1.

The Bark Company fails to record these two journal entries:

- Expiration of Prepaid Insurance: $10

- Cash dividends declared: $40

Working capital will be:

Select one:

a. $10 overstated

b. $30 overstated

c. $10 understated

d. $50 overstated

e. $50 understated

2.

The Looper River Company makes three adjusting entries at 12/31:

- Depreciation $50

- Accrued Revenue $80

- Accrued Expense $65

Indicate the net effect of these three entries on Net Income and

Working Capital, respectively:

Select one:

a. Increase $15, Increase $15

b. Decrease $65, Decrease $15

c. Decrease $15, Increase $15

d. Decrease $35, Decrease $65

e. Decrease $35, Increase $15

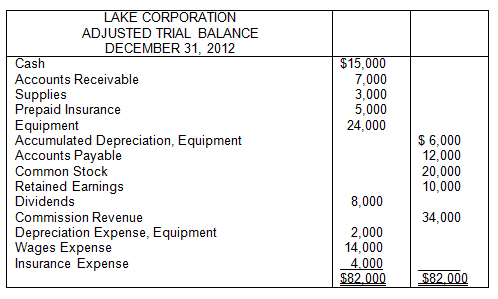

3.

Following all closing entries, the trial balance totals will

be:

Select one:

a. $48,000

b. $82,000

c. $62,000

d. $88,000

e. $54,000

Homework Answers

| 1) | Working Capital = Current Asset - Current Liabilities | ||

| Prepaid Insurance = Current Assets = Which are now expired but not recorded that means woking capital overstated by $10 | |||

| Cash Dividends = Current Liabilities = Which not recorded means working capital overstated by $40 | |||

| therefore working capital overstated by = $10+$40 =$50 | |||

| Correct Option: d) $50 Overstated | |||

| 2) | Effect On Net Income | ||

| Accrued Revenue | $ 80 | ||

| Less: | |||

| Accured Expenses | $ 65 | ||

| Depreciation | $ 50 | ||

| Net Effect | $ -35 | ||

| Decrease by $35 | |||

| Effect on working capital | |||

| Accrued Revenue (Current Asset) | |||

| Less: | |||

| Accrued Expenses | |||

| Effect On Working Capital | |||

| Increase by $15 | |||

| Correct Option: e.Decrease $35, Increase $15 | |||

| 3) | b. $82,000 | ||

Add Answer to:

1.

The Bark Company fails to record these two journal entries:

Expiration of Prepaid Insurance: $10...

1. On 12/31/12, as part of the year-end adjusting journal entries, the Strickland Company accrues three...

1. On 12/31/12, as part of the year-end adjusting journal entries, the Strickland Company accrues three day's wages of $600 ($200 per day). The proper 12/31/12 closing entries are made. No reversing entry is made on 1/1/13. Strickland pays the weekly payroll of $1,000 on 1/2/13. The balance in the Wage Expense account after the 1/2/13 journal entry will be: Select one: a. $0 b. $400 c. $600 d. $1,000 e. $1,200 2. Which principle is most representative of the...

1. The Charleston Company purchases a machine on 1/1/18: The book value at 12/31/20 will be:...

1.

The Charleston Company purchases a machine on 1/1/18:

The book value at 12/31/20 will be:

Select one:

a. $16,250

b. $19,750

c. $17,000

d. $13,750

e. $22,500

2.

Given the following data:

Net Income is:

Select one:

a. Overstated $24

b. Understated $6

c. Overstated $16

d. Understated $15

e. Understated $14

3.

The Bozeman Company had current assets of $500 and current

liabilities of $400 prior to the following transactions:

1. Collection of an account receivable, $100

2....

1.

The Charleston Company purchases a machine on 1/1/18:

The book value at 12/31/20 will be:

Select one:

a. $16,250

b. $19,750

c. $17,000

d. $13,750

e. $22,500

2.

Given the following data:

Net Income is:

Select one:

a. Overstated $24

b. Understated $6

c. Overstated $16

d. Understated $15

e. Understated $14

3.

The Bozeman Company had current assets of $500 and current

liabilities of $400 prior to the following transactions:

1. Collection of an account receivable, $100

2....

1.Indicate the proper journal entry to record payment of a cash dividend previously declared: Select one:...

