On January 1, 2018, Bradley Recreational Products issued $100,000, 12%, four-year bonds. Interest is paid semiannually...

On January 1, 2018, Bradley Recreational Products issued

$100,000, 12%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $94,029 to yield

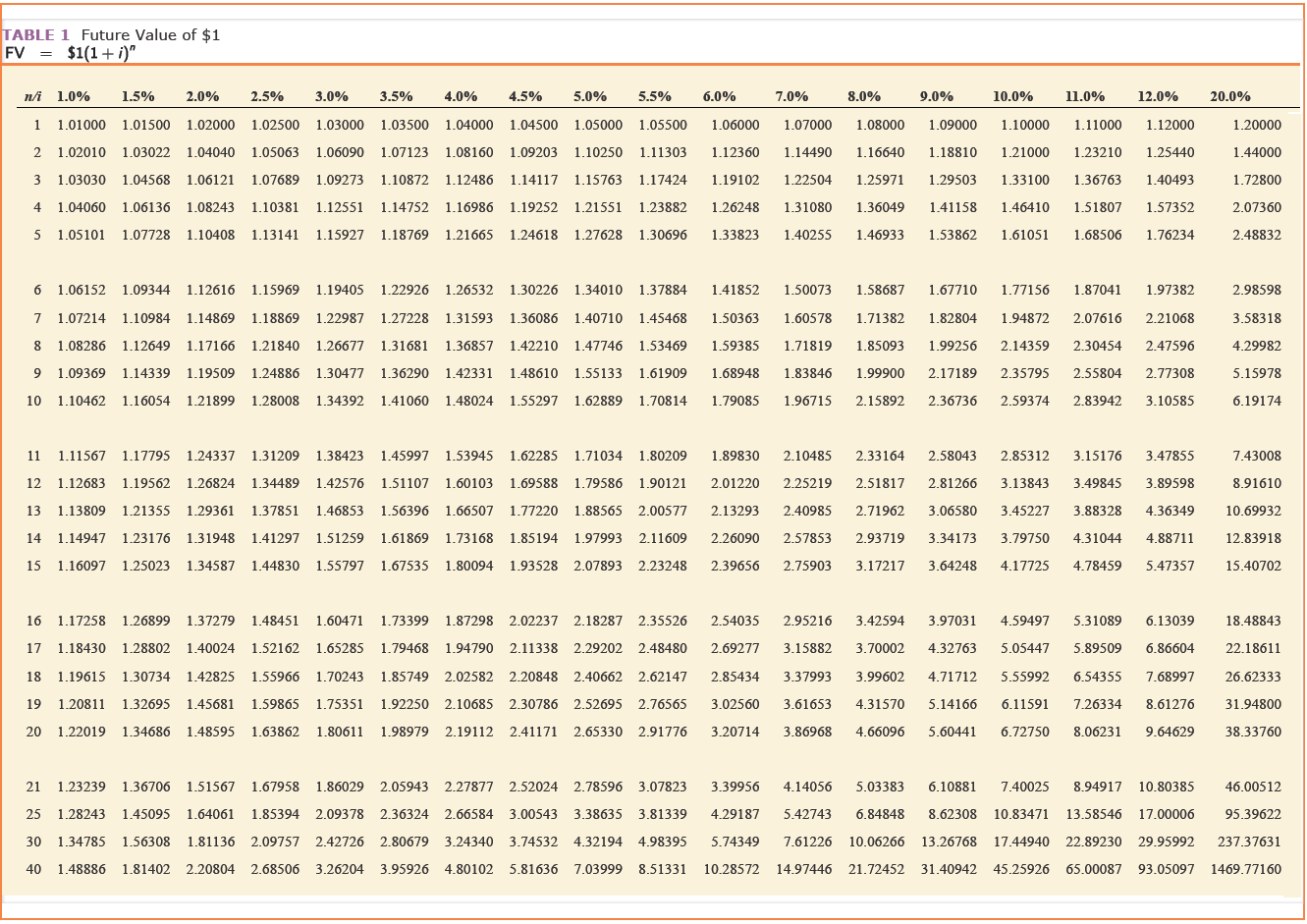

an annual return of 14%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule by the

straight-line method.

3. Prepare the journal entries to record interest

expense on June 30, 2020, by each of the two approaches.

5. Assuming the market rate is still 14%, what

price would a second investor pay the first investor on June 30,

2020, for $14,000 of the bonds?

Homework Answers

| Amortization table-Effective Interest method | ||||

| Date | Interest Payment($100,000*6.00%) | Interest expenses(Bond carrying amount*7%) | Discount amorrtization | Bond carrying amount |

| 01-Jan-18 | 94,029 | |||

| 30-Jun-18 | 6,000 | 6,582 | 582 | 94,611 |

| 31-Dec-18 | 6,000 | 6,623 | 623 | 95,234 |

| 30-Jun-19 | 6,000 | 6,666 | 666 | 95,900 |

| 31-Dec-19 | 6,000 | 6,713 | 713 | 96,613 |

| 30-Jun-20 | 6,000 | 6,763 | 763 | 97,376 |

| 31-Dec-20 | 6,000 | 6,816 | 816 | 98,192 |

| 30-Jun-21 | 6,000 | 6,873 | 873 | 99,066 |

| 31-Dec-21 | 6,000 | 6,934 | 934 | 1,00,000 |

| Date | Accounts and explanation | Debit(in $) | Credit(in $) | |

| 30-Jun-20 | Interest Expenses | 6,763 | ||

| Discounts on Bond payable | 763 | |||

| Cash | 6,000 | |||

| On June 2020 if an investor wants to buy then he has to pay $13,633($97,376*14,000/100,000) | ||||

