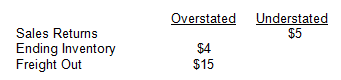

Given the following data:

Net Income is:

Select one:

a. Overstated $24

b. Understated $6

c. Overstated $16

d. Understated $15

e. Understated $14

Homework Answers

Solution:

Understated Sales returns = Income Overstated by $5

Overstated Ending Inventory = Income overstated by $4

Overstated Freight out = Income Understated by $15

Net effect on Net Income = $5 + $4 - $15 = - $6

Hence, Net income is understated by $6.

Hence option "b" is correct

Add Answer to:

Given the following data:

Net Income is:

Select one:

a. Overstated $24

b. Understated $6

c....

1.Given: Net Income is: Select one: a. Understated $16 b. Understated $24 c. Overstated $6 d....

1.Given:

Net Income is:

Select one:

a. Understated $16

b. Understated $24

c. Overstated $6

d. Understated $26

e. Understated $10

2.

Case Corp. had accounts payable of $100,000 recorded in the

general ledger as of December 31, 2012. The Accounts Payable

balance included the following recorded purchases on credit:

In Case’s December 31, 2012 balance sheet, the accounts payable

should be reported in the amount of:

Select one:

a. $125,000

b. $92,000

c. $121,000

d. $79,000

e. $75,000

3....

1.Given:

Net Income is:

Select one:

a. Understated $16

b. Understated $24

c. Overstated $6

d. Understated $26

e. Understated $10

2.

Case Corp. had accounts payable of $100,000 recorded in the

general ledger as of December 31, 2012. The Accounts Payable

balance included the following recorded purchases on credit:

In Case’s December 31, 2012 balance sheet, the accounts payable

should be reported in the amount of:

Select one:

a. $125,000

b. $92,000

c. $121,000

d. $79,000

e. $75,000

3....

1. The Charleston Company purchases a machine on 1/1/18: The book value at 12/31/20 will be:...

1.

The Charleston Company purchases a machine on 1/1/18:

The book value at 12/31/20 will be:

Select one:

a. $16,250

b. $19,750

c. $17,000

d. $13,750

e. $22,500

2.

Given the following data:

Net Income is:

Select one:

a. Overstated $24

b. Understated $6

c. Overstated $16

d. Understated $15

e. Understated $14

3.

The Bozeman Company had current assets of $500 and current

liabilities of $400 prior to the following transactions:

1. Collection of an account receivable, $100

2....

1.

The Charleston Company purchases a machine on 1/1/18:

The book value at 12/31/20 will be:

Select one:

a. $16,250

b. $19,750

c. $17,000

d. $13,750

e. $22,500

2.

Given the following data:

Net Income is:

Select one:

a. Overstated $24

b. Understated $6

c. Overstated $16

d. Understated $15

e. Understated $14

3.

The Bozeman Company had current assets of $500 and current

liabilities of $400 prior to the following transactions:

1. Collection of an account receivable, $100

2....

given the following errors of the lincoln company: sales understated - 4 begenning invetory understated -...

given the following errors of the lincoln company: sales understated - 4 begenning invetory understated - 8 interest expense understated - 2 ending inventory overstated - 7 purchase discouts overstated - 3 sales overstated - 5 net sales will be net sales will be a) overstated by 9 b) understated by 1 c) overstated by 1 d) overstated by 3 e) understanted by 9

Given the following Ending Inventory errors for the Portland Company: Ending Inventory Error Year Overstated $30...

Given the following Ending Inventory errors for the Portland Company: Ending Inventory Error Year Overstated $30 2020 Understated $40 2021 Indicate the error in the following items: Select one: a. 2022 Net Income 12/31/21 Retained Earnings Understated $10 No error b. 2022 Net Income 12/31/21 Retained Earnings Overstated $10 No error C. 2022 Net Income 12/31/21 Retained Earnings Understated $40 Understated $40 d. 2022 Net Income 12/31/21 Retained Earnings Overstated $40 Understated $40 e. 2022 Net Income 12/31/21 Retained Earnings...