1.Indicate the proper journal entry to record payment of a cash dividend previously declared: Select one: a. Debit Cash, credit Dividend Payable b. Debit Dividends, credit Cash 2.A bookkeeper erroneously recorded a $7 accrual of wages payable using this journal entry: Sales Discount $7 Inventory $7 Indicate the effect of the error on Expenses, Assets, and Liabilities, respectively: Select one: a. No Error, Understated, No Error b. Overstated, No Error, Understated c. Understated, Understated, Understated d. No Error, No Error,...

Print B. Henderson Fishing Charters has collected the following data for the December 31 adjusting entries:...

Print B. Henderson Fishing Charters has collected the following data for the December 31 adjusting entries: (Click the icon to view the data.) Read the requirements Requirement 1. Joumalize the adjusting entries needed on December 31 for Henderson Fishing Charters. Assume Henderson records adjusting entries only at the end of the year. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. The company received its electric bill on December 20 for...

Print B. Henderson Fishing Charters has collected the following data for the December 31 adjusting entries: (Click the icon to view the data.) Read the requirements Requirement 1. Joumalize the adjusting entries needed on December 31 for Henderson Fishing Charters. Assume Henderson records adjusting entries only at the end of the year. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. The company received its electric bill on December 20 for...

Blum Services has the following unadjusted balances at year-end. Cash $12,900 Prepaid insurance 2,000 Office supplies...

Blum Services has the following unadjusted balances at year-end. Cash $12,900 Prepaid insurance 2,000 Office supplies 1,300 Office equipment 10,500 Accumulated depreciation–office equipment 3,500 Accounts payable 2,900 Salaries payable -0- Unearned service revenue 4,500 A.L.Blum, capital 11,750 A.L.Blum, drawing 5,600 Service revenue 13,350 Salary expense 3,700 Depreciation expense -0- Supplies expense -0- Insurance expense -0- The following information is available to use in making adjusting entries. a. Office supplies on hand at year-end: $250 b. Prepaid insurance expired during the...

Please let me know if you can not read the numbers 2700 For Prepaid Insurance and...

Please let me know if you can not read the numbers 2700 For

Prepaid Insurance and Depreciation Expense 3250

Accounts Receivable - Prepaid Rent Prepaid Insurance BB 95.40 BB 30,00 15,000 BB 2,700 Prepaid Supplies BE 400 95420 - 1000 25000 2.200 120 Equipment Accumulated Depreciation Accrued Interest Accrued Salaries Accounts Payable BB 876 DB 400, ou 3290 1,400 I sro 400,00 3956 - 970 1,400 50 550 Unearned Rental Revenue Capital Stock - Mike Capital Stock - Julie Dividends...

Please let me know if you can not read the numbers 2700 For

Prepaid Insurance and Depreciation Expense 3250

Accounts Receivable - Prepaid Rent Prepaid Insurance BB 95.40 BB 30,00 15,000 BB 2,700 Prepaid Supplies BE 400 95420 - 1000 25000 2.200 120 Equipment Accumulated Depreciation Accrued Interest Accrued Salaries Accounts Payable BB 876 DB 400, ou 3290 1,400 I sro 400,00 3956 - 970 1,400 50 550 Unearned Rental Revenue Capital Stock - Mike Capital Stock - Julie Dividends...

Prepaid Insurance-Annual Adjustments On April 1, 2017, Stratton, Inc., purchases a 24-month property insurance policy for...

Prepaid Insurance-Annual Adjustments On April 1, 2017, Stratton, Inc., purchases a 24-month property insurance policy for $96,000. The policy is effective immediately. Assume that Stratton prepares adjustments only once a year, on December 31. Required: 1. Compute the monthly cost of the insurance policy. per month 2. Identify and analyze the transaction to record the purchase of the policy on April 1, 2017 Activity Accounts Statement(s) Financing Investing Operating How does this entry affect the accounting equatid If a financial...

Prepaid Insurance-Annual Adjustments On April 1, 2017, Stratton, Inc., purchases a 24-month property insurance policy for $96,000. The policy is effective immediately. Assume that Stratton prepares adjustments only once a year, on December 31. Required: 1. Compute the monthly cost of the insurance policy. per month 2. Identify and analyze the transaction to record the purchase of the policy on April 1, 2017 Activity Accounts Statement(s) Financing Investing Operating How does this entry affect the accounting equatid If a financial...

