On January 1, 2021, Bradley Recreational Products issued $120,000, 9%, four-year bonds. Interest is paid semiannually...

On January 1, 2021, Bradley Recreational Products issued

$120,000, 9%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $116,122 to yield

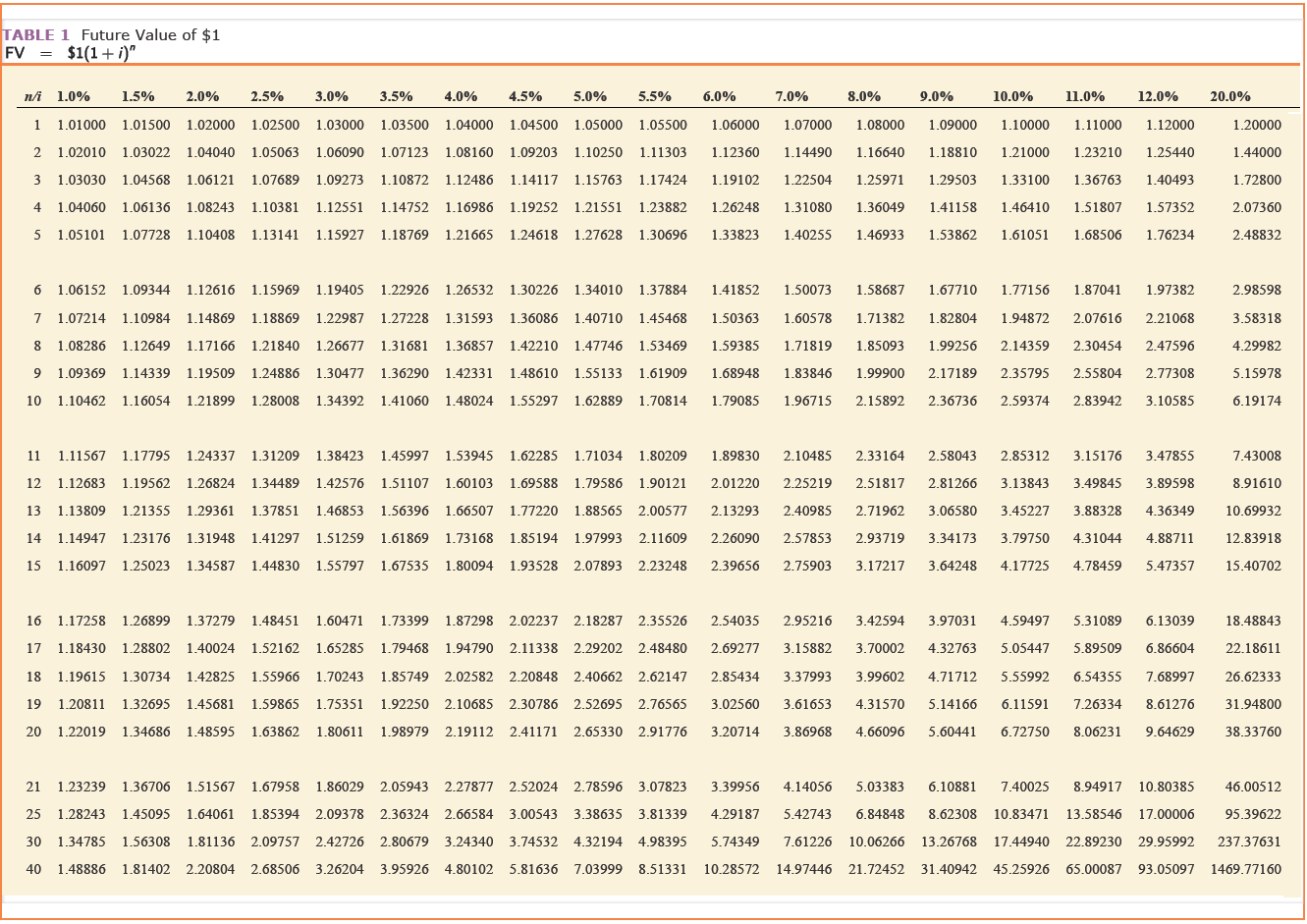

an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule by the

straight-line method.

3. Prepare the journal entries to record interest

expense on June 30, 2023, by each of the two approaches.

5. Assuming the market rate is still 10%, what

price would a second investor pay the first investor on June 30,

2023, for $12,000 of the bonds?