Given the following Ending Inventory errors for the Portland Company: Ending Inventory Error Year Overstated $30 2020 Understated $40 2021 Indicate the error in the following items: Select one: a. 2022 Net Income 12/31/21 Retained Earnings Understated $10 No error b. 2022 Net Income 12/31/21 Retained Earnings Overstated $10 No error C. 2022 Net Income 12/31/21 Retained Earnings Understated $40 Understated $40 d. 2022 Net Income 12/31/21 Retained Earnings Overstated $40 Understated $40 e. 2022 Net Income 12/31/21 Retained Earnings...

1.Given the following: 2013 Net Loss is: Select one: a. $38 b. $6 c. $12 d....

1.Given the following:

2013 Net Loss is:

Select one:

a. $38

b. $6

c. $12

d. $13

e. $8

2.The Walton Company accrued a revenue and recorded this journal

entry.

Determine the effect of the error on the following:

Select one:

a. Assets Understated, Net Income No Error

b. Assets No Error, Net Income No Error

c. Assets Understated, Net Income Understated

d. Assets Overstated, Net Income No Error

e. Assets No Error, Net Income Understated

3.

In preparing its...

1.Given the following:

2013 Net Loss is:

Select one:

a. $38

b. $6

c. $12

d. $13

e. $8

2.The Walton Company accrued a revenue and recorded this journal

entry.

Determine the effect of the error on the following:

Select one:

a. Assets Understated, Net Income No Error

b. Assets No Error, Net Income No Error

c. Assets Understated, Net Income Understated

d. Assets Overstated, Net Income No Error

e. Assets No Error, Net Income Understated

3.

In preparing its...

77) Given the following data: Ending inventory at cost $24,000 Ending inventory at current net realizable...

77) Given the following data: Ending inventory at cost $24,000 Ending inventory at current net realizable value 23,600 Cost of goods sold (before consideration of the lower-of-cost-and-net-realizable-value rule) 37,000 Which of the following depicts the proper account balance after the application of the lower-of-cost-and-net realizable value rule? A) Cost of goods sold will be $37,400. B) Cost of goods sold will be $36,400. C) Cost of goods sold will be $37,000. D) Ending inventory will be $24,000. 78) Inventory at...

1.Given the following data, by how much would taxable income change if periodic LIFO is used...

1.Given the following data, by how much would taxable income

change if periodic LIFO is used rather than periodic FIFO?

Select one:

a. Decrease by $6,000

b. Increase by $8,500

c. Decrease by $8,500

d. Increase by $6,000

e. Decrease by $4,000

2.

The Blotto Company made the following two errors in counting

ending inventory:

Understated 12/31/12 inventory by $2,000

Understated 12/31/13 inventory by $3,000

The combination of these two errors will cause:

Select one:

a. 12/31/13 Retained Earnings to...

1.Given the following data, by how much would taxable income

change if periodic LIFO is used rather than periodic FIFO?

Select one:

a. Decrease by $6,000

b. Increase by $8,500

c. Decrease by $8,500

d. Increase by $6,000

e. Decrease by $4,000

2.

The Blotto Company made the following two errors in counting

ending inventory:

Understated 12/31/12 inventory by $2,000

Understated 12/31/13 inventory by $3,000

The combination of these two errors will cause:

Select one:

a. 12/31/13 Retained Earnings to...

understatted overstated purchase Sales returns 4 Beginning inventory Freight out Purchase discounts Net income is A,...

understatted overstated purchase Sales returns 4 Beginning inventory Freight out Purchase discounts Net income is A, undersated 16 B, Understated 26 Given the following information for the ABC company Inventory at end-of-year prices Price index Date $80,000 $120,000 $130,000 100 12/31/16 12/31/17 12/31/18 120 125 Using dollar-value LIFO, the 12/31/18 inventory for the balance sheet is approximately A, $109,000 В, 104,000 C, 110,000 Given the following information for an inventory item of the ABC company $102 108 Cost Replacement cost...

understatted overstated purchase Sales returns 4 Beginning inventory Freight out Purchase discounts Net income is A, undersated 16 B, Understated 26 Given the following information for the ABC company Inventory at end-of-year prices Price index Date $80,000 $120,000 $130,000 100 12/31/16 12/31/17 12/31/18 120 125 Using dollar-value LIFO, the 12/31/18 inventory for the balance sheet is approximately A, $109,000 В, 104,000 C, 110,000 Given the following information for an inventory item of the ABC company $102 108 Cost Replacement cost...