8. On 12/31/12, as part of the year-end adjusting journal entries, the Strickland Company accrues three...

8. On 12/31/12, as part of the year-end adjusting journal entries, the Strickland Company accrues three day's wages of $600 ($200 per day). The proper 12/31/12 closing entries are made. No reversing entry is made on 1/1/13. Strickland pays the weekly payroll of $1,000 on 1/2/13. The balance in the Wage Expense account after the 1/2/13 journal entry will be: Select one: a. $0 b. $400 c. $600 d. $1,000 e. $1,200 35. The Charleston Company pre-pays annual rent. If...

8) Daisy Co. previously received & recorded $5,000 cash from a client for future consulting services....

8) Daisy Co. previously received & recorded $5,000 cash from a client for future consulting services. Now Daisy Co. has provided $3,000 of the services and earned that revenue. What is the necessary adjusting entry? Debit Credit If this adjustment is not made, the following are overstated, understated, or not impacted: (completed for you on this question) Assets: not impacted Revenue: understated Liabilities: overstated Expense:_not impacted Stockholders' Equity: understated 9) Interest of $450 has accrued on a note payable. What...

8) Daisy Co. previously received & recorded $5,000 cash from a client for future consulting services. Now Daisy Co. has provided $3,000 of the services and earned that revenue. What is the necessary adjusting entry? Debit Credit If this adjustment is not made, the following are overstated, understated, or not impacted: (completed for you on this question) Assets: not impacted Revenue: understated Liabilities: overstated Expense:_not impacted Stockholders' Equity: understated 9) Interest of $450 has accrued on a note payable. What...

Barney Company Unadjusted Trial Balance December 31, 2018 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle...

Barney Company Unadjusted Trial Balance December 31, 2018 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle 145,000 23,000 6,500 24,000 110,000 15,000 75,000 50,000 8,000 16,900 3,000 45,000 46,000 67,600 5,000 490,000 Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 10,000 45,000 5,000 54,000 12,000 145,000 13,000 4,000...

Barney Company Unadjusted Trial Balance December 31, 2018 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle 145,000 23,000 6,500 24,000 110,000 15,000 75,000 50,000 8,000 16,900 3,000 45,000 46,000 67,600 5,000 490,000 Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 10,000 45,000 5,000 54,000 12,000 145,000 13,000 4,000...

Most questions answered within 3 hours.

-

The phylum Protista has often been referred to as a junk drawer

of classification. Explain what...

asked 46 seconds from now -

The average amount of money spent for lunch per person in the

college cafeteria is $7.09...

asked 1 minute ago -

You follow the lab procedure and at the end of Part 4C, you used

an average...

asked 20 minutes ago -

Write 250-450 words, about the following: • Analyze how a

servant leader in your organization or...

asked 23 minutes ago -

3. American and Japanese workers can each produce 4 cars a

year. An American worker can...

asked 26 minutes ago -

On October 1, 20X1, a company purchased a piece of land by

agreeing to pay the...

asked 38 minutes ago -

Jamie is doing a survey at her school about whether the students

feel the cafeteria food...

asked 43 minutes ago -

What are the roles of 3' and 5' untranslated regions in

mRNAs?

asked 45 minutes ago -

A domestic television receives antenna delivers a sky noise

power of -105 dBm to a matched...

asked 43 minutes ago -

What do you think are the chemical reactions involved in the

breathalyzer tests administered to potentially...

asked 58 minutes ago -

A random sample of 120 observations produces a mean of

38.2 from a population with a...

asked 1 hour ago -

The average area of land burned by forest fires every year in

Canada is 2.5 million...

asked 1 hour ago

1.

The Charleston Company purchases a machine on 1/1/18:

The book value at 12/31/20 will be:

Select one:

a. $16,250

b. $19,750

c. $17,000

d. $13,750

e. $22,500

2.

Given the following data:

Net Income is:

Select one:

a. Overstated $24

b. Understated $6

c. Overstated $16

d. Understated $15

e. Understated $14

3.

The Bozeman Company had current assets of $500 and current

liabilities of $400 prior to the following transactions:

1. Collection of an account receivable, $100

2....

1.

The Charleston Company purchases a machine on 1/1/18:

The book value at 12/31/20 will be:

Select one:

a. $16,250

b. $19,750

c. $17,000

d. $13,750

e. $22,500

2.

Given the following data:

Net Income is:

Select one:

a. Overstated $24

b. Understated $6

c. Overstated $16

d. Understated $15

e. Understated $14

3.

The Bozeman Company had current assets of $500 and current

liabilities of $400 prior to the following transactions:

1. Collection of an account receivable, $100

2....