Homework Answers

Add Answer to:

On January 1, 2021, Bradley Recreational Products issued

$120,000, 9%, four-year bonds. Interest is paid semiannually...

On January 1, 2018, Bradley Recreational Products issued $100,000, 12%, four-year bonds. Interest is paid semiannually...

On January 1, 2018, Bradley Recreational Products issued $100,000, 12%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $94,029 to yield an annual return of 14%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2018, Bradley Recreational Products issued $100,000, 11%, four-year bonds. Interest is paid semiannually...

On January 1, 2018, Bradley Recreational Products issued $100,000, 11%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $96,895 to yield an annual return of 12%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule by...

On January 1, 2021, Bradley Recreational Products issued $120,000, 8%, four-year bonds. Interest is paid semiannually...

On January 1, 2021, Bradley Recreational Products issued

$120,000, 8%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $112,244 to yield

an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued

$120,000, 8%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $112,244 to yield

an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually...

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $130,952 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $130,952 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million,...

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million, dated January 1. The bonds mature in 2040 (20 years). The market yield for bonds of similar risk and maturity is 14%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Determine the price of the bonds at January 1, 2021....

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million, dated January 1. The bonds mature in 2040 (20 years). The market yield for bonds of similar risk and maturity is 14%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Determine the price of the bonds at January 1, 2021....

ACC 422T

On January 1, 2021, Bradley Recreational Products issued $200,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $193,537 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required:1. Prepare an amortization schedule that determines interest at the effective interest rate.2. Prepare an amortization schedule by the straight-line method.3. Prepare the journal entries to record interest expense on...

On January 1, 2021, Bradley Recreational Products issued $200,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $193,537 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required:1. Prepare an amortization schedule that determines interest at the effective interest rate.2. Prepare an amortization schedule by the straight-line method.3. Prepare the journal entries to record interest expense on...

2 Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds....

2

Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%, (FY of $1. PV of S. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2....

2

Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%, (FY of $1. PV of S. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2....

Kelly Industries issued 9% bonds, dated January 1, with a face value of $120,000 on January...

Kelly Industries issued 9% bonds, dated January 1, with a face value of $120,000 on January 1, 2021. The bonds mature in 2031 (10 years). Interest is paid semiannually on June 30 and December 31. For bonds of similar risk and maturity the market yield is 10%. What was the issue price of the bonds? FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables...

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on...

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

Most questions answered within 3 hours.

-

Suppose in the short run a firm’s production function is given

by Q = L1/2*K1/2, and...

asked 3 minutes ago -

Calculation of number of protons, neutrons , and electrons

If given the mass # of 74...

asked 4 minutes ago -

On the Apollo 14 mission to the moon, astronaut Alan Shepard hit

a golf ball with...

asked 16 minutes ago -

are primates eutherians?

i know eutherians come from therians but does primates come from

eutharia bc...

asked 21 minutes ago -

Calculate the specific heat of a certain unknown metal, if it

requires 195 joules of heat...

asked 32 minutes ago -

Identify the characteristics of a successful

project.

Describe the phases the project lifecycle.

Define the roles...

asked 42 minutes ago -

1. In Module 2 "headers" and "footers" are

described. Explain the difference between them and how...

asked 37 minutes ago -

Three polarizing filters are stacked with the polarizing axes of

the second and third at 58.5...

asked 45 minutes ago -

The capacitance in a series RCL circuit is C1 = 3.3 μF, and

the corresponding resonant...

asked 55 minutes ago -

A 357.7-gram sample of an unknown substance (MM = 92.41 g/mol)

is heated from -23.1 °C...

asked 55 minutes ago -

The project aims to design a network for a casino. The casino

has 10 floors including...

asked 1 hour ago -

Combustion of an unknown compound containing only carbon and

hydrogen produces 54.9 g of CO₂ and...

asked 1 hour ago

On January 1, 2021, Bradley Recreational Products issued

$120,000, 8%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $112,244 to yield

an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued

$120,000, 8%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $112,244 to yield

an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $130,952 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $130,952 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million, dated January 1. The bonds mature in 2040 (20 years). The market yield for bonds of similar risk and maturity is 14%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Determine the price of the bonds at January 1, 2021....

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million, dated January 1. The bonds mature in 2040 (20 years). The market yield for bonds of similar risk and maturity is 14%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Determine the price of the bonds at January 1, 2021....

2

Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%, (FY of $1. PV of S. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2....

2

Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%, (FY of $1. PV of S. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2....

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...