1.

The Charleston Company purchases a machine on 1/1/18:

The book value at 12/31/20 will be:

Select one:

a. $16,250

b. $19,750

c. $17,000

d. $13,750

e. $22,500

2.

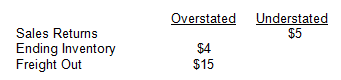

Given the following data:

Net Income is:

Select one:

a. Overstated $24

b. Understated $6

c. Overstated $16

d. Understated $15

e. Understated $14

3.

The Bozeman Company had current assets of $500 and current

liabilities of $400 prior to the following transactions:

1. Collection of an account receivable, $100

2. Payment of an account payable, $80

The combined effect of these two transactions will cause what

effect on Working Capital and the Working Capital Ratio,

respectively?

Select one:

a. No Effect, Decrease

b. No Effect, Increase

c. No Effect, No Effect

d. Decrease, Decrease

e. Decrease, Increase

4.

If a retail store has a current ratio of 2.2 to 1 and current assets of $330,000, the amount of working capital is:

Select one:

a. $110,000

b. $180,000

c. $220,000

d. $108,000

e. $150,000

Homework Answers

| Cost | $ 28,000 |

| Less: Salvage value | $ (6,000) |

| Depreciable value | $ 22,000 |

| Depreciation per year ($22,000/8) | $ 2,750 |

| Book value at 12/31/20 ($28,000-($2,750*3) | $ 19,750 |

Answer is B. $19,750

Add Answer to:

1.

The Charleston Company purchases a machine on 1/1/18:

The book value at 12/31/20 will be:...

1. The Charleston Company pre-pays annual rent. If the adjusting entry to record the current period’s...

1. The Charleston Company pre-pays annual rent. If the adjusting entry to record the current period’s prepaid rent expired is not recorded: Select one: a. Current assets will be understated b. Net income will be overstated c. Current liabilities will be overstated d. Current liabilities will be understated e. Gross Profit will be overstated 2. Which organization is attempting to establish one set of accounting standards to be used in every country in the world? Select one: a. PCAOB b....

8. On 12/31/12, as part of the year-end adjusting journal entries, the Strickland Company accrues three...

8. On 12/31/12, as part of the year-end adjusting journal entries, the Strickland Company accrues three day's wages of $600 ($200 per day). The proper 12/31/12 closing entries are made. No reversing entry is made on 1/1/13. Strickland pays the weekly payroll of $1,000 on 1/2/13. The balance in the Wage Expense account after the 1/2/13 journal entry will be: Select one: a. $0 b. $400 c. $600 d. $1,000 e. $1,200 35. The Charleston Company pre-pays annual rent. If...

Ann M. Martin Company

Exercise 8-24Ann M. Martin Company makes the following errors during the current year. (Evaluate each case independently and assume ending inventory in the following year is correctly stated.)1.Ending inventory is overstated, but purchases and related accounts payable are recorded correctly.2.Both ending inventory and purchases and related accounts payable are understated. (Assume this purchase was recorded and paid for in the following year.)3.Ending inventory is correct, but a purchase on account was not recorded. (Assume this purchase was recorded and paid...

Exercise 8-24Ann M. Martin Company makes the following errors during the current year. (Evaluate each case independently and assume ending inventory in the following year is correctly stated.)1.Ending inventory is overstated, but purchases and related accounts payable are recorded correctly.2.Both ending inventory and purchases and related accounts payable are understated. (Assume this purchase was recorded and paid for in the following year.)3.Ending inventory is correct, but a purchase on account was not recorded. (Assume this purchase was recorded and paid...

1. On 12/31/12, as part of the year-end adjusting journal entries, the Strickland Company accrues three...

1. On 12/31/12, as part of the year-end adjusting journal entries, the Strickland Company accrues three day's wages of $600 ($200 per day). The proper 12/31/12 closing entries are made. No reversing entry is made on 1/1/13. Strickland pays the weekly payroll of $1,000 on 1/2/13. The balance in the Wage Expense account after the 1/2/13 journal entry will be: Select one: a. $0 b. $400 c. $600 d. $1,000 e. $1,200 2. Which principle is most representative of the...