Improperly capitalizing expenses results in: Select one: a. Accurate financial statements b. Overstated Owner’s Equity c....

Improperly capitalizing expenses results in: Select one: a. Accurate financial statements b. Overstated Owner’s Equity c. Understated Owner’s Equity d. Understated Net Income

1. Which account is closed at the end of an accounting period? Select one: a. Prepaid...

1. Which account is closed at the end of an accounting period? Select one: a. Prepaid Expense b. Sales Discount c. Unearned Revenue d. Retained Earnings 2. At the end of the current year, the Owners' Equity in LaRose Corporation is $188,000. During the year, the assets of the business had decreased by $90,000, and the liabilities had increased by $36,000. Owners' Equity at the beginning of the year must have been: Select one: a. $242,000 b. $314,000 c. $494,000...

Most questions answered within 3 hours.

-

) Assume that in the market for widgets, demand is highly

elastic compared to supply. If...

asked 7 minutes ago -

Why is a personal interview the most important step in the sales

selection process? What are...

asked 17 minutes ago -

In Python rOverlap (x1, y1, w1, h1, x2, y2, w2, h2) A rectangle

is axis-aligned if...

asked 17 minutes ago -

If we observe in a protein solution that DNA is causing a

mixture 260/280 ratio ~0.9,...

asked 27 minutes ago -

Explain the steps involved in making cDNA from mRNA, and how you

would create a cDNA...

asked 28 minutes ago -

A beta (β) particle is described by which of the following?

Select the correct answer below:...

asked 31 minutes ago -

A new machine costs $150,000, lasts 10 years, has an annual

O&M cost of $50,000, and...

asked 34 minutes ago -

A newspaper in a large Midwestern city reported that the

National Association of Realtors said that...

asked 35 minutes ago -

1. Develop a use case diagram for the bank case study described

in Chapter 1. 2....

asked 45 minutes ago -

The phylum Protista has often been referred to as a junk drawer

of classification. Explain what...

asked 52 minutes ago -

The average amount of money spent for lunch per person in the

college cafeteria is $7.09...

asked 54 minutes ago -

You follow the lab procedure and at the end of Part 4C, you used

an average...

asked 1 hour ago

1.Given:

Net Income is:

Select one:

a. Understated $16

b. Understated $24

c. Overstated $6

d. Understated $26

e. Understated $10

2.

Case Corp. had accounts payable of $100,000 recorded in the

general ledger as of December 31, 2012. The Accounts Payable

balance included the following recorded purchases on credit:

In Case’s December 31, 2012 balance sheet, the accounts payable

should be reported in the amount of:

Select one:

a. $125,000

b. $92,000

c. $121,000

d. $79,000

e. $75,000

3....

1.Given:

Net Income is:

Select one:

a. Understated $16

b. Understated $24

c. Overstated $6

d. Understated $26

e. Understated $10

2.

Case Corp. had accounts payable of $100,000 recorded in the

general ledger as of December 31, 2012. The Accounts Payable

balance included the following recorded purchases on credit:

In Case’s December 31, 2012 balance sheet, the accounts payable

should be reported in the amount of:

Select one:

a. $125,000

b. $92,000

c. $121,000

d. $79,000

e. $75,000

3....

1.

The Charleston Company purchases a machine on 1/1/18:

The book value at 12/31/20 will be:

Select one:

a. $16,250

b. $19,750

c. $17,000

d. $13,750

e. $22,500

2.

Given the following data:

Net Income is:

Select one:

a. Overstated $24

b. Understated $6

c. Overstated $16

d. Understated $15

e. Understated $14

3.

The Bozeman Company had current assets of $500 and current

liabilities of $400 prior to the following transactions:

1. Collection of an account receivable, $100

2....

1.

The Charleston Company purchases a machine on 1/1/18:

The book value at 12/31/20 will be:

Select one:

a. $16,250

b. $19,750

c. $17,000

d. $13,750

e. $22,500

2.

Given the following data:

Net Income is:

Select one:

a. Overstated $24

b. Understated $6

c. Overstated $16

d. Understated $15

e. Understated $14

3.

The Bozeman Company had current assets of $500 and current

liabilities of $400 prior to the following transactions:

1. Collection of an account receivable, $100

2....

