maturing Indicates how quickly receivables are collected Indicates in d ons Average Inventory to sell the a 365 Days Days to Sell I Free cash flow Net Cash from Debt ratic ion...

EXHIBIT 14-26 Summary of Analytical Measures Ratios or Other Measurements Method of Computation Significance Measures of short-term liquidi Current ratio ab Current Liabilities Quick ratio A measure of short-term debt Current Liabilities A measure of short-term debt tes the cash generated by operations Indicates ability to cover currently maturing Indicates how quickly receivables are collected Indicates in d ons Average Inventory to sell the a 365 Days Days to Sell I Free cash flow Net Cash from Debt ratic ion...

11. Dividends, repurchases, and firm value Remember that the primary goal of a firm is to maximize shareholder wealth by increasing the firm's intrinsic value. It is thus important to understand the impact of distributions- both in the form of dividends or stock repurchases-on the firm's value. Consider the following situation Rihana is a financial analyst in BTR Warehousing. As part of her analysis of the annual distribution policy and its impact on the firm's value, she makes the following...

11. Dividends, repurchases, and firm value Remember that the primary goal of a firm is to maximize shareholder wealth by increasing the firm's intrinsic value. It is thus important to understand the impact of distributions- both in the form of dividends or stock repurchases-on the firm's value. Consider the following situation Rihana is a financial analyst in BTR Warehousing. As part of her analysis of the annual distribution policy and its impact on the firm's value, she makes the following...