Print B. Henderson Fishing Charters has collected the following data for the December 31 adjusting entries: (Click the icon to view the data.) Read the requirements Requirement 1. Joumalize the adjusting entries needed on December 31 for Henderson Fishing Charters. Assume Henderson records adjusting entries only at the end of the year. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. The company received its electric bill on December 20 for...

Print B. Henderson Fishing Charters has collected the following data for the December 31 adjusting entries: (Click the icon to view the data.) Read the requirements Requirement 1. Joumalize the adjusting entries needed on December 31 for Henderson Fishing Charters. Assume Henderson records adjusting entries only at the end of the year. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. The company received its electric bill on December 20 for...

Please let me know if you can not read the numbers 2700 For

Prepaid Insurance and Depreciation Expense 3250

Accounts Receivable - Prepaid Rent Prepaid Insurance BB 95.40 BB 30,00 15,000 BB 2,700 Prepaid Supplies BE 400 95420 - 1000 25000 2.200 120 Equipment Accumulated Depreciation Accrued Interest Accrued Salaries Accounts Payable BB 876 DB 400, ou 3290 1,400 I sro 400,00 3956 - 970 1,400 50 550 Unearned Rental Revenue Capital Stock - Mike Capital Stock - Julie Dividends...

Please let me know if you can not read the numbers 2700 For

Prepaid Insurance and Depreciation Expense 3250

Accounts Receivable - Prepaid Rent Prepaid Insurance BB 95.40 BB 30,00 15,000 BB 2,700 Prepaid Supplies BE 400 95420 - 1000 25000 2.200 120 Equipment Accumulated Depreciation Accrued Interest Accrued Salaries Accounts Payable BB 876 DB 400, ou 3290 1,400 I sro 400,00 3956 - 970 1,400 50 550 Unearned Rental Revenue Capital Stock - Mike Capital Stock - Julie Dividends...

Prepaid Insurance-Annual Adjustments On April 1, 2017, Stratton, Inc., purchases a 24-month property insurance policy for $96,000. The policy is effective immediately. Assume that Stratton prepares adjustments only once a year, on December 31. Required: 1. Compute the monthly cost of the insurance policy. per month 2. Identify and analyze the transaction to record the purchase of the policy on April 1, 2017 Activity Accounts Statement(s) Financing Investing Operating How does this entry affect the accounting equatid If a financial...

Prepaid Insurance-Annual Adjustments On April 1, 2017, Stratton, Inc., purchases a 24-month property insurance policy for $96,000. The policy is effective immediately. Assume that Stratton prepares adjustments only once a year, on December 31. Required: 1. Compute the monthly cost of the insurance policy. per month 2. Identify and analyze the transaction to record the purchase of the policy on April 1, 2017 Activity Accounts Statement(s) Financing Investing Operating How does this entry affect the accounting equatid If a financial...

8) Daisy Co. previously received & recorded $5,000 cash from a client for future consulting services. Now Daisy Co. has provided $3,000 of the services and earned that revenue. What is the necessary adjusting entry? Debit Credit If this adjustment is not made, the following are overstated, understated, or not impacted: (completed for you on this question) Assets: not impacted Revenue: understated Liabilities: overstated Expense:_not impacted Stockholders' Equity: understated 9) Interest of $450 has accrued on a note payable. What...

8) Daisy Co. previously received & recorded $5,000 cash from a client for future consulting services. Now Daisy Co. has provided $3,000 of the services and earned that revenue. What is the necessary adjusting entry? Debit Credit If this adjustment is not made, the following are overstated, understated, or not impacted: (completed for you on this question) Assets: not impacted Revenue: understated Liabilities: overstated Expense:_not impacted Stockholders' Equity: understated 9) Interest of $450 has accrued on a note payable. What...

Barney Company Unadjusted Trial Balance December 31, 2018 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle 145,000 23,000 6,500 24,000 110,000 15,000 75,000 50,000 8,000 16,900 3,000 45,000 46,000 67,600 5,000 490,000 Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 10,000 45,000 5,000 54,000 12,000 145,000 13,000 4,000...

Barney Company Unadjusted Trial Balance December 31, 2018 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle 145,000 23,000 6,500 24,000 110,000 15,000 75,000 50,000 8,000 16,900 3,000 45,000 46,000 67,600 5,000 490,000 Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 10,000 45,000 5,000 54,000 12,000 145,000 13,000 4,000...