| 5971 | ||||

| Amortization table-Straight-Line method | ||||

| Discount on Bond =$100,000 - $94,029 =$5,971 | ||||

| Date | Interest Payment | Interest expenses | Discount amorrtization | Bond carrying amount |

| 01-Jan-18 | 94,029 | |||

| 30-Jun-18 | 6,000 | 6,746 | 746 | 94,775 |

| 31-Dec-18 | 6,000 | 6,746 | 746 | 95,522 |

| 30-Jun-19 | 6,000 | 6,746 | 746 | 96,268 |

| 31-Dec-19 | 6,000 | 6,746 | 746 | 97,015 |

| 30-Jun-20 | 6,000 | 6,746 | 746 | 97,761 |

| 31-Dec-20 | 6,000 | 6,746 | 746 | 98,507 |

| 30-Jun-21 | 6,000 | 6,746 | 746 | 99,254 |

| 31-Dec-21 | 6,000 | 6,746 | 746 | 1,00,000 |

| Date | Accounts and explanation | Debit(in $) | Credit(in $) | |

| 30-Jun-20 | Interest Expenses | 6,746 | ||

| Discounts on Bond payable | 746 | |||

| Cash | 6,000 | |||

| On June 2020 if an investor wants to buy then he has to pay $13,687($97,761*14,000/100,000) | ||||

Add Answer to:

On January 1, 2018, Bradley Recreational Products issued

$100,000, 12%, four-year bonds. Interest is paid semiannually...

On January 1, 2018, Bradley Recreational Products issued $100,000, 11%, four-year bonds. Interest is paid semiannually...

On January 1, 2018, Bradley Recreational Products issued $100,000, 11%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $96,895 to yield an annual return of 12%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule by...

On January 1, 2021, Bradley Recreational Products issued $120,000, 9%, four-year bonds. Interest is paid semiannually...

On January 1, 2021, Bradley Recreational Products issued $120,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $116,122 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually...

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $120,000, 8%, four-year bonds. Interest is paid semiannually...

On January 1, 2021, Bradley Recreational Products issued

$120,000, 8%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $112,244 to yield

an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued

$120,000, 8%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $112,244 to yield

an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $130,952 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $130,952 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million,...

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million, dated January 1. The bonds mature in 2040 (20 years). The market yield for bonds of similar risk and maturity is 14%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Determine the price of the bonds at January 1, 2021....

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million, dated January 1. The bonds mature in 2040 (20 years). The market yield for bonds of similar risk and maturity is 14%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Determine the price of the bonds at January 1, 2021....

ACC 422T

On January 1, 2021, Bradley Recreational Products issued $200,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $193,537 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required:1. Prepare an amortization schedule that determines interest at the effective interest rate.2. Prepare an amortization schedule by the straight-line method.3. Prepare the journal entries to record interest expense on...

On January 1, 2021, Bradley Recreational Products issued $200,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $193,537 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required:1. Prepare an amortization schedule that determines interest at the effective interest rate.2. Prepare an amortization schedule by the straight-line method.3. Prepare the journal entries to record interest expense on...

2 Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds....

2

Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%, (FY of $1. PV of S. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2....

2

Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%, (FY of $1. PV of S. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2....

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on...

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

National Orthopedics Co. issued 8% bonds, dated January 1, with a face amount of $600,000 on...

National Orthopedics Co. issued 8% bonds, dated January 1, with a face amount of $600,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

National Orthopedics Co. issued 8% bonds, dated January 1, with a face amount of $600,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

Most questions answered within 3 hours.

-

At 1 bar, how much energy is required to heat 61.0 g of H2O(s)

at −12.0...

asked 10 minutes ago -

Find the mixed-strategy equilibrium to the Battle of the sexes

game in Figure 5.1 below

Hockey...

asked 11 minutes ago -

Use the following information to answer the next three

questions.

QUESTION 5

As of today, the...

asked 17 minutes ago -

Using the specific identification method: Date Units purchased

Cost per unit Ending inventory March 1 15...

asked 19 minutes ago -

PLEASE HELP, NO ONE IS ANSWERING MY QUESTION AND IT IS SUE TODAY

WORTH 20% OF...

asked 34 minutes ago -

α = 0.0007889 T, I = 2.9 A

Other Magnetic Fields: First, based on your

value...

asked 34 minutes ago -

This assignment is a continuation of the 2nd one. You as a HR

Manager, select an...

asked 36 minutes ago -

Hastings Entertainment has a beta of 0.64. If the market return

is expected to be 13.80...

asked 47 minutes ago -

9. Depository institutions are always:

a. illiquid

b. profitable

c. insolvent

d. all of the above...

asked 55 minutes ago -

Use AstroTurf Company's income statement below to answer the

following two questions. Answer these questions with...

asked 55 minutes ago -

How is a firm's task

environment different from its general environment? Provide

examples of both types...

asked 53 minutes ago -

What is one reason Innovators can adopt innovations so

early?

Group of answer choices

they are...

asked 56 minutes ago

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued

$120,000, 8%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $112,244 to yield

an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued

$120,000, 8%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $112,244 to yield

an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $130,952 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $130,952 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million, dated January 1. The bonds mature in 2040 (20 years). The market yield for bonds of similar risk and maturity is 14%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Determine the price of the bonds at January 1, 2021....

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million, dated January 1. The bonds mature in 2040 (20 years). The market yield for bonds of similar risk and maturity is 14%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Determine the price of the bonds at January 1, 2021....

2

Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%, (FY of $1. PV of S. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2....

2

Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%, (FY of $1. PV of S. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2....

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

National Orthopedics Co. issued 8% bonds, dated January 1, with a face amount of $600,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

National Orthopedics Co. issued 8% bonds, dated January 1, with a face amount of $600,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...