1. The Bark Company fails to record these two journal entries: Expiration of Prepaid Insurance: $10...

1. The Bark Company fails to record these two journal entries: Expiration of Prepaid Insurance: $10 Cash dividends declared: $40 Working capital will be: Select one: a. $10 overstated b. $30 overstated c. $10 understated d. $50 overstated e. $50 understated 2. The Looper River Company makes three adjusting entries at 12/31: Depreciation $50 Accrued Revenue $80 Accrued Expense $65 Indicate the net effect of these three entries on Net Income and Working Capital, respectively: Select one: a. Increase $15,...

Page 1 of 3 ACCT 201 Spring Semester Preparation for Mid-Term Exam The exam has 9 questions, SOLV...

Page 1 of 3 ACCT 201 Spring Semester Preparation for Mid-Term Exam The exam has 9 questions, SOLVE THE QUESTIONS 1. ABC adopts the (15 marks) plus a 1 mark bonus question. Here are 13 questions to help you prepare for the exam accounting practice whereby all external transactions involving prepaid expenses are initially debited to the ount. if the company fails to adjust any one of these accounts for the current year what will be the effect on (1)...

Page 1 of 3 ACCT 201 Spring Semester Preparation for Mid-Term Exam The exam has 9 questions, SOLVE THE QUESTIONS 1. ABC adopts the (15 marks) plus a 1 mark bonus question. Here are 13 questions to help you prepare for the exam accounting practice whereby all external transactions involving prepaid expenses are initially debited to the ount. if the company fails to adjust any one of these accounts for the current year what will be the effect on (1)...

1- which one of the following is not included in net working capital? A) account receivable...

1- which one of the following is not included in net working capital? A) account receivable , B) retained earnings, C) cash and cash equivalent , D) prepaid expenses, E) Account payable. 2- Depreciation does which one of the following for a profitable firm? A) has no effect on net income, B) decrease net working capital, C) decrease net income, D) increase net income, E) increase taxes 3- a firm has a current ratio 0.9, given this you know for...

1.Indicate the proper journal entry to record payment of a cash dividend previously declared: Select one:...

1.Indicate the proper journal entry to record payment of a cash dividend previously declared: Select one: a. Debit Cash, credit Dividend Payable b. Debit Dividends, credit Cash 2.A bookkeeper erroneously recorded a $7 accrual of wages payable using this journal entry: Sales Discount $7 Inventory $7 Indicate the effect of the error on Expenses, Assets, and Liabilities, respectively: Select one: a. No Error, Understated, No Error b. Overstated, No Error, Understated c. Understated, Understated, Understated d. No Error, No Error,...

A direct financing capital lease begins on 12/31/16. The first lease payment is collected by the...

A direct financing capital lease begins on 12/31/16. The first lease payment is collected by the lessor on that date. Assume the lessor makes NO 12/31/16 journal entries to record the lease or the 12/31/16 cash collection. What is the effect of the error on the lessor's 2016 Net Income and 12/31/16 Total Assets, respectively? Select one: a. No Error, No Error O b. No Error, Understated O c. Understated, Overstated O d. Understated, No Error e. Understated, Understated

A direct financing capital lease begins on 12/31/16. The first lease payment is collected by the lessor on that date. Assume the lessor makes NO 12/31/16 journal entries to record the lease or the 12/31/16 cash collection. What is the effect of the error on the lessor's 2016 Net Income and 12/31/16 Total Assets, respectively? Select one: a. No Error, No Error O b. No Error, Understated O c. Understated, Overstated O d. Understated, No Error e. Understated, Understated

Required ndicate the effect of each of the following transactions on (1) the current ratio, (2)...

Required ndicate the effect of each of the following transactions on (1) the current ratio, (2) working capital, (3) stockholders' equity. (4) book value per share of common stock, and (5) retained earnings. Assume that the current ratio is greater than 1:1. (Indicate the effect of each transactions by selecting"" for increase, "-" for decrease, and "NC" for no change.) a. Collected account receivable. b. Wrote off account receivable. c. Converted a short-term note payable to a long-term note payable....