Given the following Ending Inventory errors for the Portland Company: Ending Inventory Error Year Overstated $30 2020 Understated $40 2021 Indicate the error in the following items: Select one: a. 2022 Net Income 12/31/21 Retained Earnings Understated $10 No error b. 2022 Net Income 12/31/21 Retained Earnings Overstated $10 No error C. 2022 Net Income 12/31/21 Retained Earnings Understated $40 Understated $40 d. 2022 Net Income 12/31/21 Retained Earnings Overstated $40 Understated $40 e. 2022 Net Income 12/31/21 Retained Earnings...

Given the following Ending Inventory errors for the Portland Company: Ending Inventory Error Year Overstated $30 2020 Understated $40 2021 Indicate the error in the following items: Select one: a. 2022 Net Income 12/31/21 Retained Earnings Understated $10 No error b. 2022 Net Income 12/31/21 Retained Earnings Overstated $10 No error C. 2022 Net Income 12/31/21 Retained Earnings Understated $40 Understated $40 d. 2022 Net Income 12/31/21 Retained Earnings Overstated $40 Understated $40 e. 2022 Net Income 12/31/21 Retained Earnings...

1.Given the following:

2013 Net Loss is:

Select one:

a. $38

b. $6

c. $12

d. $13

e. $8

2.The Walton Company accrued a revenue and recorded this journal

entry.

Determine the effect of the error on the following:

Select one:

a. Assets Understated, Net Income No Error

b. Assets No Error, Net Income No Error

c. Assets Understated, Net Income Understated

d. Assets Overstated, Net Income No Error

e. Assets No Error, Net Income Understated

3.

In preparing its...

1.Given the following:

2013 Net Loss is:

Select one:

a. $38

b. $6

c. $12

d. $13

e. $8

2.The Walton Company accrued a revenue and recorded this journal

entry.

Determine the effect of the error on the following:

Select one:

a. Assets Understated, Net Income No Error

b. Assets No Error, Net Income No Error

c. Assets Understated, Net Income Understated

d. Assets Overstated, Net Income No Error

e. Assets No Error, Net Income Understated

3.

In preparing its...

1.Given the following data, by how much would taxable income

change if periodic LIFO is used rather than periodic FIFO?

Select one:

a. Decrease by $6,000

b. Increase by $8,500

c. Decrease by $8,500

d. Increase by $6,000

e. Decrease by $4,000

2.

The Blotto Company made the following two errors in counting

ending inventory:

Understated 12/31/12 inventory by $2,000

Understated 12/31/13 inventory by $3,000

The combination of these two errors will cause:

Select one:

a. 12/31/13 Retained Earnings to...

1.Given the following data, by how much would taxable income

change if periodic LIFO is used rather than periodic FIFO?

Select one:

a. Decrease by $6,000

b. Increase by $8,500

c. Decrease by $8,500

d. Increase by $6,000

e. Decrease by $4,000

2.

The Blotto Company made the following two errors in counting

ending inventory:

Understated 12/31/12 inventory by $2,000

Understated 12/31/13 inventory by $3,000

The combination of these two errors will cause:

Select one:

a. 12/31/13 Retained Earnings to...

understatted overstated purchase Sales returns 4 Beginning inventory Freight out Purchase discounts Net income is A, undersated 16 B, Understated 26 Given the following information for the ABC company Inventory at end-of-year prices Price index Date $80,000 $120,000 $130,000 100 12/31/16 12/31/17 12/31/18 120 125 Using dollar-value LIFO, the 12/31/18 inventory for the balance sheet is approximately A, $109,000 В, 104,000 C, 110,000 Given the following information for an inventory item of the ABC company $102 108 Cost Replacement cost...

understatted overstated purchase Sales returns 4 Beginning inventory Freight out Purchase discounts Net income is A, undersated 16 B, Understated 26 Given the following information for the ABC company Inventory at end-of-year prices Price index Date $80,000 $120,000 $130,000 100 12/31/16 12/31/17 12/31/18 120 125 Using dollar-value LIFO, the 12/31/18 inventory for the balance sheet is approximately A, $109,000 В, 104,000 C, 110,000 Given the following information for an inventory item of the ABC company $102 108 Cost Replacement cost...