Required ndicate the effect of each of the following transactions on (1) the current ratio, (2) working capital, (3) stockholders' equity. (4) book value per share of common stock, and (5) retained earnings. Assume that the current ratio is greater than 1:1. (Indicate the effect of each transactions by selecting"" for increase, "-" for decrease, and "NC" for no change.) a. Collected account receivable. b. Wrote off account receivable. c. Converted a short-term note payable to a long-term note payable....

Most questions answered within 3 hours.

-

The denaturation of proteins can be described by the

equilibrium

F⇌U

where F and U represent...

asked 24 minutes ago -

Please answer what the maximum and minimum force is, and the

angle on the ion is...

asked 26 minutes ago -

implement a program that reads a number of rows and a symbol.

The program will draw...

asked 31 minutes ago -

Assume that when adults with smartphones are randomly selected,

45% use them in meetings or classes....

asked 35 minutes ago -

Determine the number of formula units of

Na2SO4 and moles of oxygen contained in 8.11

moles...

asked 45 minutes ago -

Explain in steps on the following code

What would be the output when executed

using System;...

asked 53 minutes ago -

Given the information in the table, which of the following

statements is CORRECT?

Stock A

Stock...

asked 51 minutes ago -

Write MARIE assembly language programs that do the following:

Write a program that inputs an integer...

asked 55 minutes ago -

Explain an understanding of services and protocols.

Explain the job of DNS.

Explain the three email...

asked 1 hour ago -

(As soon as possible) Balance each of the following equations

according to the half-reaction method:

H2O2(aq)...

asked 1 hour ago -

A thin rod with a mass of 3.5kg and a length L=1.5 m is oriented

horizontally....

asked 1 hour ago -

Inheritance pattern in BRCA 1

Describe the inheritance pattern of BRCA 1 Is it recessive or...

asked 1 hour ago

Page 1 of 3 ACCT 201 Spring Semester Preparation for Mid-Term Exam The exam has 9 questions, SOLVE THE QUESTIONS 1. ABC adopts the (15 marks) plus a 1 mark bonus question. Here are 13 questions to help you prepare for the exam accounting practice whereby all external transactions involving prepaid expenses are initially debited to the ount. if the company fails to adjust any one of these accounts for the current year what will be the effect on (1)...

Page 1 of 3 ACCT 201 Spring Semester Preparation for Mid-Term Exam The exam has 9 questions, SOLVE THE QUESTIONS 1. ABC adopts the (15 marks) plus a 1 mark bonus question. Here are 13 questions to help you prepare for the exam accounting practice whereby all external transactions involving prepaid expenses are initially debited to the ount. if the company fails to adjust any one of these accounts for the current year what will be the effect on (1)...

A direct financing capital lease begins on 12/31/16. The first lease payment is collected by the lessor on that date. Assume the lessor makes NO 12/31/16 journal entries to record the lease or the 12/31/16 cash collection. What is the effect of the error on the lessor's 2016 Net Income and 12/31/16 Total Assets, respectively? Select one: a. No Error, No Error O b. No Error, Understated O c. Understated, Overstated O d. Understated, No Error e. Understated, Understated

A direct financing capital lease begins on 12/31/16. The first lease payment is collected by the lessor on that date. Assume the lessor makes NO 12/31/16 journal entries to record the lease or the 12/31/16 cash collection. What is the effect of the error on the lessor's 2016 Net Income and 12/31/16 Total Assets, respectively? Select one: a. No Error, No Error O b. No Error, Understated O c. Understated, Overstated O d. Understated, No Error e. Understated, Understated

Required ndicate the effect of each of the following transactions on (1) the current ratio, (2) working capital, (3) stockholders' equity. (4) book value per share of common stock, and (5) retained earnings. Assume that the current ratio is greater than 1:1. (Indicate the effect of each transactions by selecting"" for increase, "-" for decrease, and "NC" for no change.) a. Collected account receivable. b. Wrote off account receivable. c. Converted a short-term note payable to a long-term note payable....

Required ndicate the effect of each of the following transactions on (1) the current ratio, (2) working capital, (3) stockholders' equity. (4) book value per share of common stock, and (5) retained earnings. Assume that the current ratio is greater than 1:1. (Indicate the effect of each transactions by selecting"" for increase, "-" for decrease, and "NC" for no change.) a. Collected account receivable. b. Wrote off account receivable. c. Converted a short-term note payable to a long-term note payable....